tax rate 24%

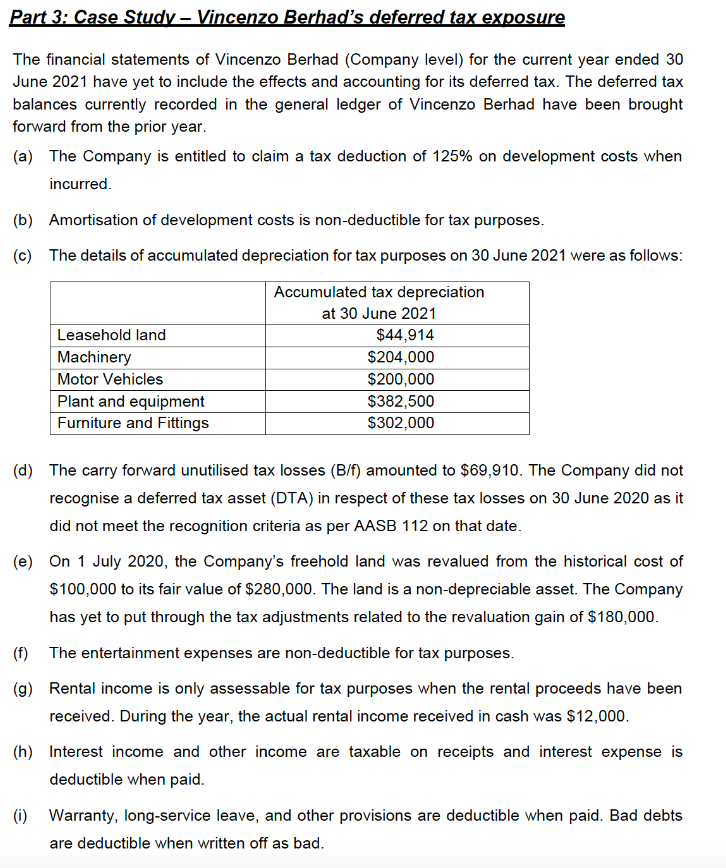

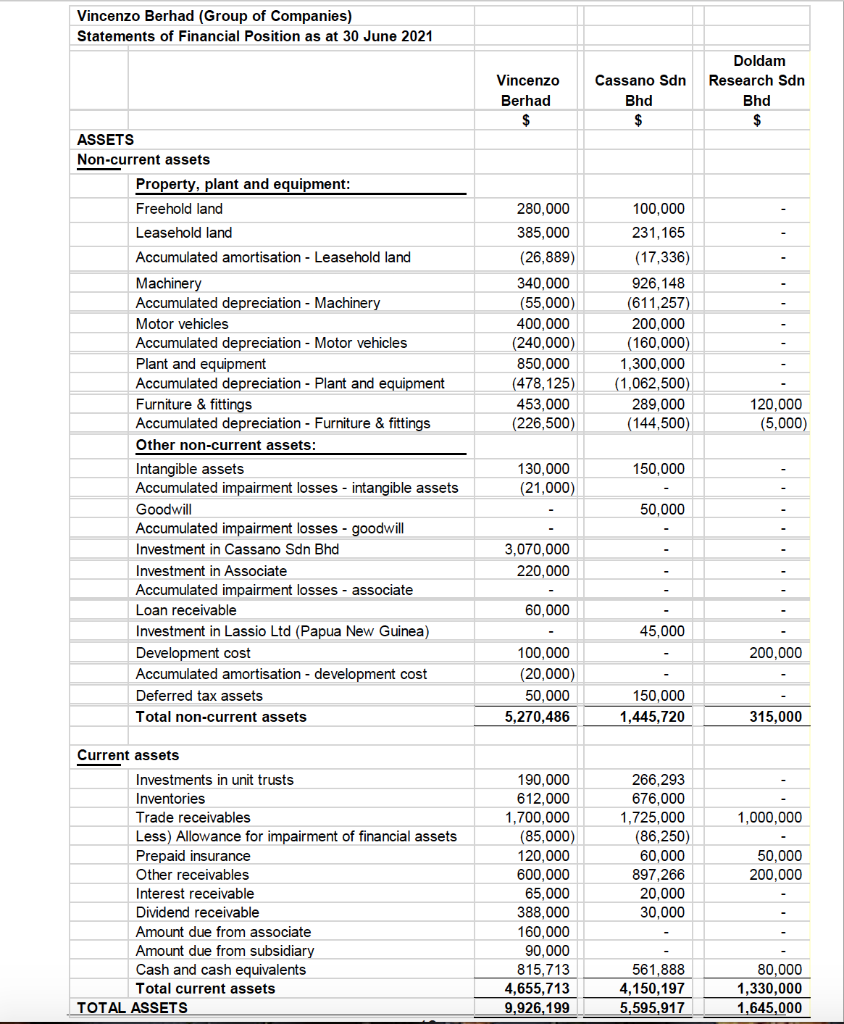

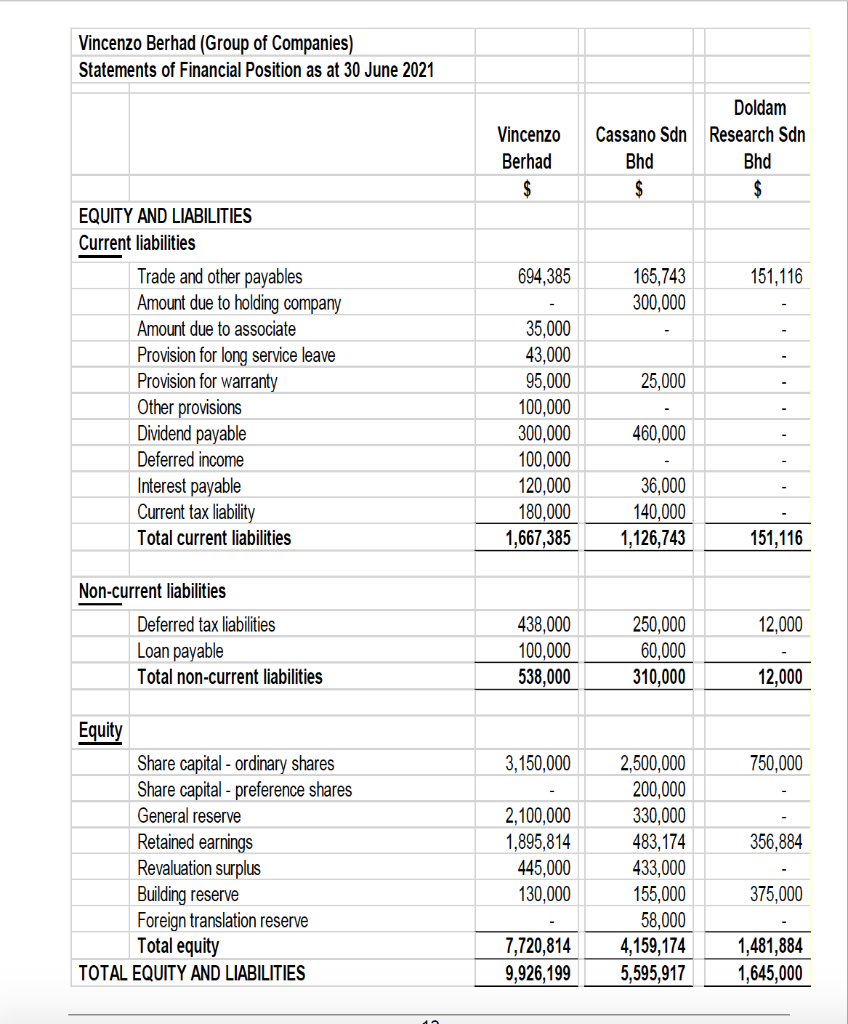

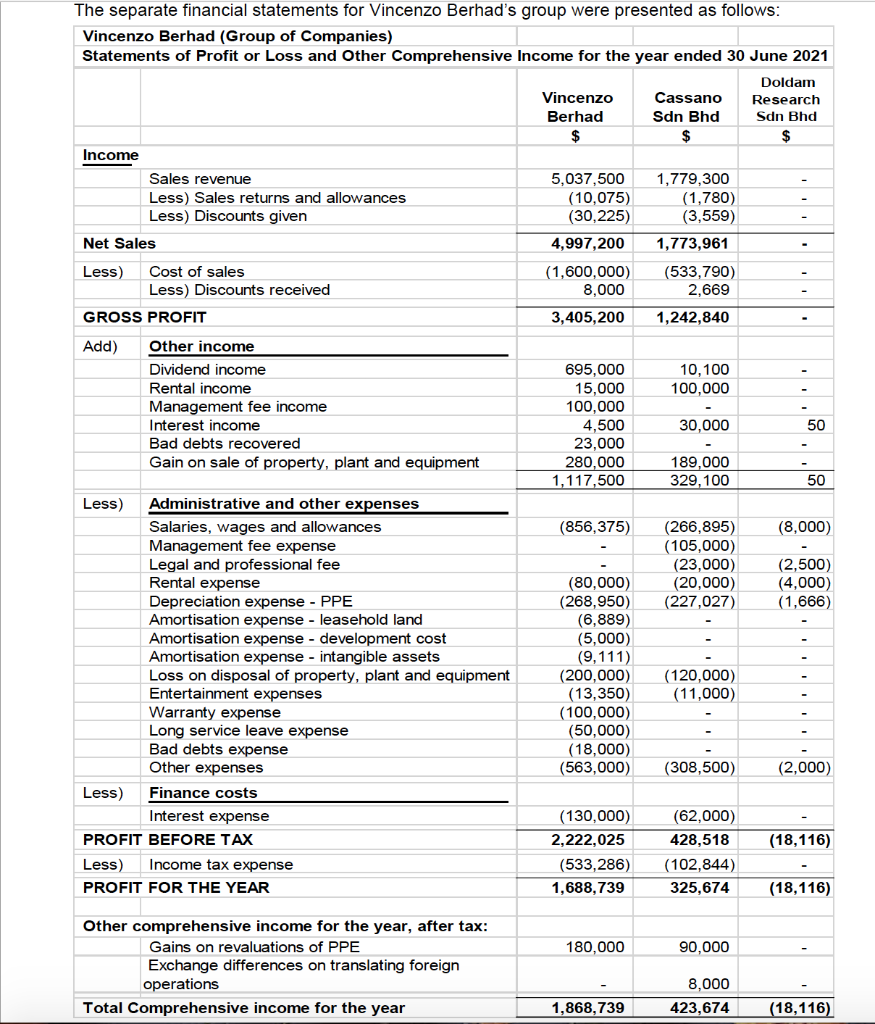

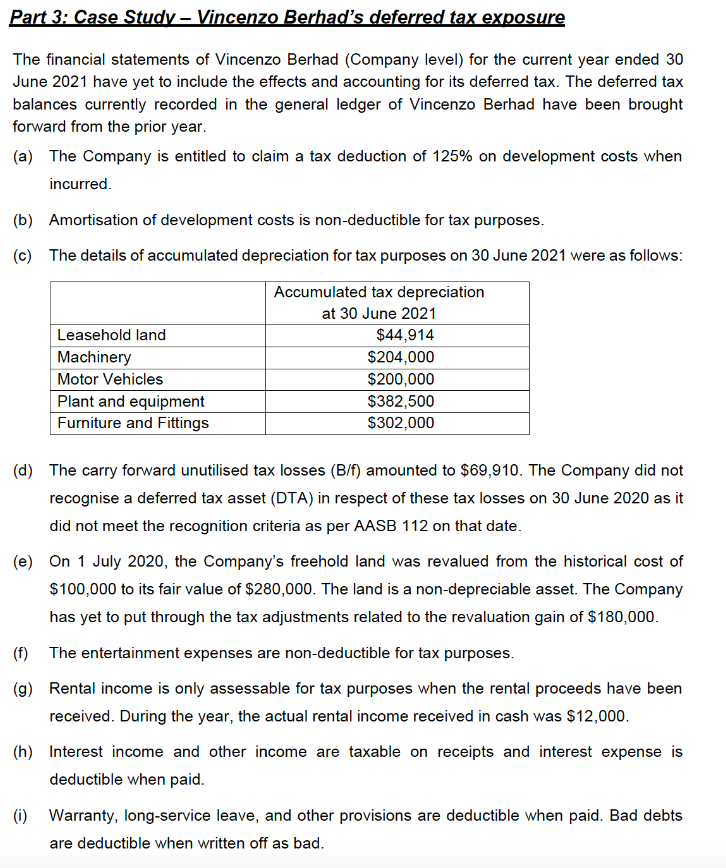

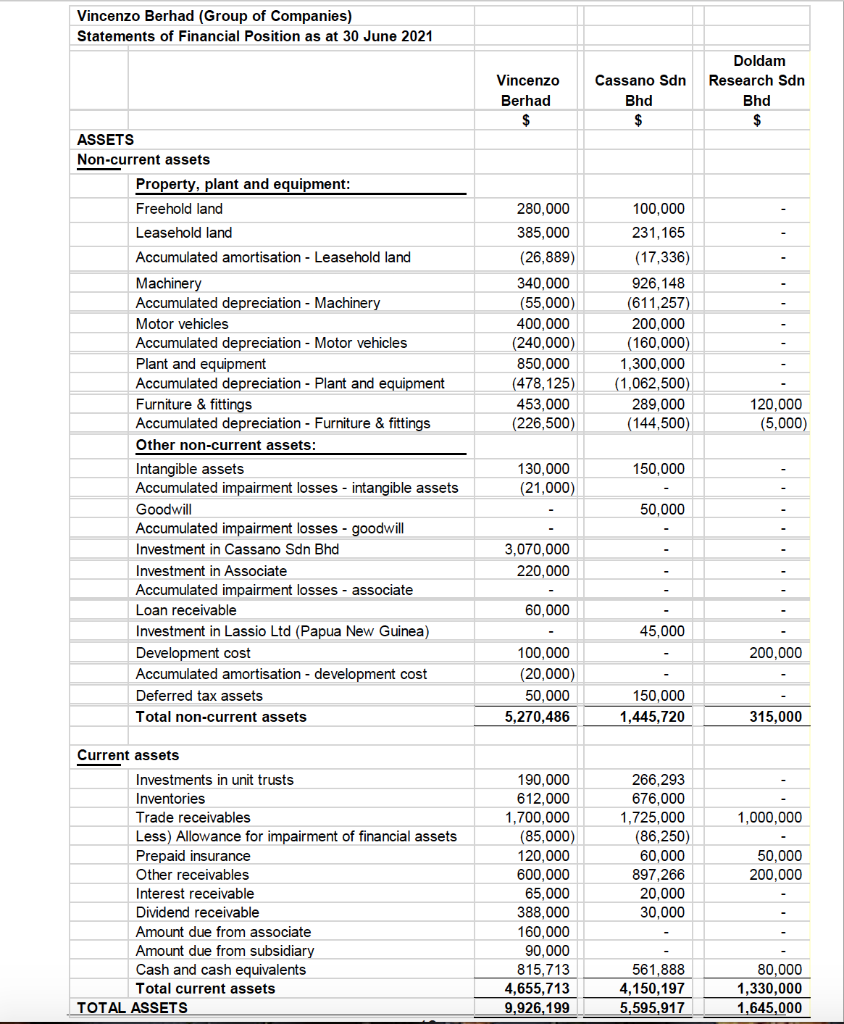

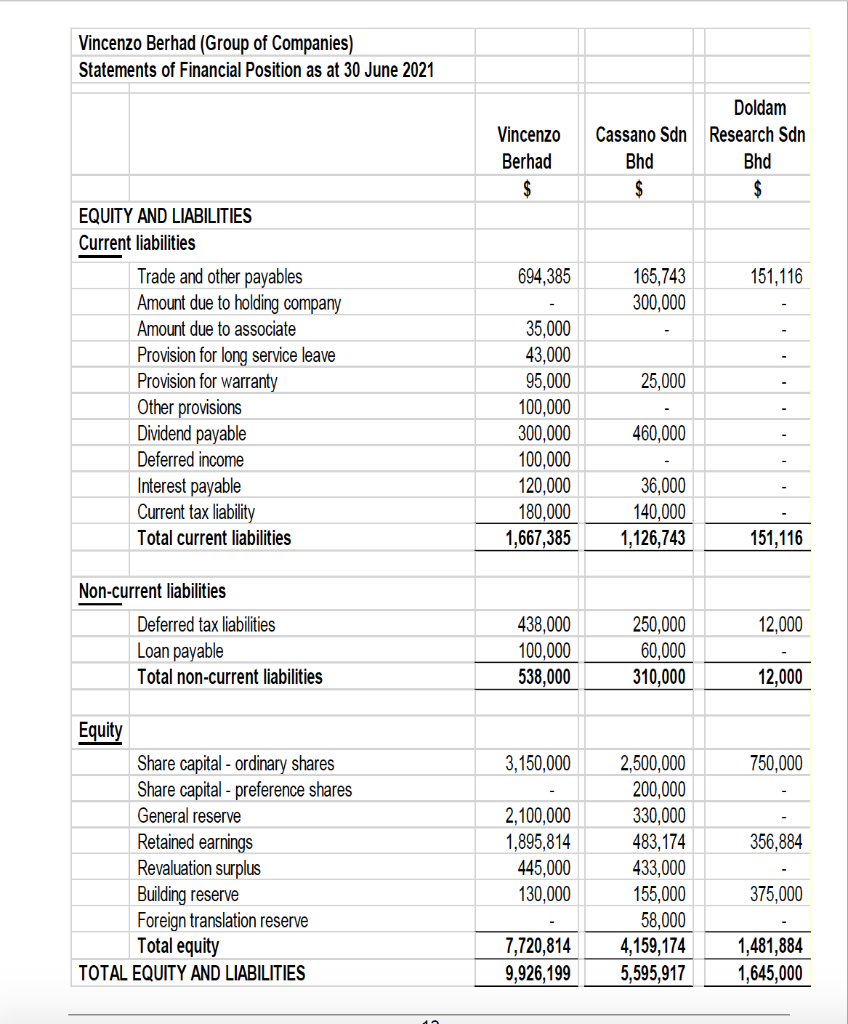

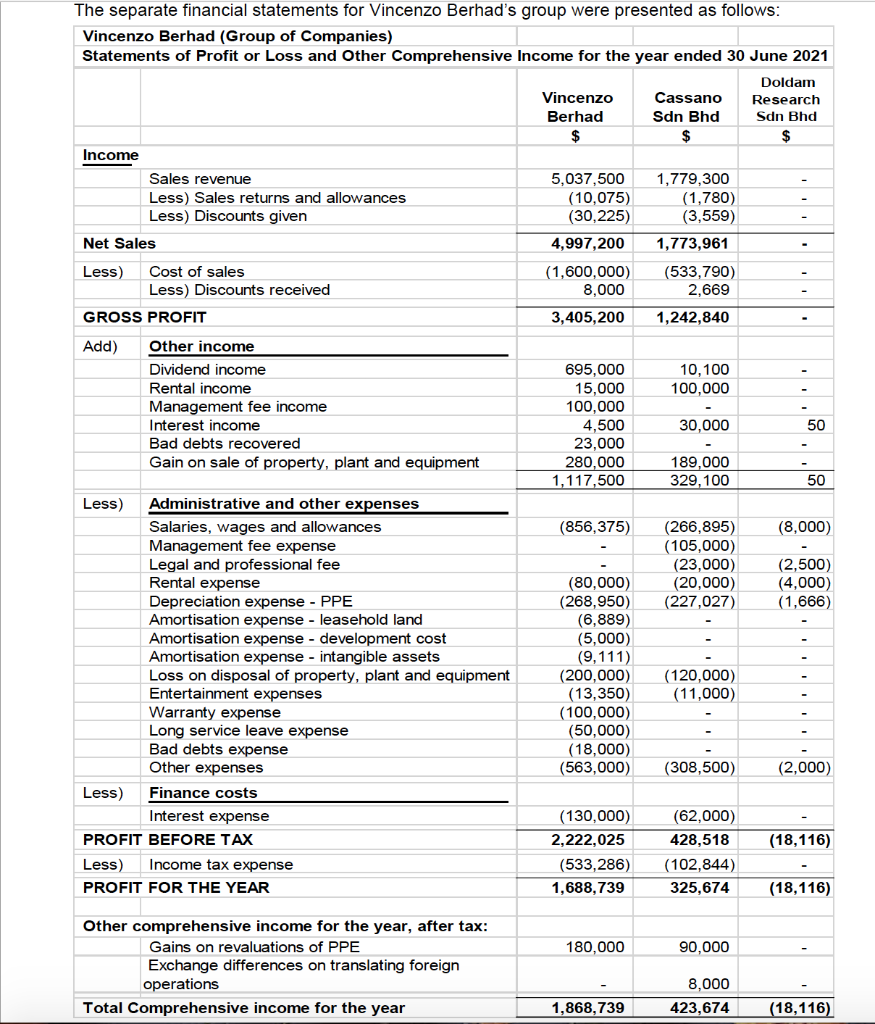

Part 3: Case Study Vincenzo Berhad's deferred tax exposure The financial statements of Vincenzo Berhad (Company level) for the current year ended 30 June 2021 have yet to include the effects and accounting for its deferred tax. The deferred tax balances currently recorded in the general ledger of Vincenzo Berhad have been brought forward from the prior year. (a) The Company is entitled to claim a tax deduction of 125% on development costs when incurred. (b) Amortisation of development costs is non-deductible for tax purposes. (C) The details of accumulated depreciation for tax purposes on 30 June 2021 were as follows: Leasehold land Machinery Motor Vehicles Plant and equipment Furniture and Fittings Accumulated tax depreciation at 30 June 2021 $44,914 $204,000 $200,000 $382,500 $302,000 (d) The carry forward unutilised tax losses (B/f) amounted to $69,910. The Company did not recognise a deferred tax asset (DTA) in respect of these tax losses on 30 June 2020 as it did not meet the recognition criteria as per AASB 112 on that date. (e) On 1 July 2020, the Company's freehold land was revalued from the historical cost of $100,000 to its fair value of $280,000. The land is a non-depreciable asset. The Company has yet to put through the tax adjustments related to the revaluation gain of $180,000. (f) The entertainment expenses are