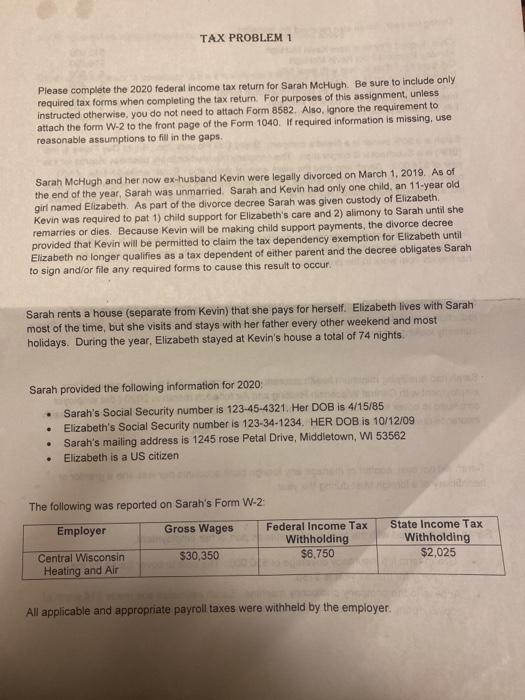

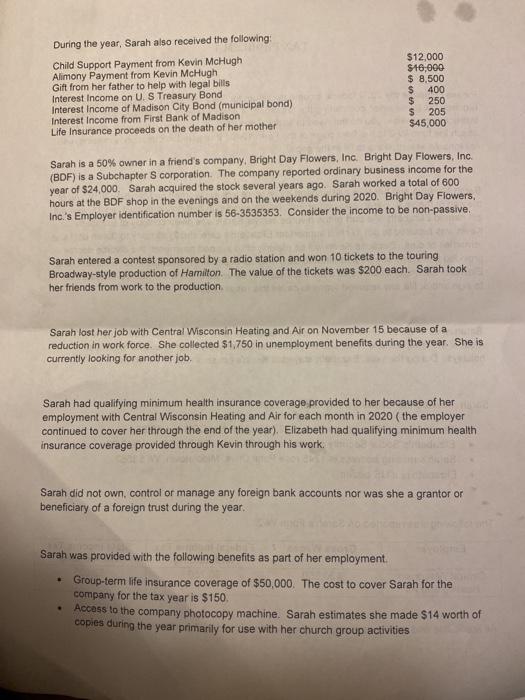

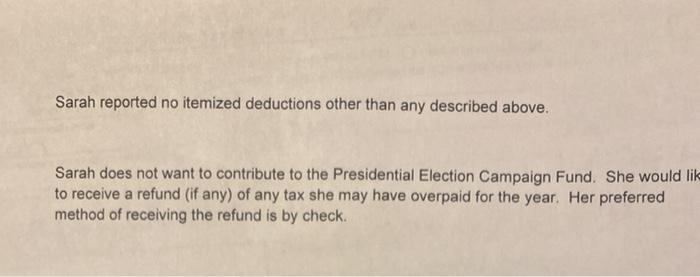

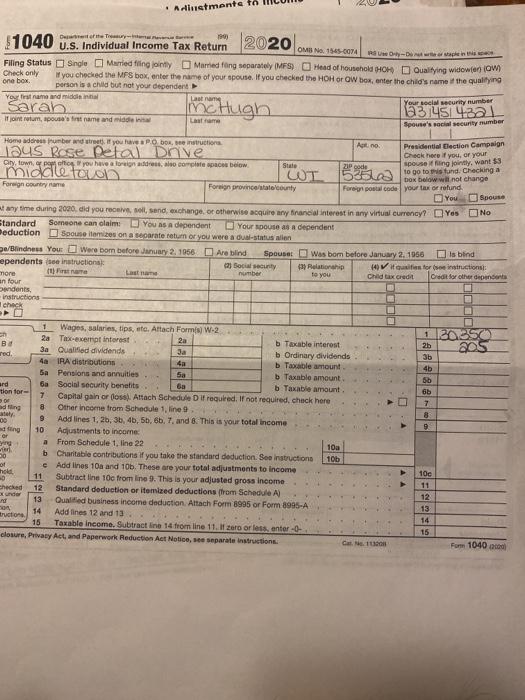

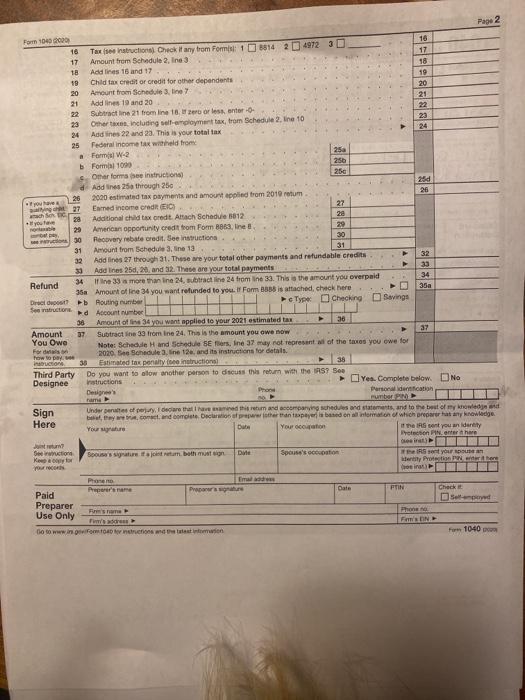

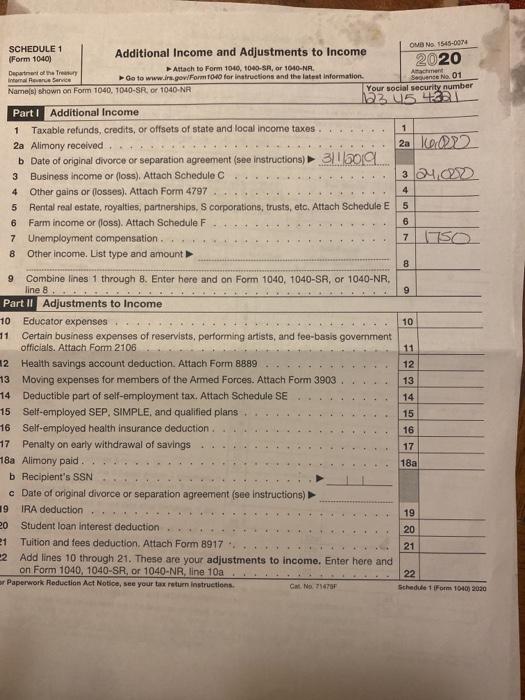

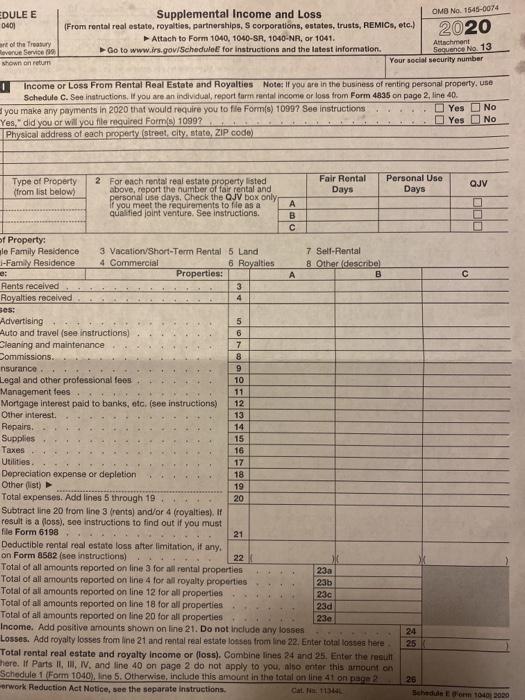

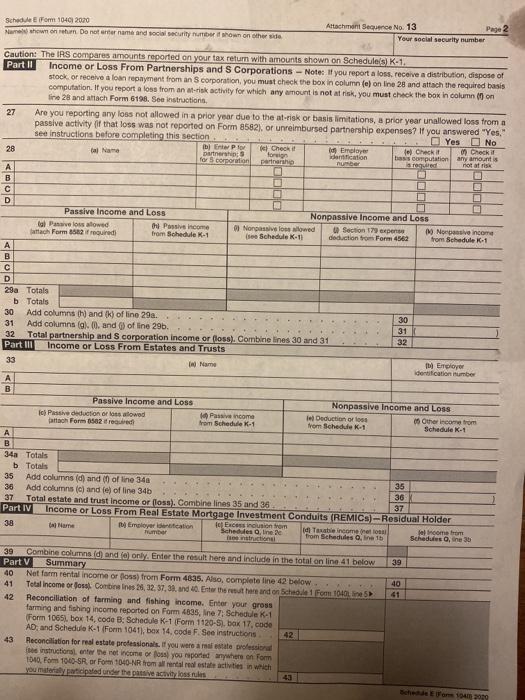

TAX PROBLEM 1 Please complete the 2020 federal income tax return for Sarah McHugh Be sure to include only required tax forms when completing the tax return. For purposes of this assignment, unless instructed otherwise, you do not need to attach Form 8582. Also, ignore the requirement to attach the form W-2 to the front page of the Form 1040. If required information is missing, use reasonable assumptions to fill in the gaps. Sarah McHugh and her now ex-husband Kevin were legally divorced on March 1, 2019. As of the end of the year, Sarah was unmarried. Sarah and Kevin had only one child, an 11-year old girl named Elizabeth. As part of the divorce decree Sarah was given custody of Elizabeth Kevin was required to pat 1) child support for Elizabeth's care and 2) alimony to Sarah until she remarries or dies. Because Kevin will be making child support payments, the divorce decree provided that Kevin will be permitted to claim the tax dependency exemption for Elizabeth until Elizabeth no longer qualifies as a tax dependent of either parent and the decree obligates Sarah to sign and/or file any required forms to cause this result to occur Sarah rents a house (separate from Kevin) that she pays for herself. Elizabeth lives with Sarah most of the time, but she visits and stays with her father every other weekend and most holidays. During the year, Elizabeth stayed at Kevin's house a total of 74 nights. Sarah provided the following information for 2020 Sarah's Social Security number is 123-45-4321. Her DOB is 4/15/85 Elizabeth's Social Security number is 123-34-1234. HER DOB is 10/12/09 Sarah's mailing address is 1245 rose Petal Drive, Middletown, WI 53562 Elizabeth is a US citizen . The following was reported on Sarah's Form W-2 Employer Gross Wages Federal Income Tax Withholding $6.750 State Income Tax Withholding $2,025 $30,350 Central Wisconsin Heating and Air All applicable and appropriate payroll taxes were withheld by the employer. During the year, Sarah also received the following: Child Support Payment from Kevin McHugh Alimony Payment from Kevin McHugh Gift from her father to help with legal bills Interest Income on US Treasury Bond Interest Income of Madison City Bond (municipal bond) Interest Income from First Bank of Madison Life Insurance proceeds on the death of her mother $12,000 $16,000 $ 8,500 $ 400 $ 250 $ 205 $45,000 Sarah is a 50% owner in a friend's company, Bright Day Flowers, Inc. Bright Day Flowers, Inc. (BDF) is a Subchapters corporation. The company reported ordinary business income for the year of $24,000. Sarah acquired the stock several years ago. Sarah worked a total of 600 hours at the BDF shop in the evenings and on the weekends during 2020. Bright Day Flowers, Inc.'s Employer identification number is 56-3535353. Consider the income to be non-passive, Sarah entered a contest sponsored by a radio station and won 10 tickets to the touring Broadway-style production of Hamilton. The value of the tickets was $200 each. Sarah took her friends from work to the production Sarah lost her job with Central Wisconsin Heating and Air on November 15 because of a reduction in work force. She collected $1.750 in unemployment benefits during the year. She is currently looking for another job. Sarah had qualifying minimum health insurance coverage provided to her because of her employment with Central Wisconsin Heating and Air for each month in 2020 (the employer continued to cover her through the end of the year). Elizabeth had qualifying minimum health insurance coverage provided through Kevin through his work. Sarah did not own, control or manage any foreign bank accounts nor was she a grantor or beneficiary of a foreign trust during the year. Sarah was provided with the following benefits as part of her employment Group-term life insurance coverage of $50,000. The cost to cover Sarah for the company for the tax year is $150 Access to the company photocopy machine. Sarah