Question

Tara Williams and Tilly North had been yoga buddies for almost a decade. Yoga was an escape from the daily stresses of being working parents

Tara Williams and Tilly North had been yoga buddies for almost a decade. Yoga was an escape from the daily stresses of being working parents for both of them. One thing Tara and Tilly always talked about was the lack of a perfect "yoga bag" to contain all the equipment they carted with them first to their workplaces and then to their favorite yoga studio. A perfect yoga bag that would store their sneakers when they took them off; had pockets to conveniently store their phones, keys, and other accessories, and held their rolled-up yoga mat and other accessories. Eventually, they decided to make one themselves! They each made a modest investment to start their new company?The Om Shanti Bag, LLC?and began operating on the side while they continued their respective professional careers.

That had been more than five years ago. The company had grown substantially, had achieved annual sales of over $1.5 million, and had begun to generate a healthy profit (Exhibit 1provides an income statement for the most recent year of operation). As Tara and Tilly reflected on their success to date, they contemplated what might be possible if they could devote themselves full time to Om Shanti. They decided to dive deeper into the numbers. They wanted to better understand the impact that alternative decisions they could make about managing costs, changing prices, and different sales volumes would have on the company, so that they could better determine whether pursuing their venture full time was even a possibility. They both agreed that if they could see annual profit climb to around $300,000, they would consider making this a full-time endeavor.

The two owners decided to begin their analysis by gaining a better understanding of the costs being incurred to produce and sell the bags. They gathered some data to help them in their analysis. First, they compiled data on actual total costs and number of bags produced and sold per month for the past 24 months (seeExhibit 2for selected extracts of this data). They noted that they typically only produced the bags once they had an order; they were averse to tying up cash in inventory, and pursuing this strategy meant that units produced and sold were the same each month. Second, they compiled detailed data on costs by category for 2 of the 24 months (seeExhibit 3for a description of each cost category, andExhibit 3Afor selected costs by category). They could have gathered this information for all 24 months, but they decided to start with just these months to keep their analysis more manageable.

Information to complete questions

Exhibit 1- Income Statement for a (Typical) Early Year of Operation

Revenues $1,680,000

Cost of Goods Sold ($1,164,075)

Gross Margin $515,925

SGA Expenses ($324,225)

Profit before Tax $190,700

Exhibit 2 - Production/Sales Levels and Costs by Month

Exhibit 2A - Typical high-activity months

Month Actual units Actual total monthly costs

September 1,800 $148,000

June 1,900 $154,000

Exhibit 2B - Typical low-activity months

Month Actual units Actual total monthly costs

January 1,000 $100,000

February 1,100 $106,000

April 1,200 $112,000

Exhibit 3A - Selected Monthly Costs at Different Volume Levels

Units produced/sold - 1200 Units produced/sold - 1900

Direct material 36,000 57,000

Direct labor 18,000 28,500

Rent 5,000 5,000

Depreciation 4,000 4,000

Electricity 4,400 5,800

Other manufacturing 9,600 21,700

Exhibit 4 - Detailed Data by Product Line (all $ data are per bag)

Basic bags Custom bags

Units per month 2,000 500

Price $100 $120

Direct Costs:

Direct materials $30.00 $35.00

Direct labor $15.00 $20.00

Sales commissions $10.00 $12.00

Exhibit 5 - Monthly overhead costs

Manufacturing overhead costs: OH costs ($)

Rent $7,000

Depreciation $4,000

Electricity $9,000

Other manufacturing overhead $23,500

Total manufacturing overhead costs: $43,500

Non-manufacturing overhead costs:

Selling $12,500

Administrative $10,000

Other $7,500

Total non-manufacturing $30,000

overhead costs

Exhibit 6 - Activity data

Measure of activity Total amount Use by Basic bag Use by Custom bags

Square footage 100,000 70,000 30,000

Orders 50 30 20

Sales visits 40 20 20

Question 1 Answered

Using the data presented in Exhibit 2, come up with your best estimate of the average variable costs (VC) per bag and the total FC per month. (Hint: compare the low-activity months to the high-activity months to figure this out).

