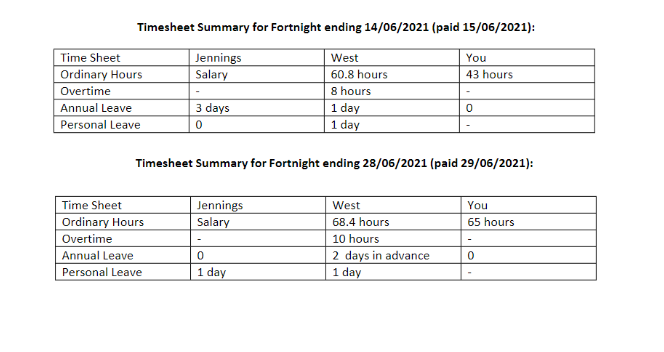

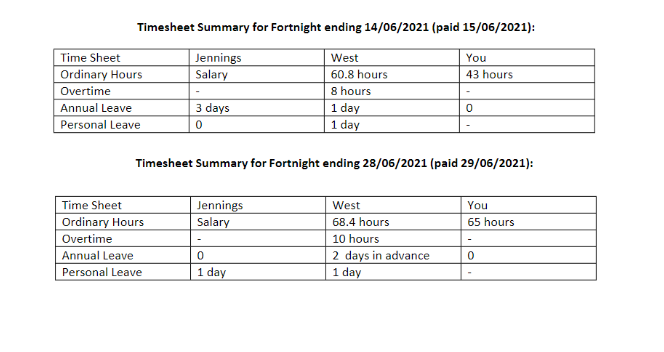

TASK 1 To Be Completed In-Class 1. From the timesheets below, process the m a n u a l pays for all employees, for (a) Fortnight ending 14/06/2021 (paid 15/06/2021) (b) Fortnight ending 28/06/2021 (paid 29/06/2021)

