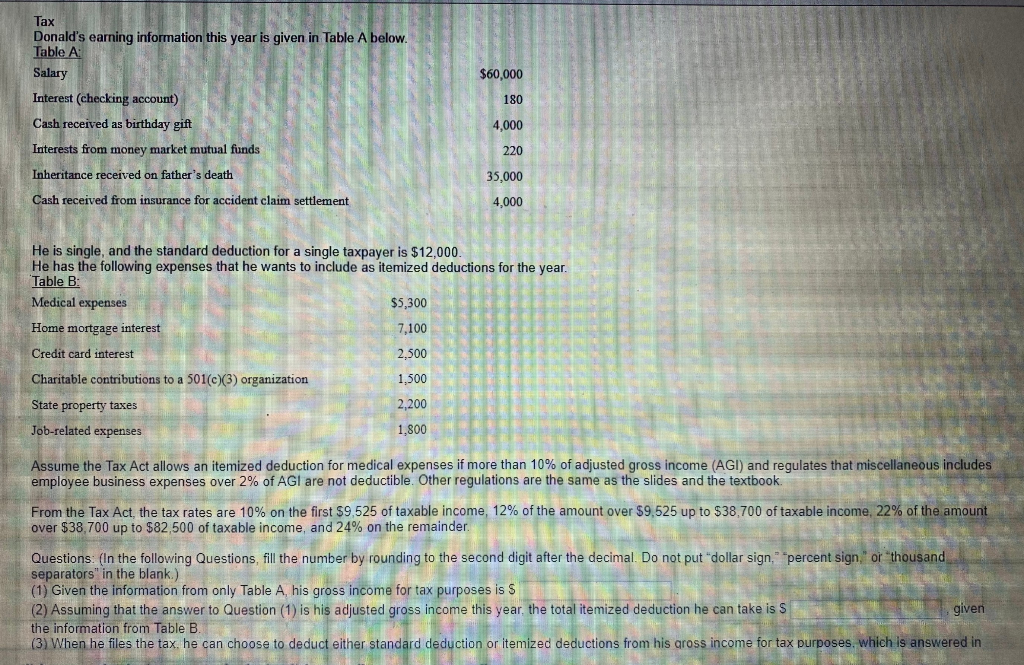

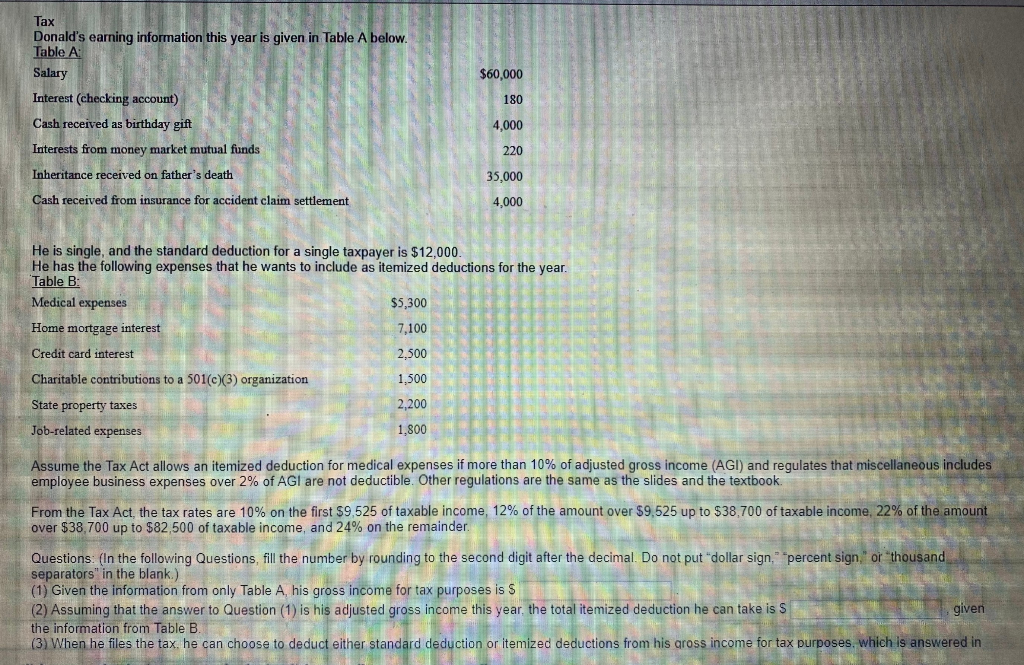

Tax Donald's earning information this year is given in Table A below. Table A Salary $60,000 Interest (checking account) 180 Cash received as birthday gift 4,000 220 Interests from money market mutual funds Inheritance received on father's death Cash received from insurance for accident claim settlement 35,000 4,000 He is single, and the standard deduction for a single taxpayer is $12,000. He has the following expenses that he wants to include as itemized deductions for the year. Table B: Medical expenses $5,300 Home mortgage interest 7,100 Credit card interest 2,500 Charitable contributions to a 501(c)(3) organization 1,500 State property taxes 2,200 Job-related expenses 1,800 Assume the Tax Act allows an itemized deduction for medical expenses if more than 10% of adjusted gross income (AGI) and regulates that miscellaneous includes employee business expenses over 2% of AGI are not deductible Other regulations are the same as the slides and the textbook. From the Tax Act, the tax rates are 10% on the first $9.525 of taxable income, 12% of the amount over $9,525 up to 538,700 of taxable income, 22% of the amount over $38,700 up to $82,500 of taxable income, and 24% on the remainder. Questions: (In the following Questions, fill the number by rounding to the second digit after the decimal. Do not put "dollar sign, percent sign," or "thousand separators" in the blank.) (1) Given the information from only Table A his gross income for tax purposes is s (2) Assuming that the answer to Question (1) is his adjusted gross income this year, the total itemized deduction he can take is S given the information from Table B. (3) When he files the tax, he can choose to deduct either standard deduction or itemized deductions from his gross income for tax purposes, which is answered in Tax Donald's earning information this year is given in Table A below. Table A Salary $60,000 Interest (checking account) 180 Cash received as birthday gift 4,000 220 Interests from money market mutual funds Inheritance received on father's death Cash received from insurance for accident claim settlement 35,000 4,000 He is single, and the standard deduction for a single taxpayer is $12,000. He has the following expenses that he wants to include as itemized deductions for the year. Table B: Medical expenses $5,300 Home mortgage interest 7,100 Credit card interest 2,500 Charitable contributions to a 501(c)(3) organization 1,500 State property taxes 2,200 Job-related expenses 1,800 Assume the Tax Act allows an itemized deduction for medical expenses if more than 10% of adjusted gross income (AGI) and regulates that miscellaneous includes employee business expenses over 2% of AGI are not deductible Other regulations are the same as the slides and the textbook. From the Tax Act, the tax rates are 10% on the first $9.525 of taxable income, 12% of the amount over $9,525 up to 538,700 of taxable income, 22% of the amount over $38,700 up to $82,500 of taxable income, and 24% on the remainder. Questions: (In the following Questions, fill the number by rounding to the second digit after the decimal. Do not put "dollar sign, percent sign," or "thousand separators" in the blank.) (1) Given the information from only Table A his gross income for tax purposes is s (2) Assuming that the answer to Question (1) is his adjusted gross income this year, the total itemized deduction he can take is S given the information from Table B. (3) When he files the tax, he can choose to deduct either standard deduction or itemized deductions from his gross income for tax purposes, which is answered in