Fill your answers into the blanks below. Submit workings in a separate file. State any assumptions you need to make to answer the question.

Q1

The average VC is $60per bag,and the average total FC per month is $. 40,000

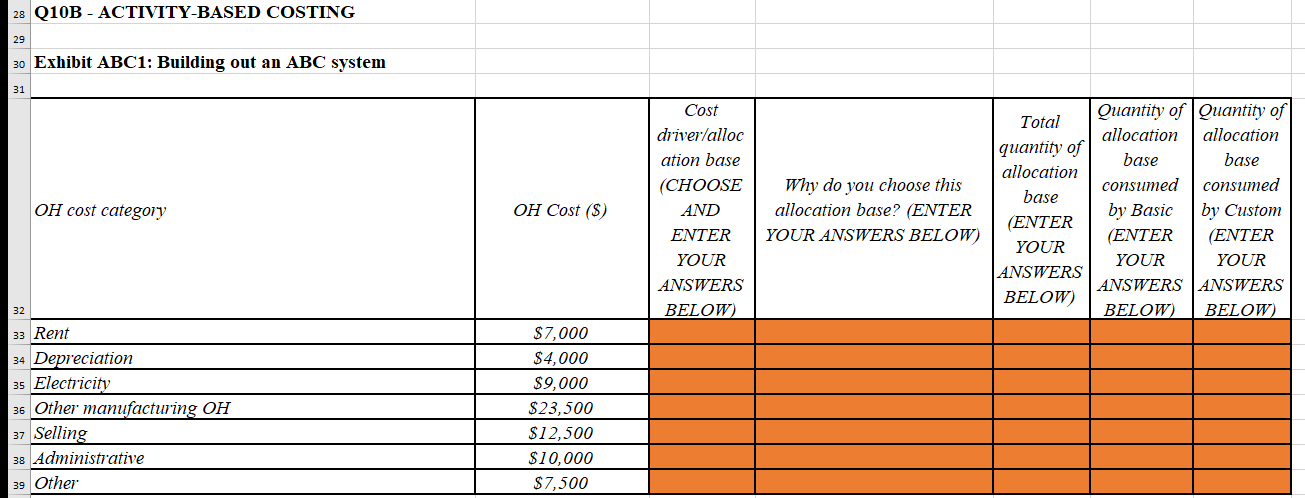

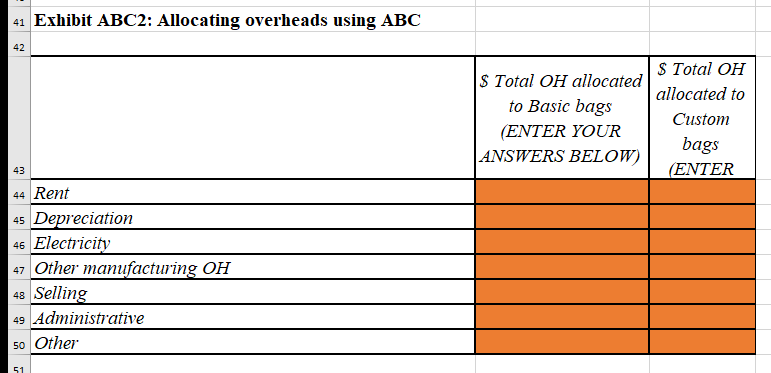

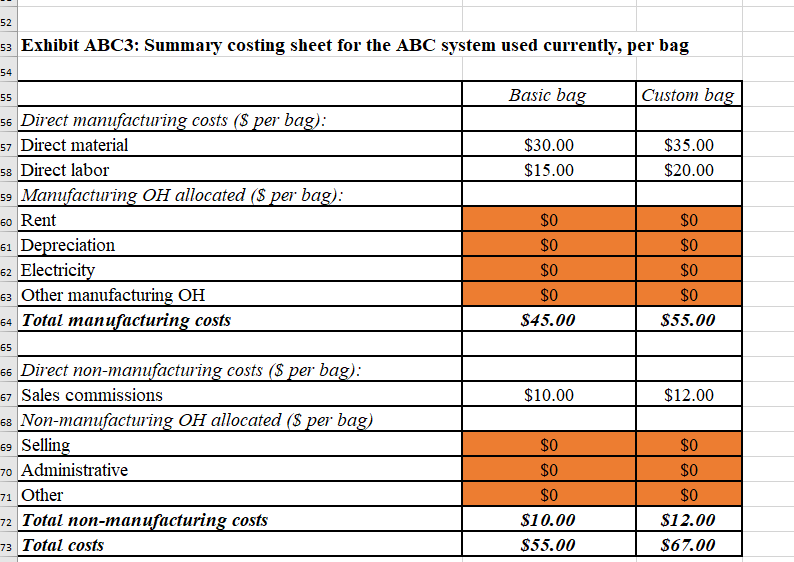

Question 2 Tara and Tilly are conducting an analysis to see if an ABC costing system will lead to different estimates of the costs of Basic and Custom bags. Using the activity data and any other data from Exhibits 1-6 that might be relevant, w build out an ABC costing system.

On the Excel sheet that you have open, please fill in the missing steps in Exhibit ABC1-ABC2-ABC3. Enter your answers into the highlighted locations on the sheet. Show your workings either within the highlighted cells (using formulae), or show them elsewhere on the sheet and label them clearly.

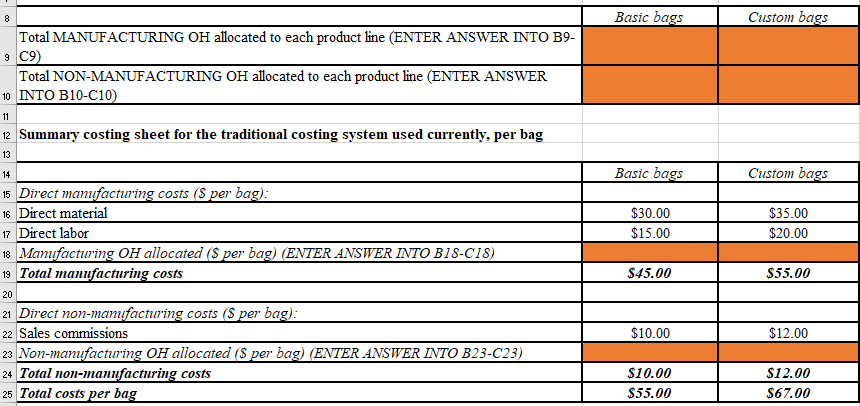

8 Basic bags Custom bags Total MANUFACTURING OH allocated to each product line (ENTER ANSWER INTO B9- 9 C9) Total NON-MANUFACTURING OH allocated to each product line (ENTER ANSWER 10 INTO B10-C10) 11 12 Summary costing sheet for the traditional costing system used currently, per bag 13 14 Basic bags Custom bags 15 Direct manufacturing costs ($ per bag): 16 Direct material $30.00 $35.00 17 Direct labor $15.00 $20.00 18 Manufacturing OH allocated ($ per bag) (ENTER ANSWER INTO B18-C18) 19 Total manufacturing costs $45.00 $55.00 20 21 Direct non-manufacturing costs ($ per bag): 22 Sales commissions $10.00 $12.00 23 Non-manufacturing OH allocated ($ per bag) (ENTER ANSWER INTO B23-C23) 24 Total non-manufacturing costs $10.00 $12.00 25 Total costs per bag $55.00 $67.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Tara Williams and Tilly Norths entrepreneurial spirit led them to create The Om Shanti Bag LLC a com...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started