non-deductible for tax purposes. (9) Rental income is only assessable for tax purposes when the rental proceeds have been received. During the year, the actual rental income received in cash was $12,000. (h) Interest income and other income are taxable on receipts and interest expense is deductible when paid. (i) Warranty, long-service leave, and other provisions are deductible when paid. Bad debts are deductible when written off as bad. Vincenzo Berhad (Group of Companies) Statements of Financial Position as at 30 June 2021 Vincenzo Berhad $ Cassano Sdn Bhd $ Doldam Research Sdn Bhd $ ASSETS Non-current assets Property, plant and equipment: Freehold land Leasehold land Accumulated amortisation - Leasehold land Machinery Accumulated depreciation - Machinery Motor vehicles Accumulated depreciation - Motor vehicles Plant and equipment Accumulated depreciation - Plant and equipment Furniture & fittings Accumulated depreciation - Furniture & fittings Other non-current assets: Intangible assets Accumulated impairment losses - intangible assets Goodwill Accumulated impairment losses - goodwill Investment in Cassano Sdn Bhd Investment in Associate Accumulated impairment losses - associate Loan receivable Investment in Lassio Ltd (Papua New Guinea) Development cost Accumulated amortisation - development cost Deferred tax assets Total non-current assets 280,000 385,000 (26,889) 340,000 (55,000) 400.000 (240,000) 850,000 (478,125) 453,000 (226,500) 100,000 231,165 (17,336) 926,148 (611,257) 200,000 (160,000) 1,300,000 (1,062,500) 289,000 (144,500) 120,000 (5,000) 150,000 130,000 (21,000) 50,000 3,070,000 220,000 60,000 45,000 200,000 100,000 (20,000) 50,000 5,270,486 150,000 1,445,720 