Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Task 1: The Canadian federal personal income tax is calculated based on filing status and taxable income. There are four filing statuses: single filers

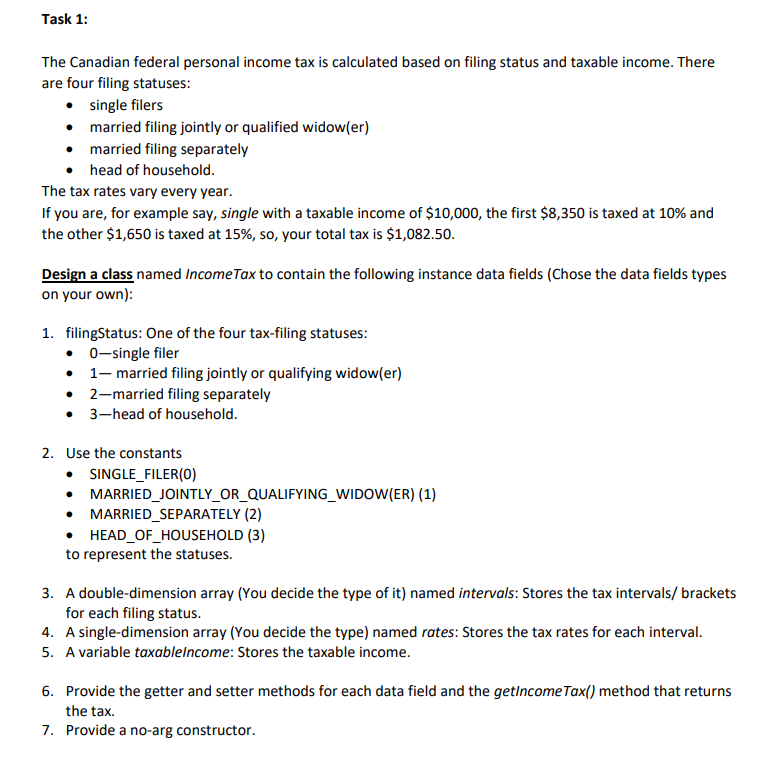

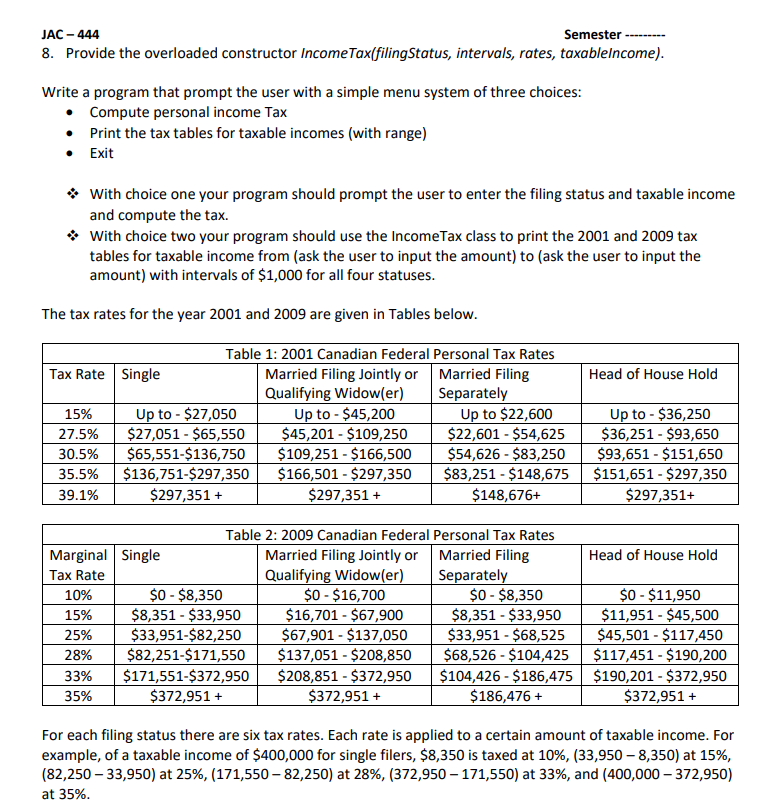

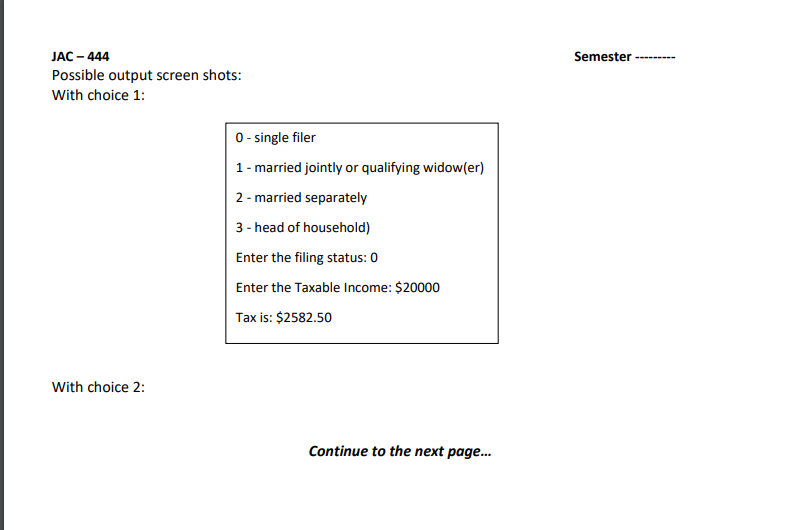

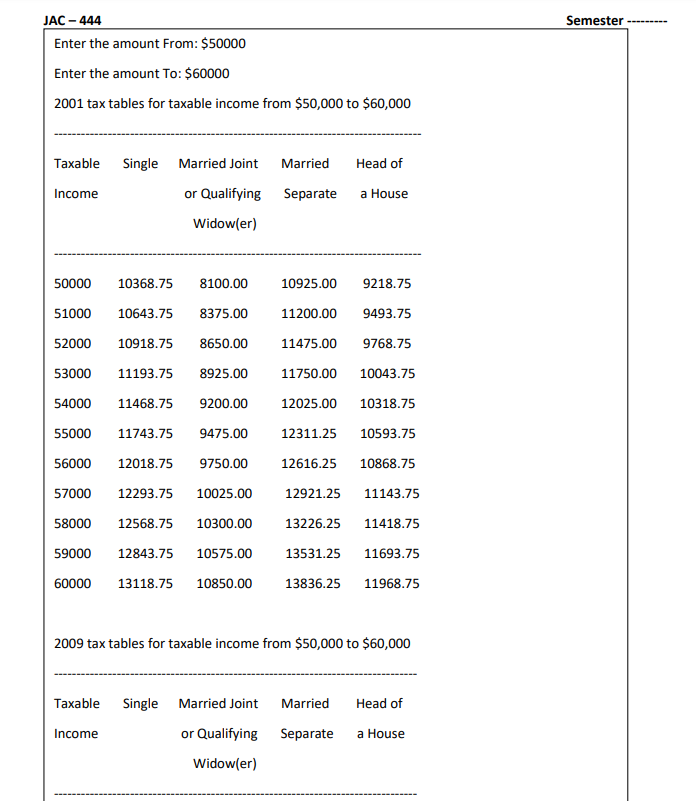

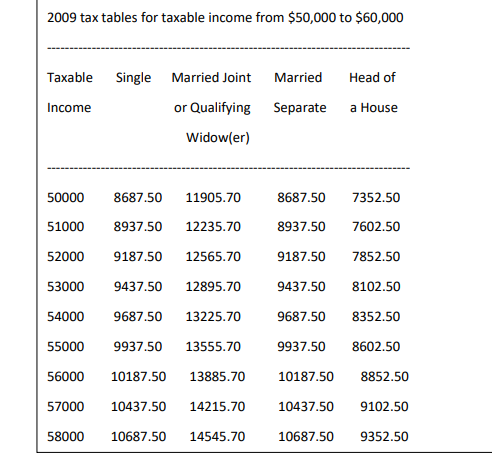

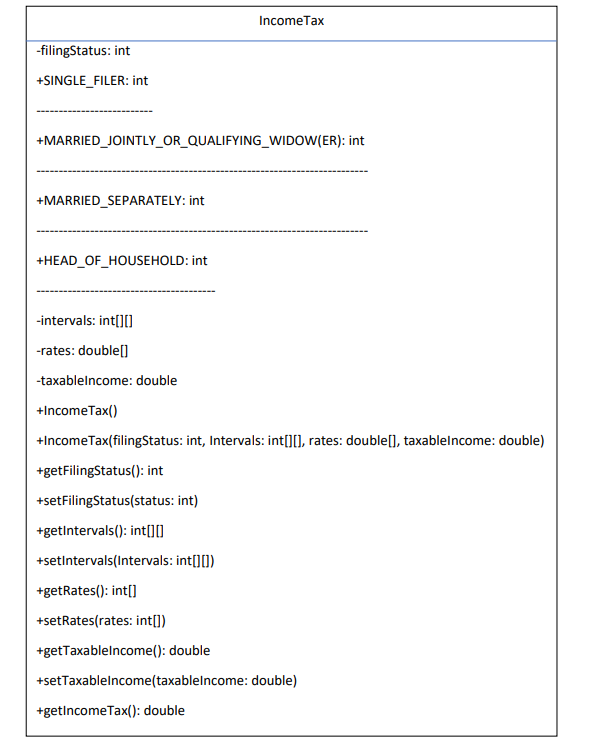

Task 1: The Canadian federal personal income tax is calculated based on filing status and taxable income. There are four filing statuses: single filers married filing jointly or qualified widow(er) married filing separately head of household. The tax rates vary every year. If you are, for example say, single with a taxable income of $10,000, the first $8,350 is taxed at 10% and the other $1,650 is taxed at 15%, so, your total tax is $1,082.50. Design a class named Income Tax to contain the following instance data fields (Chose the data fields types on your own): 1. filingStatus: One of the four tax-filing statuses: 0-single filer 1-married filing jointly or qualifying widow(er) 2-married filing separately 3-head of household. 2. Use the constants SINGLE_FILER(0) MARRIED JOINTLY_OR_QUALIFYING_WIDOW(ER) (1) MARRIED SEPARATELY (2) HEAD_OF_HOUSEHOLD (3) to represent the statuses. 3. A double-dimension array (You decide the type of it) named intervals: Stores the tax intervals/brackets for each filing status. 4. A single-dimension array (You decide the type) named rates: Stores the tax rates for each interval. 