tasty foods produces two types of microwave products: beef-flavored ramen and shrimp

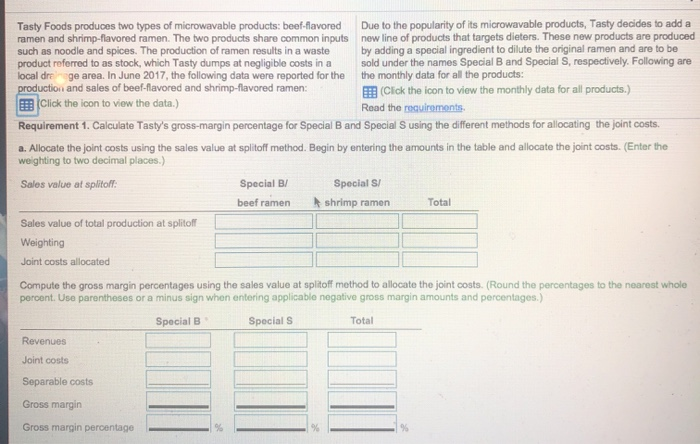

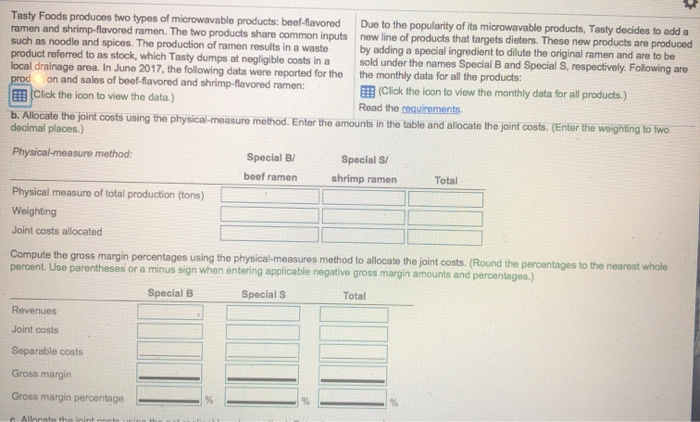

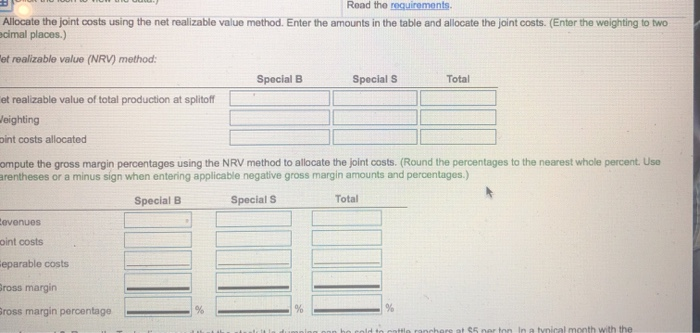

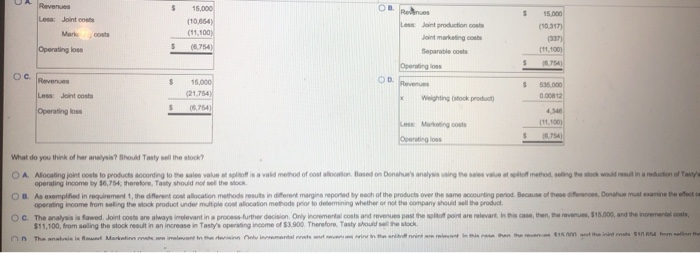

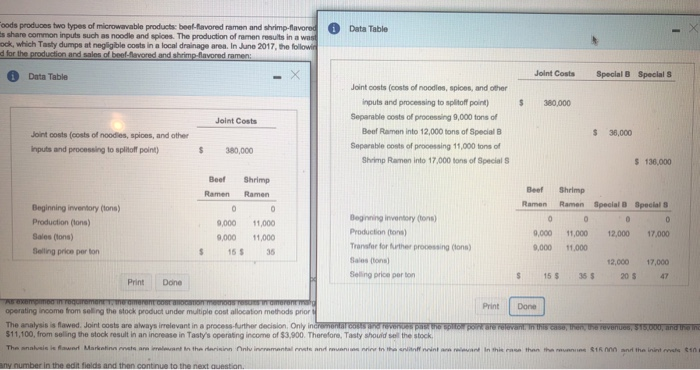

Tasty Foods produces two types of microwavable products: beef-flavored Due to the popularity of its microwavable products, Tasty decides to add a ramen and shrimp-flavored ramen. The two products share common inputs new line of products that targets dieters. These new products are produced such as noodle and spices. The production of ramen results in a waste by adding a special ingredient to dilute the original ramen and are to be product referred to as stock, which Tasty dumps at negligible costs in a sold under the names Special B and Special S, respectively. Following are local drainage area. In June 2017, the following data were reported for the the monthly data for all the products: prodon and sales of beef-flavored and shrimp-flavored ramen: (Click the icon to view the monthly data for all products.) Click the icon to view the data.) Read the requirements b. Allocate the joint costs using the physical measure method. Enter the amounts in the table and allocate the joint costs. (Enter the weighting to two decimal places.) Physical-measure method: Special B/ beef ramen Special S/ shrimp ramen Total Physical measure of total production (tons) Weighting Joint costs allocated Compute the gross margin percentages using the physical measures method to allocate the joint costs. (Round the percentages to the nearest whole percent. Use parentheses or a minus sign when entering applicable negative gross margin amounts and percentages.) Special B Special S Total Revenues Joint costs Separable costs Gross margin Gross margin percentage UAB 15000 Les Joints Mark 15,000 (10 654 (11,100 Joint production cos costs (8.754 337) 111.00 Operating lose $ 754 OC. Reve La $35.000 0.00812 Joint costs Weighting stock product Operating loss What do you think of her analysis? Should Tasty sell the stock? O A Allocating joint costs to products according to the sales value offisa vald m od of cost o sedon Don 'analysing the value of methodseling the would reduction of any operating income by 16,754, therefore, Tasty should not be the stock OB. As exemplified in requirement, the different collocation methods results in different margins reported by each of the products over the same accounting period because of the forces, Donahue mutexamine the effect operating income from selling the wock product under multiple cost allocation methods prior to determining whether or not the company should sell the product O C. The analysis is fowed. Joint costs are always relevant in a process further decision Orly incremental costs and revenues past the point are relevant in this case, then there $15.000, and the incremental costs $11,100, from siling the stock result in an increase in Tasly's operating income of $3.900. Therefore, Tasly would the stock The answeis Marmara in the numatlar in thei r than tha the insinu om wall the