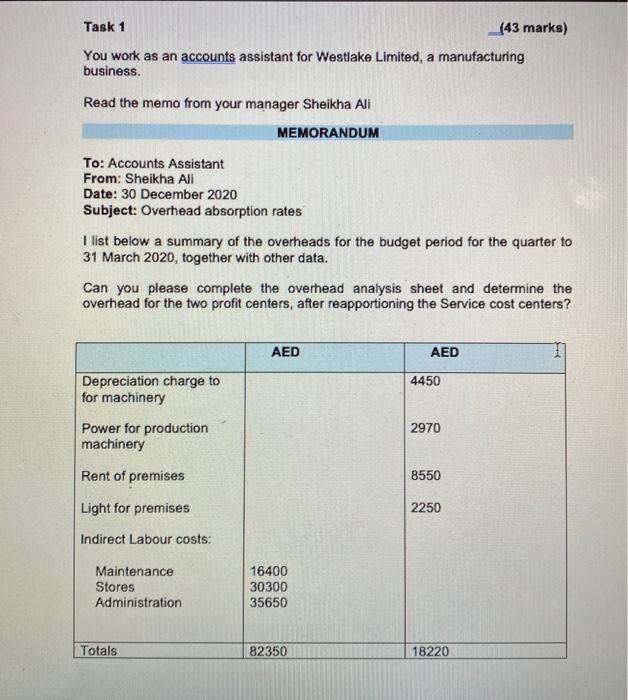

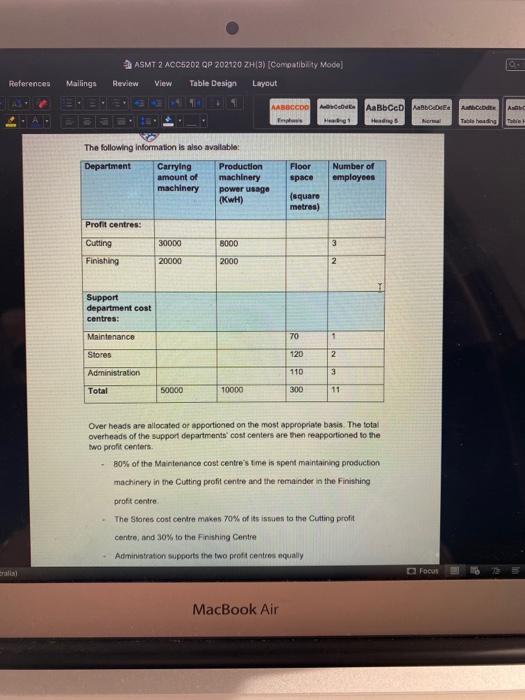

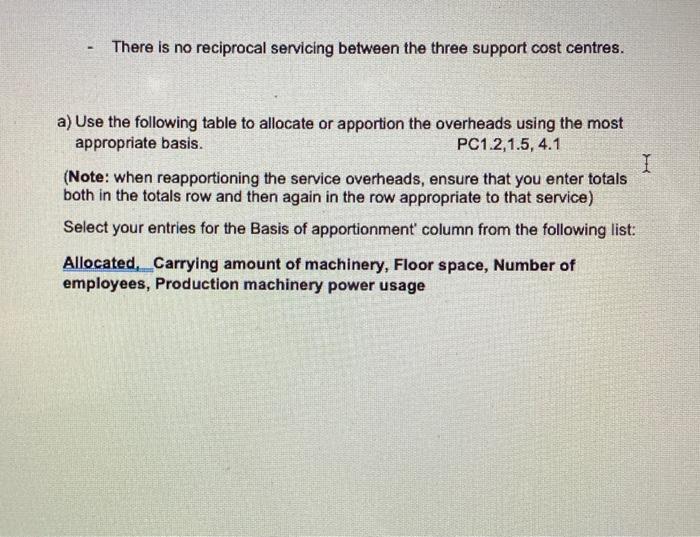

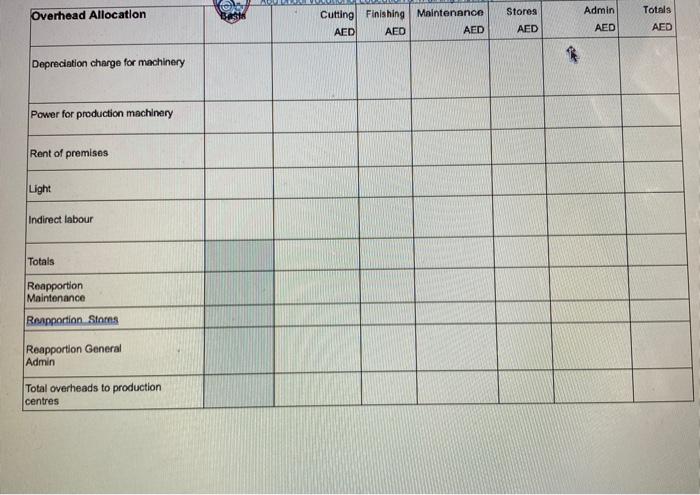

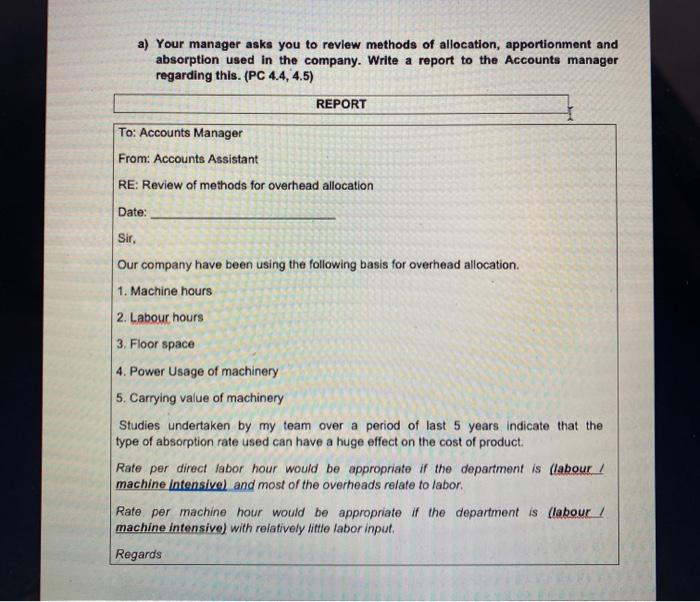

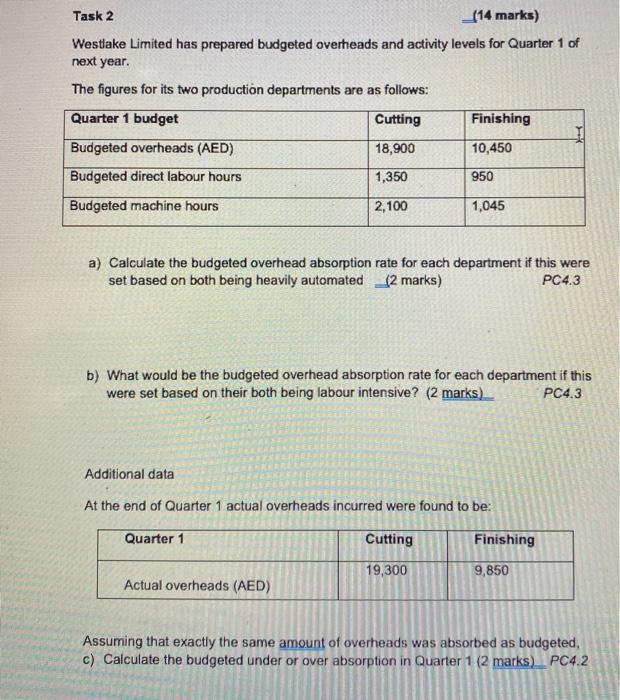

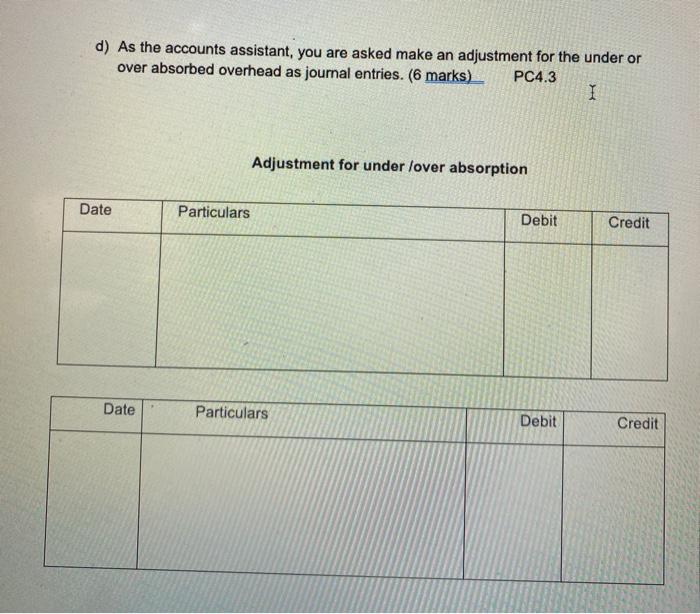

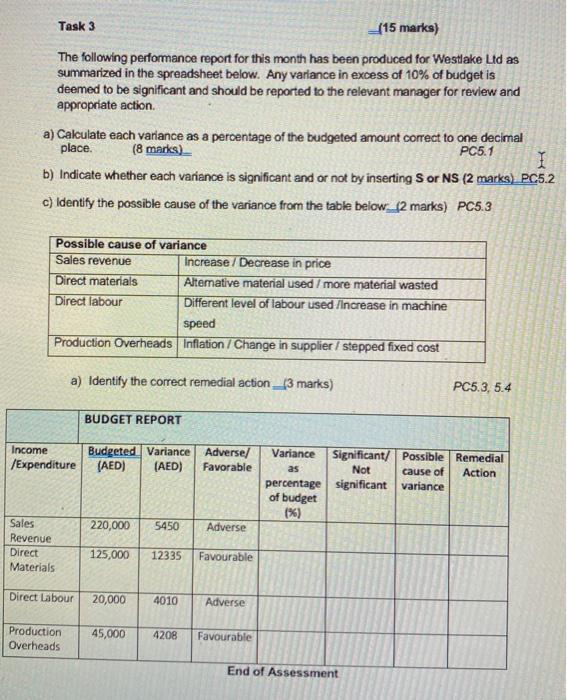

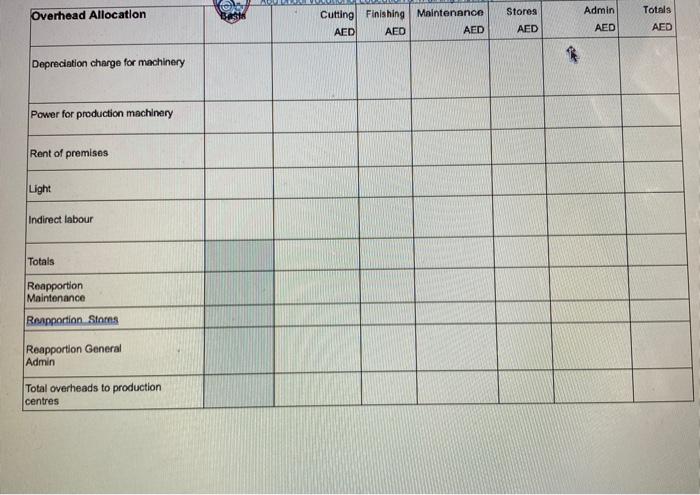

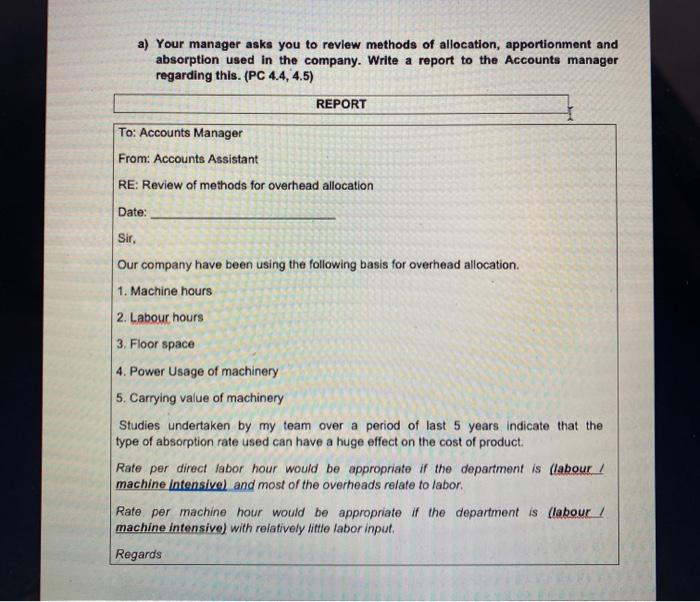

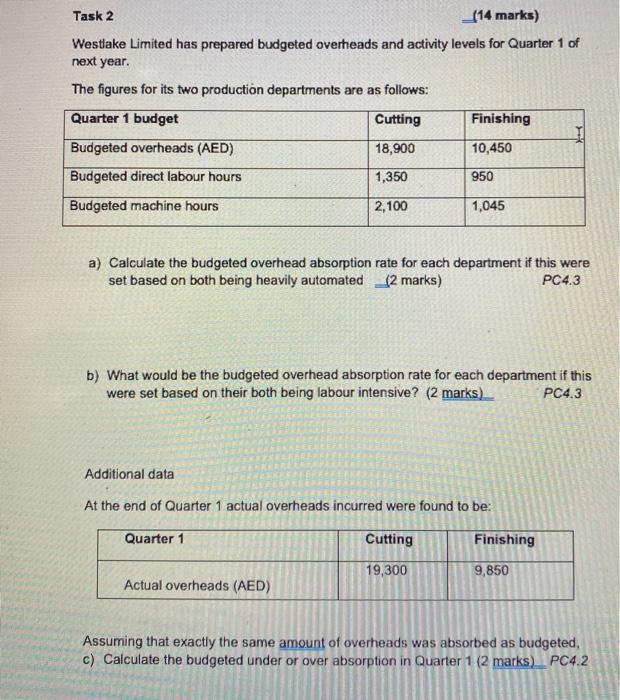

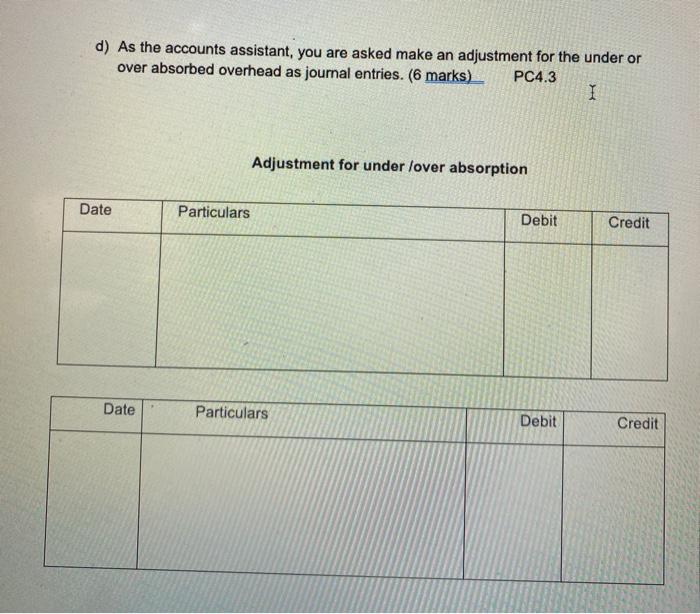

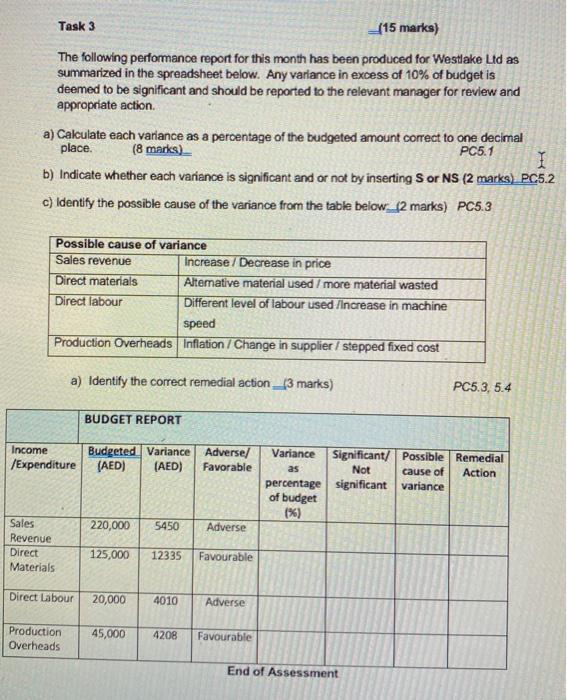

Task 1 (43 marks) You work as an accounts assistant for Westlake Limited, a manufacturing business. Read the memo from your manager Sheikha Ali MEMORANDUM To: Accounts Assistant From: Sheikha Ali Date: 30 December 2020 Subject: Overhead absorption rates I list below a summary of the overheads for the budget period for the quarter to 31 March 2020, together with other data. Can you please complete the overhead analysis sheet and determine the overhead for the two profit centers, after reapportioning the Service cost centers? AED AED 4450 Depreciation charge to for machinery 2970 Power for production machinery Rent of premises 8550 Light for premises 2250 Indirect Labour costs: Maintenance Stores Administration 16400 30300 35650 Totals 82350 18220 ASMT 2 ACC5202 QP 202120 ZH(3) Compatibility Modo) Review View Table Design Layout References Mailings ALS NABOCCOD B AaBbcco Kabba Acade Het To The following information is also available: Department Carrying Production amount of machinery machinery power usage (KWH) Number of employees Floor space square metres) Profit centres: Cutting 30000 8000 3 Finishing 20000 2000 2 Support department cost centres: Maintenance 70 1 Stores 120 2 Administration 110 3 Total 50000 10000 