Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TATA STARBUCKS: A BREW FOR INDIA?* In April 2022, Tata Starbucks announced its entry into Nagpur, a tier-2 city in India, as the premium coffeehouse

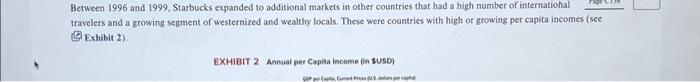

TATA STARBUCKS: A BREW FOR INDIA?* In April 2022, Tata Starbucks announced its entry into Nagpur, a tier-2 city in India, as the premium coffeehouse chain marked its tenth yeat of operations. This would bring Tata Starbucks' total to 270 outlets across 27 cities in India. In recent years, Tata Starbucks had been on an expansion drive to explore prospective non-metro cities despite the Covid-19 pandemic that ravaged across the globe during the period of 2020-21. Notably the coffee house chain opened about 50 new outlets during the financial period ended March 31, 2022. "Tata Starbucks has had an incredible journey in India, we are honored to celebrate our tenth year by entering newer and vibrant cities, like Nagpur," said CEO Sushant Dash at the launch. "Cities other than metros also have a population with spending capacity on premium brands. Nagpur has the right number of such consumers to start an outlet. 1 Sushant Dash, who was the president of Packaged Beverages. Tata Consumer Products Ltd, was appointed CEO of Tata Starbucks in April 2021. Dash was the fourth CEO to manage the chain's business ever since it first launched in 2012 and was part of the core team that opened the first Starbucks in India. Dash was taking over from Navin Gurnaney, who had been CEO for the previous two years. Speaking on the announcement, Sara Trilling, president, Starbucks Asia Pacific, praised Navin Gurnaney for making significant contributions to the Tata Starbucks experience in India by stepping up expansions and enhancing the customer experience. Trilling then shifted focus to the future, saying, "We are pleased to welcome Sushant, a recognized leader in growing retail businesses and brands through locally relevant initiatives. India is a strategic market for Starbucks, and we remain committed to the long-term in the country, 2 Tata Starbucks Pvt. L.d in India is a joint venture of the U.S. beverage company Starbucks and Tata Consumer Products Limited. Began in October 2012, at first Tata Starbucks, under founding CEO Avani Davda, offered the usual Starbucks cotfee menu in India, which was not successful. By early 2019. Tata Starbucks had refined the India-speciffe strategy, as a more promising path for future growth and success among Indian customers. One of the first things they did was to introduce Starbucks Teavana with 18 diverse varieties of tea to serve the Indian market The market in India is intensely competitive, with multiple domestic and foreign players. The most formidable competitor of the Tata Starbucks venture is domestic giant Cafe Coffee Day (CCD), with its strategy of flooding the market with its cafes, closely mimicking what Starbucks has done in the United States. At the same time, high real estate costs and rental rates, along with competitive pricing pressures and India-specific cultural preferences, make it extremely difficult for new coffee companies in India to recover their initial investments. While CCD has about 570 stores across the country, heavy debt and the economic crisis laid by Covid-19 have forced Cafe Coffee Day to permanently close many outlets in the last three years, suggesting that the gap between the chains could continue to close within the next 12 months. 6 Former Tata Starbucks CEO Avani Davda admits that the initial consumer experience was a humbling one. Tata Starbucks opened its first store with a lot of fanfare in the trendy Horniman Circle area of Mumbai. Despite having a high-profile local partner, Starbucks was unable to use its name to secure any discounted rates in renting real estate. The first store was located in a Tata Group-owned 4,000-square-foot site that had been vacant for a while. As of March 2022, Tata Starbucks had expanded to over 270 locations across the country in major metropolises such as Mumbai, Delhi, Pune, and Bengaluru as well as tier-1 and tier-2 eities.' Yet this was still well short of initial expectations. Clearly, something had changed in management's expectations of the size and pace of the venture's growth. Quarterly earnings presentations boasted of robust store proftability, but with no numbers provided, possibly pointing to a slower and more selective approach to expansion. 8 In its first full year in the Indian market (12 months ending March 2014), Tata Starbucks reported losses of $7.8 million, more than half its total sales of $14.34 million during the same period? The joint venture appeared to be at the crossroads of an important strategic decision. It could revert to a plan to grow its store count aggressively, much like Starbucks did in the United States. It is possible that this was the original intent. After all, the initial launch pricing had been set to be competitive with CCD's pricing (coffee drinks available for as low as Rs 100). This approach would have put it in direct price competition with CCD, the domestic cafe market leader. Gaining market share among the youth of the country was critical for Tata Starbucks to tap into a large demographic