Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TASK 1 The Internal audit department of Southampton ple are commencing the planning of the internal audit of the group for the year ending

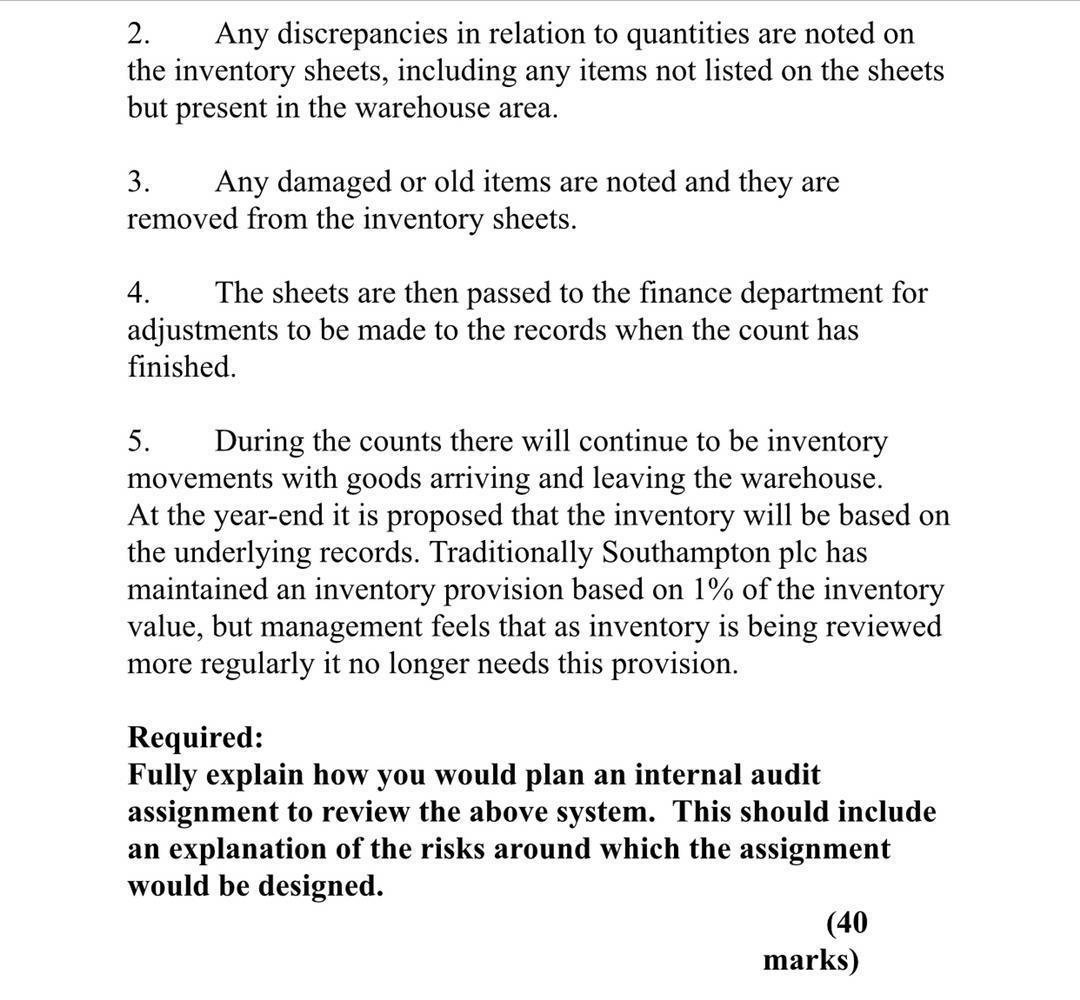

TASK 1 The Internal audit department of Southampton ple are commencing the planning of the internal audit of the group for the year ending 31 December 2022. Southampton ple is a paint manufacturer and has been trading for over 50 years, it operates from one central site, which includes the production facility, warehouse and administration offices. However, it has a subsidiary Grealish Co, a retailer of ladies clothing and accessories. Southampton plc sells all of its goods to large home improvement stores, with 60% being to one large chain store Homewares. The company has a one-year contract to be the sole supplier of paint to Homewares. It secured the contract through significantly reducing prices and offering a four-month credit period, the company's normal credit period is one month. Goods in/purchases In recent years, Southampton plc has reduced the level of goods directly manufactured and instead started to import paint from South Asia. Approximately 60% is imported and 40% manufactured. Within the production facility is a large amount of old plant and equipment that is now redundant and has minimal scrap value. Purchase orders for overseas paint are made six months in advance and goods can be in transit for up to two months. Southampton plc accounts for the inventory when it receives the goods. To avoid the disruption of a year-end inventory count, Southampton plc has this year introduced a continuous/perpetual inventory counting system. The warehouse has been divided into 12 areas and these are each to be counted once over the year. The counting team includes a member of the internal audit department and a warehouse staff member. The following procedures have been adopted; 1. The team prints the inventory quantities and descriptions from the system and these records are then compared to the inventory physically present. 2. Any discrepancies in relation to quantities are noted on the inventory sheets, including any items not listed on the sheets. 2. Any discrepancies in relation to quantities are noted on the inventory sheets, including any items not listed on the sheets but present in the warehouse area. 3. Any damaged or old items are noted and they are removed from the inventory sheets. 4. The sheets are then passed to the finance department for adjustments to be made to the records when the count has finished. During the counts there will continue to be inventory movements with goods arriving and leaving the warehouse. At the year-end it is proposed that the inventory will be based on the underlying records. Traditionally Southampton plc has maintained an inventory provision based on 1% of the inventory value, but management feels that as inventory is being reviewed more regularly it no longer needs this provision. 