315,000 1,000,000 Current assets Investments in unit trusts Inventories Trade receivables Less) Allowance for impairment of financial assets Prepaid insurance Other les Interest receivable Dividend receivable Amount due from associate Amount due from subsidiary Cash and cash equivalents Total current assets TOTAL ASSETS 190,000 612,000 1,700,000 (85,000) 120,000 600,000 65,000 388,000 160,000 90,000 815,713 4,655,713 9,926,199 266,293 676,000 1,725,000 (86,250) 60,000 897,266 20,000 30,000 50,000 200,000 561.888 4,150,197 5,595,917 80,000 1,330,000 1,645,000 Vincenzo Berhad (Group of Companies) Statements of Financial Position as at 30 June 2021 Vincenzo Berhad $ Doldam Cassano Sdn Research Sdn Bhd Bhd $ $ 694,385 151,116 165,743 300,000 EQUITY AND LIABILITIES Current liabilities Trade and other payables Amount due to holding company Amount due to associate Provision for long service leave Provision for warranty Other provisions Dividend payable Deferred income Interest payable Current tax liability Total current liabilities 25,000 35,000 43,000 95,000 100,000 300,000 100,000 120,000 180,000 1,667,385 460,000 36,000 140,000 1,126,743 151,116 12,000 Non-current liabilities Deferred tax liabilities Loan payable Total non-current liabilities 438,000 100,000 538,000 250,000 60,000 310,000 12,000 3,150,000 750,000 Equity Share capital - ordinary shares Share capital - preference shares General reserve Retained earnings Revaluation surplus Building reserve Foreign translation reserve Total equity TOTAL EQUITY AND LIABILITIES 356,884 2,100,000 1,895,814 445,000 130,000 2,500,000 200,000 330,000 483,174 433,000 155,000 58,000 4,159,174 5,595,917 375,000 7,720,814 9,926,199 