Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TATA, an Indian motor company, plans to raise GBP 10 million (or equivalent in other currencies) to acquire Lotus, a British firm. Therefore, TATA decides

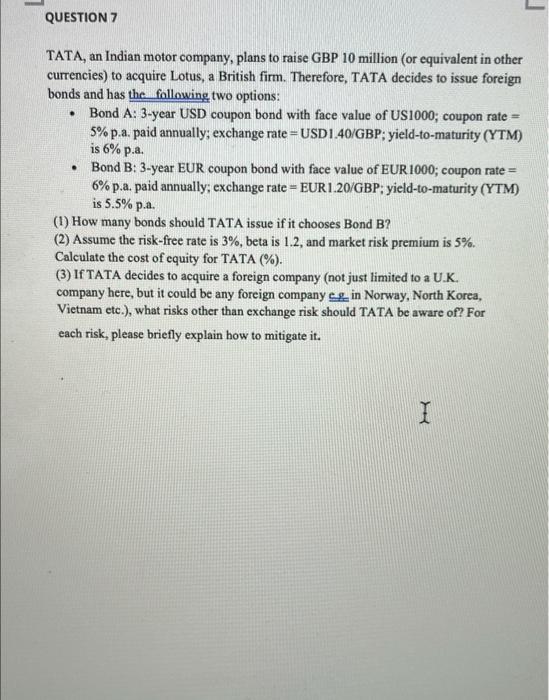

TATA, an Indian motor company, plans to raise GBP 10 million (or equivalent in other currencies) to acquire Lotus, a British firm. Therefore, TATA decides to issue foreign bonds and has the following two options:

Bond A: 3-year USD coupon bond with face value of US1000; coupon rate = 5% p.a. paid annually; exchange rate = USD1.40/GBP; yield-to-maturity (YTM) is 6% p.a.

Bond B: 3-year EUR coupon bond with face value of EUR1000; coupon rate = 6% p.a. paid annually; exchange rate = EUR1.20/GBP; yield-to-maturity (YTM) is 5.5% p.a.

(1) How many bonds should TATA issue if it chooses Bond B?

(2) Assume the risk-free rate is 3%, beta is 1.2, and market risk premium is 5%. Calculate the cost of equity for TATA (%).

(3) If TATA decides to acquire a foreign company (not just limited to a U.K. company here, but it could be any foreign company e.g. in Norway, North Korea, Vietnam etc.), what risks other than exchange risk should TATA be aware of? For each risk, please briefly explain how to mitigate it.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started