Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Task 2 Using the financial statements for ALPHA Limited calculate the ratios required and comment on the companys performance from a potential investors perspective. The

Task 2 Using the financial statements for ALPHA Limited calculate the ratios required and comment on the companys performance from a potential investors perspective.

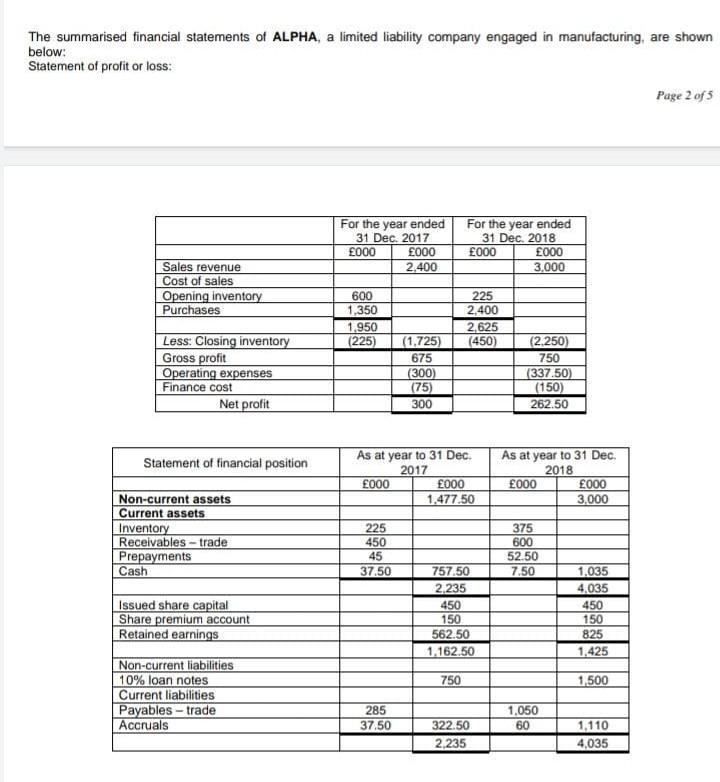

The summarised financial statements of ALPHA, a limited liability company engaged in manufacturing, are shown below: Statement of profit or loss: Page 2 of 5 For the year ended 31 Dec. 2017 000 E000 2,400 For the year ended 31 Dec. 2018 000 000 3.000 Sales revenue Cost of sales Opening inventory Purchases 600 1,350 1.950 (225) 225 2,400 2,625 (450) Less: Closing inventory Gross profit Operating expenses Finance cost Net profit (1.725) 675 (300) (75) 300 (2.250) 750 (337.50) (150) 262.50 Statement of financial position As at year to 31 Dec. 2017 000 000 1.477.50 As at year to 31 Dec. 2018 000 000 3.000 Non-current assets Current assets Inventory Receivables - trade Prepayments Cash 225 450 45 37.50 375 600 52.50 7.50 Issued share capital Share premium account Retained earnings 757.50 2.235 450 150 562.50 1.162.50 1.035 4,035 450 150 825 1,425 750 1,500 Non-current liabilities 10% loan notes Current liabilities Payables - trade Accruals 285 37.50 1.050 60 322.50 2.235 1,110 4,035 Task 2 - Required Calculate the following five ratios for each of the two years: 0 Return on capital employed (ii) Net profit margin Page 3 of 5 (ii) Current ratio (iv) Average Receivable days/ Debtors collection period (V) Average Payable days/Creditors collection period (10 marks) b. Comment on the performance of ALPHA LTD. results and position between the two years, mentioning possible causes and effects for the changes. (40 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started