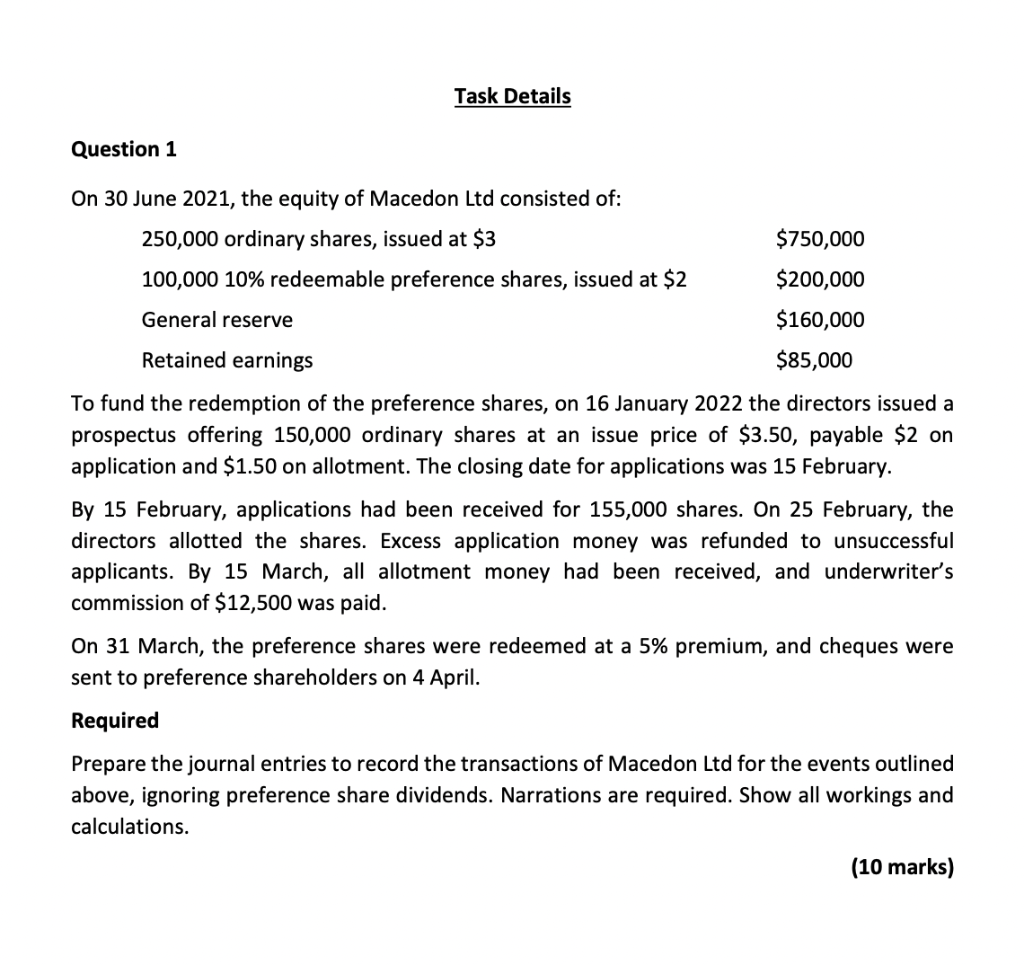

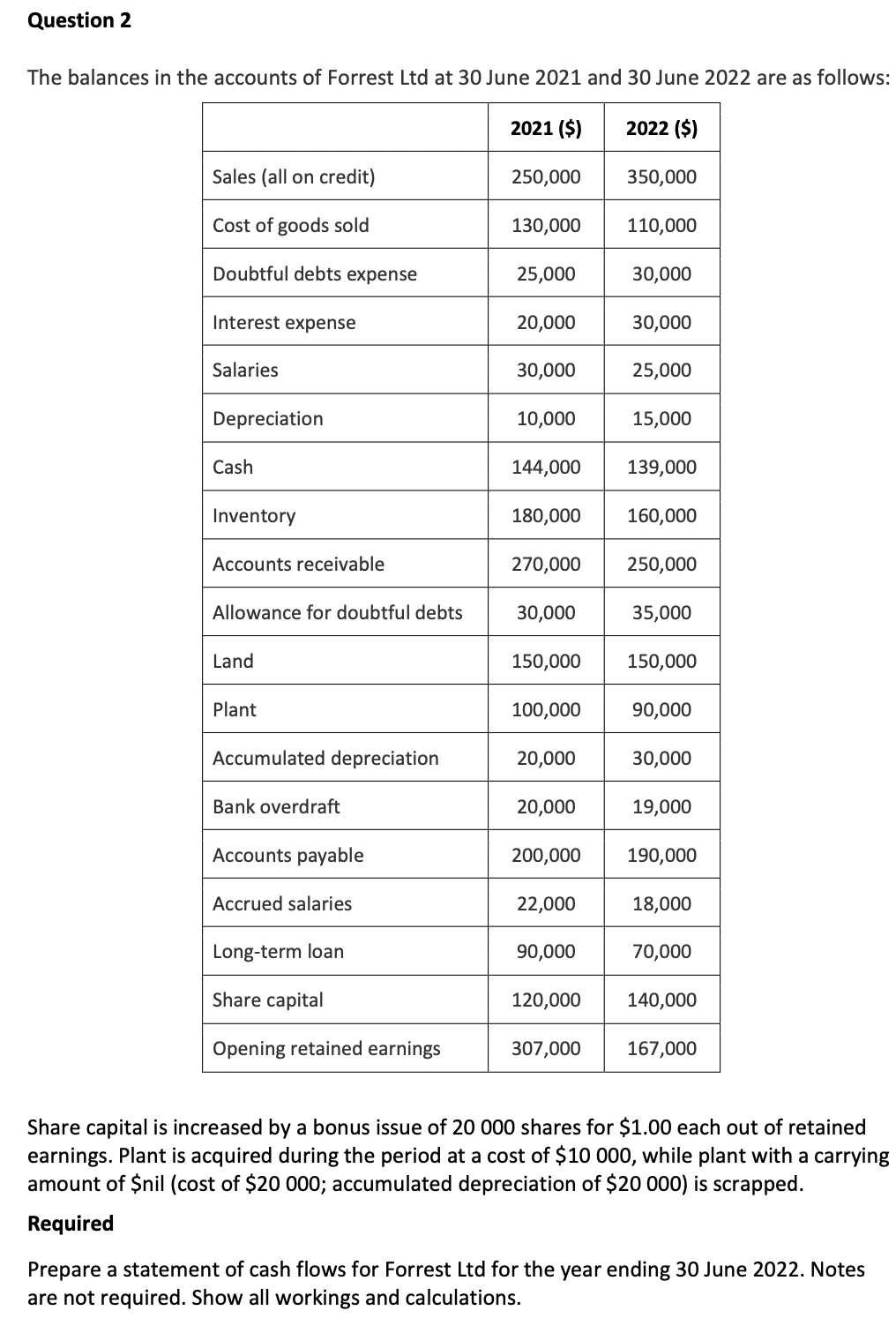

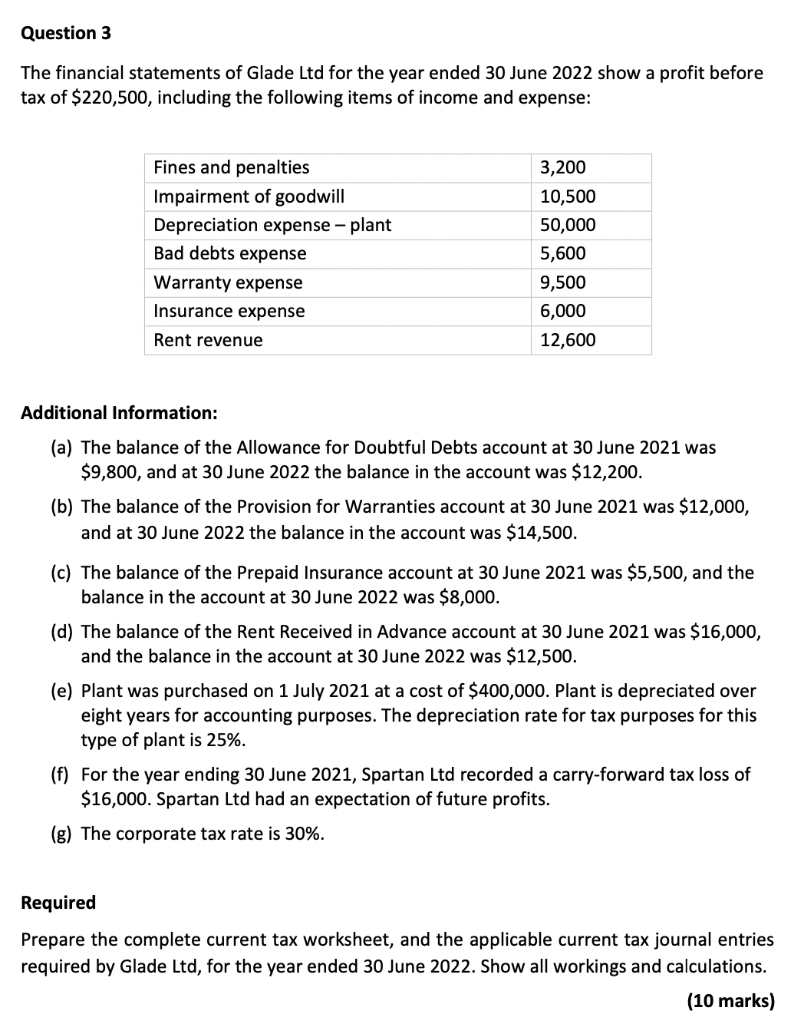

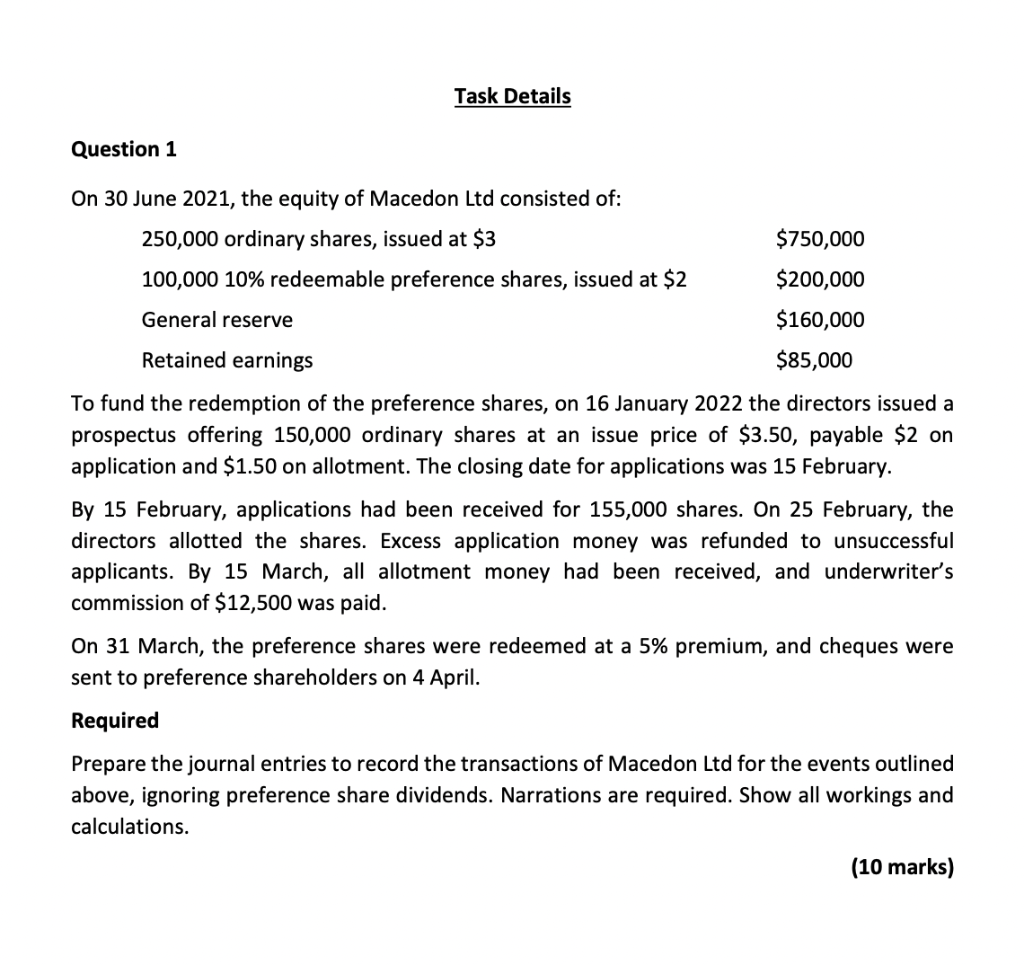

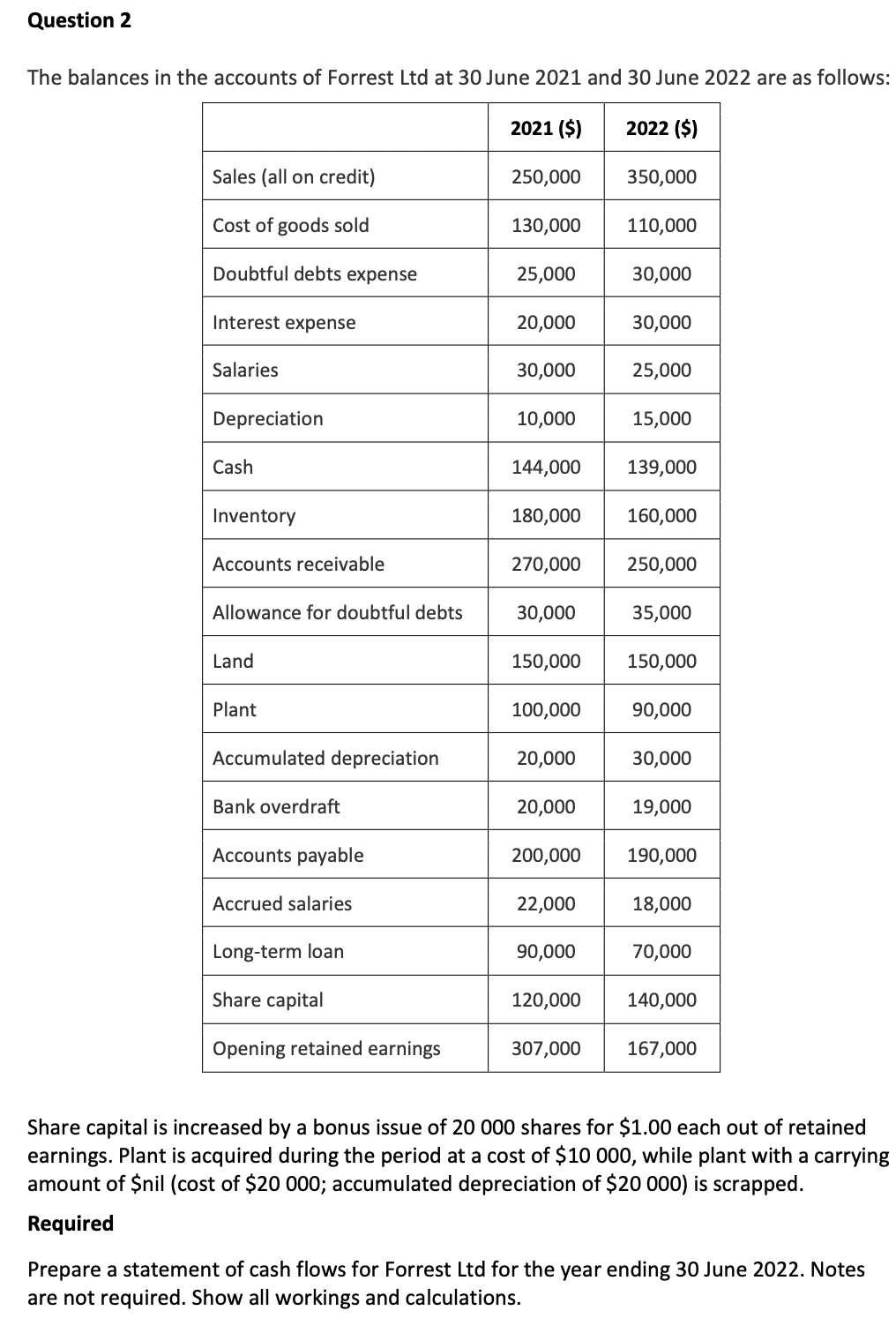

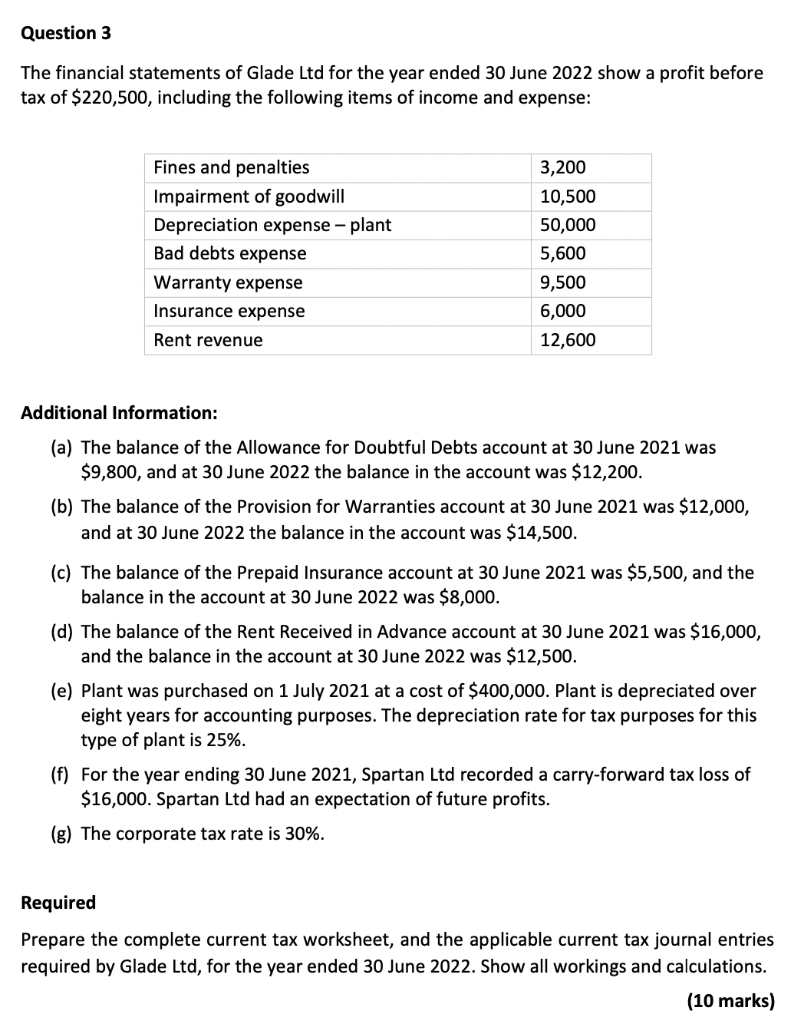

Task Details Question 1 On 30 June 2021, the equity of Macedon Ltd consisted of: 250,000 ordinary shares, issued at $3 $750,000 100,000 10% redeemable preference shares, issued at $2 $200,000 General reserve $160,000 Retained earnings $85,000 To fund the redemption of the preference shares, on 16 January 2022 the directors issued a prospectus offering 150,000 ordinary shares at an issue price of $3.50, payable $2 on