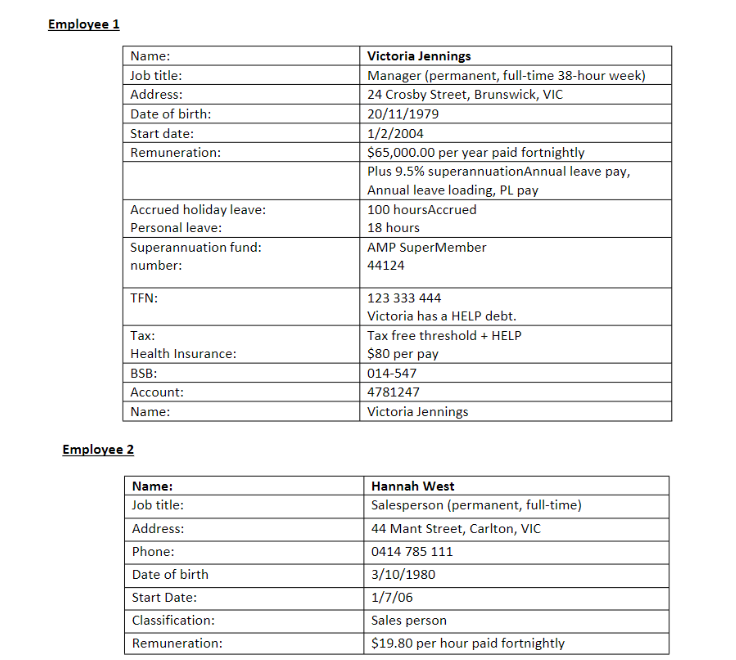

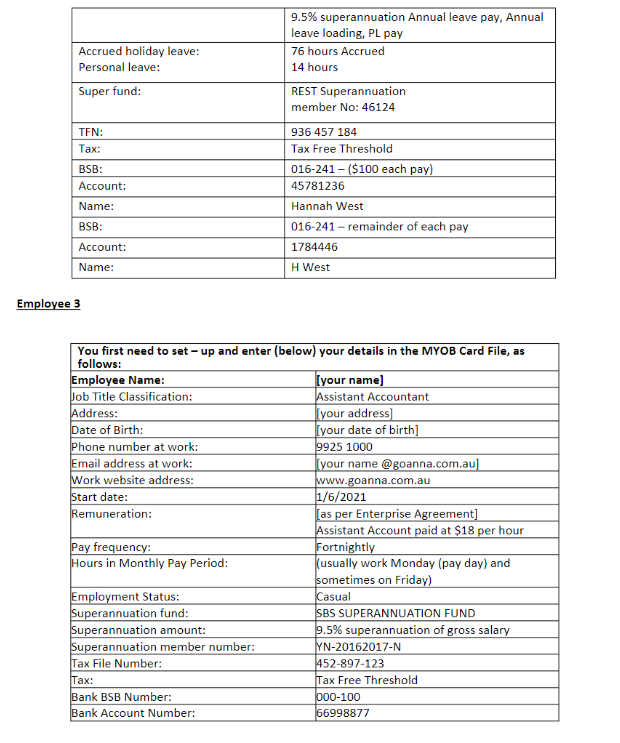

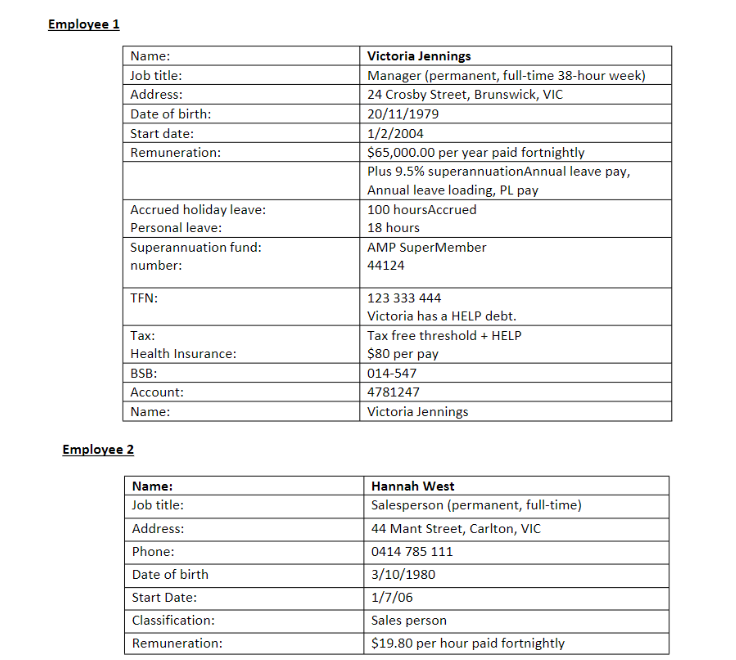

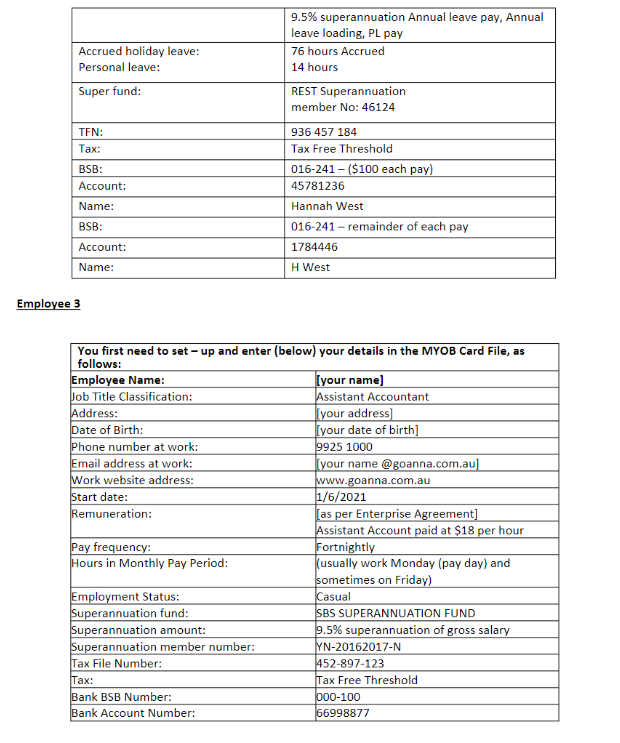

Employee 1 Name: Job title: Address: Date of birth: Start date: Remuneration: Victoria Jennings Manager (permanent, full-time 38-hour week) 24 Crosby Street, Brunswick, VIC 20/11/1979 1/2/2004 $65,000.00 per year paid fortnightly Plus 9.5% superannuation Annual leave pay, Annual leave loading, PL pay 100 hoursAccrued 18 hours AMP SuperMember 44124 Accrued holiday leave: Personal leave: Superannuation fund: number: TEN: Tax: Health Insurance: BSB: Account: Name: 123 333 444 Victoria has a HELP debt. Tax free threshold + HELP $80 per pay 014-547 4781247 Victoria Jennings Employee 2 Name: Job title: Address: Phone: Date of birth Start Date: Classification: Remuneration: Hannah West Salesperson (permanent, full-time) 44 Mant Street, Carlton, VIC 0414 785 111 3/10/1980 1/7/06 Sales person $19.80 per hour paid fortnightly Accrued holiday leave: Personal leave: Super fund: TEN: Tax: 9.5% superannuation Annual leave pay, Annual leave loading, PL pay 76 hours Accrued 14 hours REST Superannuation member No: 46124 936 457 184 Tax Free Threshold 016-241 - ($100 each pay) 45781236 Hannah West 016-241 - remainder of each pay 1784446 BSB: Account: Name: BSB: Account: Name: H West Employee 3 You first need to set up and enter (below) your details in the MYOB Card File, as follows: Employee Name: [your name) Job Title Classification: Assistant Accountant Address: (your address) Date of Birth: [your date of birth] Phone number at work: 9925 1000 Email address at work: (your name @goanna.com.au) Work website address: www.goanna.com.au Start date: 1/6/2021 Remuneration: (as per Enterprise Agreement] Assistant Account paid at $18 per hour Pay frequency: Fortnightly Hours in Monthly Pay Period: (usually work Monday (pay day) and sometimes on Friday) Employment Status: Casual Superannuation fund: SBS SUPERANNUATION FUND Superannuation amount: 9.5% superannuation of gross salary Superannuation member number: YN-20162017-N Tax File Number: 452-897-123 Tax: Tax Free Threshold Bank BSB Number: 000-100 Bank Account Number: 66998877 Timesheet Summary for Fortnight ending 14/06/2021 (paid 15/06/2021): Jennings Salary You 43 hours Time Sheet Ordinary Hours Overtime Annual Leave Personal Leave West 60.8 hours 8 hours 1 day 1 day 0 3 days 0 Timesheet Summary for Fortnight ending 28/06/2021 (paid 29/06/2021): Jennings Salary You 65 hours Time Sheet Ordinary Hours Overtime