1,481,884 1,645,000 50 The separate financial statements for Vincenzo Berhad's group were presented as follows: Vincenzo Berhad (Group of Companies) Statements of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2021 Doldam Vincenzo Cassano Research Berhad Sdn Bhd Sdn Bhd $ $ $ Income Sales revenue 5,037,500 1,779,300 Less) Sales returns and allowances (10,075) (1,780) Less) Discounts given (30,225) (3,559) Net Sales 4,997,200 1,773,961 Less) Cost of sales (1,600,000) (533,790) Less) Discounts received 8,000 2,669 GROSS PROFIT 3,405,200 1,242,840 Add) Other income Dividend income 695,000 10,100 Rental income 15,000 100,000 Management fee income 100,000 Interest income 4,500 30,000 Bad debts recovered 23,000 Gain on sale of property, plant and equipment 280,000 189,000 1,117,500 329,100 50 Less) Administrative and other expenses Salaries, wages and allowances (856,375) (266,895) (8,000) Management fee expense (105,000) Legal and professional fee (23,000) (2,500) Rental expense (80,000) (20,000) (4,000) Depreciation expense - PPE (268,950) (227,027) (1,666) Amortisation expense - leasehold land (6,889) Amortisation expense - development cost (5,000) Amortisation expense - intangible assets (9,111) Loss on disposal of property, plant and equipment (200,000) (120,000) Entertainment expenses (13,350) (11,000) Warranty expense (100,000) Long service leave expense (50,000) Bad debts expense (18,000) Other expenses (563,000) (308,500) (2,000) Less) Finance costs Interest expense (130,000) (62,000) PROFIT BEFORE TAX 2,222,025 428,518 (18,116) Less) Income tax expense (533,286) (102,844) PROFIT FOR THE YEAR 1,688,739 325,674 (18,116) 180,000 90,000 Other comprehensive income for the