application and $1.50 on allotment. The closing date for applications was 15 February. By 15 February, applications had been received for 155,000 shares. On 25 February, the directors allotted the shares. Excess application money was refunded to unsuccessful applicants. By 15 March, all allotment money had been received, and underwriter's commission of $12,500 was paid. On 31 March, the preference shares were redeemed at a 5% premium, and cheques were sent to preference shareholders on 4 April. Required Prepare the journal entries to record the transactions of Macedon Ltd for the events outlined above, ignoring preference share dividends. Narrations are required. Show all workings and calculations. (10 marks) Question 2 The balances in the accounts of Forrest Ltd at 30 June 2021 and 30 June 2022 are as follows: 2021 ($) 2022 ($) Sales (all on credit) 250,000 350,000 Cost of goods sold 130,000 110,000 Doubtful debts expense 25,000 30,000 Interest expense 20,000 30,000 Salaries 30,000 25,000 Depreciation 10,000 15,000 Cash 144,000 139,000 Inventory 180,000 160,000 Accounts receivable 270,000 250,000 Allowance for doubtful debts 30,000 35,000 Land 150,000 150,000 Plant 100,000 90,000 Accumulated depreciation 20,000 30,000 Bank overdraft 20,000 19,000 Accounts payable 200,000 190,000 Accrued salaries 22,000 18,000 Long-term loan 90,000 70,000 