300 11 Over heads are allocated or apportioned on the most appropriate basis. The total overheads of the support departments cost centers are then reapportioned to the two profit centers B0% of the Maintenance cost centre's time is spent maintaining production machinery in the Cutting profit centre and the remainder in the Finishing profit centre The Stores cost centre makes 70% of its issues to the Cutting profit centre, and 30% to the Finishing Centre Administration supports the two profit centres equally tcut MacBook Air There is no reciprocal servicing between the three support cost centres. a) Use the following table to allocate or apportion the overheads using the most appropriate basis. PC1.2,1.5, 4.1 I (Note: when reapportioning the service overheads, ensure that you enter totals both in the totals row and then again in the row appropriate to that service) Select your entries for the Basis of apportionment column from the following list: Allocated. Carrying amount of machinery, Floor space, Number of employees, Production machinery power usage Overhead Allocation Cutting Finishing Maintenance AED AED AED Stores AED Admin AED Totals AED Depreciation charge for machinery Power for production machinery Rent of premises Light Indirect labour Totals Reapportion Maintenance Rapportion Stoms Reapportion General Admin Total overheads to production centres a) Your manager asks you to review methods of allocation, apportionment and absorption used in the company. Write a report to the Accounts manager regarding this. (PC 4.4, 4.5) REPORT To: Accounts Manager From: Accounts Assistant RE: Review of methods for overhead allocation Date: Sir. Our company have been using the following basis for overhead allocation. 