Answered step by step

Verified Expert Solution

Question

1 Approved Answer

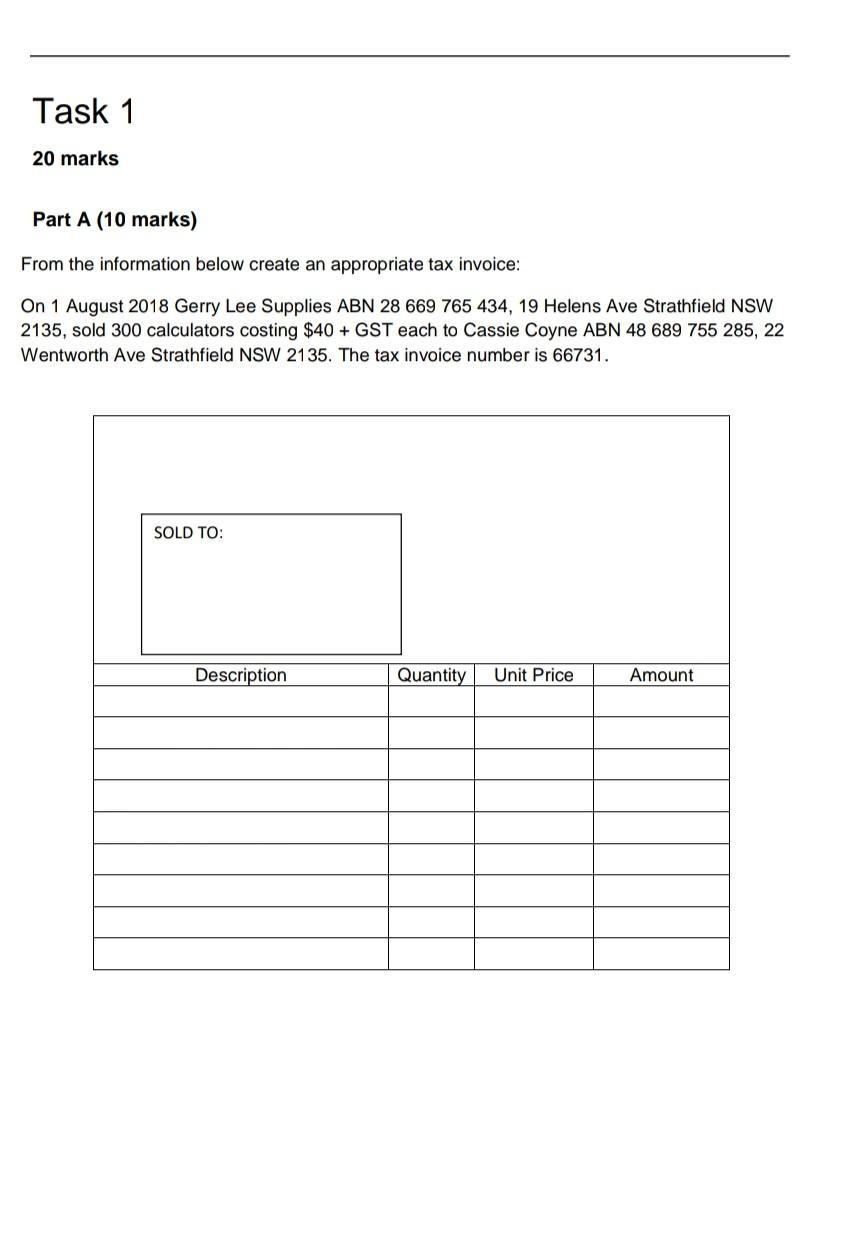

Task 1 20 marks Part A (10 marks) From the information below create an appropriate tax invoice: On 1 August 2018 Gerry Lee Supplies ABN

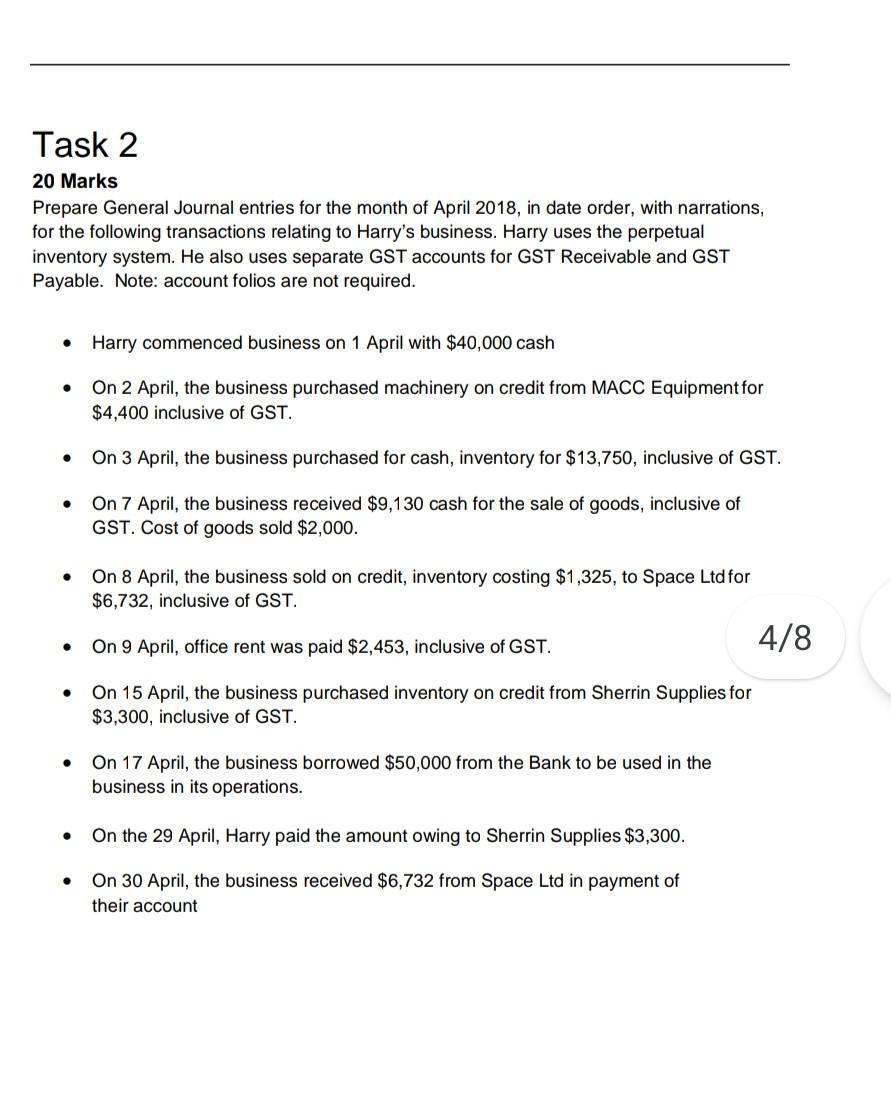

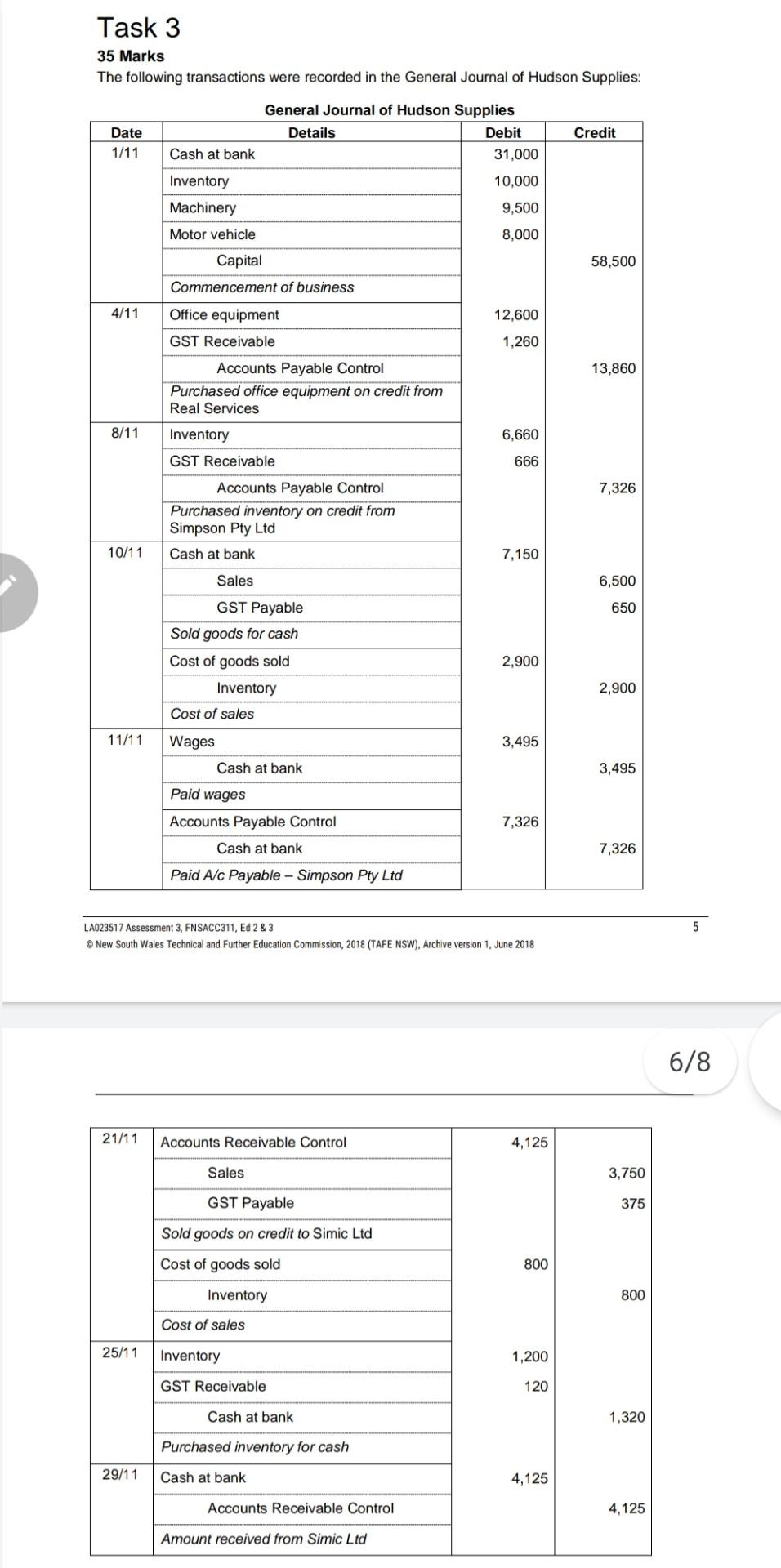

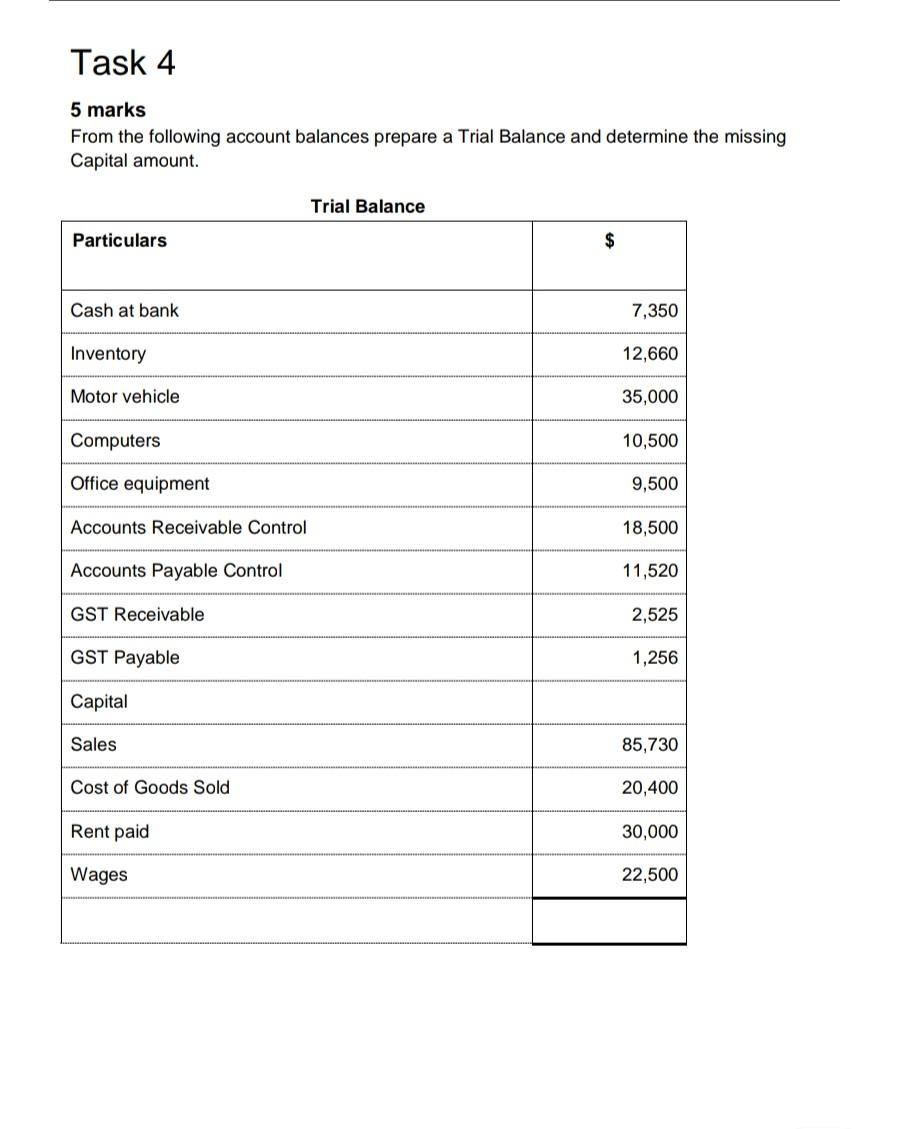

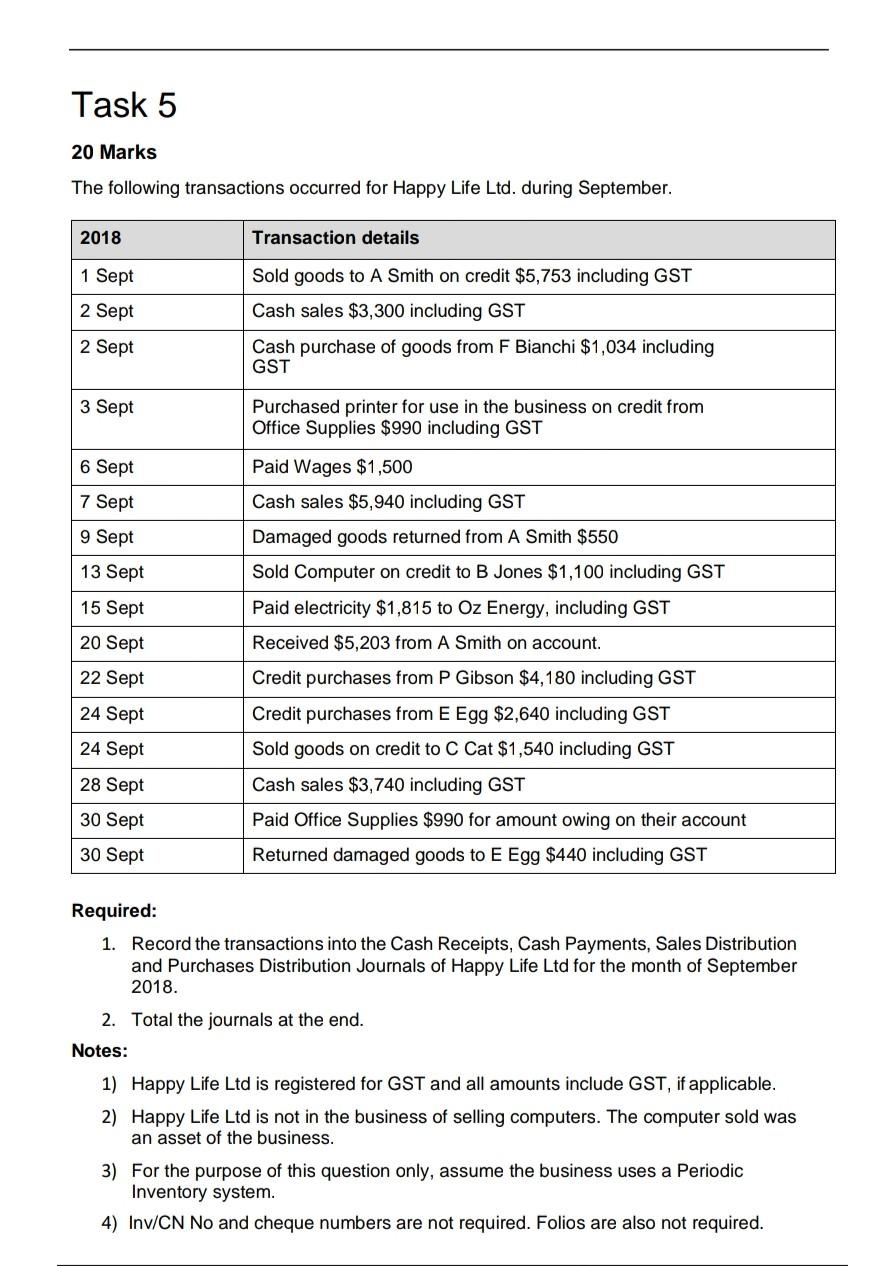

Task 1 20 marks Part A (10 marks) From the information below create an appropriate tax invoice: On 1 August 2018 Gerry Lee Supplies ABN 28 669 765 434, 19 Helens Ave Strathfield NSW 2135, sold 300 calculators costing $40 + GST each to Cassie Coyne ABN 48 689 755 285, 22 Wentworth Ave Strathfield NSW 2135. The tax invoice number is 66731. SOLD TO: Description Quantity Unit Price Amount Task 2 20 Marks Prepare General Journal entries for the month of April 2018, in date