Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Task 2: Thomas decided to take on an assistant to help him with customer service and marketing. Thomas employed his assistant, whose name is

.

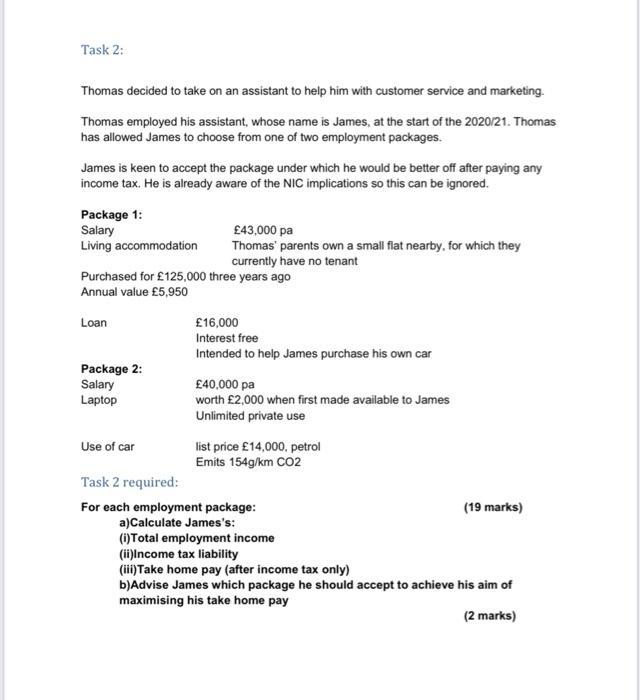

Task 2: Thomas decided to take on an assistant to help him with customer service and marketing. Thomas employed his assistant, whose name is James, at the start of the 2020/21. Thomas has allowed James to choose from one of two employment packages. James is keen to accept the package under which he would be better off after paying any income tax. He is already aware of the NIC implications so this can be ignored. Package 1: Salary Living accommodation Purchased for 125,000 three years ago Annual value 5,950 Loan Package 2: Salary Laptop 43,000 pa Thomas' parents own a small flat nearby, for which they currently have no tenant Use of car 16,000 Interest free Intended to help James purchase his own car 40,000 pa worth 2,000 when first made available to James Unlimited private use list price 14,000, petrol Emits 154g/km CO2 Task 2 required: For each employment package: a)Calculate James's: (i) Total employment income (ii)Income tax liability (iii) Take home pay (after income tax only) b)Advise James which package he should accept to achieve his aim of maximising his take home pay (2 marks) (19 marks)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Amanda Rapomantaisit 20 Monthly gross Salary P310 20000 C06214 Loran Blo Pay Period April 11512...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started