estimates she made $14 worth of copies during the year primarily for use with her church group activities Sarah reported no itemized deductions other than any described above. Sarah does not want to contribute to the Presidential Election Campaign Fund. She would like to receive a refund (if any) of any tax she may have overpaid for the year. Her preferred method of receiving the refund is by check. A Alustments to $1040 U.S. Individual Income Tax Return 2020 OMB No 1545-6074 In hey-haplin Filing Status Single Married fling jointly Married fing separately (MFS) Head of household How Qualifying widowienia Check only you checked the MFS box, enter the name of your spouse. If you checked the HOH or GW box, enter the child's name if the qualifying one box person is a child but not your dependent You first name and midt Last name Your security number Saran la314514aal Ifjot rotum, spouse's rename and middle Spouse's social security number McHugh laus Rose petal Drive middleton No Home addressumber and streets. If you have a PO box, intruction Agit no. Presidential Election Campaign Check here if you, or your City, town, pomote you have a loreign dos ao compiute ac below State ZIP code spouseling jointly, want CT 500 to go to this tund. Checking a box below will not change Foreign country name Foreign provincesto county Foreign postal code your tax or refund You Spouse any time during 2020. did you receive, sell, and exchange or otherwise acquire any financial interest in any virtual currency? Yes Standard Someone can claim: You as a dependent Your DOUBO as a dependent Deduction sous item.ou on a separate return or you were a dual status allen pe/Blindness You Were bom before January 2, 1956. Are blind Spouse was bom before January 2.1956 Dis blind ependents se instruction social security 4) Relationship 14) Vis for structions: more (1) First number to you Child tax credit Credit for other dependent en four bendents, instructions check 120350 205 2b 36 4b ob Gb 7 8 9 1 Wages, salaries, tips, etc. Altach Formis) W-2 28 Tix-exempt interest 2a Ba bTaxable interest 3a Qualified dividends Ja red b Ordinary dividends 4a IFA distributions 4a b Taxable amount 5a Pensions and annuities 5a Taxable amount ard 6a Social security benefits Sa b Taxable amount tion for 7 Capital gain or oss. Attach Schedule if required. If not required. chuck here ading 8 Other income from Schedule 1. line 9 Add lines 1, 2, 3, 4, 5, 6, 7 and 8. This is your total income 10 Adjustments to incorne or From Schedule 1. line 22 10a 30 b Charitable contributions if you take the standard deduction. See Instructions 10b of c Add lines 10a and 10b. These are your total adjustments to Income hold 11 Subtract line 10c from line 9. This is your adjusted gross income checked 12 Standard deduction or itemized deductions from Schedule A 13 Qualified business income deduction. Attach Form 8995 or Form 8995-A 14 Add lines 12 and 13 truction 15 Taxable income. Subtract line 14 from line 11. 1200 or less enter-O- closur. Privacy Act, and Paperwork Reduction Act Notice, se separate instructions Cat 10 10 AA 11 12 13 14 15 Form 1040 Page 2 Form 14000 18 16 Tax Instructions. Check it any trom Form: 8814 24972 3 17 17 Amount from Schedule 2. Ine 3 18 18 Add lines 15 and 17 19 19 Child tax credit or credit for other dependents 20 20 Amount from Schedule 3. line 7 21 21 Add lines 19 and 20 22 22 Subtractie 21 from line 18, 2 or less anter 23 23 Other tecluding logamatta, trom Schedule 2 line 10 24 244 Add lines 22 and 23. This is your total tax Federal income tax wired from Forms 250 Forma 1090 2:56 Other forma e instructions 250 250 Addnes 25 through 250 26 2000 estimated tax payments and amount applied from 2010 rotum - you have 27 Emned income Cred EC 27 chic 28 Additional child tax redt. Altach Schedule 5612 you 29 American opportunity credit from Form , tine 29 Recovery rebate credit. See instructions 30 31 Amount from Schedule 3 line 13 31 32 And in 27 through 21. These are your total other payments and refundable credits 32 30 Addnes 250, 20, and 32. These are your total payments 33 34 34 If line 33 more than in 24 Subtract line 24 from ne 33. This is the amount you overpaid Refund 35a Amount of line 34 you want refunded to you. If Form 383 is attached, check here 350 