5. A variable taxableIncome: Stores the taxable income. 6. Provide the getter and setter methods for each data field and the getIncome Tax() method that returns the tax. 7. Provide a no-arg constructor. JAC - 444 Semester 8. Provide the overloaded constructor Income Tax(filingStatus, intervals, rates, taxable income). Write a program that prompt the user with a simple menu system of three choices: Compute personal income Tax Print the tax tables for taxable incomes (with range) Exit With choice one your program should prompt the user to enter the filing status and taxable income and compute the tax. With choice two your program should use the Income Tax class to print the 2001 and 2009 tax tables for taxable income from (ask the user to input the amount) to (ask the user to input the amount) with intervals of $1,000 for all four statuses. The tax rates for the year 2001 and 2009 are given in Tables below. Table 1: 2001 Canadian Federal Married Filing Jointly or Qualifying Widow(er) Tax Rate Single 15% 27.5% 30.5% 35.5% Up to - $27,050 $27,051 $65,550 39.1% $65,551-$136,750 $136,751-$297,350 $297,351 + Marginal Single Up to -$45,200 $45,201-$109,250 $109,251 $166,500 $166,501-$297,350 $297,351 + Table 2: 2009 Canadian Federal Married Filing Jointly or Qualifying Widow(er) Personal Tax Rates Married Filing Separately Up to $22,600 $22,601 - $54,625 $54,626-$83,250 $83,251 - $148,675 $148,676+ Personal Tax Rates Married Filing Separately Tax Rate 10% $0-$8,350 15% $8,351-$33,950 