segment. India's population showed a pronounced skew to younger age brackets (see ($S Exhibit 1 ) and lower incomes when compared to countries like Japan and the United States. Building a presence within these segments as CCD had done was critical for success in the long term. Alternatively, instead of trying to saturate the country with stores at once, the venture could choose a premium-priced, niche approach similar to the one Starbucks had used successfully in other Asian countries, like Japan and China. The premium offering would cater to an older business elite with higher spending power. This would result in less rapid growth, with a cherry-picked list of high-profile, businessfriendly locations, allowing the venture to build a premium brand with prentium pricing. Would Starbucks and Tata under Dash's leadership be able to crack the code for sustained suceess in the competitive and complex Indian market? Though at first Starbucks appeared optimistic about the success of Teavana as the company focused on offering products exclusively according to the taste of the Indian customer, some critical strategic choices would need to be made to ensure the long-term success of Starbucks in India. PajeC155 Schultz and Starbucks-Cultivating a Company from an Idea Starbucks started out in 1971 with a single coffee roaster and retail store in the Pike Place Market in Seattle. Since then, the company had expanded its global footprint mightily, with over 32,000 coffec stores in more than 80 countries. 10 The visionary behind this international success story was CEO Howard Schultz Schultz joined the company in 1981 and quickly assessed its gromth potential after visiting coffechouses in ftaly. He eavisioned his coffechouses offering much more than just a cup of eoffee. They were to become a third place, in addition to bome and work. For people to met and socialize. In addition to serving cotfee, the eoffeehouves would help people conneet with other people and their local communities. Employees would be trained on coffee, company products, and customer service to deliver a positive "Starbucks Experience" to each and every customer. Starbucks quickly acquired a reputation for being an employer of choice and a socially responsible player: - When the eompany went public in 1992, all employees were made "partners" in the compary and given a share of Starbecks equity (commonly known as "bean stock"), Comprebenive health care coverage was also provided to both fallime and part-time employoes . Ffforts were made to ethically source prodocis and establish strong relationchips with coffeeproducing farmers all ower the wotld in Starbucks quickly acquired a reputation for being an employer of choice and a socially responsible player: - When the company went public in 1992, all employees were made "partners" in the company and given a share of Starbucks equity (commonly known as "bean stock"). Comprehensive health care coverage was also provided to both full-time and part-time employees. - Efforts were made to ethically souree products and establish strong relationships with coffee-producing farmers all over the world. In later years, the company began to utilize reusable and recyclable cups in its stores. Its emplogec partners contributed many hours of volunteer work to help with community causes: - After the 20082009 recession and the introduction of the Alfordable Care Act in 2010, several companies began to cut employee benefits to manage costs. Schultz refused to reduce benefits for his parthers, arguing that this was a short-term reaction and not in the interests of the company in the long term. - In 2019, to help provide employment opportanities for refugees and mititary veterans in the United States, Starbucks announced a goal to hire 10,000 refugees by 2022 , and 25,000 military viterans by 2025 . - Since the start of the Covid.19 pandemic in 2020, Starbucks has prowided frontline workers in the U.S. with more than 4.2 mittion free cups of cotfee, along with thousands of Starbucks gift cards and K-Cup pod pallets for hospitals across the globe. The company's mission was "to inspire and nurture the human spirit, one person, one cup, and one neighborhood at a time," The company planned on doing this not just in the United States but across the globe. The Starbecks name had been taken from a character in Herman Melville's classic adventure novel Moby Dick. It was felt that the history of the coffee trade and Seattle had a strong association with the sea. In keeping with the sea theme, the image of a Norse twintailed siren was adopted as the company logo." The company under Schultz's lesdership performed remarkably well financially over time. Performance in 2016 showed total revenues of $21.3 billion, and $2.8 bilition in net carnings. On Aprit 3, 2017, former Chief Operating Officer and member of Starbucks board of directors Kevin Johnson became the saccessor of Howand Schultr as the new CFO, with a vision similar to Schalex' Under Johnson. performance in 2021 rose to $29.1 billion in revenues and net earnings of $4.2 biltion. 