Drupal Routing number e Type Checking Savings Second Account number 38 Amount of 34 you want applied to your 2021 estimated tax 36 Amount 37 Subtractine 33 from Ine 24. This is the amount you owe now a7 You Owe Notes Schedule and schedule Seers, Ine 37 may not represent of the taxes you owe for Ford How to pay 2020. Besohedule 3 line 12, and its instructions for details insun Estimated tax penalty Constructions 38 Third Party Do you want to low another person to dous this reburn with the RSS Designee Instructions Yes. Complete below. No Designs Pro Personal dentication PAN Sign Undergrof jy, declare that were and accompanying schedules and statements, and to the best of my knowledge Here y come and complete. Dari poterantopered on mor of which prowany knowledge Your up Dube Your coton I hent you an idarity y-len A v hn e) Section Spouse's signature for both to De Rewoo Spouse's con RS OF der Prother Groen Em Paid Peper's name Properties PTIN Check Preparer Use Only Phone Tum' FAN 000 win omistamin for 1040 11 4 9 SCHEDULE 1 OMB NS 1545-0074 (Form 1040) Additional Income and Adjustments to Income 2020 Departmental e Tre Attach to Form 1040, 040-SR, or 1010-NR. Aachent Internal Reservice Go to www.irs.gov/ Form100 for instructions and the latest information Sande No 01 Names) shown on Form 1040 1040-SR or 1040-NR Your social security number 122 15 221 Parti Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 1 2a Alimony received .. 2a 102 b Date of original divorce or separation agreement (see instructions) 31100 3 Business income or loss), Attach Schedule C 3 24.0 4 Other gains or losses). Attach Form 4797 5 Rental real estate, royalties, partnerships. S corporations, trusts, etc. Attach Schedule E 5 6 Farm income or loss). Attach Schedule F 6 7 Unemployment compensation 7 SO 8 Other income. List type and amount 8 9 Combine lines 1 through 8. Enter here and on Form 1040, 1040-SR, or 1040-NR. line 8 Part II Adjustments to Income 10 Educator expenses. 10 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 11 12 Health savings account deduction. Attach Form 8889 12 13 Moving expenses for members of the Armed Forces. Attach Form 3903 13 14 Deductible part of self-employment tax. Attach Schedule SE 14 15 Self-employed SEP. SIMPLE, and qualified plans 15 16 Self-employed health insurance deduction. 16 17 Penalty on early withdrawal of savings 17 48a Alimony paid. 18a b Recipient's SSN c Date of original divorce or separation agreement (see Instructions) 19 IRA deduction 19 20 Student loan interest deduction 20 21 Tuition and fees deduction. Attach Form 8917 21 2 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040, 040-SR, or 1040-NR, line 10a 22 or Paperwork Reduction Act Notice, see your tax return instructions Cat No. 71670F Schedule 1 Form 1040) 2020 EDULE E Supplemental Income and Loss OMB No 1545-0074 0401 From rontal real estate, royalties, partnerships, Scorporations, estates, trusts, REMIOs, etc.) 2020 Attach to Form 1040, 040-SR. 1040-NR, or 1041. ant of the Treasury evenue Service Go to www.irs.gov/Schedule for instructions and the latest information, Attachment Seouence No. 13 shown on returns Your social security number Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use Schedule C. See instructions. If you are an individual, report farm rental income or loss trom Form 4835 on page 2, line 40 you make any payments in 2020 that would require you to file Formis) 1099? See instructions Yes No Yes," did you or will you file required Forms) 1099? Yes No Physical address of each property (street city, stato, ZIP code) Type of Property (from list below) Fair Rental Days Personal Use Days QJV 2 For each rental real estate property listed above, report the number of fair rental and personal use days. Check the QJV box only If you meet the requirements to file as a qualified joint venture. See instructions. B BG of Property ale Family Residence 3 Vacation Short-Term Rental 5 Land 7 Self-Rental |-Family Residence 4 Commercial 6 Royalties 8 Other (describe e: Properties: A B Rents received 3 Royalties received 4 ses Advertising 5 Auto and travel (see instructions) 6 Cleaning and maintenance 7 Commissions. 8 Insurance 9 Legal and other professional fees 10 Management fees 11 Mortgage interest paid to banks, etc. (see instructions) 12 Other interest. 