Question

Tax Return Preparation: Sonny Shine Sr. (222-33-1234) is single and lives at 425 UNI Way, Cedar Falls, lowa, 50613. Sonny has a 7-year-old son, Sonny

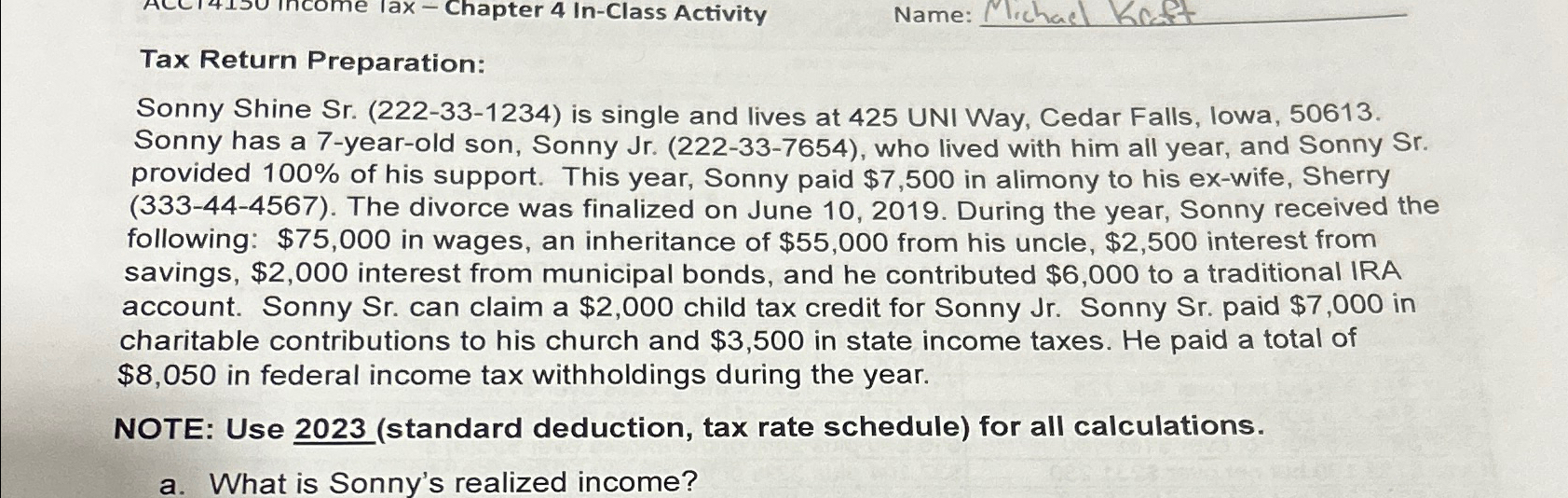

Tax Return Preparation:\ Sonny Shine Sr. (222-33-1234) is single and lives at 425 UNI Way, Cedar Falls, lowa, 50613. Sonny has a 7-year-old son, Sonny Jr. (222-33-7654), who lived with him all year, and Sonny Sr. provided

100%of his support. This year, Sonny paid

$7,500in alimony to his ex-wife, Sherry (333-44-4567). The divorce was finalized on June 10,2019. During the year, Sonny received the following:

$75,000in wages, an inheritance of

$55,000from his uncle,

$2,500interest from savings,

$2,000interest from municipal bonds, and he contributed

$6,000to a traditional IRA account. Sonny Sr. can claim a

$2,000child tax credit for Sonny Jr. Sonny Sr. paid

$7,000in charitable contributions to his church and

$3,500in state income taxes. He paid a total of

$8,050in federal income tax withholdings during the year.\ NOTE: Use

2023_()(standard deduction, tax rate schedule) for all calculations.\ a. What is Sonny's realized income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started