5. Required: Fully explain how you would plan an internal audit assignment to review the above system. This should include an explanation of the risks around which the assignment would be designed. (40 marks) TASK 2 Grealish Co is a retailer of ladies clothing and accessories and a subsidiary of Southampton plc. It operates in many countries around the world and has expanded steadily from its base in Europe. Its main market is aimed at 15 to 35 year olds and its prices are mid to low range. In the past the company has bulk ordered its clothing and accessories twice a year. However, if their goods failed to meet the key fashion trends then this resulted in significant inventory write downs. As a result of this the company has recently introduced a just in time ordering system. The fashion buyers make an assessment nine months in advance as to what the key trends are likely to be, these goods are sourced from their suppliers but only limited numbers are initially ordered. Grealish Co has an internal audit department from the parent company Southampton plc but at present their only role is to perform regular inventory counts at the stores. The internal audit department of Southampton plc are planning the audit of Grealish Co for the year ended 31" December 2022. The Internal Audit Manager had earlier discussed with the Finance Director of Grealish Co and produced the following notes of his meeting and financial statement extracts. Grealish Co management were disappointed with the 2020 results and so in 2021 undertook a number of strategies to improve the trading results. This included the introduction of a generous sales-related bonus scheme for their salesmen and a high profile advertising campaign. In addition, as market conditions are difficult for their customers, they have extended the credit period given to them. The finance director of Grealish Co has reviewed the inventory valuation policy and has included additional overheads incurred this year as he considers them to be production related. He is happy with the emerging 2021 results and feels that they are a good reflection of the improved trading levels. Revenue Cost of Sales Gross Profit Operating Expenses Forecast 2021 Sm 23 -11 12.0 -7.5 Actual 2020 $m 18 -10 8.0 -4 PBIT Inventory Receivables Cash Trade Payables Overdraft 4.5 2.1 marks) 4.5 marks) - 1.6 0.9 4 1.6 3 2.3 Required: a) Outline the key elements of an annual internal audit plan for Grealish Co in 2022. 1.2 marks) b) Explain the differences between Internal audit planning at the strategic, annual and operational levels. (10 marks) c) Discuss the statement that a risk-based internal audit approach allows internal audit to concentrate on reviewing the major risks to the organisation. (5 (15 (Total 30 TASK 3 Southampton plc is considering the acquisition of a company SCL. I know we need to carry out due diligence on the SCL figures. Don't worry, I wasn't going to ask the finance team to do this. I know that you (Chief Financial Officer) are busy with month- end reporting, but I thought a cost-effective solution would be to get the Internal Audit Department to carry it out. I'm sure they could delay some of their audit work to make time for this, and this is probably the sort of thing that they could do, isn't it, you know, checking figures and things like that? Could you let me know if this is likely to cause any problems? Required Explain the role of the Internal Audit Department and critically evaluate whether they should undertake the proposed due diligence work. You must fully reference the relevant provisions of the IPPF. (30

Step by Step Solution

★★★★★

3.48 Rating (178 Votes )

There are 3 Steps involved in it

Step: 1

Task 1 When planning an internal audit assignment to review the system described above the auditor would need to consider the following risks 1 There is a risk that inventory levels may be overstated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started