Tax return information can be found From your textbook, Chapter 9 "Tax Return Problems #1, Lance and Wanda Dean.

Requirements:

1. You will file 2021 Federal income tax return (treat all info as for year 2021 not year 2020).

2. file Form 1040 and Sch. 1 (do not need Schedule A because they use standard deduction)

3. Check Figures: Line 15-Taxable Income is 74000; Line 16-Tax is $8482; Line 19 child and/or dependent credit is $4000; Line 35 and 35a refund are the same, a refund of $1218.

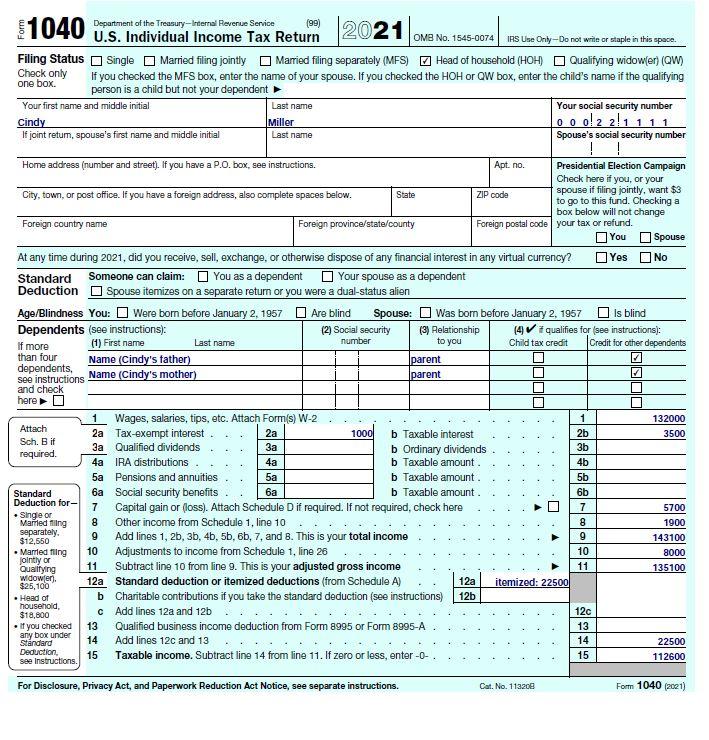

