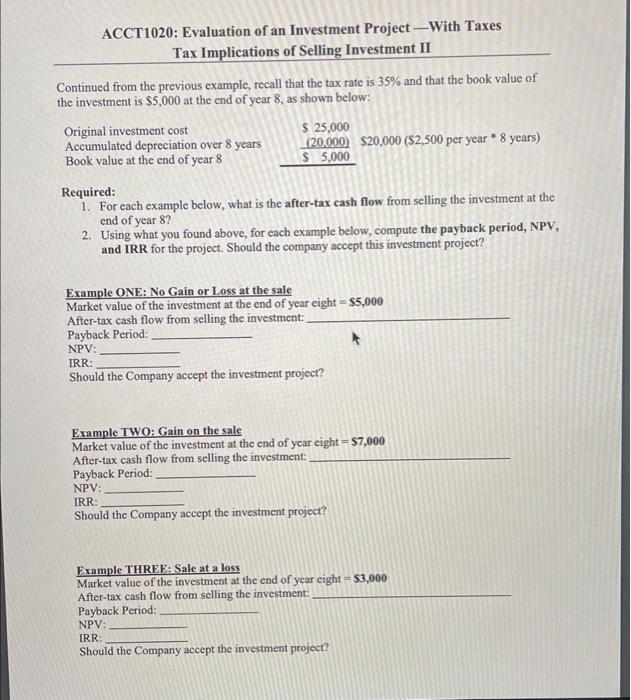

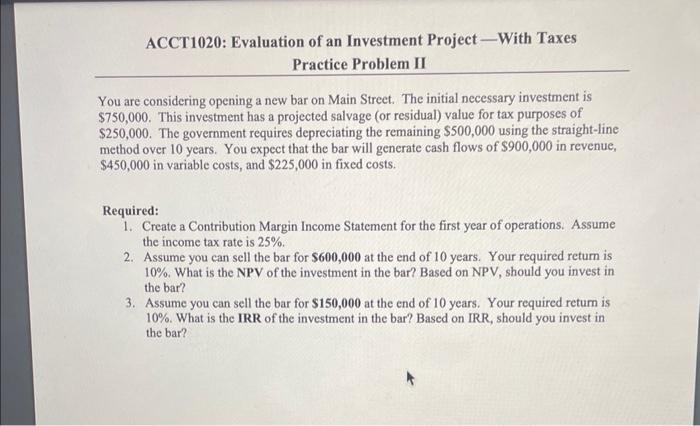

Tax Implications of Selling Investment II Continued from the previous example, recall that the tax rate is 35% and that the book value of the investment is $5,000 at the end of year 8 , as shown below: Required: 1. For each example below, what is the after-tax cash flow from selling the investment at the end of year 8 ? 2. Using what you found above, for each example below, compute the payback period, NPV, and IRR for the project. Should the company accept this investment project? Example ONE: No Gain or Loss at the sale Market value of the investment at the end of year eight =$5,000 After-tax cash flow from selling the investment: Payback Period: NPV: IRR: Should the Company accept the investment project? Example TWO: Gain on the sale Market value of the investment at the end of year eight =57,000 After-tax cash flow from selling the investment: Payback Period: NPV: IRR: Should the Company accept the investment project? Example THREE: Sale at a loss Market value of the investment at the end of year eight =$3,000 After-tax cash flow from selling the investment: Payback Period: NPV: IRR: Should the Company accept the investment project? You are considering opening a new bar on Main Street. The initial necessary investment is $750,000. This investment has a projected salvage (or residual) value for tax purposes of $250,000. The government requires depreciating the remaining $500,000 using the straight-line method over 10 years. You expect that the bar will generate cash flows of $900,000 in revenue, $450,000 in variable costs, and $225,000 in fixed costs. Required: 1. Create a Contribution Margin Income Statement for the first year of operations. Assume the income tax rate is 25%. 2. Assume you can sell the bar for $600,000 at the end of 10 years. Your required return is 10%. What is the NPV of the investment in the bar? Based on NPV, should you invest in the bar? 3. Assume you can sell the bar for $150,000 at the end of 10 years. Your required return is 10%. What is the IRR of the investment in the bar? Based on IRR, should you invest in the bar