Question

Organic Farms has a $10,000,000 loan with a variable interest rate, due December 31, 2024. The interest rate is set at the beginning of each

Organic Farms has a $10,000,000 loan with a variable interest rate, due December 31, 2024. The interest rate is set at the beginning of each year and interest is paid at year-end. On January 1, 2023, when the variable rate is 3%, Organic Farms enters a swap agreement whereby it pays a fixed rate of 3.2% and receives the variable rate required to pay interest on the loan. On December 31, 2023, the variable rate is reset to 3.1%.

Required

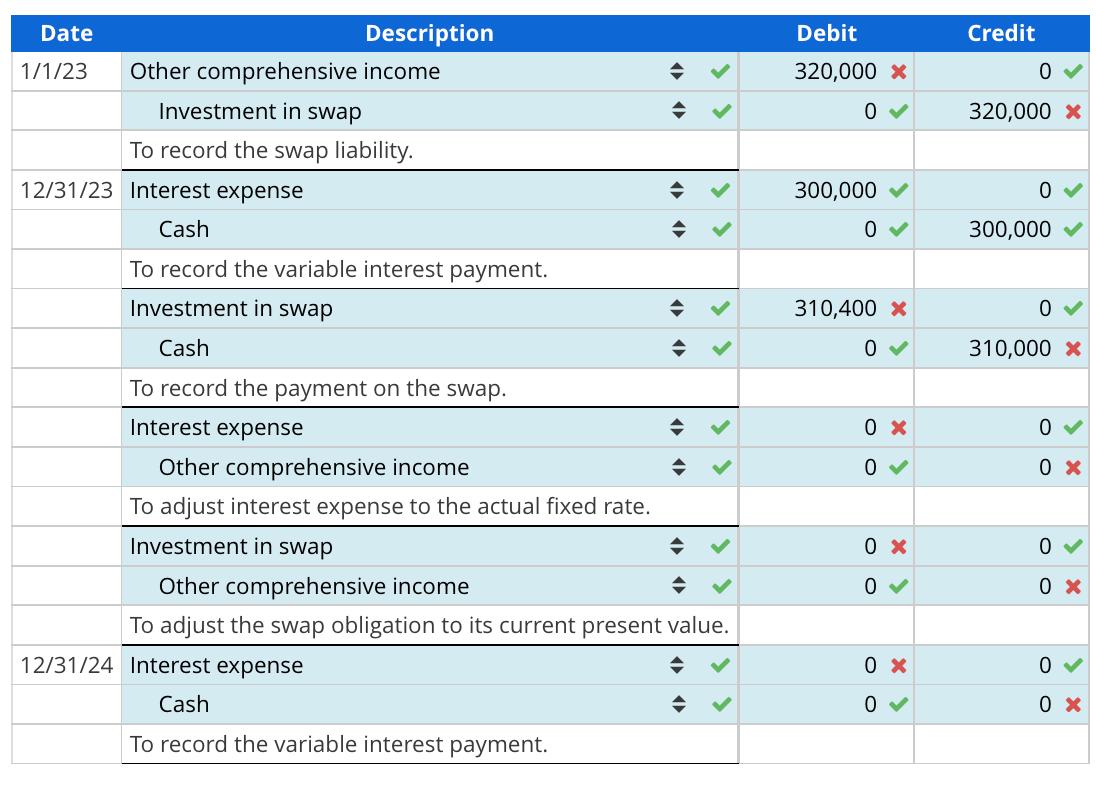

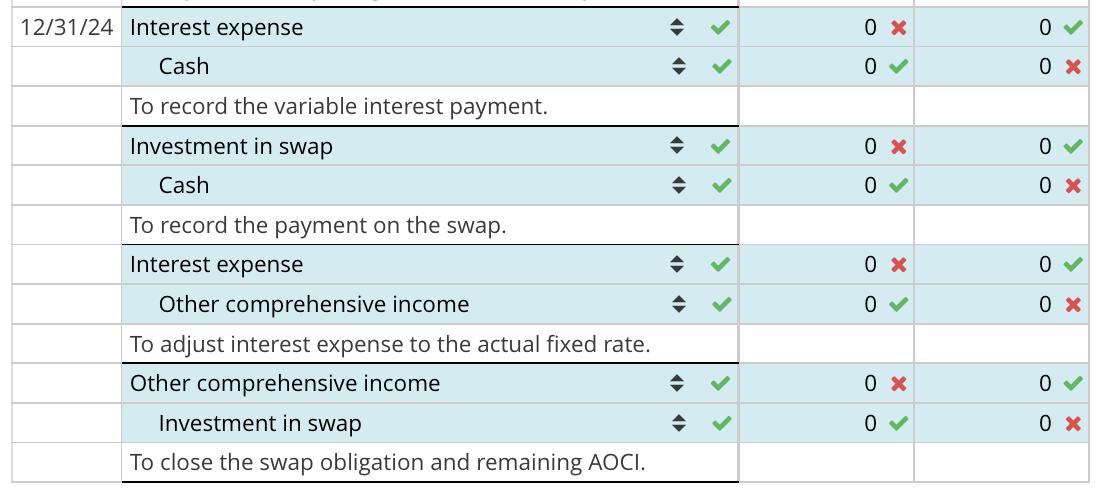

Prepare journal entries to record the swap liability at January 1, 2023, and all entries required at December 31, 2023 and 2024. Organic Farms records the swap liability at the present value of future expected payments, discounted at the variable rate.

Description Date 1/1/23 Other comprehensive income Investment in swap To record the swap liability. 12/31/23 Interest expense Cash To record the variable interest payment. Investment in swap Cash To record the payment on the swap. Interest expense 0 0 x

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To account for the swap agreement we need to prepare journal entries for Organic Farms on January 1 2023 December 31 2023 and December 31 2024 Since O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started