12 Initial Expansion into Asia-Targeting the Westernized and the Wealthy The first Starbucks sore cutside North America opened in the fashionable Gisza district in Japan in 1996. Within the next few years, Starbucks became a wellknown brand name in Japan. Like Starbucks shops in the United States, those in Japan featured comfy rofas with American music playing in the background. Unlike most Japanese kbafer, or local coffee shops, Starbucks did not allow smokine. The policy proved popular with women, who did not smoke as much as men in Japan. Men eventualty followed the women to Starbucks locations, and basiness started tumming. Given the strone performance, the stock of Starbucks Colfee Japan Lid, made its debut on the NASDAQ Japan exchange and performed stroogly, "Any way you measure it, we've exceeded our wildest expectations," CEO Howard Schultz annoanced jubilanily at the initial pubbic offering in Tokyo, October 2001. Teadrinking Japan was not a total stranger to coffes. Dutch tradess first brought coffee to Japan in the 17th century, but the shogas prohibited them from iravelins freely in Japan, so very few Japanese were exposed to colfee and those who were lived mainly in port eities tike Nayasak. Coffes penetrated Japan further in the 1850 s with the arrival of American ships. Soon after, Japanese staried to travel owerseas and brought back etements of the European coffee culture. the next few decades, coffee increased in popularity within Japan, and a number of coffee ctuins entered the makket. As business Bourished between the UnMed Staterand Japan, many lapanese traveled to the United Siates. West Coant cibes like Seatile were popular destinations So, when Starbucks finally entered Japan in 1996 , many Japanese were alfeady familiar with the brasd. Starbucks soon caltivated a logal clientele of wealthy Japanese, who conuidered is to the the original nourmet coffee thop and aspired to emalate the Western lifewyle Starbucks Cotfee Japan turned its firs profh in 2000 , nearly four years afer is initial taunch. Clearly, Starbucks entered markets with a commitment to win them over the long haul. Starbocks grew to over 1,500 stores in the country. For a while, sales volume per store in Japan was twice as high as that in the United States 13 Between 1996 and 1999 . Starbucks expanded to additional markets in other countries that had a high number of internatiohal travelers and a growing segment of westernized and wealthy locals. These were countries with high or growing per capita incomes (see Exhibit 2). EXHIBIT 2 Annual per Capita income (n suso) - Starbucks Singapore opened its fint sore in December 1996 at Liat Towers, strategically located along the nution's renowned Orchairs Koad shopping belt. - Starbucks then entered the Philippines (1997), Tawan. Thailand. and Malysia (1998), and South Korea (1999), once apain selecting peemium locations frequented by the country's growing westernired, affluent elasses and international travelers. 14 Happy whth iss inilal successes, Starbuks began plannisg expansions into countries with more entrenched cultures and larre, diverse pogulations. Next Expansion Wave-Cracking the Cultural Codes Unlike Japan, teadrinking China had latile prot experience with cotice. In addition, the emergine superpower had decply entrenched cuitural traditions with refard to food and drink. Socceeding in China would be a critical challenge and opportunity for Starbucts Cracting the cutrurat code there could facilitse conquerieg other emerene nurkes, sach as todia. was yet coeducive to local values and tauch. In China, instant colfee accounted for upwad of 80 percent of all coffee consumpeion. Given the areroge Chinese consumer's limited prien expenure to colfee, insunt coffee had proved to te a bighly effective and affordable way of expasding consumption. Starbucks took a differet approach and targeted aftlucot Chinese consumers with bererages priced up to 50 percent higher than the prices at is US Aores cost as litile as RMBIS (USso. 10) per packet. The wealing commercial capital Shanghai quickly became the coffee culture capital of China. The owner of Stunghai-based Cafe del Volean, one of Stanghars popatar coffee fetail outlets, had noticed an interesting pheoomenon in the initial days after operiling his cafeThe prices had not yet been displayed, yet most customers ordered their beverages without inquiring about pricek. Ciearly, the Shangha elte were not pricesensitive. Much like Starbucks, the eafe then began to focus primarily on achieving the highest level of quality and service. In 2021, Starbucks posted an 18 percent year-onyear growth to $964 mallion over the last quarter from its besiness in China Howevet, the Covid 19 pandem had hampered the coffec chain's growth in China to some estent. Likefortike store sales decreased 7 pertent, driven by a 5 percent dectine in averape ticket and 2 percent all in transactions. Nevertheless, Starbucks was optimistic about China and accelerated its prowt plats it China in recent years. To capialize further on the Chineso market, Starbucks announced a taget of 6,000 stores in China by 2022. The U.S and China congirise about 62 percent of Starbucks' stors, with the company operatieg 15,490 and 5,360 sores in each market, reypectively is in put can be atinbuted to senesetine the maket and recognizine the Chines as unique consumers with different tastes and habits than