Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Task 2: Sourcing Decision for NVIDIA Description: NVIDIA is headquartered in Santa Clara, California, and became a major force in the computer gaming industry

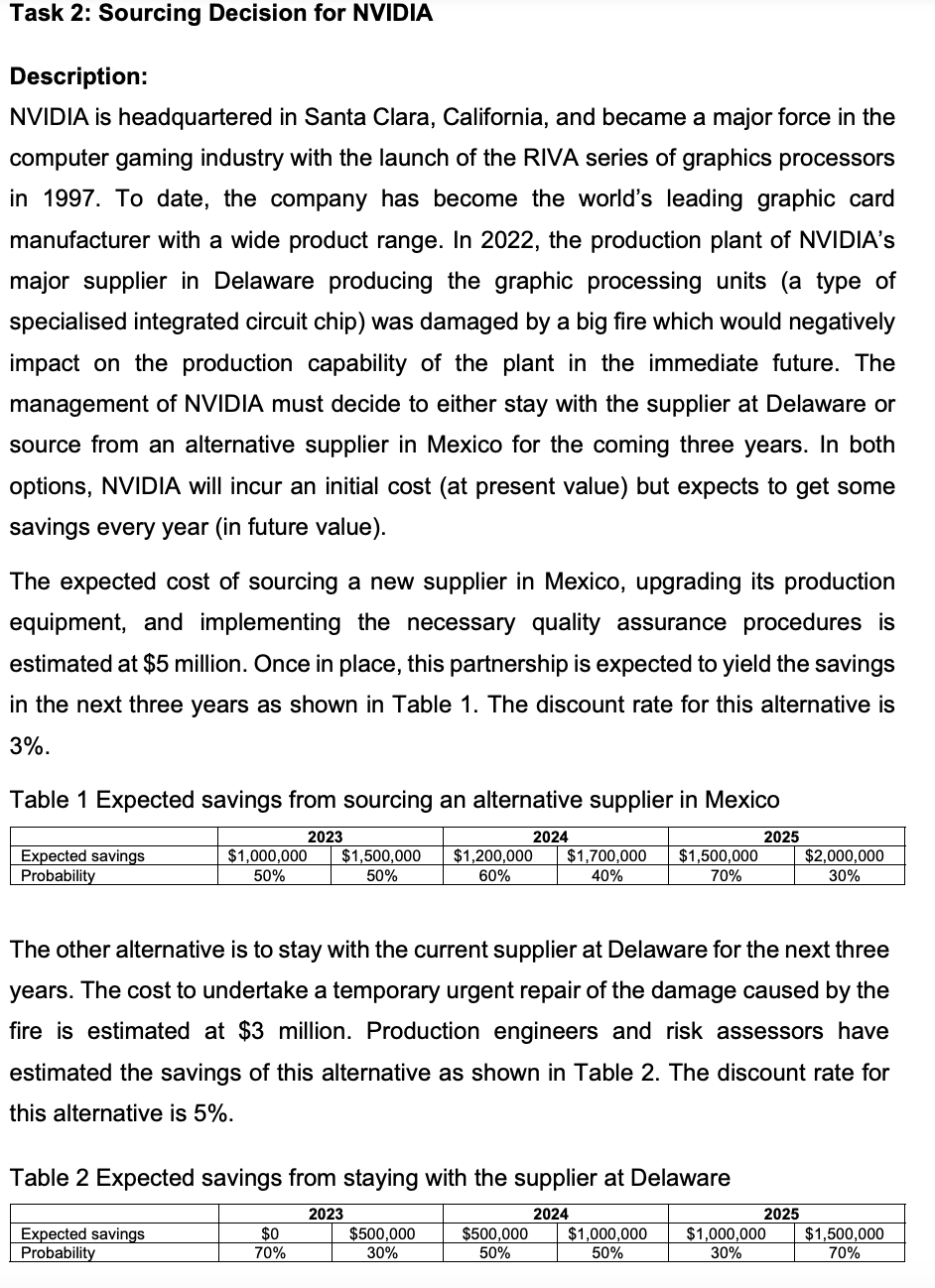

Task 2: Sourcing Decision for NVIDIA Description: NVIDIA is headquartered in Santa Clara, California, and became a major force in the computer gaming industry with the launch of the RIVA series of graphics processors in 1997. To date, the company has become the world's leading graphic card manufacturer with a wide product range. In 2022, the production plant of NVIDIA'S major supplier in Delaware producing the graphic processing units (a type of specialised integrated circuit chip) was damaged by a big fire which would negatively impact on the production capability of the plant in the immediate future. The management of NVIDIA must decide to either stay with the supplier at Delaware or source from an alternative supplier in Mexico for the coming three years. In both options, NVIDIA will incur an initial cost (at present value) but expects to get some savings every year (in future value). The expected cost of sourcing a new supplier in Mexico, upgrading its production equipment, and implementing the necessary quality assurance procedures is estimated at $5 million. Once in place, this partnership is expected to yield the savings in the next three years as shown in Table 1. The discount rate for this alternative is 3%. Table 1 Expected savings from sourcing an alternative supplier in Mexico 2023 Expected savings Probability $1,000,000 $1,500,000 $1,200,000 $1,700,000 $1,500,000 50% 50% 60% 40% 70% Expected savings Probability Table 2 Expected savings from staying with the supplier at Delaware 2023 2024 2024 The other alternative is to stay with the current supplier at Delaware for the next three years. The cost to undertake a temporary urgent repair of the damage caused by the fire is estimated at $3 million. Production engineers and risk assessors have estimated the savings of this alternative as shown in Table 2. The discount rate for this alternative is 5%. $0 70% $500,000 30% $500,000 50% 2025 $1,000,000 50% $2,000,000 30% 2025 $1,000,000 $1,500,000 30% 70% Task Questions to be done in Excel: a) Draw a decision tree in the Excel file to represent the two alternatives being considered. Show all the nodes and the branches with proper labels, probabilities and expected returns clearly. (5 marks) b) Show clearly how the total present value of each alternative is calculated in separate spreadsheets, one for one alternative. (8 marks) c) Create a comparison sheet using the following format. Based on the findings from (b), which alternative should NVIDIA pursue? Why? (1 mark) NPV of Total Investment Option Sourcing from a new supplier in Mexico Staying with existing supplier in Delaware Which sourcing option would you recommend? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started