Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company Alpha holds a 50% investment in company Beta, which is owned by company Theta for the remaining 50%. On the basis of a

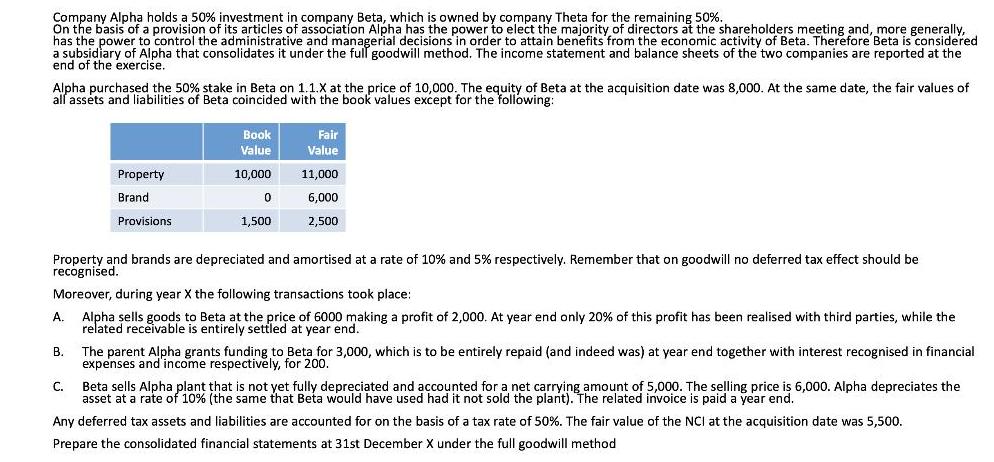

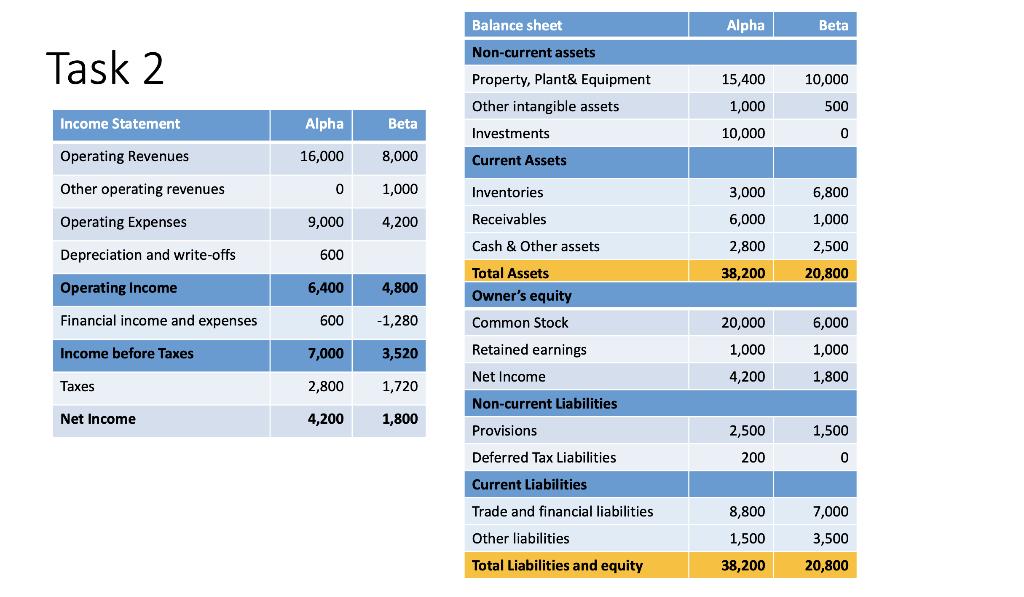

Company Alpha holds a 50% investment in company Beta, which is owned by company Theta for the remaining 50%. On the basis of a provision of its articles of association Alpha has the power to elect the majority of directors at the shareholders meeting and, more generally, has the power to control the administrative and managerial decisions in order to attain benefits from the economic activity of Beta. Therefore Beta is considered a subsidiary of Alpha that consolidates it under the full goodwill method. The income statement and balance sheets of the two companies are reported at the end of the exercise. Alpha purchased the 50% stake in Beta on 1.1.X at the price of 10,000. The equity of Beta at the acquisition date was 8,000. At the same date, the fair values of all assets and liabilities of Beta coincided with the book values except for the following: Book Fair Value Value Property 10,000 11,000 Brand 6,000 Provisions 1,500 2,500 Property and brands are depreciated and amortised at a rate of 10% and 5% respectively. Remember that on goodwill no deferred tax effect should be recognised. Moreover, during year X the following transactions took place: A. Alpha sells goods to Beta at the price of 6000 making a profit of 2,000. At year end only 20% of this profit has been realised with third parties, while the related receivable is entirely settled at year end. . The parent Alpha grants funding to Beta for 3,000, which is to be entirely repaid (and indeed was) at year end together with interest recognised in financial expenses and'income respectively, for 200. C. Beta sells Alpha plant that is not yet fully depreciated and accounted for a net carrying amount of 5,000. The selling price is 6,000. Alpha depreciates the asset at a rate of 10% (the same that Beta would have used had it not sold the plant). The related invoice is paid a year end. Any deferred tax assets and liabilities are accounted for on the basis of a tax rate of 50%. The fair value of the NCI at the acquisition date was 5,500. Prepare the consolidated financial statements at 31st December X under the full goodwill method Balance sheet Alpha Beta Non-current assets Task 2 Property, Plant& Equipment 15,400 10,000 Other intangible assets 1,000 500 Income Statement Alpha Beta Investments 10,000 Operating Revenues 16,000 8,000 Current Assets Other operating revenues 1,000 Inventories 3,000 6,800 Operating Expenses 9,000 4,200 Receivables 6,000 1,000 Cash & Other assets 2,800 2,500 Depreciation and write-offs 600 Total Assets 38,200 20,800 Operating Income 6,400 4,800 Owner's equity Financial income and expenses 600 -1,280 Common Stock 20,000 6,000 Income before Taxes 7,000 3,520 Retained earnings 1,000 1,000 Net Income 4,200 1,800 Taxes 2,800 1,720 Non-current Liabilities Net Income 4,200 1,800 Provisions 2,500 1,500 Deferred Tax Liabilities 200 Current Liabilities Trade and financial liabilities 8,800 7,000 Other liabilities 1,500 3,500 Total Liabilities and equity 38,200 20,800

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

CONSOLIDATED BALANCE SHEET PARTICULAR ALPHA NONCURRENT ASSETS PROPER...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started