1. Machine hours 2. Labour hours 3. Floor space 4. Power Usage of machinery 5. Carrying value of machinery Studies undertaken by my team over a period of last 5 years indicate that the type of absorption rate used can have a huge effect on the cost of product. Rate per direct labor hour would be appropriate if the department is (labour 1 machine intensive) and most of the overheads relate to labor. Rate per machine hour would be appropriate the department is (labour machine intensive) with relatively little labor input Regards Task 2 _(14 marks) Westlake Limited has prepared budgeted overheads and activity levels for Quarter 1 of next year. The figures for its two production departments are as follows: Quarter 1 budget Cutting Finishing Budgeted overheads (AED) 18,900 10,450 Budgeted direct labour hours 1,350 950 Budgeted machine hours 2,100 1,045 a) Calculate the budgeted overhead absorption rate for each department if this were set based on both being heavily automated (2 marks) PC4.3 b) What would be the budgeted overhead absorption rate for each department if this were set based on their both being labour intensive? (2 marks) PC4.3 Additional data At the end of Quarter 1 actual overheads incurred were found to be: Quarter 1 Cutting Finishing 19,300 9,850 Actual overheads (AED) Assuming that exactly the same amount of overheads was absorbed as budgeted, c) Calculate the budgeted under or over absorption in Quarter 1 (2 marks) PC4.2 d) As the accounts assistant, you are asked make an adjustment for the under or over absorbed overhead as journal entries. (6 marks) PC4.3 I Adjustment for under lover absorption Date Particulars Debit Credit Date Particulars Debit Credit Task 3 _{15 marks) The following performance report for this month has been produced for Westlake Ltd as summarized in the