Question

Task: 1. Prepare of consolidated income statement and balance sheet worksheet; 2 equity method journal entries; 3 financial statements Consolidated income statement and balance sheet

Task: 1. Prepare of consolidated income statement and balance sheet worksheet; 2 equity method journal entries; 3 financial statements

Consolidated income statement and balance sheet for the fiscal year ending December 31, 2021. You will need to recreate the equity method journal entries for Paper Company for the year and use a consolidation worksheet.

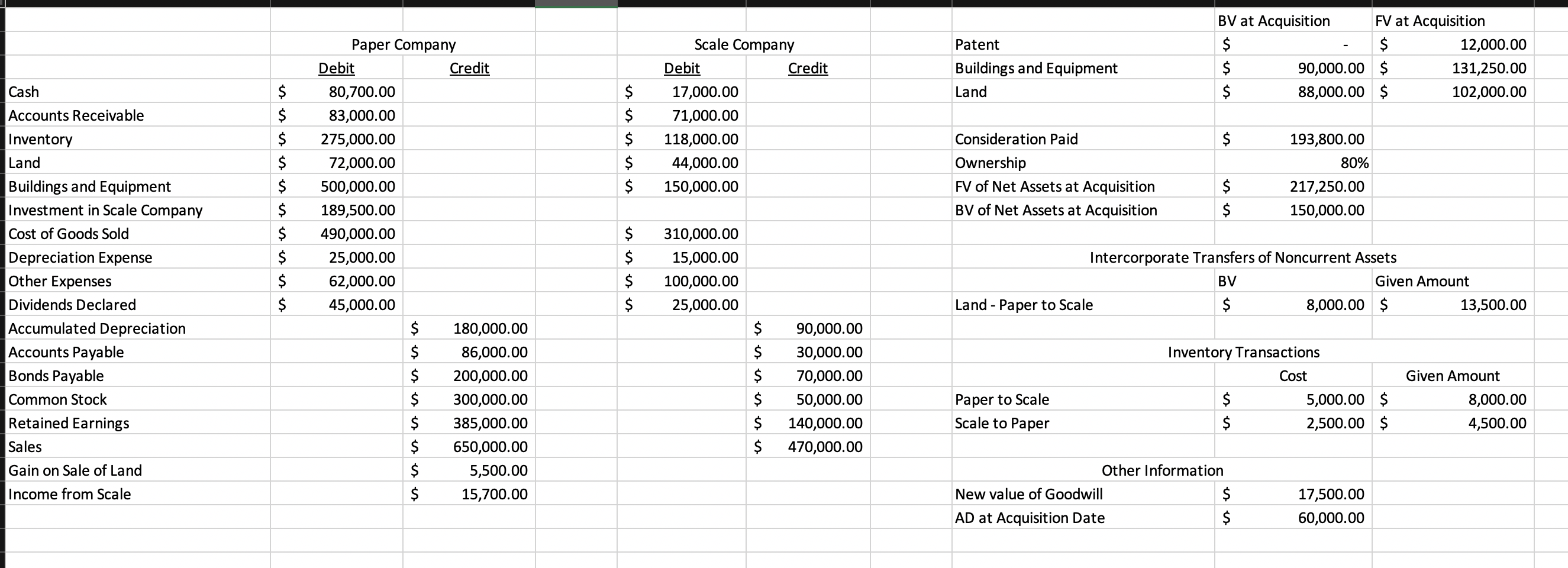

In 2020 Paper Company acquired 80% of the common stock of Scale Company for $193,800 in cash. The FV of the net assets were determined to be $217,250. This included an unrecorded patent worth $12,000, undervaluation of buildings and equipment of $41,250, and undervalued land of $14,000. Any remaining differential was determined to be due to goodwill. Scale Company reported common stock of $100,000 and retained earnings of $50,000 at the time of acquisition. Scale Company had Accumulated Depreciation at the time of $60,000 on its buildings and equipment. In 2021 Paper Company's accounting staff determined that the value of the goodwill related to the acquisition was impaired and Goodwill was now best valued at $17,500. In 2021 Scale Company sold inventory to Paper Company for $4,500 and had an original cost of $2,500. Paper Company sold inventory to Scale Company for $8,000 when it had an original cost of $5,000. Neither Paper nor Scale Company had sold the inventory to a third party by the end of December 31, 2021. Paper Company sold land to Scale Company originally costing $8,000 for $13,500. Presume Paper Company uses the full equity method to account for activities of Scale Company.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started