Answered step by step

Verified Expert Solution

Question

1 Approved Answer

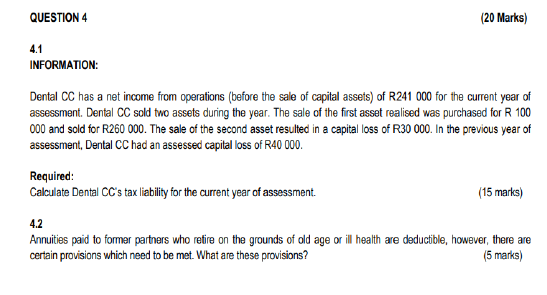

tax 2b INFORMATION: Dental CC has a net income from operations (before the sale of capital assets) of R241 000 for the current year of

tax 2b

INFORMATION: Dental CC has a net income from operations (before the sale of capital assets) of R241 000 for the current year of assessment. Dental CC sold two assets during the year. The sale of the first asset realised was purchased for \\( R 100 \\) 000 and sold for R260 000. The sale of the second asset resulted in a capital loss of R30 000. In the previous year of assessment, Dental CC had an assessed capital loss of R40 000. Required: Calculate Dental CC's tax liability for the current year of assessment. (15 marks) 4.2 Annuities paid to former partners who refire on the grounds of old age or ill health are deductible, however, there are certain provisions which need to be met. What are these provisions

INFORMATION: Dental CC has a net income from operations (before the sale of capital assets) of R241 000 for the current year of assessment. Dental CC sold two assets during the year. The sale of the first asset realised was purchased for \\( R 100 \\) 000 and sold for R260 000. The sale of the second asset resulted in a capital loss of R30 000. In the previous year of assessment, Dental CC had an assessed capital loss of R40 000. Required: Calculate Dental CC's tax liability for the current year of assessment. (15 marks) 4.2 Annuities paid to former partners who refire on the grounds of old age or ill health are deductible, however, there are certain provisions which need to be met. What are these provisions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started