spreadsheet below. Any variance in excess of 10% of budget is deemed to be significant and should be reported to the relevant manager for review and appropriate action a) Calculate each variance as a percentage of the budgeted amount correct to one decimal place. (8 marks) PC5.1 I b) Indicate whether each variance is significant and or not by inserting Sor NS (2 marks) PC5.2 c) Identify the possible cause of the variance from the table below_[2 marks) PC5.3 Possible cause of variance Sales revenue Increase / Decrease in price Direct materials Alternative material used / more material wasted Direct labour Different level of labour used /Increase in machine speed Production Overheads Inflation / Change in supplier / stepped fixed cost a) Identify the correct remedial action (3 marks) PC5.3, 5.4 BUDGET REPORT Income /Expenditure Budgeted Variance Adverse/ (AED) (AED) Favorable Variance Significant/ Possible Remedial as Not cause of Action percentage significant variance of budget (%) 220,000 5450 Adverse Sales Revenue Direct Materials 125,000 12335 Favourable Direct Labour 20,000 4010 Adverse Production Overheads 45,000 4208 Favourable End of Assessment Task 1 (43 marks) You work as an accounts assistant for Westlake Limited, a manufacturing business. Read the memo from your manager Sheikha Ali MEMORANDUM To: Accounts Assistant From: Sheikha Ali Date: 30 December 2020 Subject: Overhead absorption rates I list below a summary of the overheads for the budget period for the quarter to 31 March 2020, together with other data. Can you please complete the overhead analysis sheet and determine the overhead for the two profit centers, after reapportioning the Service cost centers? AED AED 4450 Depreciation charge to for machinery 2970 Power for production machinery