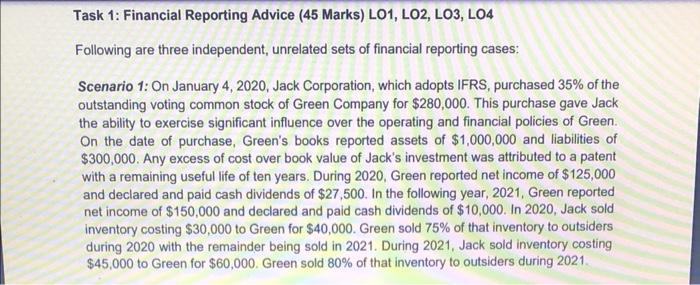

Task 1: Financial Reporting Advice (45 Marks) LO1, LO2, LO3, LO4 Following are three independent, unrelated sets of financial reporting cases: Scenario 1: On January 4, 2020, Jack Corporation, which adopts IFRS, purchased 35% of the outstanding voting common stock of Green Company for $280,000. This purchase gave Jack the ability to exercise significant influence over the operating and financial policies of Green. On the date of purchase, Green's books reported assets of $1,000,000 and liabilities of $300,000. Any excess of cost over book value of Jack's investment was attributed to a patent with a remaining useful life of ten years. During 2020 , Green reported net income of $125,000 and declared and paid cash dividends of $27,500. In the following year, 2021, Green reported net income of $150,000 and declared and paid cash dividends of $10,000. In 2020, Jack sold inventory costing $30,000 to Green for $40,000. Green sold 75% of that inventory to outsiders during 2020 with the remainder being sold in 2021. During 2021, Jack sold inventory costing $45,000 to Green for $60,000. Green sold 80% of that inventory to outsiders during 2021. Required: Advise the companies on the above accounting issues, illustrating your advice, where appropriate, with relevant references, journal entries, financial extracts and numerical details. Note: Round to the nearest $, if needed. Task 1: Financial Reporting Advice (45 Marks) LO1, LO2, LO3, LO4 Following are three independent, unrelated sets of financial reporting cases: Scenario 1: On January 4, 2020, Jack Corporation, which adopts IFRS, purchased 35% of the outstanding voting common stock of Green Company for $280,000. This purchase gave Jack the ability to exercise significant influence over the operating and financial policies of Green. On the date of purchase, Green's books reported assets of $1,000,000 and liabilities of $300,000. Any excess of cost over book value of Jack's investment was attributed to a patent with a remaining useful life of ten years. During 2020 , Green reported net income of $125,000 and declared and paid cash dividends of $27,500. In the following year, 2021, Green reported net income of $150,000 and declared and paid cash dividends of $10,000. In 2020, Jack sold inventory costing $30,000 to Green for $40,000. Green sold 75% of that inventory to outsiders during 2020 with the remainder being sold in 2021. During 2021, Jack sold inventory costing $45,000 to Green for $60,000. Green sold 80% of that inventory to outsiders during 2021. Required: Advise the companies on the above accounting issues, illustrating your advice, where appropriate, with relevant references, journal entries, financial extracts and numerical details. Note: Round to the nearest $, if needed