Share capital 120,000 140,000 Opening retained earnings 307,000 167,000 Share capital is increased by a bonus issue of 20 000 shares for $1.00 each out of retained earnings. Plant is acquired during the period at a cost of $10 000, while plant with a carrying amount of $nil (cost of $20 000; accumulated depreciation of $20 000) is scrapped. Required Prepare a statement of cash flows for Forrest Ltd for the year ending 30 June 2022. Notes are not required. Show all workings and calculations. Question 3 The financial statements of Glade Ltd for the year ended 30 June 2022 show a profit before tax of $220,500, including the following items of income and expense: Fines and penalties Impairment of goodwill Depreciation expense - plant Bad debts expense Warranty expense Insurance expense Rent revenue 3,200 10,500 50,000 5,600 9,500 6,000 12,600 Additional Information: (a) The balance of the Allowance for Doubtful Debts account at 30 June 2021 was $9,800, and at 30 June 2022 the balance in the account was $12,200. (b) The balance of the Provision for Warranties account at 30 June 2021 was $12,000, and at 30 June 2022 the balance in the account was $14,500. (c) The balance of the Prepaid Insurance account at 30 June 2021 was $5,500, and the balance in the account at 30 June 2022 was $8,000. (d) The balance of the Rent Received in Advance account at 30 June 2021 was $16,000, and the balance in the account at 30 June 2022 was $12,500. (e) Plant was purchased on 1 July 2021 at a cost of $400,000. Plant is depreciated over eight years for accounting purposes. The depreciation rate for tax purposes for this type of plant is 25%. (f) For the year ending 30 June 2021, Spartan Ltd recorded a carry-forward tax loss of $16,000. Spartan Ltd had an expectation of future profits. (g) The corporate tax rate is 30%. Required Prepare the complete current tax worksheet, and the applicable current tax journal entries required by Glade Ltd, for the year ended 30 June 2022. Show all workings and calculations. (10 marks)