year, after tax: Gains on revaluations of PPE Exchange differences on translating foreign operations Total Comprehensive income for the year 8,000 423,674 1,868,739 (18,116) Part 3: Case Study Vincenzo Berhad's deferred tax exposure The financial statements of Vincenzo Berhad (Company level) for the current year ended 30 June 2021 have yet to include the effects and accounting for its deferred tax. The deferred tax balances currently recorded in the general ledger of Vincenzo Berhad have been brought forward from the prior year. (a) The Company is entitled to claim a tax deduction of 125% on development costs when incurred. (b) Amortisation of development costs is non-deductible for tax purposes. (C) The details of accumulated depreciation for tax purposes on 30 June 2021 were as follows: Leasehold land Machinery Motor Vehicles Plant and equipment Furniture and Fittings Accumulated tax depreciation at 30 June 2021 $44,914 $204,000 $200,000 $382,500 $302,000 (d) The carry forward unutilised tax losses (B/f) amounted to $69,910. The Company did not recognise a deferred tax asset (DTA) in respect of these tax losses on 30 June 2020 as it did not meet the recognition criteria as per AASB 112 on that date. (e) On 1 July 2020, the Company's freehold land was revalued from the historical cost of $100,000 to its fair value of $280,000. The land is a non-depreciable asset. The Company has yet to put through the tax adjustments related to the revaluation gain of $180,000. (f) The entertainment expenses are non-deductible for tax purposes. (9) Rental income is only assessable for tax purposes when the rental proceeds have been received. During the year, the actual rental income