Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Task/Proposal 4: Valuation analysis - Xenia Hotels and Resorts, Inc Xenia Hotels & Resorts, Inc. (NYSE:XHR) is a self-advised and self-administered REIT that invests in

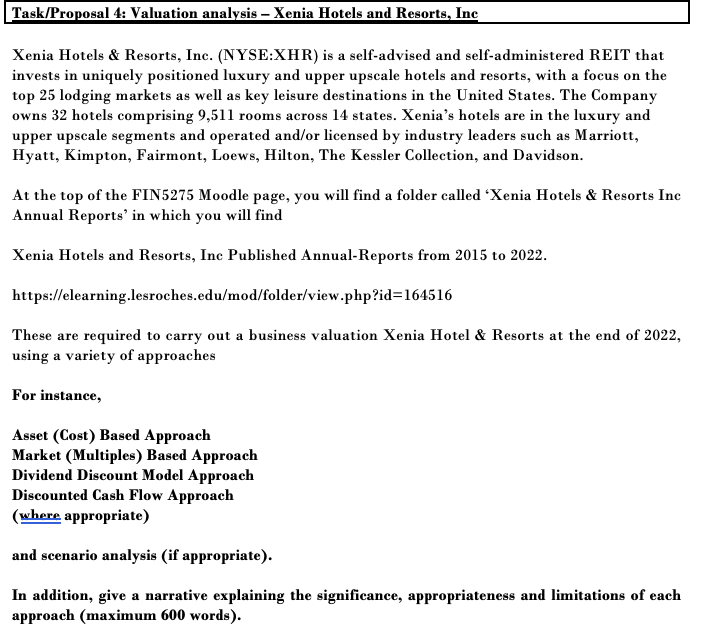

Task/Proposal 4: Valuation analysis - Xenia Hotels and Resorts, Inc Xenia Hotels \& Resorts, Inc. (NYSE:XHR) is a self-advised and self-administered REIT that invests in uniquely positioned luxury and upper upscale hotels and resorts, with a focus on the top 25 lodging markets as well as key leisure destinations in the United States. The Company owns 32 hotels comprising 9,511 rooms across 14 states. Xenia's hotels are in the luxury and upper upscale segments and operated and/or licensed by industry leaders such as Marriott, Hyatt, Kimpton, Fairmont, Loews, Hilton, The Kessler Collection, and Davidson. At the top of the FIN5275 Moodle page, you will find a folder called 'Xenia Hotels \& Resorts Inc Annual Reports' in which you will find Xenia Hotels and Resorts, Inc Published Annual-Reports from 2015 to 2022. https://elearning.lesroches.edu/mod/folder/view.php?id=164516 These are required to carry out a business valuation Xenia Hotel \& Resorts at the end of 2022, using a variety of approaches For instance, Asset (Cost) Based Approach Market (Multiples) Based Approach Dividend Discount Model Approach Discounted Cash Flow Approach (where appropriate) and scenario analysis (if appropriate). In addition, give a narrative explaining the significance, appropriateness and limitations of each

Task/Proposal 4: Valuation analysis - Xenia Hotels and Resorts, Inc Xenia Hotels \& Resorts, Inc. (NYSE:XHR) is a self-advised and self-administered REIT that invests in uniquely positioned luxury and upper upscale hotels and resorts, with a focus on the top 25 lodging markets as well as key leisure destinations in the United States. The Company owns 32 hotels comprising 9,511 rooms across 14 states. Xenia's hotels are in the luxury and upper upscale segments and operated and/or licensed by industry leaders such as Marriott, Hyatt, Kimpton, Fairmont, Loews, Hilton, The Kessler Collection, and Davidson. At the top of the FIN5275 Moodle page, you will find a folder called 'Xenia Hotels \& Resorts Inc Annual Reports' in which you will find Xenia Hotels and Resorts, Inc Published Annual-Reports from 2015 to 2022. https://elearning.lesroches.edu/mod/folder/view.php?id=164516 These are required to carry out a business valuation Xenia Hotel \& Resorts at the end of 2022, using a variety of approaches For instance, Asset (Cost) Based Approach Market (Multiples) Based Approach Dividend Discount Model Approach Discounted Cash Flow Approach (where appropriate) and scenario analysis (if appropriate). In addition, give a narrative explaining the significance, appropriateness and limitations of each Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started