Question

Tax Research Memo - NOL Madness ABC, Inc. began operations in 2015. ABC is a C-Corporation who has elected to be taxed as a corporation.

Tax Research Memo - NOL Madness ABC, Inc. began operations in 2015. ABC is a C-Corporation who has elected to be taxed as a corporation. Their taxable income history is as follows: 2015: (100,000) in ordinary loss 2016: 100,000 in income 2017: (150,000) in an ordinary loss 2018: (150,000) in ordinary loss 2019: 50,000 in ordinary income 2020: 100,000 in ordinary income 2021: (290,000) in ordinary loss 2022: 720,000 in ordinary income Assuming the proper NOL rules were followed, what should have been the taxable income in 2015 - 2022 after the application of any carryback or carryforwards? Also, what if any NOL carryover should we have going into 2023?

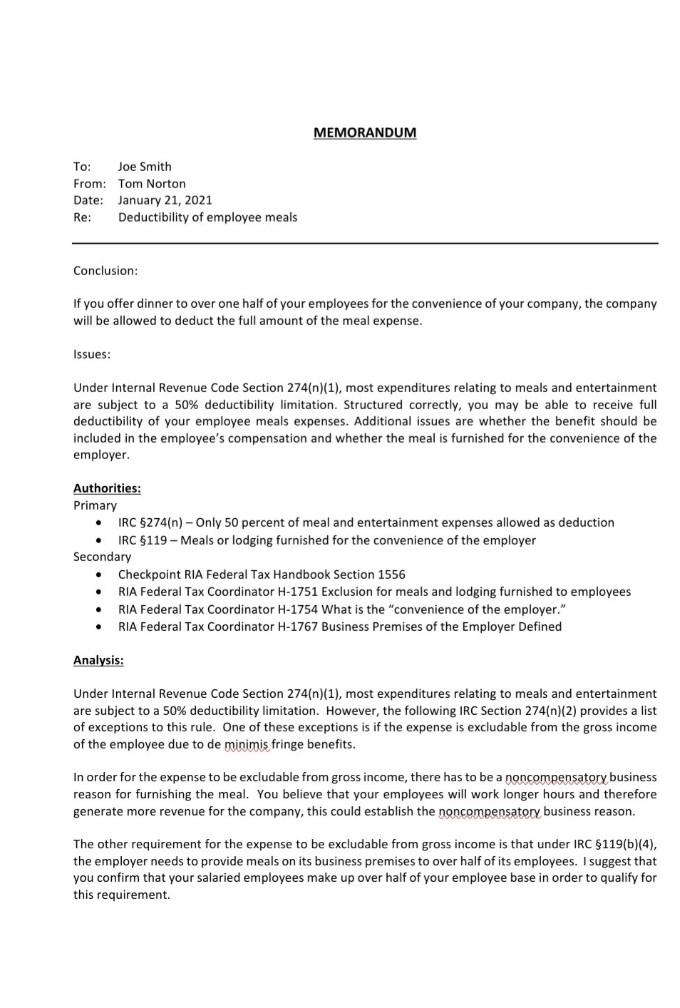

MEMORANDUM To: Joe Smith From: Tom Norton Date: January 21, 2021 Re: Deductibility of employee meals Conclusion: If you offer dinner to over one half of your employees for the convenience of your company, the company will be allowed to deduct the full amount of the meal expense. Issues: Under Internal Revenue Code Section 274(n)(1), most expenditures relating to meals and entertainment are subject to a 50% deductibility limitation. Structured correctly, you may be able to receive full deductibility of your employee meals expenses. Additional issues are whether the benefit should be included in the employee's compensation and whether the meal is furnished for the convenience of the employer. . Authorities: Primary IRC $274(n) - Only 50 percent of meal and entertainment expenses allowed as deduction IRC $119-Meals or lodging furnished for the convenience of the employer Secondary Checkpoint RIA Federal Tax Handbook Section 1556 RIA Federal Tax Coordinator H-1751 Exclusion for meals and lodging furnished to employees RIA Federal Tax Coordinator H-1754 What is the "convenience of the employer." RIA Federal Tax Coordinator H-1767 Business Premises of the Employer Defined Analysis: Under Internal Revenue Code Section 274(n)(1), most expenditures relating to meals and entertainment are subject to a 50% deductibility limitation. However, the following IRC Section 274(n)(2) provides a list of exceptions to this rule. One of these exceptions is if the expense is excludable from the gross income of the employee due to de minimis fringe benefits. In order for the expense to be excludable from gross income, there has to be a noncompensatory business reason for furnishing the meal. You believe that your employees will work longer hours and therefore generate more revenue for the company, this could establish the noncompensatory business reason. The other requirement for the expense to be excludable from gross income is that under IRC $119(b)(4), the employer needs to provide meals on its business premises to over half of its employees. I suggest that you confirm that your salaried employees make up over half of your employee base in order to qualify for this requirement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started