13 Repairs 14 Supplies 15 Taxes 16 Utilities 17 Depreciation expense or depletion 18 Other (list) 19 Total expenses. Add lines 5 through 19 20 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (los), see instructions to find out if you must file Form 6198 21 Deductible rental real estate loss after limitation, if any. on Form 8562 (see instructions) 22 Total of all amounts reported on line 3 for all rental properties 23a Total of all amounts reported on line 4 for all royalty properties 23b Total of all amounts reported on line 12 for all properties 23c Total of all amounts reported on line 18 for all properties 23a Total of all amounts reported on line 20 for all properties 23e Income. Add positive amounts shown on line 21. Do not include any losses Losses. Add royalty losses from line 21 and rental real estate lossen from line 22. Enter total loses here Total rental real estate and royalty Income or loss). Combine lines 24 and 25. Enter the result here. If Parts II, I, I, and line 40 on page 2 do not apply to you, alto enter this amount on Schedule 1 Form 1040), line 5. Otherwise, include this amount in the total on line 41 on page 2 orwork Reduction Act Notice, see the separate instructions. Cal 11544 24 25 26 Behedule E10402020 Schedule E Form 10401 2020 Mama shown on Do not enter name and social security number own on other side Attachment Sequence No. 13 Page 2 Your social security number Motal Caution: The IRS compares amounts reported on your tax return with amounts shown on Schedules, K.1. Part II Income or Loss From Partnerships and S Corporations - Notes If you report a fons receive a distribution, dispose of stock or receive a loan repayment from an corporation, you must check the box incolumn (e) on line 28 and attach the required basis computation. If you report a fons from an at-risk activity for which any amount is not at risk, you must check the box in column on line 28 and attach Form 6198. See instructions 27 Are you reporting any loss not allowed in a prior year due to the at-risk of basis limitations, a prior year unallowed loss from a passive activity of that loss was not reported on Form 8582), or unreimbursed partnership expenses? If you answered "Yes, see instructions before completing this section Yes No EP e Check 28 taj Name Id Employer to Check m Check it Dartnerships foreign action for corporation bass computationary amount is partnership number required A B D Passive Income and Loss Nonpassive Income and Loss tal Pavellowed thi Passive income Norpassive low wowed Section 179 expens Nosive income attach Form 582 ruired from Schedule K-1 see Schedule K-11 deduction to Form 4562 from Schedule 1-1 A B C D 29a Totals bTotals 30 Add columns th) and () of line 29a. 30 31 Add columns (gl. 00. and () of line 29b. 31 32 Total partnership and S corporation income or loss). Combine lines 30 and 31 32 Part III Income or Loss From Estates and Trusts 33 w Name Identification number A B Passive Income and Loss Nonpassive Income and Loss Ich Passive deduction of allowed Passive income Deduction or loss atoh Form 502 reed from Schedule - 1 Other income from from Schedule K-1 Schedule K-1 A B 34a Totals bTotals 35 Add columns (d) and (of line 34 35 36 Add columns (c) and (e) of line 34 36 37 Total estate and trust income or loss). Combine lines 35 and 36 37 Part IV Income or Loss From Real Estate Mortgage Investment Conduits (REMICS) -Residual Holder 38 Gal Name Employer cation Esiosionom Schedules, line Id Taxable income nelloni umber el come from from Schedules in 1b Schedules, ne 30 39 40 41 39 Combine columns Id and forly. Enter the result here and include in the total on line 41 below Part V Summary 40 Net form rental income or goss) from Form 4835. Also, complete line 42 below 41 Total income of fossi Combines 1, 32, 37, 38, and 40. Enter the share andon Schoom 1042. Ines 42 Reconciliation of farming and fishing income. Enter you gross farming and fishing income reported on Form 4835, Ine 7: Schedule K-1 (Form 10651, box 14 code 3: Schedule K-1 (Form 1120-5, box 17.code AD, and Schedule K-1 Form 1041) box 14 code F. See Instructions 42 43 Reconciliation for real estate professionals. If you were estate profession instructions entre net income