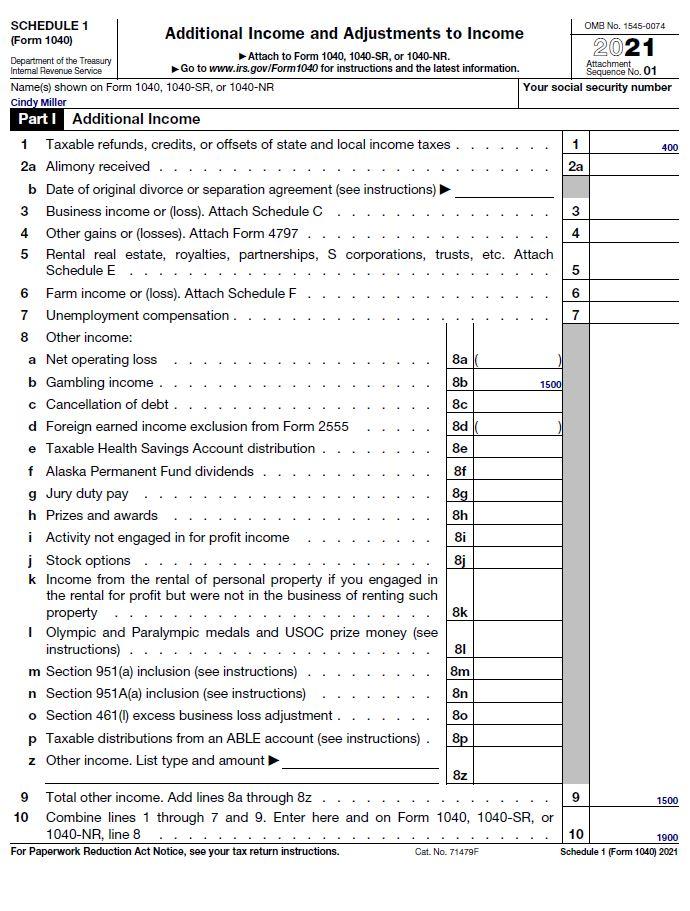

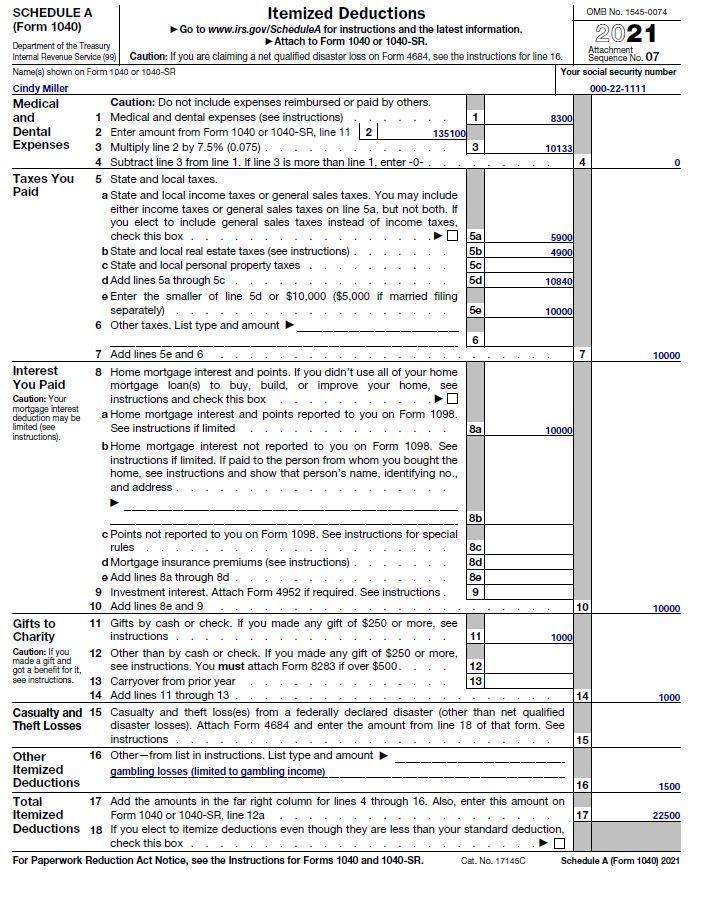

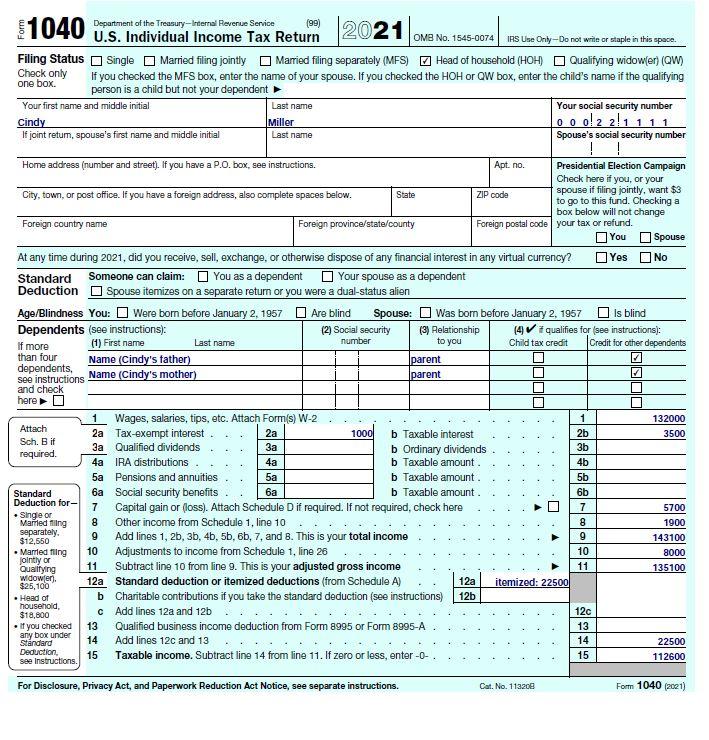

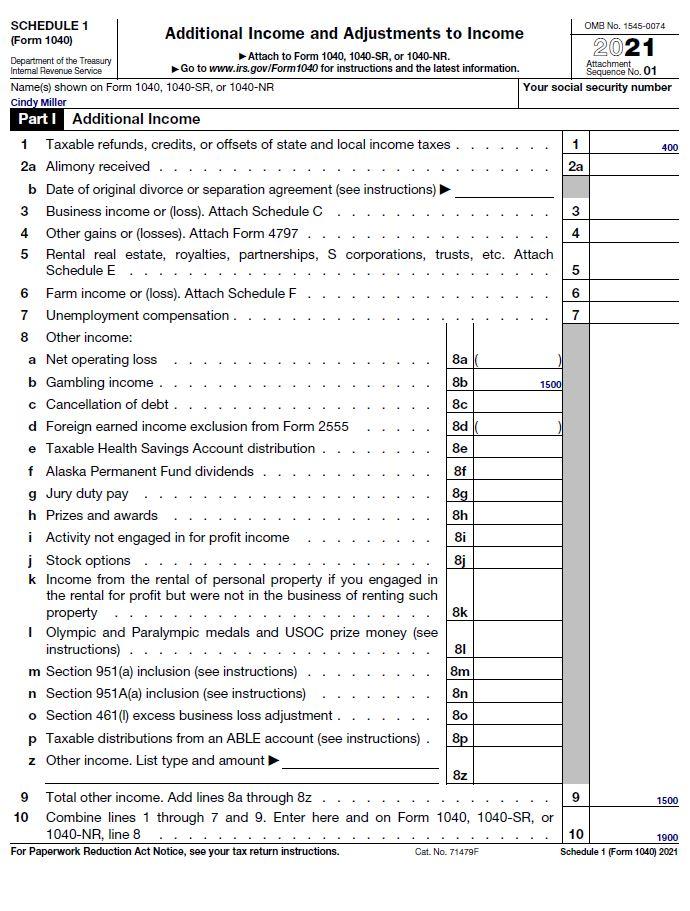

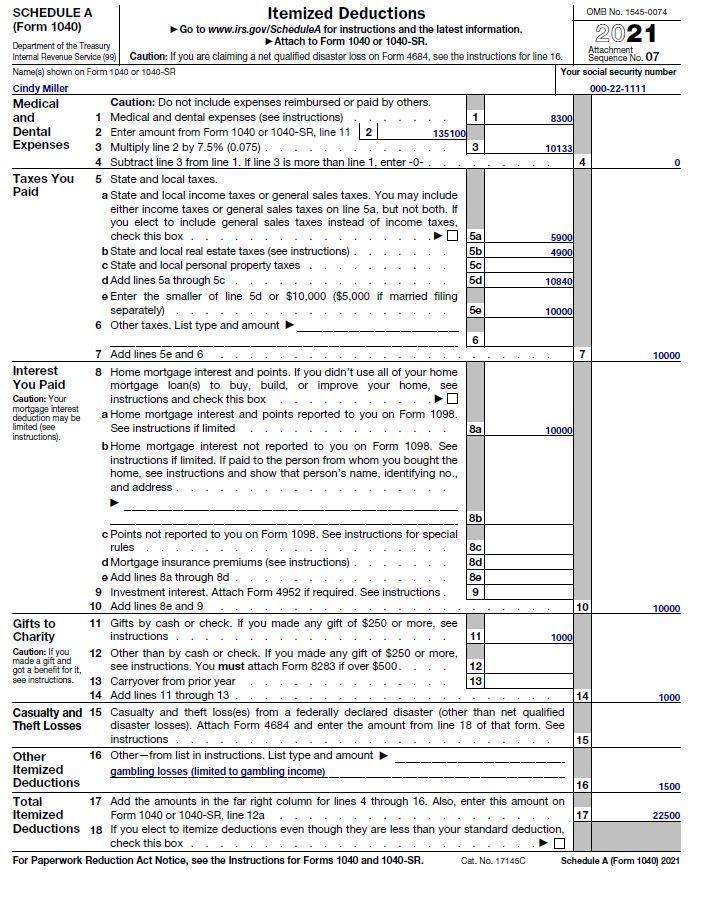

Example below on what needs to be filled out.