25% $33,951-$82,250 28% $82,251-$171,550 33% $171,551-$372,950 35% $372,951 + $0 - $16,700 $16,701 - $67,900 $67,901 - $137,050 $137,051 - $208,850 $208,851 - $372,950 $372,951 + $0 - $8,350 $8,351 - $33,950 $33,951-$68,525 $68,526 - $104,425 $104,426 - $186,475 $186,476 + Head of House Hold Up to - $36,250 $36,251 - $93,650 $93,651 - $151,650 $151,651 - $297,350 $297,351+ Head of House Hold $0 - $11,950 $11,951 - $45,500 $45,501 - $117,450 $117,451 $190,200 $190,201 - $372,950 $372,951 + For each filing status there are six tax rates. Each rate is applied to a certain amount of taxable income. For example, of a taxable income of $400,000 for single filers, $8,350 is taxed at 10%, (33,950 - 8,350) at 15%, (82,250-33,950) at 25%, (171,550 - 82,250) at 28%, (372,950-171,550) at 33%, and (400,000 - 372,950) at 35%. JAC-444 Possible output screen shots: With choice 1: With choice 2: 0 - single filer 1 - married jointly or qualifying widow(er) 2 - married separately 3 - head of household) Enter the filing status: 0 Enter the Taxable Income: $20000 Tax is: $2582.50 Continue to the next page... Semester JAC - 444 Enter the amount From: $50000 Enter the amount To: $60000 2001 tax tables for taxable income from $50,000 to $60,000 Taxable Single Married Joint Married Head of Income or Qualifying Separate a House Widow(er) 50000 10368.75 8100.00 10925.00 9218.75 51000 10643.75 8375.00 11200.00 9493.75 52000 10918.75 8650.00 11475.00 9768.75 53000 11193.75 8925.00 11750.00 10043.75 54000 11468.75 9200.00 55000 11743.75 9475.00 