Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tara's Textiles currently has credit sales of $22 million per month, an average collection period of 58 days, and bad debts equal to 4.5%

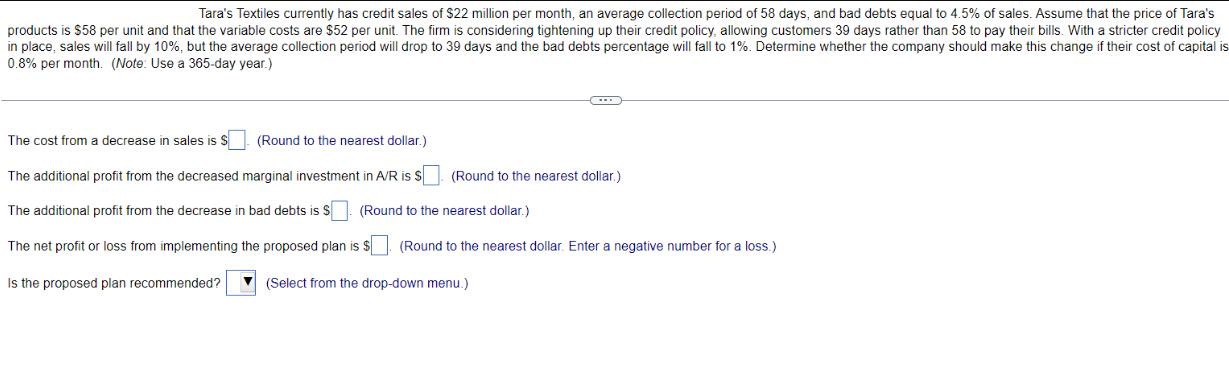

Tara's Textiles currently has credit sales of $22 million per month, an average collection period of 58 days, and bad debts equal to 4.5% of sales. Assume that the price of Tara's products is $58 per unit and that the variable costs are $52 per unit. The firm is considering tightening up their credit policy, allowing customers 39 days rather than 58 to pay their bills. With a stricter credit policy in place, sales will fall by 10%, but the average collection period will drop to 39 days and the bad debts percentage will fall to 1%. Determine whether the company should make this change if their cost of capital is 0.8% per month. (Note: Use a 365-day year.) The cost from a decrease in sales is S. (Round to the nearest dollar.) The additional profit from the decreased marginal investment in A/R is $ The additional profit from the decrease in bad debts is $ (Round to the nearest dollar.) The net profit or loss from implementing the proposed plan is $ (Round to the nearest dollar. Enter a negative number for a loss.) Is the proposed plan recommended? (Select from the drop-down menu.) (Round to the nearest dollar)

Step by Step Solution

★★★★★

3.45 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether the proposed plan is recommended lets calculate the cost from a decrease in sales the additional profit from the decreased margin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started