Return 2021 1040 Department of the Treasury - Internal Revenue Service ) OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Filing Status Single Married filing jointly Married filing separately (MES) Head of household (HOH) Qualifying widower) (W) Check only one box. If you checked the MFS box, enter the name of your spouse. If you checked the HOH or GW box, enter the child's name if the qualifying person is a child but not your dependent Your first name and middle initial Last name Your social security number Cindy Miller 0 0 0!2 211 111 If joint retum, spouse's first name and middle initial Spouse's social security number Last name DOOR Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election Campaign Check here if you, or your City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change Foreign country name Foreign province/state/county Foreign postal code your tax or refund. You Spouse At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were bom before January 2, 1957 Are blind Spouse: Was born before January 2, 1957 is blind Dependents (see instructions): (2) Social security (3) Relationship 14 i qualifies for see instructions): If more (1) First name number Last name to you Child tax credit Credit for other dependents than four Name (Cindy's father) parent dependents, see instructions Name (Cindy's mother) Iparent and check here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 132000 Attach 2a Tax-exempt interest 2a 1000 b Taxable interest 2b 3500 Sch. Bit 3a Qualified dividends 3a required. 3b b Ordinary dividends 4a IRA distributions 4a b Taxable amount. 4b 5a Pensions and annuities 5a b Taxable amount 5b Standard 6a Social security benefits 6 b Taxable amount 6b Deduction for- 7 Capital gain or loss). Attach Schedule D if required. If not required, check here 7 5700 Single or Married fing 8 Other income from Schedule 1, line 10 1900 separately. 9 $12,550 9 Add lines 1, 26, 35, 45, 56, 66, 7, and B. This is your total income 143100 Married fling 10 Adjustments to income from Schedule 1, line 26 10 8000 jointly or Qualifying 11 Subtract line 10 from fine 9. This is your adjusted gross income 11 135100 widower. 12a Standard deduction or itemized deductions (from Schedule A) 12a $25,100 itemized: 22500 Head of b Charitable contributions if you take the standard deduction (see instructions) 12b household $18,800 c Add lines 12a and 12b 12c . If you checked 13 Qualified business income deduction from Form 8995 or Form 8995-A 13 any box under Standard 14 Add lines 120 and 13 14 22500 Deduction, 15 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter - O- . 112600 See Instructions. For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 113200 Form 1040 (2001) 8 OMB No. 1545-0074 Attachment Sequence No. 01 400 3 4 5 6 7 1500 8d SCHEDULE 1 (Form 1040) Additional Income and Adjustments to Income 2021 Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Internal Revenue Service Go to www.irs.gov/Form 1040 for instructions and the latest information. Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number Cindy Millor Part1 Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 1 2a Alimony received ... 2a b Date of original divorce or separation agreement (see instructions) 3 Business income or loss). Attach Schedule C 4 Other gains or losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Farm income or loss). Attach Schedule F 7 Unemployment compensation. 8 Other income: a Net operating loss 8 b Gambling income 8b c Cancellation of debt. 8c d Foreign earned income exclusion from Form 2555 e Taxable Health Savings Account distribution. 8e f Alaska Permanent Fund dividends 8f g Jury duty pay 8g h Prizes and awards 8h i Activity not engaged in for profit income Stock options k Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property Olympic and Paralympic medals and USOC prize money (see instructions) 81 m Section 951(a) inclusion (see instructions) 8m n Section 951A(a) inclusion (see instructions) 8n o Section 461() excess business loss adjustment. 80 p Taxable distributions from an ABLE account (see instructions) 8p z Other income. List type and amount 8z 9 Total other income. Add lines 8a through 8z . . 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 10 For Paperwork Reduction Act Notice, see your tax return instructions. Schedule 1 (Form 1040) 2021 8i Bj 8k 1500 1900 Cat. No. 71479F 83001 135100 3 4 SCHEDULE A Itemized Deductions OMB No. 1545-0074 (Form 1040) Go to www.irs.gov/ScheduleA for instructions and the latest information. 