Answered step by step

Verified Expert Solution

Question

1 Approved Answer

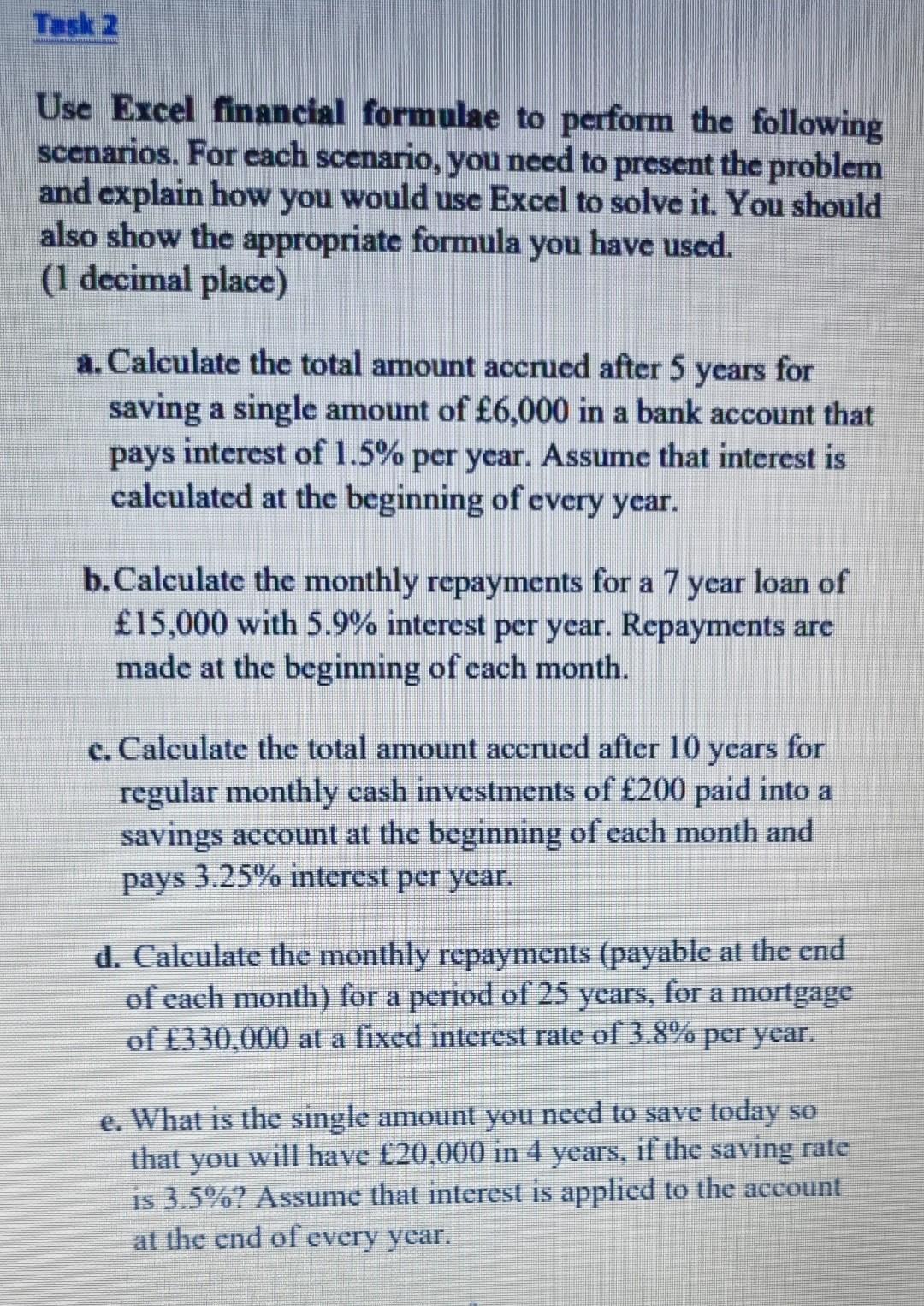

Task 2 Use Excel financial formulae to perform the following scenarios. For each scenario, you need to present the problem and explain how you would

Task 2 Use Excel financial formulae to perform the following scenarios. For each scenario, you need to present the problem and explain how you would use Excel to solve it. You should also show the appropriate formula you have used. (1 decimal place) a. Calculate the total amount accrued after 5 years for saving a single amount of 6,000 in a bank account that pays interest of 1.5% per year. Assume that interest is calculated at the beginning of every year. b. Calculate the monthly repayments for a 7 year loan of 15,000 with 5.9% interest per year. Repayments are made at the beginning of each month. c. Calculate the total amount accrued after 10 years for regular monthly cash investments of 200 paid into a savings account at the beginning of each month and pays 3.25% interest per year. d. Calculate the monthly repayments (payable at the end of each month) for a period of 25 years, for a mortgage of 330,000 at a fixed interest rate of 3.8% per year. e. What is the single amount you need to save today so that you will have 20,000 in 4 years, if the saving rate is 3.5% ? Assume that interest is applied to the account at the end of every year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started