received in cash was $12,000. (h) Interest income and other income are taxable on receipts and interest expense is deductible when paid. (i) Warranty, long-service leave, and other provisions are deductible when paid. Bad debts are deductible when written off as bad. Vincenzo Berhad (Group of Companies) Statements of Financial Position as at 30 June 2021 Vincenzo Berhad $ Cassano Sdn Bhd $ Doldam Research Sdn Bhd $ ASSETS Non-current assets Property, plant and equipment: Freehold land Leasehold land Accumulated amortisation - Leasehold land Machinery Accumulated depreciation - Machinery Motor vehicles Accumulated depreciation - Motor vehicles Plant and equipment Accumulated depreciation - Plant and equipment Furniture & fittings Accumulated depreciation - Furniture & fittings Other non-current assets: Intangible assets Accumulated impairment losses - intangible assets Goodwill Accumulated impairment losses - goodwill Investment in Cassano Sdn Bhd Investment in Associate Accumulated impairment losses - associate Loan receivable Investment in Lassio Ltd (Papua New Guinea) Development cost Accumulated amortisation - development cost Deferred tax assets Total non-current assets 280,000 385,000 (26,889) 340,000 (55,000) 400.000 (240,000) 850,000 (478,125) 453,000 (226,500) 100,000 231,165 (17,336) 926,148 (611,257) 200,000 (160,000) 1,300,000 (1,062,500) 289,000 (144,500) 120,000 (5,000) 150,000 130,000 (21,000) 50,000 3,070,000 220,000 60,000 45,000 200,000 100,000 (20,000) 50,000 5,270,486 150,000 1,445,720 315,000 1,000,000 Current assets Investments in unit trusts Inventories Trade receivables Less) Allowance for impairment of financial assets Prepaid insurance Other les