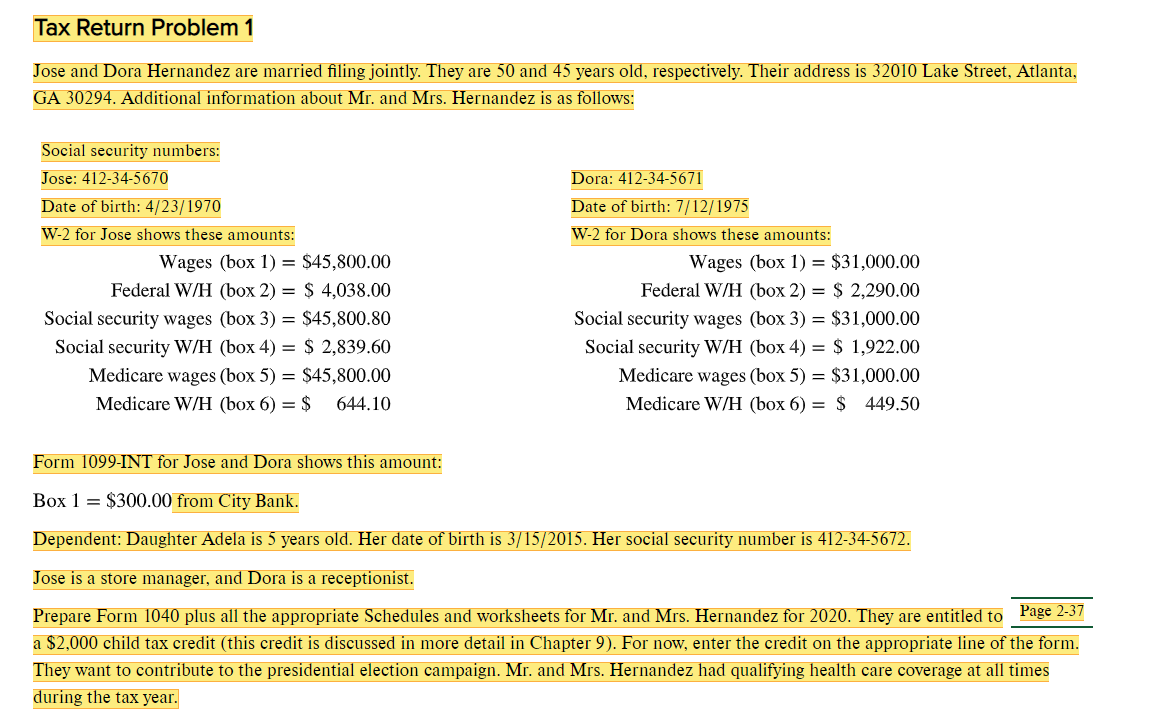

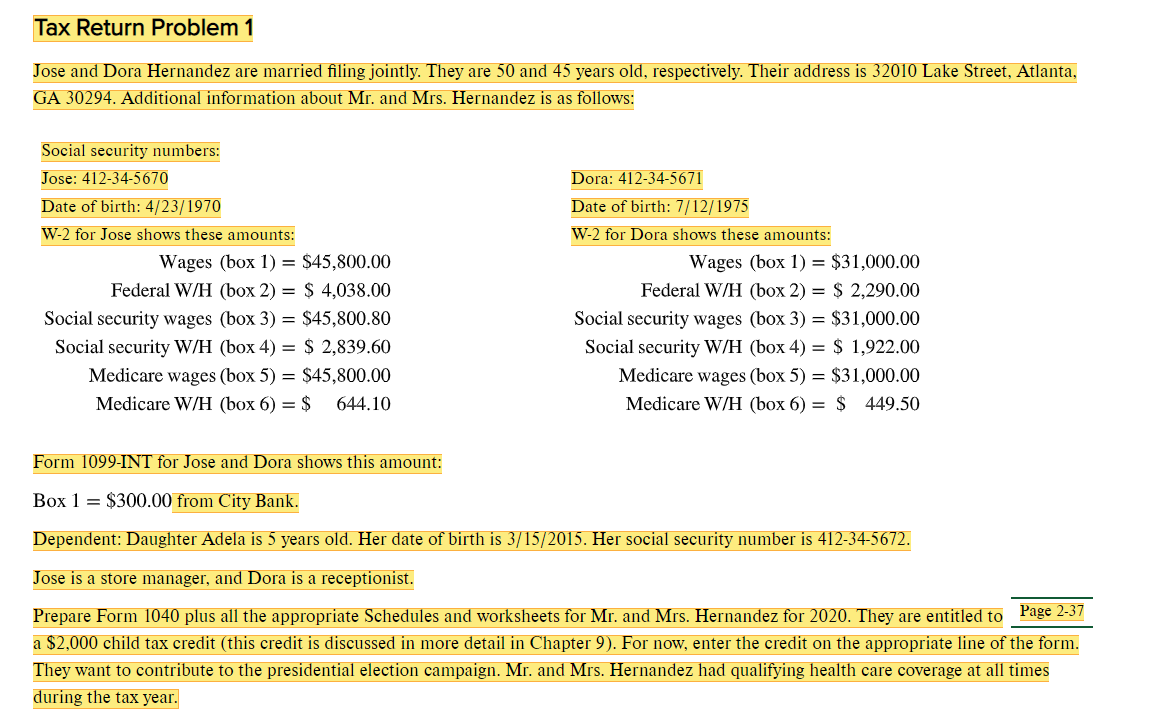

Tax Return Problem 1 Jose and Dora Hernandez are married filing jointly. They are 50 and 45 years old, respectively. Their address is 32010 Lake Street, Atlanta, GA 30294. Additional information about Mr. and Mrs. Hernandez is as follows: Social security numbers: Jose: 412-34-5670 Date of birth: 4/23/1970 W-2 for Jose shows these amounts: Wages (box 1) = $45,800.00 Federal W/H (box 2) = $ 4,038.00 Social security wages (box 3) = $45,800.80 Social security W/H (box 4) = $ 2,839.60 Medicare wages (box 5) = $45,800.00 Medicare W/H (box 6) = $ 644.10 Dora: 412-34-5671 Date of birth: 7/12/1975 W-2 for Dora shows these amounts: Wages (box 1) = $31,000.00 Federal W/H (box 2) = $ 2,290.00 Social security wages (box 3) = $31,000.00 Social security W/H (box 4) = $ 1,922.00 Medicare wages (box 5) = $31,000.00 Medicare W/H (box 6) = $ 449.50 Form 1099-INT for Jose and Dora shows this amount: Box 1 = $300.00 from City Bank. Dependent: Daughter Adela is 5 years old. Her date of birth is 3/15/2015. Her social security number is 412-34-5672. Jose is a store manager, and Dora is a receptionist. Prepare Form 1040 plus all the appropriate Schedules and worksheets for Mr. and Mrs. Hernandez for 2020. They are entitled to Page 2-37 a $2,000 child tax credit (this credit is discussed in more detail in Chapter 9). For now, enter the credit on the appropriate line of the form. They want to contribute to the presidential election campaign. Mr. and Mrs. Hernandez had qualifying health care