Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taussig Technologies Corporation (TTC) has been growing at a rate of 20% per year in recent years. This same growth rate is expected to last

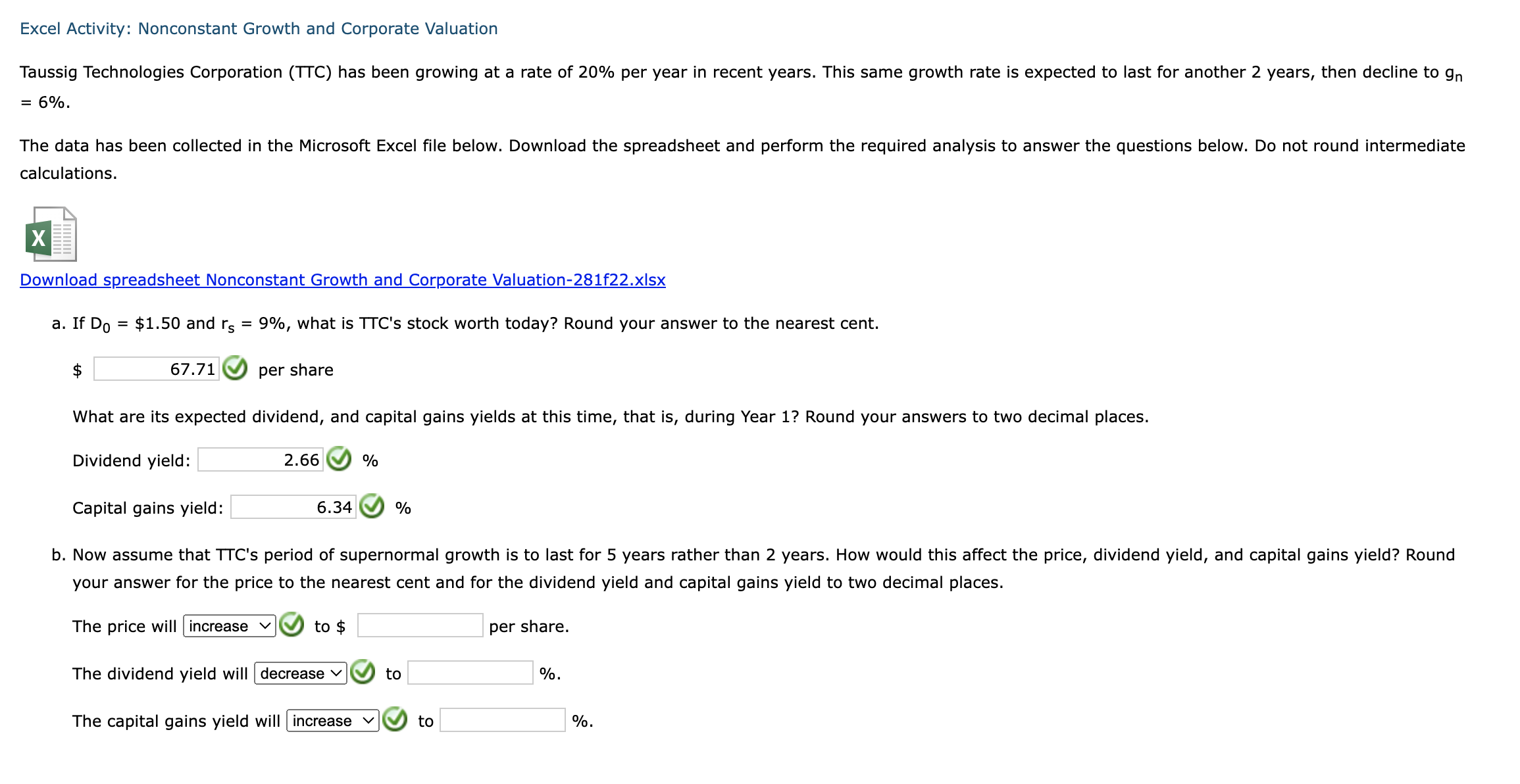

Taussig Technologies Corporation (TTC) has been growing at a rate of 20% per year in recent years. This same growth rate is expected to last for another 2 years, then decline to gn = 6%.