of you reported anywhere on for 1640, Form 1000-SR or Form 1040-NR from all rental real estate activities in which you midated under the pative actions DE102019 TAX PROBLEM 1 Please complete the 2020 federal income tax return for Sarah McHugh Be sure to include only required tax forms when completing the tax return. For purposes of this assignment, unless instructed otherwise, you do not need to attach Form 8582. Also, ignore the requirement to attach the form W-2 to the front page of the Form 1040. If required information is missing, use reasonable assumptions to fill in the gaps. Sarah McHugh and her now ex-husband Kevin were legally divorced on March 1, 2019. As of the end of the year, Sarah was unmarried. Sarah and Kevin had only one child, an 11-year old girl named Elizabeth. As part of the divorce decree Sarah was given custody of Elizabeth Kevin was required to pat 1) child support for Elizabeth's care and 2) alimony to Sarah until she remarries or dies. Because Kevin will be making child support payments, the divorce decree provided that Kevin will be permitted to claim the tax dependency exemption for Elizabeth until Elizabeth no longer qualifies as a tax dependent of either parent and the decree obligates Sarah to sign and/or file any required forms to cause this result to occur Sarah rents a house (separate from Kevin) that she pays for herself. Elizabeth lives with Sarah most of the time, but she visits and stays with her father every other weekend and most holidays. During the year, Elizabeth stayed at Kevin's house a total of 74 nights. Sarah provided the following information for 2020 Sarah's Social Security number is 123-45-4321. Her DOB is 4/15/85 Elizabeth's Social Security number is 123-34-1234. HER DOB is 10/12/09 Sarah's mailing address is 1245 rose Petal Drive, Middletown, WI 53562 Elizabeth is a US citizen . The following was reported on Sarah's Form W-2 Employer Gross Wages Federal Income Tax Withholding $6.750 State Income Tax Withholding $2,025 $30,350 Central Wisconsin Heating and Air All applicable and appropriate payroll taxes were withheld by the employer. During the year, Sarah also received the following: Child Support Payment from Kevin McHugh Alimony Payment from Kevin McHugh Gift from her father to help with legal bills Interest Income on US Treasury Bond Interest Income of Madison City Bond (municipal bond) Interest Income from First Bank of Madison Life Insurance proceeds on the death of her mother $12,000 $16,000 $ 8,500 $ 400 $ 250 $ 205 $45,000 Sarah is a 50% owner in a friend's company, Bright Day Flowers, Inc. Bright Day Flowers, Inc. (BDF) is a Subchapters corporation. The company reported ordinary business income for the year of $24,000. Sarah acquired the stock several years ago. Sarah worked a total of 600 hours at the BDF shop in the evenings and on the weekends during 2020. Bright Day Flowers, Inc.'s Employer identification number is 56-3535353. Consider the income to be non-passive, Sarah entered a contest sponsored by a radio station and won 10 tickets to the touring Broadway-style production of Hamilton. The value of the tickets was $200 each. Sarah took her friends from work to the production Sarah lost her job with Central Wisconsin Heating and Air on November 15 because of a reduction in work force. She collected $1.750 in unemployment benefits during the year. She is currently looking for another job. Sarah had qualifying minimum health insurance coverage provided to her because of her employment with Central Wisconsin Heating and Air for each month in 2020 (the employer continued to cover her through the end of the year). Elizabeth had qualifying minimum health insurance coverage provided through Kevin through his work. Sarah did not own, control or manage any foreign bank accounts nor was she a grantor or beneficiary of a foreign trust during the year. Sarah was provided with the following benefits as part of her employment Group-term life insurance coverage of $50,000. The cost to cover Sarah for the company for the tax year is $150 Access to the company photocopy machine. Sarah estimates she made $14 worth of copies during the year primarily for use with her church group activities Sarah reported no itemized deductions other than any described above. Sarah