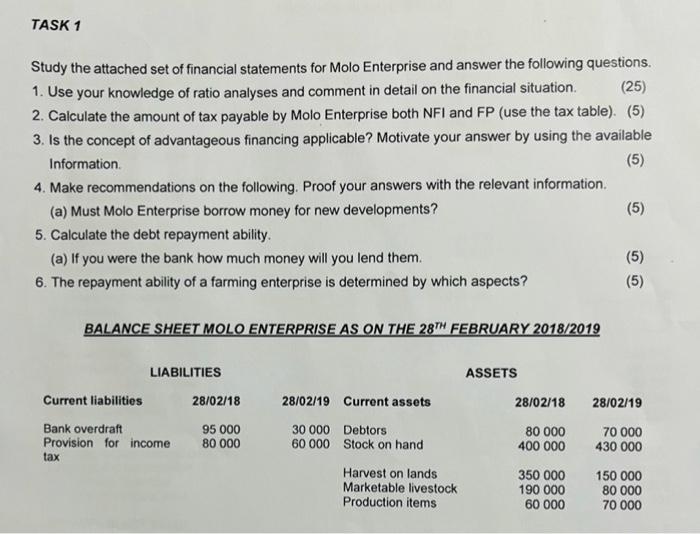

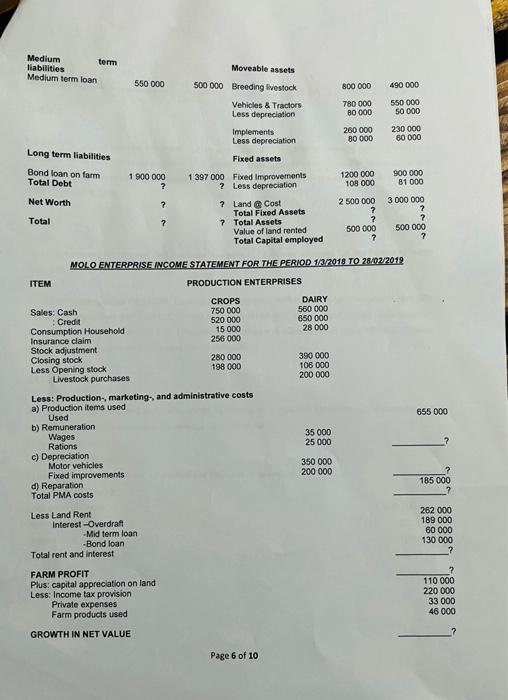

TASK 1 Study the attached set of financial statements for Molo Enterprise and answer the following questions. (25) 1. Use your knowledge of ratio analyses and comment in detail on the financial situation. 2. Calculate the amount of tax payable by Molo Enterprise both NFI and FP (use the tax table). (5) 3. Is the concept of advantageous financing applicable? Motivate your answer by using the available Information. (5) 4. Make recommendations on the following. Proof your answers with the relevant information. (a) Must Molo Enterprise borrow money for new developments? 5. Calculate the debt repayment ability. (a) If you were the bank how much money will you lend them. 6. The repayment ability of a farming enterprise is determined by which aspects? BALANCE SHEET MOLO ENTERPRISE AS ON THE 28TH FEBRUARY 2018/2019 Current liabilities LIABILITIES Bank overdraft Provision for income tax 28/02/18 95 000 80 000 28/02/19 30 000 60 000 Current assets Debtors Stock on hand Harvest on lands Marketable livestock Production items ASSETS 28/02/18 80 000 400 000 350 000 190 000 60 000 (5) (5) (5) 28/02/19 70 000 430 000 150 000 80 000 70 000 Medium liabilities Medium term loan Long term liabilities Bond loan on farm Total Debt Net Worth Total ITEM Sales: Cash Credit term Consumption Household Insurance claim Stock adjustment Closing stock Less Opening stock Livestock purchases Motor vehicles Fixed improvements d) Reparation Total PMA costs Less Land Rent 1 900 000 Interest -Overdraft 550 000 Total rent and interest -Mid term loan -Bond loan ? ? FARM PROFIT Plus: capital appreciation on land Less: Income tax provision Private expenses Farm products used GROWTH IN NET VALUE Moveable assets 500 000 Breeding livestock 1 397 000 ? ? Less: Production-, marketing, and administrative costs a) Production items used Used b) Remuneration Wages Rations c) Depreciation. ? Vehicles & Tractors Less depreciation MOLO ENTERPRISE INCOME STATEMENT FOR THE PERIOD 1/3/2018 TO 28/02/2019 PRODUCTION ENTERPRISES Implements Less depreciation Fixed assets Fixed Improvements Less depreciation Land @ Cost Total Fixed Assets Total Assets Value of land rented Total Capital employed CROPS 750 000 520 000 15 000 256 000 280 000 198 000 Page 6 of 10 DAIRY 560 000 650 000 28 000 390 000 106 000 200 000 35 000 25 000 800 000 780 000 80 000 350 000 200 000 260 000 80 000 1200 000 108 000 2 500 000 ? ? 500 000 ? 490 000 550 000 50 000 230 000 60 000 900 000 81 000 3 000 000 ? 500 000 ? 655 000 185 000 ? 262 000 189 000 60 000 130 000 ? 