order, with narrations, for the following transactions relating to Harry's business. Harry uses the perpetual inventory system. He also uses separate GST accounts for GST Receivable and GST Payable. Note: account folios are not required. . Harry commenced business on 1 April with $40,000 cash On 2 April, the business purchased machinery on credit from MACC Equipment for $4,400 inclusive of GST. On 3 April, the business purchased for cash, inventory for $13,750, inclusive of GST. . On 7 April, the business received $9,130 cash for the sale of goods, inclusive of GST. Cost of goods sold $2,000. . On 8 April, the business sold on credit, inventory costing $1,325, to Space Ltd for $6,732, inclusive of GST. 4/8 On 9 April, office rent was paid $2,453, inclusive of GST. . . On 15 April, the business purchased inventory on credit from Sherrin Supplies for $3,300, inclusive of GST. . On 17 April, the business borrowed $50,000 from the Bank to be used in the business in its operations. . On the 29 April, Harry paid the amount owing to Sherrin Supplies $3,300. . On 30 April, the business received $6,732 from Space Ltd in payment of their account Task 3 35 Marks The following transactions were recorded in the General Journal of Hudson Supplies: General Journal of Hudson Supplies Date Details Debit Credit 1/11 Cash at bank 31,000 10,000 Inventory Machinery 9,500 Motor vehicle 8,000 58,500 Capital Commencement of business 4/11 Office equipment 12,600 GST Receivable 1,260 13,860 8/11 6,660 Accounts Payable Control Purchased office equipment on credit from Real Services Inventory GST Receivable Accounts Payable Control Purchased inventory on credit from Simpson Pty Ltd Cash at bank 666 7,326 10/11 7,150 Sales 6,500 650 GST Payable Sold goods for cash Cost of goods sold Inventory Cost of sales 2,900 