coverage at all times during the tax year. Tax Return Problem 1 Jose and Dora Hernandez are married filing jointly. They are 50 and 45 years old, respectively. Their address is 32010 Lake Street, Atlanta, GA 30294. Additional information about Mr. and Mrs. Hernandez is as follows: Social security numbers: Jose: 412-34-5670 Date of birth: 4/23/1970 W-2 for Jose shows these amounts: Wages (box 1) = $45,800.00 Federal W/H (box 2) = $ 4,038.00 Social security wages (box 3) = $45,800.80 Social security W/H (box 4) = $ 2,839.60 Medicare wages (box 5) = $45,800.00 Medicare W/H (box 6) = $ 644.10 Dora: 412-34-5671 Date of birth: 7/12/1975 W-2 for Dora shows these amounts: Wages (box 1) = $31,000.00 Federal W/H (box 2) = $ 2,290.00 Social security wages (box 3) = $31,000.00 Social security W/H (box 4) = $ 1,922.00 Medicare wages (box 5) = $31,000.00 Medicare W/H (box 6) = $ 449.50 Form 1099-INT for Jose and Dora shows this amount: Box 1 = $300.00 from City Bank. Dependent: Daughter Adela is 5 years old. Her date of birth is 3/15/2015. Her social security number is 412-34-5672. Jose is a store manager, and Dora is a receptionist. Prepare Form 1040 plus all the appropriate Schedules and worksheets for Mr. and Mrs. Hernandez for 2020. They are entitled to Page 2-37 a $2,000 child tax credit (this credit is discussed in more detail in Chapter 9). For now, enter the credit on the appropriate line of the form. They want to contribute to the presidential election campaign. Mr. and Mrs. Hernandez had qualifying health care coverage at all times during the tax year