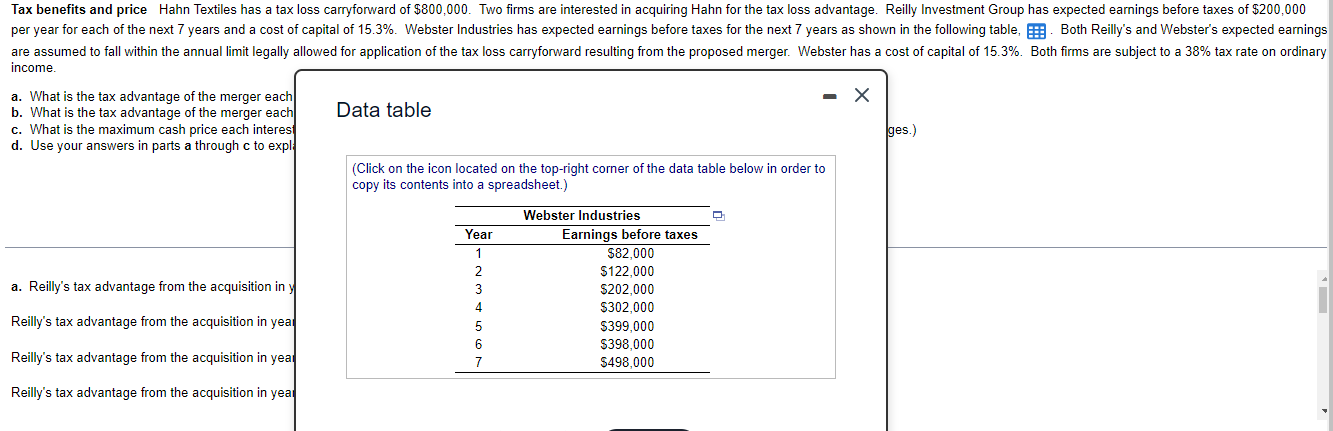

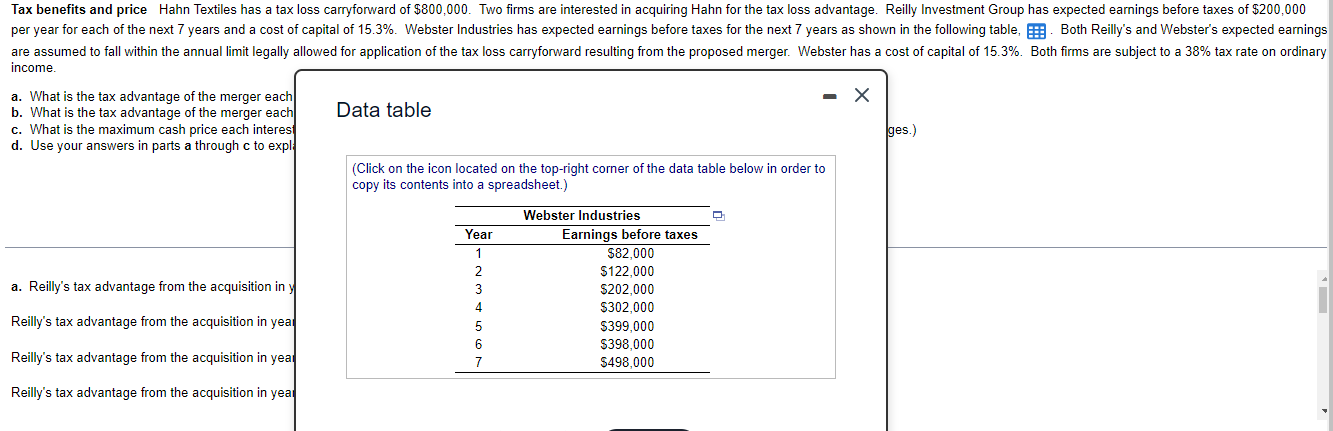

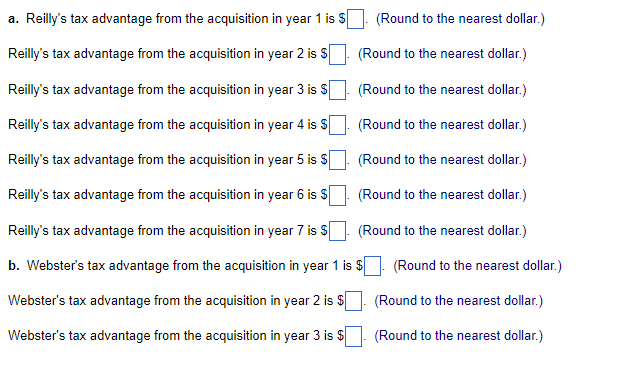

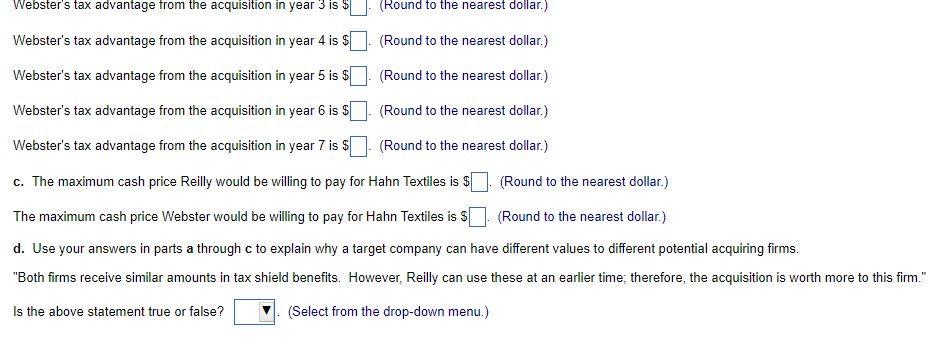

Tax benefits and price Hahn Textiles has a tax loss carryforward of $800,000. Two firms are interested in acquiring Hahn for the tax loss advantage. Reilly Investment Group has expected earnings before taxes of $200,000 per year for each of the next 7 years and a cost of capital of 15.3% Webster Industries has expected earnings before taxes for the next 7 years as shown in the following table, E. Both Reilly's and Webster's expected earnings are assumed to fall within the annual limit legally allowed for application of the tax loss carryforward resulting from the proposed merger. Webster has a cost of capital of 15.3%. Both firms are subject to a 38% tax rate on ordinary income - X Data table a. What is the tax advantage of the merger each b. What is the tax advantage of the merger each c. What is the maximum cash price each interest d. Use your answers in parts a through c to expl ges.) (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Year a. Reilly's tax advantage from the acquisition in 1 2 3 4 Webster Industries Earnings before taxes $82,000 $122.000 S202,000 $302,000 $399.000 $398,000 $498,000 Reilly's tax advantage from the acquisition in year 5 6 7 Reilly's tax advantage from the acquisition in yea Reilly's tax advantage from the acquisition in yea a. Reilly's tax advantage from the acquisition in year 1 is $ (Round to the nearest dollar.) Reilly's tax advantage from the acquisition in year 2 is $ (Round to the nearest dollar.) (Round to the nearest dollar.) Reilly's tax advantage from the acquisition