2021 Department of the Treasury Attach to Form 1040 or 1040-SR. Attachment Internal Revenue Service (99) Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16. Sequence No. 07 Name(s) shown on Form 1040 or 1040-SA Your social security number Cindy Miller 000-22-1111 Medical Caution: Do not include expenses reimbursed or paid by others. and 1 Medical and dental expenses (see instructions) Dental 2 Enter amount from Form 1040 or 1040-SR, line 11 2 Expenses 3 Multiply line 2 by 7.5% (0.075) 10133 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter-O- Taxes You 5 State and local taxes. Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box. O 5a 5900 b State and local real estate taxes (see instructions) 5b c State and local personal property taxes 5C d Add lines 5a through 5c 5d e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) 5e 10000 6 Other taxes. List type and amount 6 7 Add lines 5e and 6 10000 Interest 8 Home mortgage interest and points. If you didn't use all of your home You Paid mortgage loan(s) to buy, build, or improve your home, see Caution: Your instructions and check this box mortgage interest deduction may be a Home mortgage interest and points reported to you on Form 1098. limited (see See instructions if limited 8a 100001 instructions). bHome mortgage interest not reported to you on Form 1098. See instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address 4900 10840 10001 8b c Points not reported to you on Form 1098. See instructions for special rules 8c d Mortgage insurance premiums (see instructions) 8d e Add lines Ba through 8d. 8e 9 Investment interest. Attach Form 4952 if required. See instructions 9 10 Add lines 8e and 9 10 10000 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, see Charity instructions 11 Caution: If you 12 Other than by cash or check. If you made any gift of $250 or more, made a gift and got a benefit for it, see instructions. You must attach Form 8283 it over $500. 12 see instructions. 13 Carryover from prior year 13 14 Add lines 11 through 13 14 1000 Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions. 15 Other 16 Other-from list in instructions. List type and amount Itemized gambling losses (limited to gambling income) Deductions 16 1500 Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040 or 1040-SR, line 12a 17 22500 Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check this box For Paperwork Reduction Act Notice, see the Instructions for Forms 1040 and 1040-SR. Cat No. 17145C Schedule A (Form 1040) 2021 Return 2021 1040 Department of the Treasury - Internal Revenue Service ) OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Filing Status Single Married filing jointly Married filing separately (MES) Head of household (HOH) Qualifying widower) (W) Check only one box. If you checked the MFS box, enter the name of your spouse. If you checked the HOH or GW box, enter the child's name if the qualifying person is a child but not your dependent Your first name and middle initial Last name Your social security number Cindy Miller 0 0 0!2 211 111 If joint retum, spouse's first name and middle initial Spouse's social security number Last name DOOR Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election Campaign Check here if you, or your City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change Foreign country name Foreign province/state/county Foreign postal code your tax or refund. You Spouse At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were bom before January 2, 1957 Are blind Spouse: Was born before January 2, 1957 is blind Dependents (see instructions): (2) Social security (3) Relationship 14 i qualifies for see instructions): If more (1) First name number Last name to you Child tax credit Credit for other dependents than four Name (Cindy's father) parent dependents, see instructions Name (Cindy's mother) Iparent and check here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 132000 Attach 2a Tax-exempt interest 2a 1000 b Taxable interest 2b 3500 Sch. Bit 3a Qualified dividends 3a required. 3b b Ordinary dividends 4a IRA distributions 4a b Taxable amount. 4b 5a Pensions and annuities 5a b Taxable amount 5b Standard 6a Social security benefits 6 b Taxable amount 6b Deduction for- 7 Capital gain or loss). Attach Schedule D if required. If not required, check here 7 5700 Single or Married fing 8 Other income from Schedule 1, line 10 1900 separately. 9 $12,550 9 Add lines 1, 26, 35, 45, 56, 66, 7, and B. This is your total income 143100 Married fling 10 Adjustments to income from Schedule 1, line 26 10 8000 jointly or Qualifying 11 Subtract line 10 from fine 9. This is your adjusted gross income 11 135100 widower. 