does not want to contribute to the Presidential Election Campaign Fund. She would like to receive a refund (if any) of any tax she may have overpaid for the year. Her preferred method of receiving the refund is by check. A Alustments to $1040 U.S. Individual Income Tax Return 2020 OMB No 1545-6074 In hey-haplin Filing Status Single Married fling jointly Married fing separately (MFS) Head of household How Qualifying widowienia Check only you checked the MFS box, enter the name of your spouse. If you checked the HOH or GW box, enter the child's name if the qualifying one box person is a child but not your dependent You first name and midt Last name Your security number Saran la314514aal Ifjot rotum, spouse's rename and middle Spouse's social security number McHugh laus Rose petal Drive middleton No Home addressumber and streets. If you have a PO box, intruction Agit no. Presidential Election Campaign Check here if you, or your City, town, pomote you have a loreign dos ao compiute ac below State ZIP code spouseling jointly, want CT 500 to go to this tund. Checking a box below will not change Foreign country name Foreign provincesto county Foreign postal code your tax or refund You Spouse any time during 2020. did you receive, sell, and exchange or otherwise acquire any financial interest in any virtual currency? Yes Standard Someone can claim: You as a dependent Your DOUBO as a dependent Deduction sous item.ou on a separate return or you were a dual status allen pe/Blindness You Were bom before January 2, 1956. Are blind Spouse was bom before January 2.1956 Dis blind ependents se instruction social security 4) Relationship 14) Vis for structions: more (1) First number to you Child tax credit Credit for other dependent en four bendents, instructions check 120350 205 2b 36 4b ob Gb 7 8 9 1 Wages, salaries, tips, etc. Altach Formis) W-2 28 Tix-exempt interest 2a Ba bTaxable interest 3a Qualified dividends Ja red b Ordinary dividends 4a IFA distributions 4a b Taxable amount 5a Pensions and annuities 5a Taxable amount ard 6a Social security benefits Sa b Taxable amount tion for 7 Capital gain or oss. Attach Schedule if required. If not required. chuck here ading 8 Other income from Schedule 1. line 9 Add lines 1, 2, 3, 4, 5, 6, 7 and 8. This is your total income 10 Adjustments to incorne or From Schedule 1. line 22 10a 30 b Charitable contributions if you take the standard deduction. See Instructions 10b of c Add lines 10a and 10b. These are your total adjustments to Income hold 11 Subtract line 10c from line 9. This is your adjusted gross income checked 12 Standard deduction or itemized deductions from Schedule A 13 Qualified business income deduction. Attach Form 8995 or Form 8995-A 14 Add lines 12 and 13 truction 15 Taxable income. Subtract line 14 from line 11. 1200 or less enter-O- closur. Privacy Act, and Paperwork Reduction Act Notice, se separate instructions Cat 10 10 AA 11 12 13 14 15 Form 1040 Page 2 Form 14000 18 16 Tax Instructions. Check it any trom Form: 8814 24972 3 17 17 Amount from Schedule 2. Ine 3 18 18 Add lines 15 and 17 19 19 Child tax credit or credit for other dependents 20 20 Amount from Schedule 3. line 7 21 21 Add lines 19 and 20 22 22 Subtractie 21 from line 18, 2 or less anter 23 23 Other tecluding logamatta, trom Schedule 2 line 10 24 244 Add lines 22 and 23. This is your total tax Federal income tax wired from Forms 250 Forma 1090 2:56 Other forma e instructions 250 250 Addnes 25 through 250 26 2000 estimated tax payments and amount applied from 2010 rotum - you have 27 Emned income Cred EC 27 chic 28 Additional child tax redt. Altach Schedule 5612 you 29 American opportunity credit from Form , tine 29 Recovery rebate credit. See instructions 30 31 Amount from Schedule 3 line 13 31 32 And in 27 through 21. These are your total other payments and refundable credits 32 30 Addnes 250, 20, and 32. These are your total payments 33 34 34 If line 33 more than in 24 Subtract line 24 from ne 33. This is the amount you overpaid Refund 35a Amount of line 34 you want refunded to you. If Form 383 is attached, check here 350 Drupal Routing number e Type Checking Savings Second Account number 38 Amount of 34 you want applied to your 2021 estimated tax 36 Amount 37 Subtractine 33 from Ine 24. This