Answered step by step

Verified Expert Solution

Question

1 Approved Answer

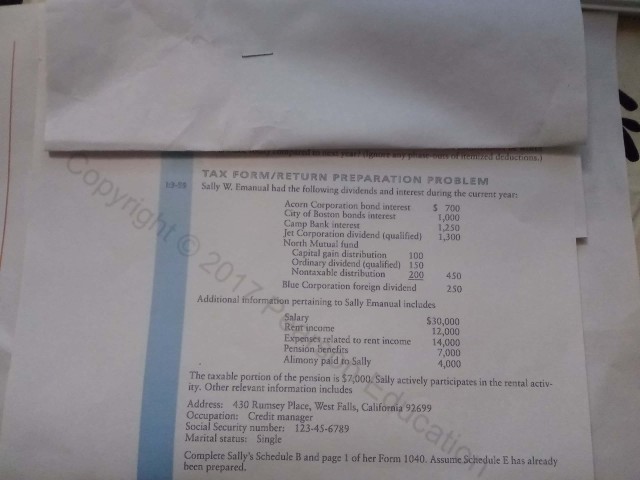

TAX FORM/RETURN PREPARATION PROBLEM Sally W. Emanual had the following dividends and interest during the current year Acorn Corporation bond interest City of Boston bonds

TAX FORM/RETURN PREPARATION PROBLEM Sally W. Emanual had the following dividends and interest during the current year Acorn Corporation bond interest City of Boston bonds interest Camp Bank interest let Corporation dividend (qualified) North Mutual fund $ 700 1,000 1,250 1,300 Capital gain distribution 100 150 Ordinary dividend (qualified) Nontaxable distribution 20 450 Blue Corporation foreign dividend250 Additional information pertaining to Sally Emanual inclades Salary Rent income Expenses related to rent income Pensin bencfirs $30,000 12,000 14,000 7,000 4,000 Alimony pad to Sally The taxable portion of the pension is $7,000. Sally actively participates in the rental activ- ity. Other relevant information includes Address: 430 Rumsey Place, West Falls, Califoraia 9269 Occupation: Credit manager Social Security number: 123-45-6789 Marital status: Single Complere Sally's Schedule B and page 1 of her Form 1040. Assume Schedule E has already been prepared. TAX FORM/RETURN PREPARATION PROBLEM Sally W. Emanual had the following dividends and interest during the current year Acorn Corporation bond interest City of Boston bonds interest Camp Bank interest let Corporation dividend (qualified) North Mutual fund $ 700 1,000 1,250 1,300 Capital gain distribution 100 150 Ordinary dividend (qualified) Nontaxable distribution 20 450 Blue Corporation foreign dividend250 Additional information pertaining to Sally Emanual inclades Salary Rent income Expenses related to rent income Pensin bencfirs $30,000 12,000 14,000 7,000 4,000 Alimony pad to Sally The taxable portion of the pension is $7,000. Sally actively participates in the rental activ- ity. Other relevant information includes Address: 430 Rumsey Place, West Falls, Califoraia 9269 Occupation: Credit manager Social Security number: 123-45-6789 Marital status: Single Complere Sally's Schedule B and page 1 of her Form 1040. Assume Schedule E has already been prepared

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started