those of Americas consumers. For insance, Chinese consumes do not like the bitier taste associaled with Back colfee of tapresw, so customired choices tike green tea tiramba and Chipse moan cales. colfoe Tamity forums" were introduced to esplain to parents the merits of having their childres aork at Starbucks, Large loonpes wath include foods that were tallared to lecal tastes, for ecangle, a Hainan Chicien sandwich and a Thai-syle Prakn wrap. "t By the end of 2021, Starbucks had opened about 5,360 stores in China and expected to take the total store count in China in 6,000 by 202217 In terms of Starbucks' expansion in China, it meant opening more than one store per day. It was this success in China that made Schaltz particularly eager to venture into India. Like China, India was another large market with culturally entrenched tastes. Is In a press interview, Howard Schultz later reminisced: Our stotes, domestically and around the world, have become the third place for customers betwees bome and work. Toe environment, the store Shanchai, in Spain, in Tokjo of in New Yoek Cay. We've cracked the code on univeral relirvance." Conquering Unfamiliar Markets-Seeking the Magic Formula Wha Starbacks' stellar performance in its initial capansion inio Asia, namerous industry analysts speculated on the best practices that could be used by the company to penetrate other markets, or that could be emulated from other companies. 20 Thre key thenes emened: 1. Be actiol in marketing the brand - Opce Starbucks decided to enter Chiea, it implensented a smart marketentry straegy. It did not use amy advertising and promotions that could be perceived by the Chinese as an American intrusion into the local teadrinking culture. It jast qquietly focused on carefully selecting premitum locations to bould its brand image. - Starbucks capialized on the tea-drinking culture of Chinese consumers by introducine beverages using popular local ingredients such as green tea. It alio added more milkbased beverages, such as Frappocsinos, since the Chinese did not tike the taste of bitter coffee. 2 Find a good local purtiner - Working with the right partners could be an effective way to reach focal customers and expand quickly without poing through a sygnifeant learning curve. - Working with the right partners could be an effective way to reach local customers and expand quickly without going through a significant learning curve. - China was not one homogeneous market. There were many Chinas. The culture of northern China was very different from that of the east. Consumer spending power inland was not on par with that in coastal cities. To address this complexity or the Chinese market, Starbucks collaborated with three regional partners as part of its expansion plans. - In the north, Starbucks entered a joint venture with Bejing Mei Da coffee company. In the east, Starbucks collaborated with the Taiwan-based Uni-President. In the south, Starbucks wotked with Hong Kong-based Maxim's Caterers. Each partner brought different strengths and local expertise that helped Starbucks gain insights into the tastes and preferences of local Chinese consumers. 3. Make a longserm cammitment: - Longterm commitment required patience. It took Starbocks time to educate the market and gain customer loyalty, Starbucks also did an excellent job in recruiting and iraining its employees. This turned out to be a win-win strategy because employees were, after all, the face of the Starbucks brand and were at the heart of delivering the "Starbucks Experience" to customers. Passage to India-Tata Group a Worthy Partner Founded by Jamsetji Tata in 1868. Tata's early years were inspired by the spirit of nationalisnt. Tata pononered several industries of national importance in India: steel, power, hospitality, and airlines. In more recent times, its pioneering spirit was showcased by companies such as TCS, India's first software company, and Tata Motors, which made India's first indigenously developed car, the Tata Indica, and the world's most affordable car, the Tata Nano. The Tata Group comprised over 100 operating companies in seven basiness sectors-communications and information Page Cisi technology, engineering. materials, services, energy, consumer products, and chemicals. The group had operations in more than 100 countries across six continents, and its companies exported products and services to 150 coantries. Alone with the increasing global footprint of Tata companies, the Tata brand was also gaining international recognition. Tata ranked 13 ist among Forher' list of the Top Regarded companies, as of 2018,21 Brand Finance, a UKbased consultancy firm, valued the Tata brand at $239 bition and ranked it 78 th among the top 500 most valuable global brands in its Brand Finance Global 5002022 report. 