Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Task File the tax returns based on Tax Scenario & Facts, Form W 2 . 1 0 9 9 - DIV, 1 0 9 9

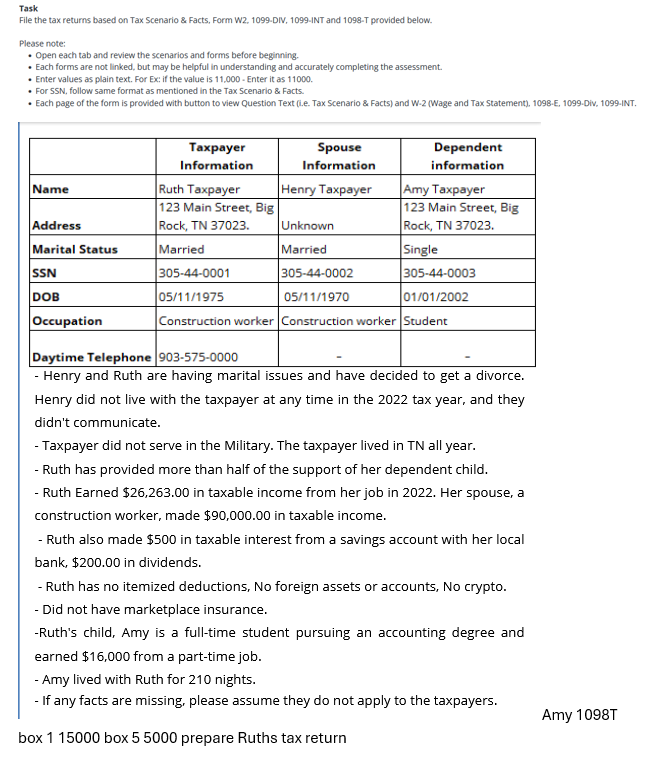

Task

File the tax returns based on Tax Scenario & Facts, Form WDIV, INT and T provided below.

Please note:

Open each tab and review the scenarios and forms before beginning.

Each forms are not linked, but may be helpful in understanding and accurately completing the assessment.

Enter values as plain text. For Ex: if the value is Enter it as

For SSN follow same format as mentioned in the Tax Scenario & Facts.

Each page of the form is provided with button to view Question Text ie Tax Scenario & Facts and WWage and Tax StatementEDiv, INT.

Henry and Ruth are having marital issues and have decided to get a divorce.

Henry did not live with the taxpayer at any time in the tax year, and they

didn't communicate.

Taxpayer did not serve in the Military. The taxpayer lived in TN all year.

Ruth has provided more than half of the support of her dependent child.

Ruth Earned $ in taxable income from her job in Her spouse, a

construction worker, made $ in taxable income.

Ruth also made $ in taxable interest from a savings account with her local

bank, $ in dividends.

Ruth has no itemized deductions, No foreign assets or accounts, No crypto.

Did not have marketplace insurance.

Ruth's child, Amy is a fulltime student pursuing an accounting degree and

earned $ from a parttime job.

Amy lived with Ruth for nights.

If any facts are missing, please assume they do not apply to the taxpayers.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started