Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tasty Subs acquired a delivery truck on October 1, 2021, for $24,000. The company estimates a residual value of $3,000 and a six-year service

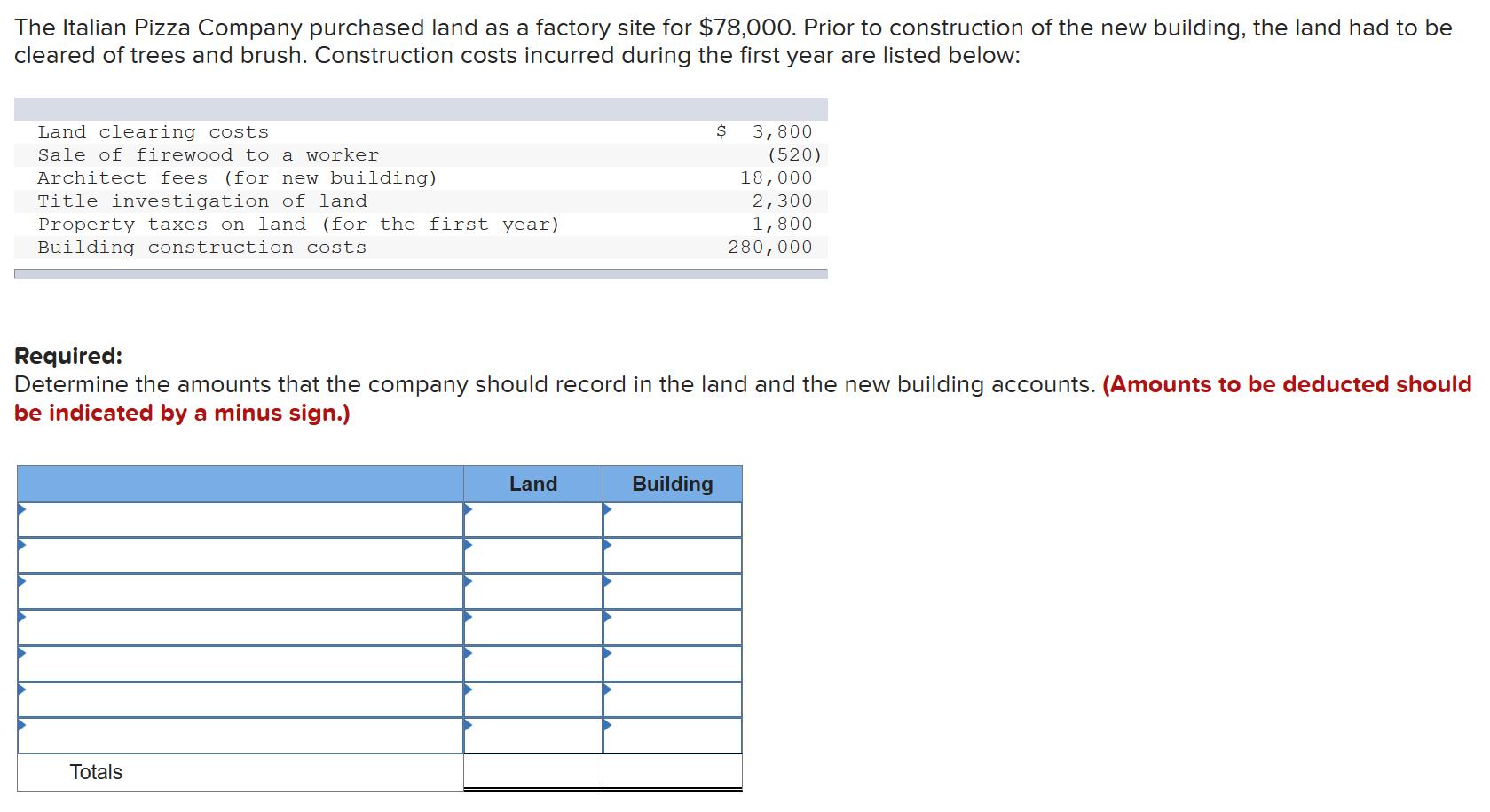

Tasty Subs acquired a delivery truck on October 1, 2021, for $24,000. The company estimates a residual value of $3,000 and a six-year service life. It expects to drive the truck 140,000 miles. Actual mileage was 5,500 miles in 2021 and 20,000 miles in 2022. Required: Calculate depreciation expense using the activity-based method for 2021 and 2022, assuming a December 31 year-end. (Do not round your intermediate calculations.) Depreciation expense 2021 2022 The Italian Pizza Company purchased land as a factory site for $78,000. Prior to construction of the new building, the land had to be cleared of trees and brush. Construction costs incurred during the first year are listed below: Land clearing costs Sale of firewood to a worker Architect fees (for new building) Title investigation of land Property taxes on land (for the first year) Building construction costs Totals Land $ Required: Determine the amounts that the company should record in the land and the new building accounts. (Amounts to be deducted should be indicated by a minus sign.) Building 3,800 (520) 18,000 2,300 1,800 280,000

Step by Step Solution

★★★★★

3.33 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Tasty Subs Depreciation rate per mile Cost Salvage value To...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started