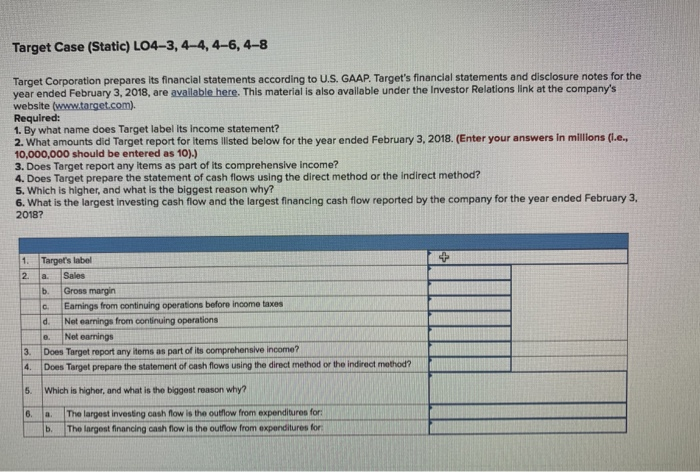

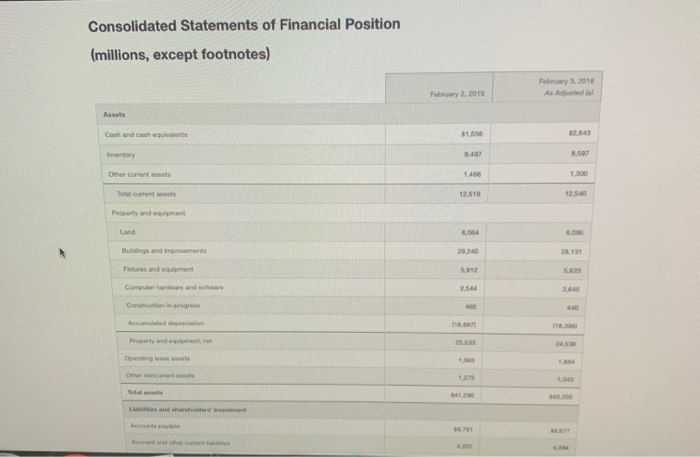

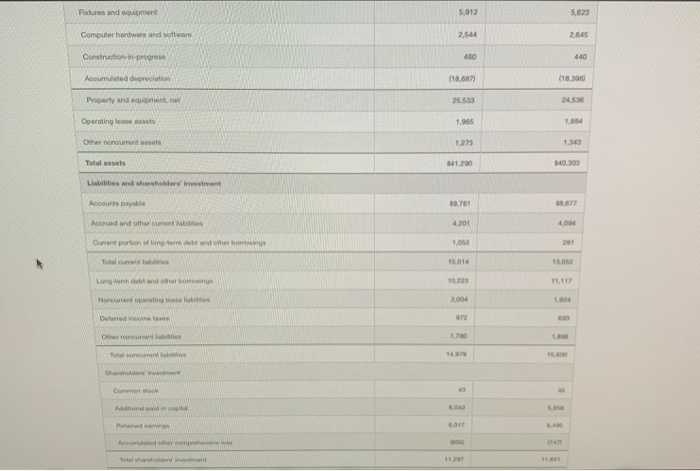

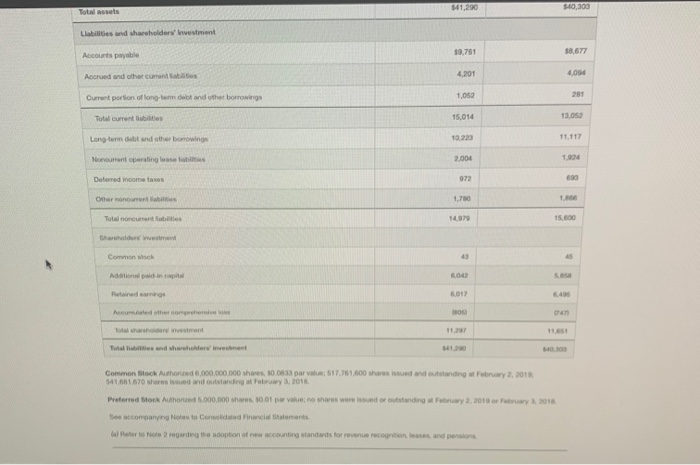

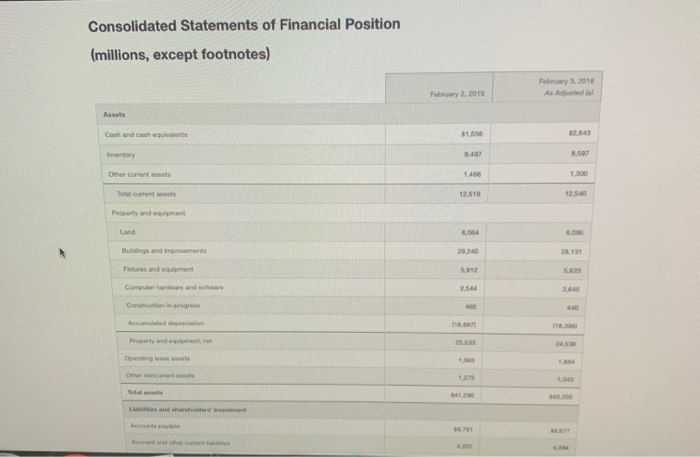

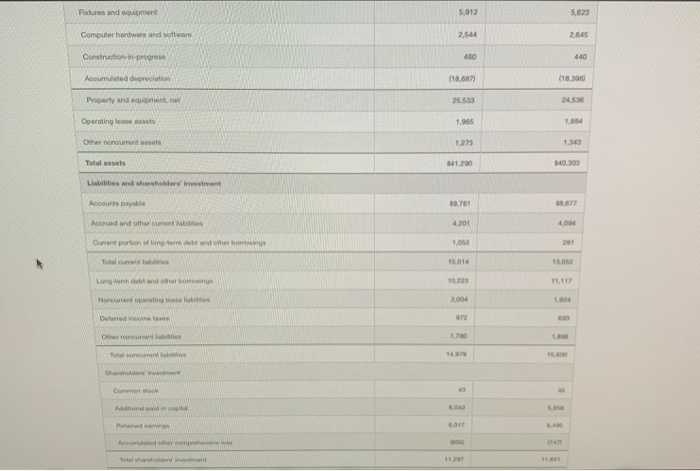

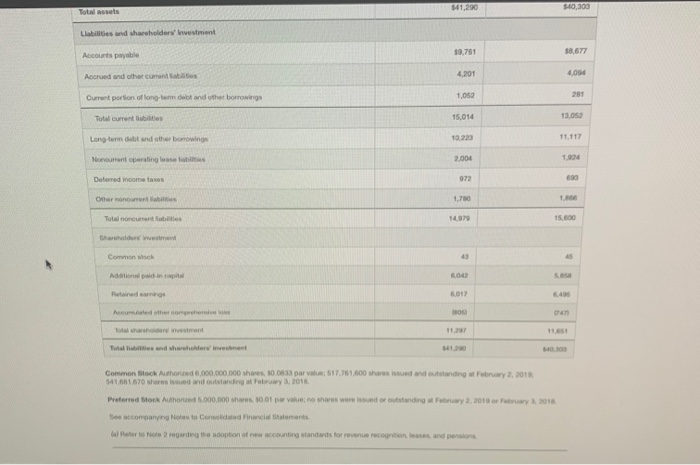

Target Case (Static) L04-3,4-4, 4-6, 4-8 Target Corporation prepares its financial statements according to U.S. GAAP. Target's financial statements and disclosure notes for the year ended February 3, 2018, are available here. This material is also available under the Investor Relations link at the company's website (www.target.com) Required: 1. By what name does Target label its income statement? 2. What amounts did Target report for Items listed below for the year ended February 3, 2018. (Enter your answers in millions (l.e.. 10,000,000 should be entered as 10).) 3. Does Target report any items as part of its comprehensive income? 4. Does Target prepare the statement of cash flows using the direct method or the Indirect method? 5. Which is higher, and what is the biggest reason why? 6. What is the largest investing cash flow and the largest financing cash flow reported by the company for the year ended February 3, 2018? 1 2 a. C Target's label Sales b. Gross margin Earnings from continuing operations before income taxes d. Net earnings from continuing operations Net earnings Does Target report any items as part of its comprehensive income? Does Target prepare the statement of cash flows using the direct method or the indirect method? 0. 3. 4. 