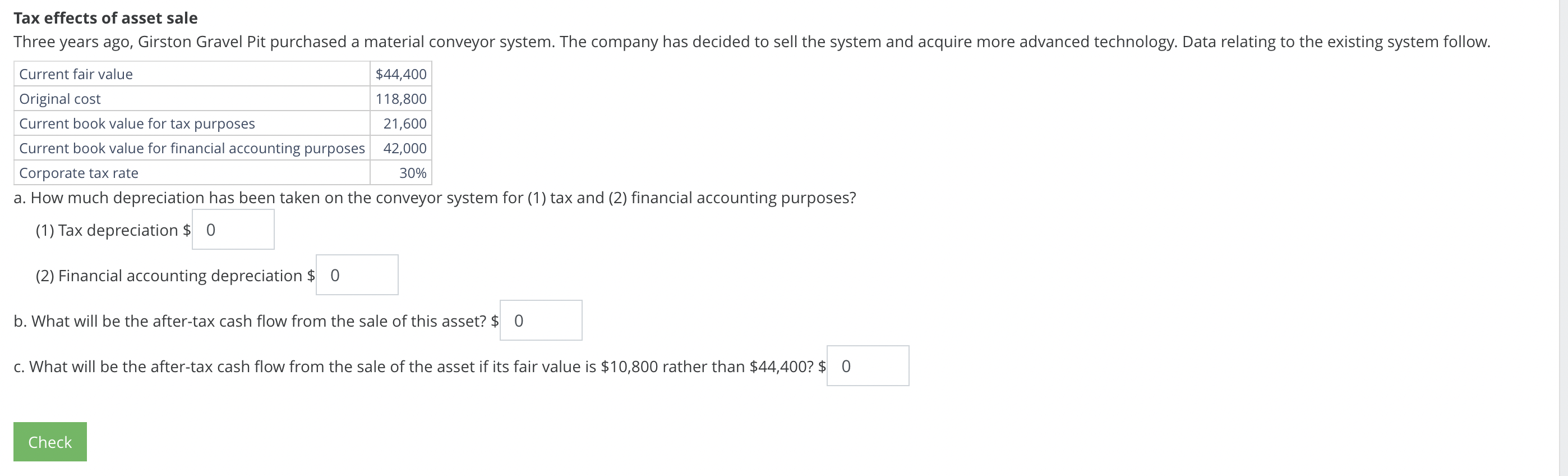

Tax effects of asset sale Three years ago, Girston Gravel Pit purchased a material conveyor system. The company has decided to sell the system

Tax effects of asset sale Three years ago, Girston Gravel Pit purchased a material conveyor system. The company has decided to sell the system and acquire more advanced technology. Data relating to the existing system follow. Current fair value Original cost Current book value for tax purposes $44,400 118,800 21,600 Current book value for financial accounting purposes 42,000 30% Corporate tax rate a. How much depreciation has been taken on the conveyor system for (1) tax and (2) financial accounting purposes? (1) Tax depreciation $ 0 (2) Financial accounting depreciation $ 0 b. What will be the after-tax cash flow from the sale of this asset? $ 0 c. What will be the after-tax cash flow from the sale of the asset if its fair value is $10,800 rather than $44,400? $ 0 Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainlylets analyze the tax effects of the asset sale based on the image you provided a Depreciation 1 Tax Depreciation 0 2 Financial Accounting Depreciation 0 b AfterTax Cash Flow from Sale 0 c Aft...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started