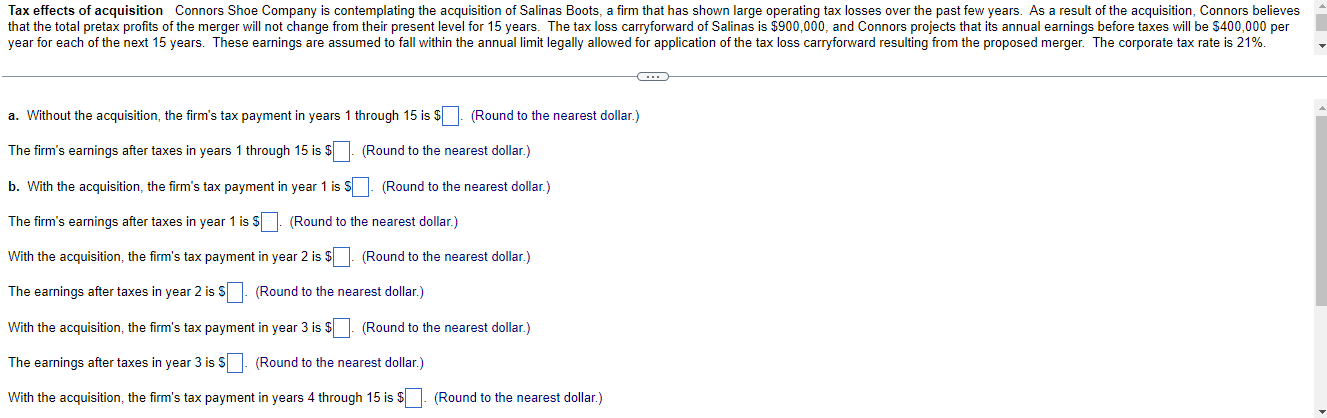

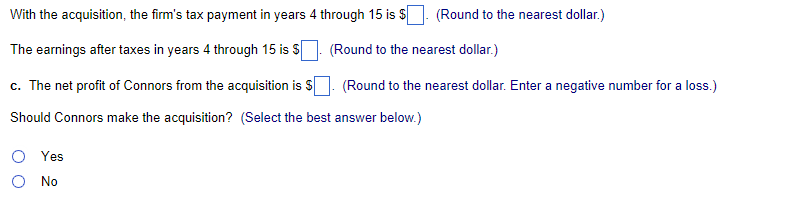

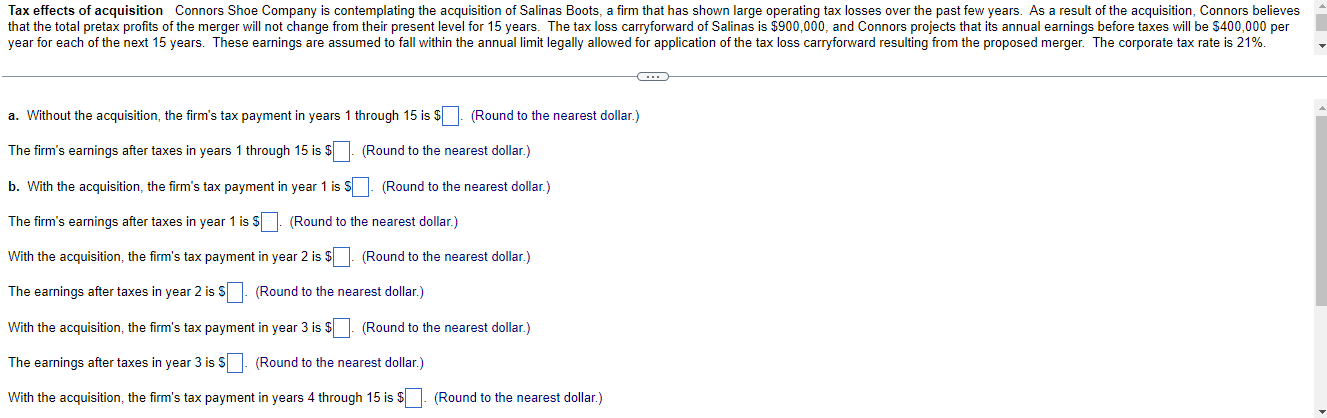

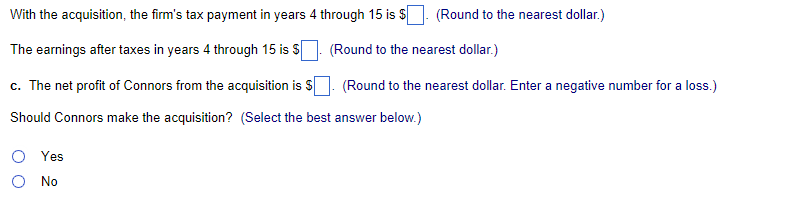

Tax effects of acquisition Connors Shoe Company is contemplating the acquisition of Salinas Boots, a firm that has shown large operating tax losses over the past few years. As a result of the acquisition, Connors believes that the total pretax profits of the merger will not change from their present level for 15 years. The tax loss carryforward of Salinas is $900,000, and Connors projects that its annual earnings before taxes will be $400,000 per year for each of the next 15 years. These earnings are assumed to fall within the annual limit legally allowed for application of the tax loss carryforward resulting from the proposed merger. The corporate tax rate is 21%. a. If Connors does not make the acquisition, what will be the company's tax liability and earnings after taxes each year over the next 15 years? b. If the acquisition is made, what will be the company's tax liability and earnings after taxes each year over the next 15 years? c. If Salinas can be acquired for $193,000 in cash, should Connors make the acquisition, judging on the basis of tax considerations? (Ignore the time value of money.) Tax effects of acquisition Connors Shoe Company is contemplating the acquisition of Salinas Boots, a firm that has shown large operating tax losses over the past few years. As a result of the acquisition, Connors believes that the total pretax profits of the merger will not change from their present level for 15 years. The tax loss carryforward of Salinas is $900,000, and Connors projects that its annual earnings before taxes will be $400,000 per year for each of the next 15 years. These earnings are assumed to fall within the annual limit legally allowed for application of the tax loss carryforward resulting from the proposed merger. The corporate tax rate is 21%. a. Without the acquisition, the firm's tax payment in years 1 through 15 is $. (Round to the nearest dollar.) The firm's earnings after taxes in years 1 through 15 is $ (Round to the nearest dollar.) b. With the acquisition, the firm's tax payment in year 1 is S (Round to the nearest dollar.) The firm's earnings after taxes in year 1 is $. (Round to the nearest dollar.) With the acquisition, the firm's tax payment in year 2 is $. (Round to the nearest dollar.) The earnings after taxes in year 2 is $. (Round to the nearest dollar.) With the acquisition, the firm's tax payment in year 3 is $. (Round to the nearest dollar.) The earnings after taxes in year 3 is $. (Round to the nearest dollar.) With the acquisition, the firm's tax payment in years 4 through 15 is $. (Round to the nearest dollar.) With the acquisition, the firm's tax payment in years 4 through 15 is $ (Round to the nearest dollar.) The earnings after taxes in years 4 through 15 is $ (Round to the nearest dollar.) c. The net profit of Connors from the acquisition is s (Round to the nearest dollar. Enter a negative number for a loss.) Should Connors make the acquisition? (Select the best answer below.) Yes