56000 12018.75 9750.00 12025.00 10318.75 12311.25 10593.75 12616.25 10868.75 57000 12293.75 10025.00 12921.25 11143.75 58000 12568.75 10300.00 13226.25 11418.75 59000 12843.75 10575.00 13531.25 11693.75 60000 13118.75 10850.00 13836.25 11968.75 2009 tax tables for taxable income from $50,000 to $60,000 Taxable Income Single Married Joint Married Head of or Qualifying Separate a House Widow(er) Semester 2009 tax tables for taxable income from $50,000 to $60,000 Taxable Single Married Joint Married Head of Income or Qualifying Separate a House Widow(er) 50000 8687.50 11905.70 8687.50 7352.50 51000 8937.50 12235.70 8937.50 7602.50 52000 9187.50 12565.70 9187.50 7852.50 53000 9437.50 12895.70 9437.50 8102.50 54000 9687.50 13225.70 9687.50 8352.50 55000 9937.50 13555.70 9937.50 8602.50 56000 10187.50 13885.70 10187.50 8852.50 57000 10437.50 14215.70 10437.50 9102.50 58000 10687.50 14545.70 10687.50 9352.50 -filingStatus: int +SINGLE_FILER: int Income Tax +MARRIED JOINTLY_OR_QUALIFYING_WIDOW(ER): int +MARRIED SEPARATELY: int +HEAD_OF_HOUSEHOLD: int -intervals: int[][] -rates: double[] -taxableIncome: double +Income Tax() +Income Tax(filingStatus: int, Intervals: int[][], rates: double[], taxable income: double) +getFilingStatus(): int +setFilingStatus(status: int) +getIntervals(): int[] [] +setIntervals (Intervals: int[][]) +getRates(): int[] +setRates(rates: int[]) +getTaxableIncome(): double +setTaxableIncome(taxableIncome: double) +getIncome Tax(): double

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started