Question

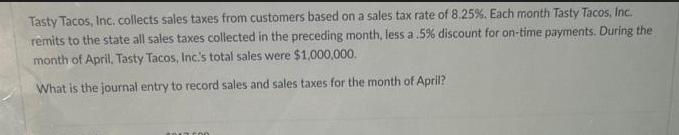

Tasty Tacos, Inc. collects sales taxes from customers based on a sales tax rate of 8.25%. Each month Tasty Tacos, Inc. remits to the

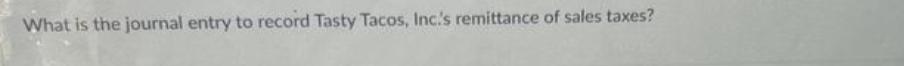

Tasty Tacos, Inc. collects sales taxes from customers based on a sales tax rate of 8.25%. Each month Tasty Tacos, Inc. remits to the state all sales taxes collected in the preceding month, less a .5% discount for on-time payments. During the month of April, Tasty Tacos, Inc.'s total sales were $1,000,000. What is the journal entry to record sales and sales taxes for the month of April? APET FOO What is the journal entry to record Tasty Tacos, Inc.'s remittance of sales taxes?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Construction accounting and financial management

Authors: Steven j. Peterson

2nd Edition

135017114, 978-0135017111

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App