Annual Leave Personal Leave West 68.4 hours 10 hours 2 days in advance 1 day 0 0 1 day Employee 1 Name: Job title: Address: Date of birth: Start date: Remuneration: Victoria Jennings Manager (permanent, full-time 38-hour week) 24 Crosby Street, Brunswick, VIC 20/11/1979 1/2/2004 $65,000.00 per year paid fortnightly Plus 9.5% superannuation Annual leave pay, Annual leave loading, PL pay 100 hoursAccrued 18 hours AMP SuperMember 44124 Accrued holiday leave: Personal leave: Superannuation fund: number: TEN: Tax: Health Insurance: BSB: Account: Name: 123 333 444 Victoria has a HELP debt. Tax free threshold + HELP $80 per pay 014-547 4781247 Victoria Jennings Employee 2 Name: Job title: Address: Phone: Date of birth Start Date: Classification: Remuneration: Hannah West Salesperson (permanent, full-time) 44 Mant Street, Carlton, VIC 0414 785 111 3/10/1980 1/7/06 Sales person $19.80 per hour paid fortnightly Accrued holiday leave: Personal leave: Super fund: TEN: Tax: 9.5% superannuation Annual leave pay, Annual leave loading, PL pay 76 hours Accrued 14 hours REST Superannuation member No: 46124 936 457 184 Tax Free Threshold 016-241 - ($100 each pay) 45781236 Hannah West 016-241 - remainder of each pay 1784446 BSB: Account: Name: BSB: Account: Name: H West Employee 3 You first need to set up and enter (below) your details in the MYOB Card File, as follows: Employee Name: [your name) Job Title Classification: Assistant Accountant Address: (your address) Date of Birth: [your date of birth] Phone number at work: 9925 1000 Email address at work: (your name @goanna.com.au) Work website address: www.goanna.com.au Start date: 1/6/2021 Remuneration: (as per Enterprise Agreement] Assistant Account paid at $18 per hour Pay frequency: Fortnightly Hours in Monthly Pay Period: (usually work Monday (pay day) and sometimes on Friday) Employment Status: Casual Superannuation fund: SBS SUPERANNUATION FUND Superannuation amount: 9.5% superannuation of gross salary Superannuation member number: YN-20162017-N Tax File Number: 452-897-123 Tax: Tax Free Threshold Bank BSB Number: 000-100 Bank Account Number: 66998877 Timesheet Summary for Fortnight ending 14/06/2021 (paid 15/06/2021): Jennings Salary You 43 hours Time Sheet Ordinary Hours Overtime Annual Leave Personal Leave West 60.8 hours 8 hours 1 day 1 day 0 3 days 0 Timesheet Summary for Fortnight ending 28/06/2021 (paid 29/06/2021): Jennings Salary You 65 hours Time Sheet Ordinary Hours Overtime Annual Leave Personal Leave West 68.4 hours 10 hours 2 days in advance 1 day 0 0 1 day