Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tax question Q1) Antonio Kambita made the following gifts and disposals of property during the tax year 2022 i) In February, he gifted 70% of

Tax question

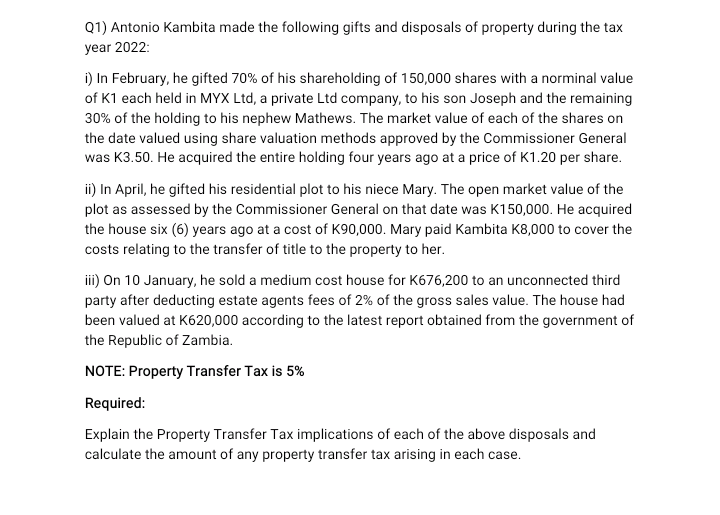

Q1) Antonio Kambita made the following gifts and disposals of property during the tax year 2022 i) In February, he gifted 70% of his shareholding of 150,000 shares with a norminal value of K1 each held in MYX Ltd, a private Ltd company, to his son Joseph and the remaining 30% of the holding to his nephew Mathews. The market value of each of the shares on the date valued using share valuation methods approved by the Commissioner General was K3.50. He acquired the entire holding four years ago at a price of K1.20 per share. ii) In April, he gifted his residential plot to his niece Mary. The open market value of the plot as assessed by the Commissioner General on that date was K150,000. He acquired the house six (6) years ago at a cost of K90,000. Mary paid Kambita K8,000 to cover the costs relating to the transfer of title to the property to her. iii) On 10 January, he sold a medium cost house for K676,200 to an unconnected third party after deducting estate agents fees of 2% of the gross sales value. The house had been valued at K620,000 according to the latest report obtained from the government of the Republic of Zambia. NOTE: Property Transfer Tax is 5% Required: Explain the Property Transfer Tax implications of each of the above disposals and calculate the amount of any property transfer tax arising in each case. Q1) Antonio Kambita made the following gifts and disposals of property during the tax year 2022 i) In February, he gifted 70% of his shareholding of 150,000 shares with a norminal value of K1 each held in MYX Ltd, a private Ltd company, to his son Joseph and the remaining 30% of the holding to his nephew Mathews. The market value of each of the shares on the date valued using share valuation methods approved by the Commissioner General was K3.50. He acquired the entire holding four years ago at a price of K1.20 per share. ii) In April, he gifted his residential plot to his niece Mary. The open market value of the plot as assessed by the Commissioner General on that date was K150,000. He acquired the house six (6) years ago at a cost of K90,000. Mary paid Kambita K8,000 to cover the costs relating to the transfer of title to the property to her. iii) On 10 January, he sold a medium cost house for K676,200 to an unconnected third party after deducting estate agents fees of 2% of the gross sales value. The house had been valued at K620,000 according to the latest report obtained from the government of the Republic of Zambia. NOTE: Property Transfer Tax is 5% Required: Explain the Property Transfer Tax implications of each of the above disposals and calculate the amount of any property transfer tax arising in each caseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started