22 Like Starbucks, Tata had a strong belief in social responsibility. The company created national iastitutions for science and technology. medical research, social studies, and the performing arts. Its trusts provided aid and assistance to nongovernment organizations (NGOs) working in the areas of education, bealth care, and livelhoods. Individual Tata companies were known to ectend rocial welfare activities to communities around their industrial units. The Tata name had been respected in India for more than 140 years because of the companys adherence to strong values and business ethics. The total revenue of Tata companies was $103 billion in 2021 , with nearly twothirds comine from business outside India. Tata companies employed over 800,000 people worldwide. Every Tata sompany of enterprise operated independently. Fach of these companies had its own beard of directors and sharebolders. The major Tata companies were Tata Steel, Tata Motors, Tata Consultancy Services (TCS), Tata Power, Tata Chtmicaks, Tata Tele-services, Than Watches, Tata Communications, Indian Hoteks, and Tara Convareer Products Limited Much like Starbucks, the Tata Consumer Products Limited unir was looking for a retail partner to sell its cotree products. Its broad product portfolio also included tea and boutled water. As with its Tata Group parents and Starbucks, Tata Consumer Products Limifed was proud of having strong values and purpose as a company. Thus, a promising partnership was formed, and Starbucks was ready to make a grand entry into the market. 23 Coffee in India-An Existing but Lesser-Known Tradition Unlike China, tea-drinking parts of south India did have some historical experience with colfee. The crop was first cultrvated in Ethiopia, and by the 1600s, it was hugely popular throughout the Ottoman Empire. According to coffee historian and author Mark Pendergfast, the Turks boiled of roasted coffee beans before they left the Yemeni port of Mocha to keep them from being grown elsewhere. That is why. according to legend, a 17 th-eentury Muslim pilerim named Baba Budan taped seven coffee beans to his stomach and smugeled them to India. The hills where he planted those beans are now known as the Bababudan Giris. When the British arrived in the 1600 s, intending to break a Dutch monopoty on the spice trade, tea and coffee were "backyard crops" in India, Over the centuries, the British inualled plantations and established more orfanized production processes. Tea, which was a much larger crop than coffec, was grown mostly is the north, while coffee was grown moslly in the south. For decades, the Coorg (also called Kodawu) rezion in south India had been home to coffee plantations. The British began planting cotfee there in the 19th century. When India eained independence is 1947, the origisal British planters sold their estates to the locals (known as Kodavas) and other southers Indians. Since the mid-1990s, when the Indian sowernment changed its policies and allomed farmers to take control of their own sales, India's cotfee industry has experienced a boost in quality and profits and taken a seat in gourmet coffee cireles. 24 With the Tata alliance, Starbucks gained access to focally produced premiumquality beans from Tatarowned plantatioas in the Coors region. Tata Coffec, a unit of Tata Consumer Products Limited, produced more than 10,000 metric tons of shadezrown Arabica and Robusta eoffees at its 19 estates in south India. 25 This was a strategic asst for Starbucks as it prepared to do battle with the domestic giant, Cafe Coftee Day Indian Cafe Market-Dominated by Cafe Coffee Day The Indian coffechouse market was strong and growing at a robust rate of above II percent. While the market was crowded with international and domestic players, Starbucks main competition came from a domestic giant, Cafe Coffee Day (CCD). Up uatil 201819. CCD was a major force to reckon with, having about 1,600 outlets in India, almost three times the number of other international coffee chains. 26 However, the homegrown coffeeshop chain fell under hard times, teeling under the shocking demise of its founder V.G. Siddhartha in 2019 which was then followed by the adverse economic inpacts of the Covid-19 lockdowns in 2020. CCD revealed that its store footprint had shrunk 67 percent to just $72 stores across 165 cities in just three years 27 Nevertheless, the colfeehouse chain still had more than double the number of stores and was present in six times the number of cities as cotnpared to Tata Starbucks. CCD had been the market leader since its beginnings as a "cyber cafe" in 1996. As the retailing arm of the nearty 150-year-old Amalgamated Bean Coffee Trading Conpany Limited (ABCTCL), it had the benefit of soarcing its cotfee locally from a network of ABCTCL-owned coffee plantations and using ABCTCL-manufactured cotfeerasting machines. This allowed CCD to insulate isself from global price fluctuations and serve cotfee at lower prices than the competition. Most of the foreign competitors relied on imported coffec and foreign roasting machines, is ABCTCL: charismatic CEO, V, G. Siddhartha, had rapidly expanded CCD stores asross the country. The mission of the company was to provide a worldeclass coffechouse experience at affordable prices. This made the stores ubiquitous, much like Starbucks stores in the United States. It also made CCD the destination of chobee for the youth in the country who had limited meney to spend and wete looking for socialty acceptable places to socialize. The majority of India still disspproved of socializing at ban, asd cafer offered a respectable aliernative. An industry stody showed that the CCD brand was synorymous with