Interest receivable Dividend receivable Amount due from associate Amount due from subsidiary Cash and cash equivalents Total current assets TOTAL ASSETS 190,000 612,000 1,700,000 (85,000) 120,000 600,000 65,000 388,000 160,000 90,000 815,713 4,655,713 9,926,199 266,293 676,000 1,725,000 (86,250) 60,000 897,266 20,000 30,000 50,000 200,000 561.888 4,150,197 5,595,917 80,000 1,330,000 1,645,000 Vincenzo Berhad (Group of Companies) Statements of Financial Position as at 30 June 2021 Vincenzo Berhad $ Doldam Cassano Sdn Research Sdn Bhd Bhd $ $ 694,385 151,116 165,743 300,000 EQUITY AND LIABILITIES Current liabilities Trade and other payables Amount due to holding company Amount due to associate Provision for long service leave Provision for warranty Other provisions Dividend payable Deferred income Interest payable Current tax liability Total current liabilities 25,000 35,000 43,000 95,000 100,000 300,000 100,000 120,000 180,000 1,667,385 460,000 36,000 140,000 1,126,743 151,116 12,000 Non-current liabilities Deferred tax liabilities Loan payable Total non-current liabilities 438,000 100,000 538,000 250,000 60,000 310,000 12,000 3,150,000 750,000 Equity Share capital - ordinary shares Share capital - preference shares General reserve Retained earnings Revaluation surplus Building reserve Foreign translation reserve Total equity TOTAL EQUITY AND LIABILITIES 356,884 2,100,000 1,895,814 445,000 130,000 2,500,000 200,000 330,000 483,174 433,000 155,000 58,000 4,159,174 5,595,917 375,000 7,720,814 9,926,199 1,481,884 1,645,000 50 The separate financial statements for Vincenzo Berhad's group were presented as follows: Vincenzo Berhad (Group of Companies) Statements