12a Standard deduction or itemized deductions (from Schedule A) 12a $25,100 itemized: 22500 Head of b Charitable contributions if you take the standard deduction (see instructions) 12b household $18,800 c Add lines 12a and 12b 12c . If you checked 13 Qualified business income deduction from Form 8995 or Form 8995-A 13 any box under Standard 14 Add lines 120 and 13 14 22500 Deduction, 15 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter - O- . 112600 See Instructions. For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 113200 Form 1040 (2001) 8 OMB No. 1545-0074 Attachment Sequence No. 01 400 3 4 5 6 7 1500 8d SCHEDULE 1 (Form 1040) Additional Income and Adjustments to Income 2021 Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Internal Revenue Service Go to www.irs.gov/Form 1040 for instructions and the latest information. Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number Cindy Millor Part1 Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 1 2a Alimony received ... 2a b Date of original divorce or separation agreement (see instructions) 3 Business income or loss). Attach Schedule C 4 Other gains or losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Farm income or loss). Attach Schedule F 7 Unemployment compensation. 8 Other income: a Net operating loss 8 b Gambling income 8b c Cancellation of debt. 8c d Foreign earned income exclusion from Form 2555 e Taxable Health Savings Account distribution. 8e f Alaska Permanent Fund dividends 8f g Jury duty pay 8g h Prizes and awards 8h i Activity not engaged in for profit income Stock options k Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property Olympic and Paralympic medals and USOC prize money (see instructions) 81 m Section 951(a) inclusion (see instructions) 8m n Section 951A(a) inclusion (see instructions) 8n o Section 461() excess business loss adjustment. 80 p Taxable distributions from an ABLE account (see instructions) 8p z Other income. List type and amount 8z 9 Total other income. Add lines 8a through 8z . . 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 10 For Paperwork Reduction Act Notice, see your tax return instructions. Schedule 1 (Form 1040) 2021 8i Bj 8k 1500 1900 Cat. No. 71479F 83001 135100 3 4 SCHEDULE A Itemized Deductions OMB No. 1545-0074 (Form 1040) Go to www.irs.gov/ScheduleA for instructions and the latest information. 2021 Department of the Treasury Attach to Form 1040 or 1040-SR. Attachment Internal Revenue Service (99) Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16. Sequence No. 07 Name(s) shown on Form 1040 or 1040-SA Your social security number Cindy Miller 000-22-1111 Medical Caution: Do not include expenses reimbursed or paid by others. and 1 Medical and dental expenses (see instructions) Dental 2 Enter amount from Form 1040 or 1040-SR, line 11 2 Expenses 3 Multiply line 2 by 7.5% (0.075) 10133 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter-O- Taxes You 5 State and local taxes. Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box. O 5a 5900 b State and local real estate taxes (see instructions) 5b c State and local personal property taxes 5C d Add lines 5a through 5c 5d e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) 5e 10000 6 Other taxes. List type and amount 6 7 Add lines 5e and 6 10000 Interest 8 Home mortgage interest and points. If you didn't use all of your home You Paid mortgage loan(s) to buy, build, or improve your home, see Caution: Your instructions and check this box mortgage interest deduction may be a Home mortgage interest and points reported to you on Form 1098. limited (see See instructions if limited 8a 100001 instructions). bHome mortgage interest not reported to you on Form 1098. See instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address 4900 10840 10001 8b c Points not reported to you on Form 1098. See instructions for special rules 8c d Mortgage insurance premiums (see instructions) 8d e Add lines Ba through 8d. 8e 9 Investment interest. Attach Form 4952 if required. See instructions 9 10 Add lines 8e and 9 10 10000 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, see Charity instructions 11 Caution: If you 12 Other than by cash or check. If you made any gift of $250 or more, made a gift and got a benefit for it, see instructions. You must attach Form 8283 it over $500. 12 see instructions. 13 Carryover from prior year 13 14 Add lines 11 through 13 14 1000 Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions. 15 Other 16 Other-from list in instructions. List type and amount Itemized gambling losses (limited to gambling income) Deductions 16 1500 Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040 or 1040-SR, line 12a 17 22500 Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check this box For Paperwork Reduction Act Notice, see the Instructions for Forms 1040 and 1040-SR. Cat No. 17145C Schedule A (Form 1040) 2021