Answered step by step

Verified Expert Solution

Question

1 Approved Answer

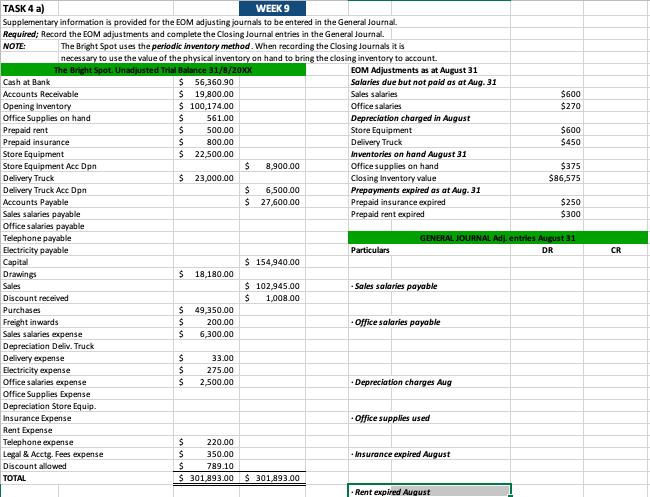

TASK 4 a) WEEK 9 Supplementary information is provided for the EOM adjusting journals to be entered in the General Journal. Required; Record the

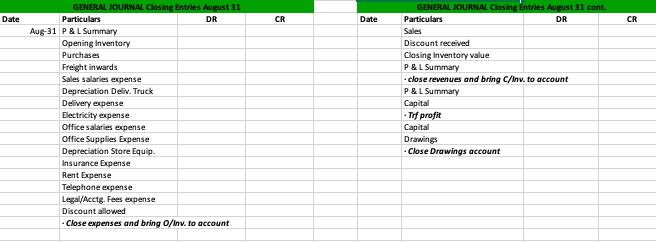

TASK 4 a) WEEK 9 Supplementary information is provided for the EOM adjusting journals to be entered in the General Journal. Required; Record the EOM adjustments and complete the Closing Journal entries in the General Journal. The Bright Spot uses the periodic inventory method. When recording the Closing Journals it is NOTE: necessary to use the value of the physical inventory on hand to bring the closing inventory to account. The Bright Spot. Unadjusted Trial Balance 31/8/20xX EOM Adjustments as at August 31 Salaries due but not paid as at Aug. 31 $ 56,360.90 $ 19,800.00 $ 100,174.00 561.00 Cash at Bank $600 $270 Accounts Receivable Sales salaries Opening Inventory Office salaries Depreciation charged in August Store Equipment Delivery Truck Inventories on hand August 31 Office supplies on hand Closing Inventory value Prepayments expired as at Aug. 31 Prepaid insurance expired Office Supplies on hand Prepaid rent $600 $450 500.00 Prepaid insurance 800.00 Store Equipment Store Equipment Acc Dpn Delivery Truck Delivery Truck Ac Dpn 22,500.00 $375 $86,575 8,900.00 $ 23,000.00 6,500.00 $ 27,600.00 Accounts Payable Sales salaries payable Office salaries payable $250 $300 Prepaid rent expired Telephone payable Electricity payable Capital Drawings Sales GENERAL JOURNAL Adj. entries August 31 Particulars DR CR $ 154,940.00 $ 18,180.00 $ 102,945.00 - Sales salaries payable Discount received 1,008.00 Purchases Freight inwards Sales salaries expense $ 49,350.00 24 Office salaries payable 200.00 6,300.00 Depreciation Deliv. Truck Delivery expense Electricity expense Office salaries expense 33.00 275.00 2,500.00 - Depreciation charges Aug Office Supplies Expense Depreciation Store Equip. Insurance Expense Rent Expense Telephone expense Legal & Acctg. Fees expense - Office supplies used 220.00 350.00 - Insurance expired August Discount allowed 789.10 TOTAL S 301,893.00$ 301,893.00 - Rent expired August GENERAL JOURNAL Closing Entries August 31 GENERAL JOURNAL Closing Entries August 31 cont. Date Particulars DR CR Date Particulars DR CR Aug-31 P&L Summary Opening Inventary Purchases Sales Discount received Closing Inventory value P&L Summary - close revenues and bring C/Inv. to account P&L Summary Capital - Trf profit Freight inwards Sales salaries expense Depreciation Deliv. Truck Delivery expense Electricity expense Office salaries expense Office Supplies Expense Capital Drawings - Close Drawings account Depreciation Store Equip. Insurance Expense Rent Expense Telephone expense Legal/Acctg. Fees expense Discount allowed - Close expenses and bring 0/Inv. to account

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started