of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2021 Doldam Vincenzo Cassano Research Berhad Sdn Bhd Sdn Bhd $ $ $ Income Sales revenue 5,037,500 1,779,300 Less) Sales returns and allowances (10,075) (1,780) Less) Discounts given (30,225) (3,559) Net Sales 4,997,200 1,773,961 Less) Cost of sales (1,600,000) (533,790) Less) Discounts received 8,000 2,669 GROSS PROFIT 3,405,200 1,242,840 Add) Other income Dividend income 695,000 10,100 Rental income 15,000 100,000 Management fee income 100,000 Interest income 4,500 30,000 Bad debts recovered 23,000 Gain on sale of property, plant and equipment 280,000 189,000 1,117,500 329,100 50 Less) Administrative and other expenses Salaries, wages and allowances (856,375) (266,895) (8,000) Management fee expense (105,000) Legal and professional fee (23,000) (2,500) Rental expense (80,000) (20,000) (4,000) Depreciation expense - PPE (268,950) (227,027) (1,666) Amortisation expense - leasehold land (6,889) Amortisation expense - development cost (5,000) Amortisation expense - intangible assets (9,111) Loss on disposal of property, plant and equipment (200,000) (120,000) Entertainment expenses (13,350) (11,000) Warranty expense (100,000) Long service leave expense (50,000) Bad debts expense (18,000) Other expenses (563,000) (308,500) (2,000) Less) Finance costs Interest expense (130,000) (62,000) PROFIT BEFORE TAX 2,222,025 428,518 (18,116) Less) Income tax expense (533,286) (102,844) PROFIT FOR THE YEAR 1,688,739 325,674 (18,116) 180,000 90,000 Other comprehensive income for the year, after tax: Gains on revaluations of PPE Exchange differences on translating foreign operations Total Comprehensive income for the year 8,000 423,674 1,868,739 (18,116)