Rent of premises 8550 Light for premises 2250 Indirect Labour costs: Maintenance Stores Administration 16400 30300 35650 Totals 82350 18220 ASMT 2 ACC5202 QP 202120 ZH(3) Compatibility Modo) Review View Table Design Layout References Mailings ALS NABOCCOD B AaBbcco Kabba Acade Het To The following information is also available: Department Carrying Production amount of machinery machinery power usage (KWH) Number of employees Floor space square metres) Profit centres: Cutting 30000 8000 3 Finishing 20000 2000 2 Support department cost centres: Maintenance 70 1 Stores 120 2 Administration 110 3 Total 50000 10000 300 11 Over heads are allocated or apportioned on the most appropriate basis. The total overheads of the support departments cost centers are then reapportioned to the two profit centers B0% of the Maintenance cost centre's time is spent maintaining production machinery in the Cutting profit centre and the remainder in the Finishing profit centre The Stores cost centre makes 70% of its issues to the Cutting profit centre, and 30% to the Finishing Centre Administration supports the two profit centres equally tcut MacBook Air There is no reciprocal servicing between the three support cost centres. a) Use the following table to allocate or apportion the overheads using the most appropriate basis. PC1.2,1.5, 4.1 I (Note: when reapportioning the service overheads, ensure that you enter totals both in the totals row and then again in the row appropriate to that service) Select your entries for the Basis of apportionment column from the following list: Allocated. Carrying amount of machinery, Floor space, Number of employees, Production machinery power usage Overhead Allocation Cutting Finishing Maintenance AED AED AED Stores AED Admin AED Totals AED