colfee for most colfec drinkers in India 29 Afer CCD, the nevi-bigest player was the Barista chain, which uarted in 2000. From 2001 to 2004, Tata Consumer Products Limited exploted the option of partacrine with Barista to sell its coffees but eventsally sold its stake. In keppine with Barstars premitum positionine. most of the comparys products were imports and its cotfee was toasted in Venice, Italy. In 2007, Barista was accaired by italian colfec eompany Lamarza. Howevet, profits prosed elusive despite several years on the martel and heavy imestrents, In 2014, Lavaza sold the company Lavazza. However, profits proved elusive despite several years on the market and heavy investments. In 2014, Lavazza sold the Barista business to Carnation Hospitality Pvt. Ltd for an undisclosed amsount. Industry watchers said that the colfee business in India was becoming a difficult one to turn profitable even after years of operations. High rental expenses and intense competition had left most foreign players strureling to achieve profltability despite years of trying Actording to industry estimates, rentals could account for 15 to 25 percent of the cost of running a cafe chain. Typical monthly rental market rakes were 200 to 300 rupees (Rs) per square foot of real estate. 36 Then, there was the investment in making the stores appealing to customers, finding people to run them, and building a food and beverage menu that was hip enough to keep 18 . to 24 yearolds, the target market for many colfee chains, coming back for more. CCD had found a way atound this problem by entering into a reventocshariag deal, papine 10 to 20 petcent of a unit's proceeds as a fee. Coffee bars were a sitin concept in India, where consumers generally bung around such outlets for hours, unlike the elobal plenomenon of grabbing coffee on the po from generally tiny outlets and kiosks 3 Cafe Coffee Day's vision was to become an "experience beyond a cup of coffee," They wanted to become the premier destiration for everyone who wanted to relax and socialize over a cup of colfee. The challenge that Cafe Coffee Day had in its initial years was that it was "just another expensive coffee shop," CCD's key strategic approach is based on the MAs: Alfordabitity, Accessibility, and Amaring Value. The brand caters as a yoath mecting space wilh oetlets near collezes and offices where people can urwind, relax, and rejuvenate over a cup of cotiec. Industry experts argued that cotfee chains in Isdia had to maintain elaborate and pluch outlets, not kiosks, to give ladian consumes what they were looking for from a coffee chain even if the proposition turned out to be very expensive, and this concept made if difficult for many companies to stay in the business and made it hard to scale up. Ualike countries such as the United Suates, where parthising corter was often a quick transaction at a coupter or kiosk for eustomers on the zo, the culture in India was fo sit down and socialize for hoep over coffee or tea. 32 Some frustrated customers stopped frequeting stores because it was so hard to flod a free table. 31 This made it moch harder fot coffe retaliers to turn a profit. Accoeding to Masmeet Vohrs, Tata Starbucks marketiof and castegry chicf, peak hours in India were 2pm to 6pm (compared to 5a.m to 11am. in the United States) and takeout onders accousted for barely 20 peccent of the Other international entrants like the UK's Costa Coffee, the U.S.based Coffee Bean and Tea Leaf Company, and Australia's Gloria Jean's Coffee experienced similar profitability challenges. 35 Cosa Coffee entered the market in 2005 and soon found its stores were too smalf to handle the peaktime crovids. The Coffee Bean and Tea Leaf Company started out in 2007 and tried to entice customers by offering new menu items each month. Gloria Jean's Coffee entered the market in 2008 hoping it could crack the profitability code by serving coffce in more kiosks, which required a lower capital investment. However, achieving profitability continued to remain elusive for most international players. Starbucks appeared to be doing well in its initial stores. As mentioned previously, in arterly investor presentations, Tata Consumer Products Limited reported robus proftability in its stores. While the company shared no numbers, industry experts corroborated the information. The 4,000-squarefoot Horniman Circle store was estimated to be generating 8.5 lakh 2 in daily sales, which compared to I lakh rupees generated by the 400 -squarefoot CCD store at the Mumbai airport. Top ladian store revenues in U.S. dollars were companble to those generated by the stores in China (about $600,000 per year). Since the real estate for the first sore was obtained from the Tata Group, cetiainly thar store, at least, was brewing a healthy proft. Quick-Service Restaurant Chains-A Looming Threat In addition to traditional coffee chains, the Indian cafe narket was being encroached upon by other quickservice restaurant (QSR) optians like MeDonald's and Dunkin. These players threstened to steal market share with lower-priced options for deinking coffer at exiutine quick service establishments. One of the major advantapes for these chains over Starbocks and other competitors was the already-existing network of locations is the coustry that allowed ready access and brought down establishment costs. Further, this ubiquaty and lower pricing would enable these playets to tap inte the larger demographie segments that made up a large section of the Indian popolation. Amut Jatis, vice chairman and CEO of Hanscastle Restaurants, which is the MeDooalds franchise for South Indias operations, stated "McDonald's has the advantage as their ability to expand is better, considerint that they home a farter footprint bow.