in year 3 is s Reilly's tax advantage from the acquisition in year 4 is s (Round to the nearest dollar.) (Round to the nearest dollar.) Reilly's tax advantage from the acquisition in year 5 is $ Reilly's tax advantage from the acquisition in year 6 is $ (Round to the nearest dollar.) Reilly's tax advantage from the acquisition in year 7 is $ (Round to the nearest dollar.) (Round to the nearest dollar.) b. Webster's tax advantage from the acquisition in year 1 is $ Webster's tax advantage from the acquisition in year 2 is $ (Round to the nearest dollar.) Webster's tax advantage from the acquisition in year 3 is $ (Round to the nearest dollar.) Webster's tax advantage from the acquisition in year 3 is $ (Round to the nearest dollar.) Webster's tax advantage from the acquisition in year 4 is $ (Round to the nearest dollar.) Webster's tax advantage from the acquisition in year 5 is $ (Round to the nearest dollar.) (Round to the nearest dollar.) Webster's tax advantage from the acquisition in year 6 is $ Webster's tax advantage from the acquisition in year 7 is $ (Round to the nearest dollar.) c. The maximum cash price Reilly would be willing to pay for Hahn Textiles is $ (Round to the nearest dollar.) The maximum cash price Webster would be willing to pay for Hahn Textiles is 5 (Round to the nearest dollar.) d. Use your answers in parts a through c to explain why a target company can have different values to different potential acquiring firms. "Both firms receive similar amounts in tax shield benefits. However, Reilly can use these at an earlier time; therefore, the acquisition is worth more to this firm." Is the above statement true or false? (Select from the drop-down menu.)