is the amount you owe now a7 You Owe Notes Schedule and schedule Seers, Ine 37 may not represent of the taxes you owe for Ford How to pay 2020. Besohedule 3 line 12, and its instructions for details insun Estimated tax penalty Constructions 38 Third Party Do you want to low another person to dous this reburn with the RSS Designee Instructions Yes. Complete below. No Designs Pro Personal dentication PAN Sign Undergrof jy, declare that were and accompanying schedules and statements, and to the best of my knowledge Here y come and complete. Dari poterantopered on mor of which prowany knowledge Your up Dube Your coton I hent you an idarity y-len A v hn e) Section Spouse's signature for both to De Rewoo Spouse's con RS OF der Prother Groen Em Paid Peper's name Properties PTIN Check Preparer Use Only Phone Tum' FAN 000 win omistamin for 1040 11 4 9 SCHEDULE 1 OMB NS 1545-0074 (Form 1040) Additional Income and Adjustments to Income 2020 Departmental e Tre Attach to Form 1040, 040-SR, or 1010-NR. Aachent Internal Reservice Go to www.irs.gov/ Form100 for instructions and the latest information Sande No 01 Names) shown on Form 1040 1040-SR or 1040-NR Your social security number 122 15 221 Parti Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 1 2a Alimony received .. 2a 102 b Date of original divorce or separation agreement (see instructions) 31100 3 Business income or loss), Attach Schedule C 3 24.0 4 Other gains or losses). Attach Form 4797 5 Rental real estate, royalties, partnerships. S corporations, trusts, etc. Attach Schedule E 5 6 Farm income or loss). Attach Schedule F 6 7 Unemployment compensation 7 SO 8 Other income. List type and amount 8 9 Combine lines 1 through 8. Enter here and on Form 1040, 1040-SR, or 1040-NR. line 8 Part II Adjustments to Income 10 Educator expenses. 10 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 11 12 Health savings account deduction. Attach Form 8889 12 13 Moving expenses for members of the Armed Forces. Attach Form 3903 13 14 Deductible part of self-employment tax. Attach Schedule SE 14 15 Self-employed SEP. SIMPLE, and qualified plans 15 16 Self-employed health insurance deduction. 16 17 Penalty on early withdrawal of savings 17 48a Alimony paid. 18a b Recipient's SSN c Date of original divorce or separation agreement (see Instructions) 19 IRA deduction 19 20 Student loan interest deduction 20 21 Tuition and fees deduction. Attach Form 8917 21 2 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040, 040-SR, or 1040-NR, line 10a 22 or Paperwork Reduction Act Notice, see your tax return instructions Cat No. 71670F Schedule 1 Form 1040) 2020 EDULE E Supplemental Income and Loss OMB No 1545-0074 0401 From rontal real estate, royalties, partnerships, Scorporations, estates, trusts, REMIOs, etc.) 2020 Attach to Form 1040, 040-SR. 1040-NR, or 1041. ant of the Treasury evenue Service Go to www.irs.gov/Schedule for instructions and the latest information, Attachment Seouence No. 13 shown on returns Your social security number Income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property, use Schedule C. See instructions. If you are an individual, report farm rental income or loss trom Form 4835 on page 2, line 40 you make any payments in 2020 that would require you to file Formis) 1099? See instructions Yes No Yes," did you or will you file required Forms) 1099? Yes No Physical address of each property (street city, stato, ZIP code) Type of Property (from list below) Fair Rental Days Personal Use Days QJV 2 For each rental real estate property listed above, report the number of fair rental and personal use days. Check the QJV box only If you meet the requirements to file as a qualified joint venture. See instructions. B BG of Property ale Family Residence 3 Vacation Short-Term Rental 5 Land 7 Self-Rental |-Family Residence 4 Commercial 6 Royalties 8 Other (describe e: Properties: A B Rents received 3 Royalties received 4 ses Advertising 5 Auto and travel (see instructions) 6 Cleaning and maintenance 7 Commissions. 8 Insurance 9 Legal and other professional fees 10 Management fees 11 Mortgage interest paid to banks, etc. (see instructions) 12 Other interest. 