Depreciation charge for machinery Power for production machinery Rent of premises Light Indirect labour Totals Reapportion Maintenance Rapportion Stoms Reapportion General Admin Total overheads to production centres a) Your manager asks you to review methods of allocation, apportionment and absorption used in the company. Write a report to the Accounts manager regarding this. (PC 4.4, 4.5) REPORT To: Accounts Manager From: Accounts Assistant RE: Review of methods for overhead allocation Date: Sir. Our company have been using the following basis for overhead allocation. 1. Machine hours 2. Labour hours 3. Floor space 4. Power Usage of machinery 5. Carrying value of machinery Studies undertaken by my team over a period of last 5 years indicate that the type of absorption rate used can have a huge effect on the cost of product. Rate per direct labor hour would be appropriate if the department is (labour 1 machine intensive) and most of the overheads relate to labor. Rate per machine hour would be appropriate the department is (labour machine intensive) with relatively little labor input Regards Task 2 _(14 marks) Westlake Limited has prepared budgeted overheads and activity levels for Quarter 1 of next year. The figures for its two production departments are as follows: Quarter 1 budget Cutting Finishing Budgeted overheads (AED) 18,900 10,450 Budgeted direct labour hours 1,350 950 Budgeted machine hours 2,100 1,045 a) Calculate the budgeted overhead absorption rate for each department if this were set based on both being heavily automated (2 marks) PC4.3 b) What would be the budgeted overhead absorption rate for each department if this were set based on their both being labour intensive? (2 marks) PC4.3 Additional data At the end of Quarter 1 actual overheads