110 000 220 000 33 000 46 000 TASK 1 Study the attached set of financial statements for Molo Enterprise and answer the following questions. (25) 1. Use your knowledge of ratio analyses and comment in detail on the financial situation. 2. Calculate the amount of tax payable by Molo Enterprise both NFI and FP (use the tax table). (5) 3. Is the concept of advantageous financing applicable? Motivate your answer by using the available Information. (5) 4. Make recommendations on the following. Proof your answers with the relevant information. (a) Must Molo Enterprise borrow money for new developments? 5. Calculate the debt repayment ability. (a) If you were the bank how much money will you lend them. 6. The repayment ability of a farming enterprise is determined by which aspects? BALANCE SHEET MOLO ENTERPRISE AS ON THE 28TH FEBRUARY 2018/2019 Current liabilities LIABILITIES Bank overdraft Provision for income tax 28/02/18 95 000 80 000 28/02/19 30 000 60 000 Current assets Debtors Stock on hand Harvest on lands Marketable livestock Production items ASSETS 28/02/18 80 000 400 000 350 000 190 000 60 000 (5) (5) (5) 28/02/19 70 000 430 000 150 000 80 000 70 000 Medium liabilities Medium term loan Long term liabilities Bond loan on farm Total Debt Net Worth Total ITEM Sales: Cash Credit term Consumption Household Insurance claim Stock adjustment Closing stock Less Opening stock Livestock purchases Motor vehicles Fixed improvements d) Reparation Total PMA costs Less Land Rent 1 900 000 Interest -Overdraft 550 000 Total rent and interest -Mid term loan -Bond loan ? ? FARM PROFIT Plus: capital appreciation on land Less: Income tax provision Private expenses Farm products used GROWTH IN NET VALUE Moveable assets 500 000 Breeding livestock 1 397 000 ? ? Less: Production-, marketing, and administrative costs a) Production items used Used b) Remuneration Wages Rations c) Depreciation. ? Vehicles & Tractors Less depreciation MOLO ENTERPRISE INCOME STATEMENT FOR THE PERIOD 1/3/2018 TO 28/02/2019 PRODUCTION ENTERPRISES Implements Less depreciation Fixed assets Fixed Improvements Less depreciation Land @ Cost Total Fixed Assets Total Assets Value of land rented Total Capital employed CROPS 750 000 520 000 15 000 256 000 280 000 198 000 Page 6 of 10 DAIRY 560 000 650 000 28 000 390 000 106 000 200 000 35 000 25 000 800 000 780 000 80 000 350 000 200 000 260 000 80 000 1200 000 108 000 2 500 000 ? ? 500 000 ? 490 000 550 000 50 000 230 000 60 000 900 000 81 000 3 000 000 ? 500 000 ? 655 000 185 000 ? 262 000 189 000 60 000 130 000 ? 110 000 220 000 33 000 46 000