2,900 11/11 Wages 3,495 Cash at bank 3,495 Paid wages Accounts Payable Control 7,326 Cash at bank 7,326 Paid A/c Payable - Simpson Pty Ltd 5 LA023517 Assessment 3, FNSACC311, Ed 2 & 3 New South Wales Technical and Further Education Commission, 2018 (TAFE NSW). Archive version 1, June 2018 6/8 21/11 Accounts Receivable Control 4,125 Sales 3,750 GST Payable 375 Sold goods on credit to Simic Ltd Cost of goods sold 800 Inventory 800 Cost of sales 25/11 Inventory 1,200 GST Receivable 120 Cash at bank 1,320 Purchased inventory for cash 29/11 Cash at bank 4,125 Accounts Receivable Control 4,125 Amount received from Simic Ltd Task 4 5 marks From the following account balances prepare a Trial Balance and determine the missing Capital amount. Trial Balance Particulars $ Cash at bank 7,350 Inventory 12,660 Motor vehicle 35,000 Computers 10,500 Office equipment 9,500 Accounts Receivable Control 18,500 Accounts Payable Control 11,520 GST Receivable 2,525 GST Payable 1,256 Capital Sales 85,730 Cost of Goods Sold 20,400 Rent paid 30,000 Wages 22,500 Task 5 20 Marks The following transactions occurred for Happy Life Ltd. during September. 2018 Transaction details 1 Sept 2 Sept Sold goods to A Smith on credit $5,753 including GST Cash sales $3,300 including GST Cash purchase of goods from F Bianchi $1,034 including GST 2 Sept 3 Sept Purchased printer for use in the business on credit from Office Supplies $990 including GST 6 Sept 7 Sept 9 Sept 13 Sept Paid Wages $1,500 Cash sales $5,940 including GST Damaged goods returned from A Smith $550 Sold Computer on credit to B Jones $1,100 including GST Paid electricity $1,815 to Oz Energy, including GST 15 Sept Received $5,203 from A Smith on account. 20 Sept 22 Sept 24 Sept 24 Sept Credit purchases from P Gibson $4,180 including GST Credit purchases from E Egg $2,640 including GST Sold goods on credit to C Cat $1,540 including GST Cash sales $3,740 including GST Paid Office Supplies $990 for amount owing on their account Returned damaged goods to E Egg $440 including GST 28 Sept 30 Sept 30 Sept Required: 1. Record the transactions into the Cash Receipts, Cash Payments, Sales Distribution and Purchases Distribution Journals of Happy Life Ltd for the month of September 2018. 2. Total the journals at the end. Notes: 1) Happy Life Ltd is registered for GST and all amounts include GST, if applicable. 2) Happy Life Ltd is not in the business of selling computers. The computer sold was an asset of the business. 3) For the purpose of this question only, assume the business uses a Periodic Inventory system. 4) Inv/CN No and cheque numbers are not required. Folios are also not required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started