Answered step by step

Verified Expert Solution

Question

1 Approved Answer

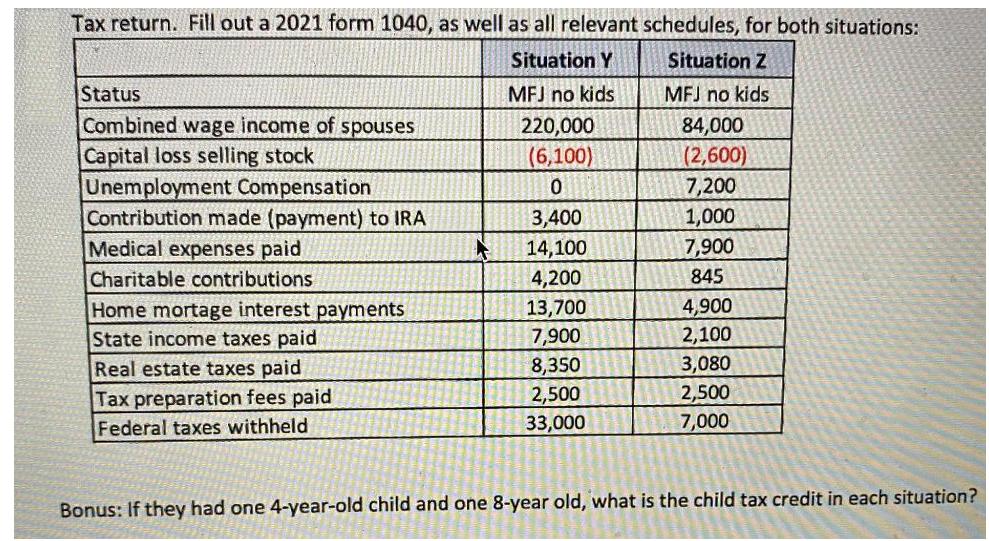

Tax return. Fill out a 2021 form 1040, as well as all relevant schedules, for both situations: Situation Y Situation Z MFJ no kids

Tax return. Fill out a 2021 form 1040, as well as all relevant schedules, for both situations: Situation Y Situation Z MFJ no kids MFJ no kids 220,000 84,000 (6,100) (2,600) 0 7,200 3,400 1,000 14,100 7,900 4,200 845 13,700 4,900 7,900 2,100 8,350 3,080 2,500 2,500 33,000 7,000 Status Combined wage income of spouses Capital loss selling stock Unemployment Compensation Contribution made (payment) to IRA Medical expenses paid Charitable contributions Home mortage interest payments State income taxes paid Real estate taxes paid Tax preparation fees paid Federal taxes withheld Bonus: If they had one 4-year-old child and one 8-year old, what is the child tax credit in each situation?

Step by Step Solution

★★★★★

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Tax return Fill out a 2021 form 1040 as well as all relevant schedules for both situations The tax return for Situation Y would include Form 1040 as well as Schedules A B C D and E The tax return for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started