5. Which is higher, and what is the biggest reason why? 6 The largest investing cash flow is the outflow from expenditures for The largest financing cash flow is the outflow from expenditures for b. Consolidated Statements of Financial Position (millions, except footnotes) February 2018 As Adjusted February 2, 2010 Assets Cash and cash equivalent $1,550 52.643 9.497 B.SE Other current sets 1.456 1,300 12.519 12500 Land 6.054 5.00 Buildings and improvements 20240 28.131 Fares and on Computer and so 2.544 2.645 Canon ingress 40 Addition an Property and equipment, Os Anh 200 Fixtures and equiment 5,912 5.623 Computer hardware and software 2,544 2.6.45 Construction-in-progress 400 640 Accurated depreciation (18,687) (18,308 Property and equipment 25,630 24534 Operating 1,005 1884 Other nonumentos 1.273 1.343 Totalets 41.290 10.300 Labies and shareholders Investment 10.761 8677 Accrued and other current 4,201 4,094 Current portion of internet dhe 1.05 28 Total current 15.014 13.05 Love me and the bo 1993 11.117 None 2.000 972 Defned income 1.70 Ornon Toloncm 15.000 Shadow Coro Adana 3.643 w Acceder That 141,290 303 Total assets Liabilities and shareholders' Investment 19,761 18,677 Accounts payable 4,201 4.004 Accrued and other currentes 281 Current portion of long-term debt and other borrowing 1,052 Total current abilities 15,014 13.052 Long-term dubt and other borrowing 10.233 11.117 Noncurrent operating lesse 2,004 1.924 Deferred income taxes 972 890 Other monouns 1.780 1 Total noncurrenties 1097 15.000 Shareholdere weet Commonsi Aston 6.042 1,017 The investment Common Stock Author 6,000.000.000 100.33 par val 17.761.600 shares issued and outstanding by 2. 2018 541.001.670 sed and outstanding rebrary 3, 2018 Preferred stock punonized 6.000.000 6001 par value no ens were sund or outstanding at February 2, 2010 or February 3, 2018 Se connes to Conded Financial Statements water to Nole regarding the option of www.counting standards for revenue recognition leases and pensions