- 16 Price was another factor by which McDonald's McCafo expected to hold an edge over Starbucks. Getting a cappuccino for 90 Pavecilo rupees from a global btand like McCafe sounded more appealing than spending more than 110 rupees for the same drink at Starbucks Like Starbucks. McCafe was sourcing its coffee locally from Chikmagalur in Karnataka, 37 The Chai Revolution India has traditionally been a tea-drinking nation. With a domestic consumption of over 2.4 billion pounds in 2021 , the market for chai (tea) is expected to grow at a CAGR of 2.06 percent through the years 2022-2026, 4 For every cup of coffee, an ladian drinks 30 cups of tea 39 However, in the last decade, coffee chains have increased as the big players like Starbucks and Conta Colfee have entered the Indian market. In comparison to highly expensive bottled teas of Starbucks Teavana, some tea startups in India explored the possbilitiet of sophisticated varieties of Indian shai for a faitly decent price. They realized the importance of tea over that of coffee and combined it with Schaler's initial idea of making the whole experience more than just a cup of chai. As the history roes, at Starbuck' inception, Howard Schuluz had undersood that the stores were more than just a cup of coffee. After Cotfee Company. The taliass had created the theatre, ronasce, ant, and magic of experiencing espresso, "Schuliz recalled, "T was oneruhelmed with a gut instinct that this is what we should be doing 40 He wanted Starbocks' experience where people met and hard to say the company entered the Indian market with the same thought proces. Ilowever, wome Indian companies were doine jast that. with a local difference. Chai Point is an Indian sea compary and a cafe chais that focuses on testased beverages mosto popular in Souch India. Chai Roint is rapidly erown to become the goto brand for a perfectby brewed cup of chai with over 300,000 cups vold every day. "Chai Point is present Chai Point is an Indian tea company and a cafe chain that focuses on tea-based beverages mostly popular in South India. Chai Point is revolutionizing the way chai is consumed in India. Beginning with the first pilot stores set up in Bangalore in April 2010, Chai Point has rapidly grown to become the go-to brand for a perfectly brewed cup of chai with over 300,000 cups sold every day, 41 Chai Point is present in eight cities: Bangalore, Delhi, Gurgaon, Noida, Mumbai, Pune, Hyderabad, and Chennai. Chai Point's offerings include varieties of hot chai, iced chai, shakes, and bite-sized Made-For-Chai snacks perfectly accompanying the morning and evening chai ritual. Chai Point retails its own brand of consumer-packaged goods, Made-For-Chai. These bitesized snacks perfectly complement a cup of their chai. The recipes are developed after thorough research on the Indian palette. It is tough to compete with Chai Point's reasonably priced fawored ica in the Indian tea market with consumption volume of more than 2 biltion pounds in 2017 . Their stratezy revolves around catering to tech parks and corporate professionals. Known to be the Siticon Valley of India, Bangalore has a large number of tech parks, and each of these hold multiple corporations with thousands of employees, mosthy individuals from middleclass backgrounds. This is a market that would be willing to spend more than 15 cents in Indian rupees for a cup of tea. but not indulge a profligate lifestyle by spending up to $3 at a Starbueks. This is where the tea startups in India intervened. The Chai Point kiosks are located in tech parks that consist of numeroas companies with professionals who prefer having a small affordable cup of chai with snacks during their lunch and breaks. This is in contrast to Starbucks Teavana that was launched in January 2017. Tewana is positioned as a premium offering competing against a slew of homegrown startups such as Chai Point that are wilting to experiment with the Indian chai at a reasonable price to give a branded experience. Is Teavana Starbucks the right answer to these home-grown startops? Or does Starbucks need to alter its stralegy further to gain the trust of the Indian market? Impact of Covid-19 Covid-19 had a devastating effect on the retail besinesses across India in 2020 and as mentioned above led to the slosure of 67 peresnt of sotes for CCD. Tata Startocks too bote the bram because of multiple lockdowns resulting in a 33 percent yearon-year fall in revenue during 2020. However, Tata Starbucks manated to recover from the impact of the pandemic and performed moch better in 2021. Under the leadership of new CEO Sushant Dash, several innovative strategles were undertaten to minimize the sdverse effect of the pandemic on businesses Durine the