Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tasman Co. has a beta of 0.9, and an expected return of 15%. Macquarie Co. has a beta of 1.2 and an expected return

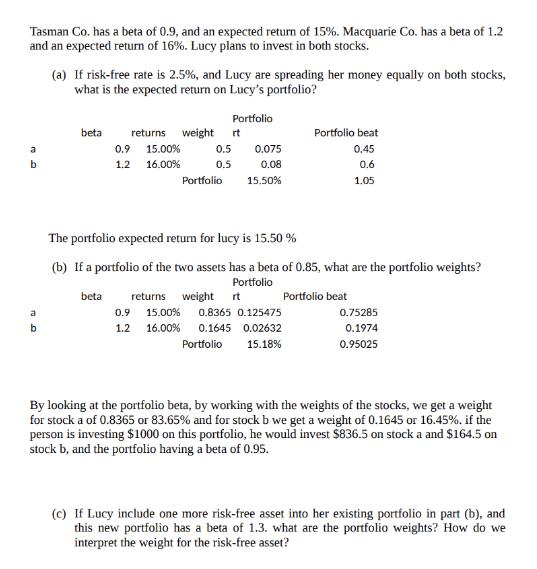

Tasman Co. has a beta of 0.9, and an expected return of 15%. Macquarie Co. has a beta of 1.2 and an expected return of 16%. Lucy plans to invest in both stocks. a b a b (a) If risk-free rate is 2.5%, and Lucy are spreading her money equally on both stocks, what is the expected return on Lucy's portfolio? beta beta returns weight rt 0.9 15.00% 1.2 16.00% Portfolio 0.5 0.075 0.5 0.08 15.50% Portfolio Portfolio beat 0.45 0.6 1.05 The portfolio expected return for lucy is 15.50% (b) If a portfolio of the two assets has a beta of 0.85, what are the portfolio weights? Portfolio Portfolio beat returns weight rt 0.9 15.00% 0.8365 0.125475 1.2 16.00% 0.1645 0.02632 Portfolio 15.18% 0.75285 0.1974 0.95025 By looking at the portfolio beta, by working with the weights of the stocks, we get a weight for stock a of 0.8365 or 83.65% and for stock b we get a weight of 0.1645 or 16.45%. if the person is investing $1000 on this portfolio, he would invest $836.5 on stock a and $164.5 on stock b, and the portfolio having a beta of 0.95. (c) If Lucy include one more risk-free asset into her existing portfolio in part (b), and this new portfolio has a beta of 1.3. what are the portfolio weights? How do we interpret the weight for the risk-free asset?

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To find the portfolio weights for the new portfolio with a beta of 13 we can use the following formu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started