Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tax Analyst Certification Test (2023) Estimated Tax Payments Irene made three federal estimated tax payments of $3,025 each. The payments were made on April

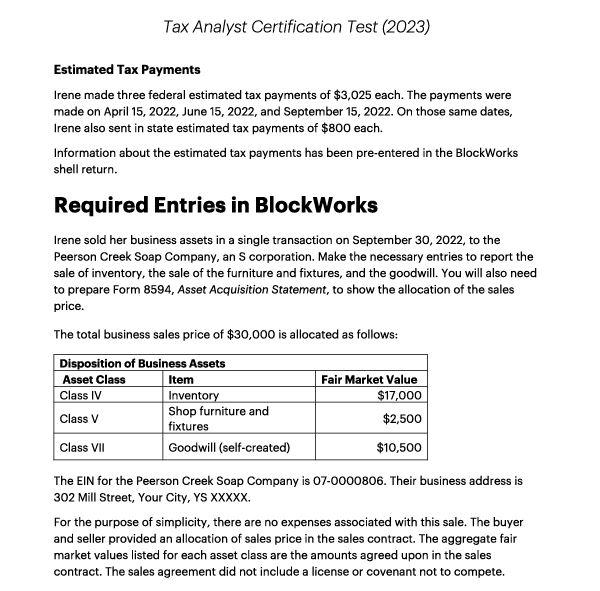

Tax Analyst Certification Test (2023) Estimated Tax Payments Irene made three federal estimated tax payments of $3,025 each. The payments were made on April 15, 2022, June 15, 2022, and September 15, 2022. On those same dates, Irene also sent in state estimated tax payments of $800 each. Information about the estimated tax payments has been pre-entered in the BlockWorks shell return. Required Entries in BlockWorks Irene sold her business assets in a single transaction on September 30, 2022, to the Peerson Creek Soap Company, an S corporation. Make the necessary entries to report the sale of inventory, the sale of the furniture and fixtures, and the goodwill. You will also need to prepare Form 8594, Asset Acquisition Statement, to show the allocation of the sales price. The total business sales price of $30,000 is allocated as follows: Disposition of Business Assets Asset Class Item Fair Market Value Class IV Inventory $17,000 Class V Shop furniture and fixtures $2,500 Class VII Goodwill (self-created) $10,500 The EIN for the Peerson Creek Soap Company is 07-0000806. Their business address is 302 Mill Street, Your City, YS XXXXX. For the purpose of simplicity, there are no expenses associated with this sale. The buyer and seller provided an allocation of sales price in the sales contract. The aggregate fair market values listed for each asset class are the amounts agreed upon in the sales contract. The sales agreement did not include a license or covenant not to compete.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

BlockWorks Entries Sale of Inventory Debit Cash 17000 Credit Inventory 17000 Sale of Furniture and F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dd75b61a37_961736.pdf

180 KBs PDF File

663dd75b61a37_961736.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started