pandemic, Tata Starbucks started home delivery for their beverage and fond items either through the Starbucks app or through they complain about isues such as spiltage and that it doesn't reach them as the tempratare it is meant to be convamed in. Tata Startods addressed these issues by innovating with their packapiaf. They atwo launched onelifer freshly brewed beveraper and athome colfee. keeping in mind the interest in home detivery. New digitat initiatives were alio introduced that becane immensely popular. Consumers using a QR code displayed oatside the store. It also experimented with new store formats, such as Drove Thru and small engine stares, to capitalize on the takexwy and delivery opportunaties. These initiatives were immensely populat and resulied in deliveries contributing to approuinately is percent of the overall sales in 2021 . The sezessive stere expansons expecially in nepmetro cities as soon as the lockdown restrictions were lifted not only drew new consuner groups who sought a premium experience bat alio contributed to cheaper reat estate cost for Tata Startucks. Revenue was on an upward trajectory when the econony opened afler the second Covid wave in India. retistering a prowth of 128 percent for Qaster 2.2021. (See @ Exhibit 3.) Tata Starbucks-Challenging Decisions Ahead In the words of John Culver, president of Starbucks Colfee China and Asia Pacifie: We have studied and evaluated the market carefully to ensure we are entering India the most respectful way. We belicve the size of the econony. the rising spending poner and the growth of cafe culture hold stong potential for oar growth and we are thrilled to be here and extend our highquality coffec. handerafted beverages, locally relevant food, legendary service, and the waique Starbucks Fxperience to eustomers here 22 The business looked simple; have a standardized decor, choose a suitable location, and offer good coffee and food. But ensuring that a customer's cappuccino tasted the same as it did yesterday and that the service did justice to the iconic Starbucks brand name every single day was far more complex. Doing so required carefully selected partners (store managers and stewards who went through intensive training) and an incredibly complex planning effort. For that reason, Starbucks had avoided the franchisee route, which coofd have seemed like the obvious choice for rapid expansion. In addition, Starbucks had to meet the expectations of its world-traveled customers, who were aware of the Starbocks Experience. Many of these customers would check whether the coffee tasted the same as it did abroad and whether the store ambieneo was equally comfortable. If the experiences matched up, they would become regulars. Nevertheless, for sustained success, Starbacks needed to penetrate the domestic young and middleincome markets. Starbecks laid out plans for different formats, such as "abbreviated stores" that would be smaller, and stores at college and school campuses. The stores in India began experimenting with their food mena. While Starbucks globally offered blueberry and chocolate muffins, it wanted to serve local innovations at its Indian locations. Coincidiag with its first anniversary in India, the company launched a new, local India Estates Blend. This blend was Tata Starbucks' special countryspecific coffee, developed thoughtfully with Tata for the Indian market, and it reflected the high qualiny Arabica coffee avaltable in India. The company also launched the Indian Eipresso Roast, which was sourced locally through a coffee sourcing and roasting agreement between Starbacks and Tata. It was felt that the coffoes captured the essence and rich heritage of the Indian coffee history. As already mentioned, to enrich the experience of Indian customers, Starbucks now unveiled a modern tea The challenge facing CEO Dash and Tata Starbucks was a difficult one. How could the company maximize the longterm success of the ventare in India? Doing so would mean going beyond the "westernized and wealthy" targeting that had worked so well in refatively older and more aflituent Asian markets. Former CEO Ghosh had emphasized positioning the company to be socially responsible by promoting worker rights in India, saying. "We are prood to be a progressive workplace in India and will continue to engago in discussions with our partners to determine how to make their experience better and more valuable in line with the mission and values of both Tata Consumer Products Limited and Starbucks. 43 While the partnership with Tata was occasionally helping in negotiating for good real estate, Starbacks still needed to figure out how to leverage the partnership to win over the large young and middleincome demographic segments. Store financials needed to be managed to maintain profitability. All these issues will need to be addressed quickly by Tata Starbecks as the company continues to expand into the next lier of Indian cities. "As they move from hight tratfie and high spend locations, revenues, or productivity of the stores wilt come down. Hence, per store sales might come down over the years once they open stores in smalfer locations," snys Devangsha Dutta, chief executive at the Indian retail consultancy Third Eyesight, 44