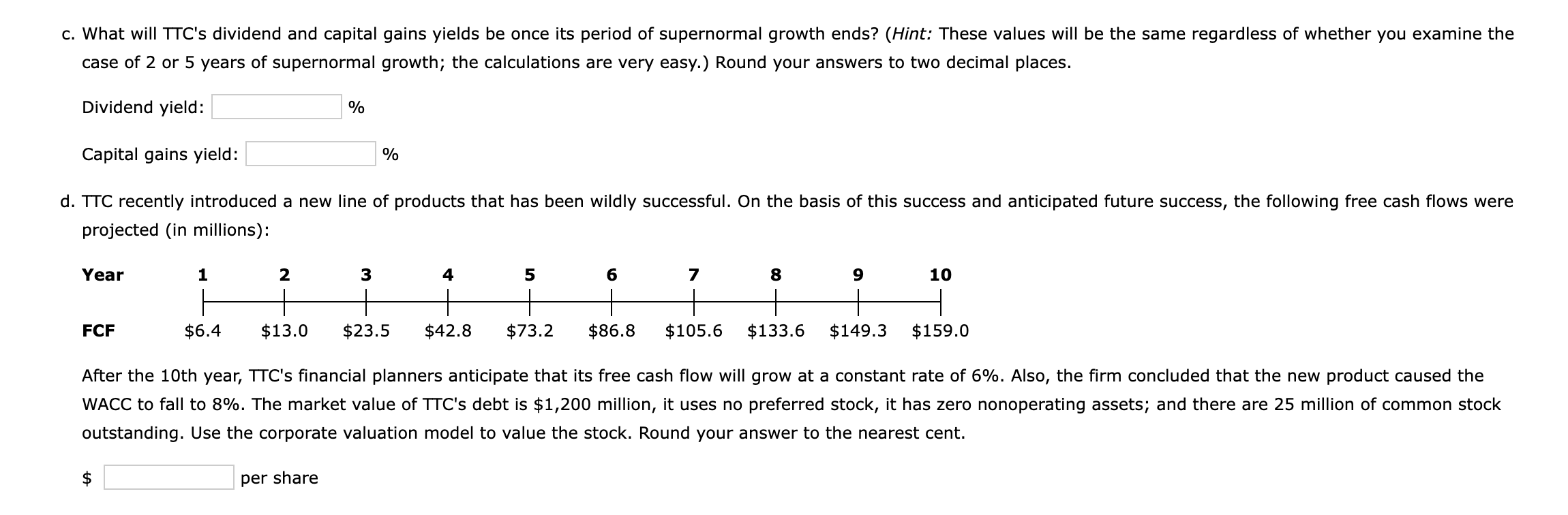

Excel Activity: Nonconstant Growth and Corporate Valuation =6%. calculations. Download spreadsheet Nonconstant Growth and Corporate Valuation-281f22.xlsx a. If D0=$1.50 and rs=9%, what is TTC's stock worth today? Round your answer to the nearest cent. $ per share What are its expected dividend, and capital gains yields at this time, that is, during Year 1 ? Round your answers to two decimal places. Dividend yield: % Capital gains yield: % your answer for the price to the nearest cent and for the dividend yield and capital gains yield to two decimal places. The price will to \$ per share. The dividend yield will to %. The capital gains yield will to %. . What will TTC's dividend and capital gains yields be once its period of supernormal growth ends? (Hint: These values will be the same regardless of whether you examine the case of 2 or 5 years of supernormal growth; the calculations are very easy.) Round your answers to two decimal places. Dividend yield: % Capital gains yield: % . TTC recently introduced a new line of products that has been wildly successful. On the basis of this success and anticipated future success, the following free cash flows were projected (in millions): After the 10th year, TTC's financial planners anticipate that its free cash flow will grow at a constant rate of 6%. Also, the firm concluded that the new product caused the WACC to fall to 8%. The market value of TTC's debt is $1,200 million, it uses no preferred stock, it has zero nonoperating assets; and there are 25 million of common stock outstanding. Use the corporate valuation model to value the stock. Round your answer to the nearest cent. $ per share

Excel Activity: Nonconstant Growth and Corporate Valuation =6%. calculations. Download spreadsheet Nonconstant Growth and Corporate Valuation-281f22.xlsx a. If D0=$1.50 and rs=9%, what is TTC's stock worth today? Round your answer to the nearest cent. $ per share What are its expected dividend, and capital gains yields at this time, that is, during Year 1 ? Round your answers to two decimal places. Dividend yield: % Capital gains yield: % your answer for the price to the nearest cent and for the dividend yield and capital gains yield to two decimal places. The price will to \$ per share. The dividend yield will to %. The capital gains yield will to %. . What will TTC's dividend and capital gains yields be once its period of supernormal growth ends? (Hint: These values will be the same regardless of whether you examine the case of 2 or 5 years of supernormal growth; the calculations are very easy.) Round your answers to two decimal places. Dividend yield: % Capital gains yield: % . TTC recently introduced a new line of products that has been wildly successful. On the basis of this success and anticipated future success, the following free cash flows were projected (in millions): After the 10th year, TTC's financial planners anticipate that its free cash flow will grow at a constant rate of 6%. Also, the firm concluded that the new product caused the WACC to fall to 8%. The market value of TTC's debt is $1,200 million, it uses no preferred stock, it has zero nonoperating assets; and there are 25 million of common stock outstanding. Use the corporate valuation model to value the stock. Round your answer to the nearest cent. $ per share Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started