incurred were found to be: Quarter 1 Cutting Finishing 19,300 9,850 Actual overheads (AED) Assuming that exactly the same amount of overheads was absorbed as budgeted, c) Calculate the budgeted under or over absorption in Quarter 1 (2 marks) PC4.2 d) As the accounts assistant, you are asked make an adjustment for the under or over absorbed overhead as journal entries. (6 marks) PC4.3 I Adjustment for under lover absorption Date Particulars Debit Credit Date Particulars Debit Credit Task 3 _{15 marks) The following performance report for this month has been produced for Westlake Ltd as summarized in the spreadsheet below. Any variance in excess of 10% of budget is deemed to be significant and should be reported to the relevant manager for review and appropriate action a) Calculate each variance as a percentage of the budgeted amount correct to one decimal place. (8 marks) PC5.1 I b) Indicate whether each variance is significant and or not by inserting Sor NS (2 marks) PC5.2 c) Identify the possible cause of the variance from the table below_[2 marks) PC5.3 Possible cause of variance Sales revenue Increase / Decrease in price Direct materials Alternative material used / more material wasted Direct labour Different level of labour used /Increase in machine speed Production Overheads Inflation / Change in supplier / stepped fixed cost a) Identify the correct remedial action (3 marks) PC5.3, 5.4 BUDGET REPORT Income /Expenditure Budgeted Variance Adverse/ (AED) (AED) Favorable Variance Significant/ Possible Remedial as Not cause of Action percentage significant variance of budget (%) 220,000 5450 Adverse Sales Revenue Direct Materials 125,000 12335 Favourable Direct Labour 20,000 4010 Adverse Production Overheads 45,000 4208 Favourable End of Assessment