13 Repairs 14 Supplies 15 Taxes 16 Utilities 17 Depreciation expense or depletion 18 Other (list) 19 Total expenses. Add lines 5 through 19 20 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (los), see instructions to find out if you must file Form 6198 21 Deductible rental real estate loss after limitation, if any. on Form 8562 (see instructions) 22 Total of all amounts reported on line 3 for all rental properties 23a Total of all amounts reported on line 4 for all royalty properties 23b Total of all amounts reported on line 12 for all properties 23c Total of all amounts reported on line 18 for all properties 23a Total of all amounts reported on line 20 for all properties 23e Income. Add positive amounts shown on line 21. Do not include any losses Losses. Add royalty losses from line 21 and rental real estate lossen from line 22. Enter total loses here Total rental real estate and royalty Income or loss). Combine lines 24 and 25. Enter the result here. If Parts II, I, I, and line 40 on page 2 do not apply to you, alto enter this amount on Schedule 1 Form 1040), line 5. Otherwise, include this amount in the total on line 41 on page 2 orwork Reduction Act Notice, see the separate instructions. Cal 11544 24 25 26 Behedule E10402020 Schedule E Form 10401 2020 Mama shown on Do not enter name and social security number own on other side Attachment Sequence No. 13 Page 2 Your social security number Motal Caution: The IRS compares amounts reported on your tax return with amounts shown on Schedules, K.1. Part II Income or Loss From Partnerships and S Corporations - Notes If you report a fons receive a distribution, dispose of stock or receive a loan repayment from an corporation, you must check the box incolumn (e) on line 28 and attach the required basis computation. If you report a fons from an at-risk activity for which any amount is not at risk, you must check the box in column on line 28 and attach Form 6198. See instructions 27 Are you reporting any loss not allowed in a prior year due to the at-risk of basis limitations, a prior year unallowed loss from a passive activity of that loss was not reported on Form 8582), or unreimbursed partnership expenses? If you answered "Yes, see instructions before completing this section Yes No EP e Check 28 taj Name Id Employer to Check m Check it Dartnerships foreign action for corporation bass computationary amount is partnership number required A B D Passive Income and Loss Nonpassive Income and Loss tal Pavellowed thi Passive income Norpassive low wowed Section 179 expens Nosive income attach Form 582 ruired from Schedule K-1 see Schedule K-11 deduction to Form 4562 from Schedule 1-1 A B C D 29a Totals bTotals 30 Add columns th) and () of line 29a. 30 31 Add columns (gl. 00. and () of line 29b. 31 32 Total partnership and S corporation income or loss). Combine lines 30 and 31 32 Part III Income or Loss From Estates and Trusts 33 w Name Identification number A B Passive Income and Loss Nonpassive Income and Loss Ich Passive deduction of allowed Passive income Deduction or loss atoh Form 502 reed from Schedule - 1 Other income from from Schedule K-1 Schedule K-1 A B 34a Totals bTotals 35 Add columns (d) and (of line 34 35 36 Add columns (c) and (e) of line 34 36 37 Total estate and trust income or loss). Combine lines 35 and 36 37 Part IV Income or Loss From Real Estate Mortgage Investment Conduits (REMICS) -Residual Holder 38 Gal Name Employer cation Esiosionom Schedules, line Id Taxable income nelloni umber el come from from Schedules in 1b Schedules, ne 30 39 40 41 39 Combine columns Id and forly. Enter the result here and include in the total on line 41 below Part V Summary 40 Net form rental income or goss) from Form 4835. Also, complete line 42 below 41 Total income of fossi Combines 1, 32, 37, 38, and 40. Enter the share andon Schoom 1042. Ines 42 Reconciliation of farming and fishing income. Enter you gross farming and fishing income reported on Form 4835, Ine 7: Schedule K-1 (Form 10651, box 14 code 3: Schedule K-1 (Form 1120-5, box 17.code AD, and Schedule K-1 Form 1041) box 14 code F. See Instructions 42 43 Reconciliation for real estate professionals. If you were estate profession instructions entre net income of you reported anywhere on for 1640, Form 1000-SR or Form 1040-NR from all rental real estate activities in which you midated under the pative actions DE102019