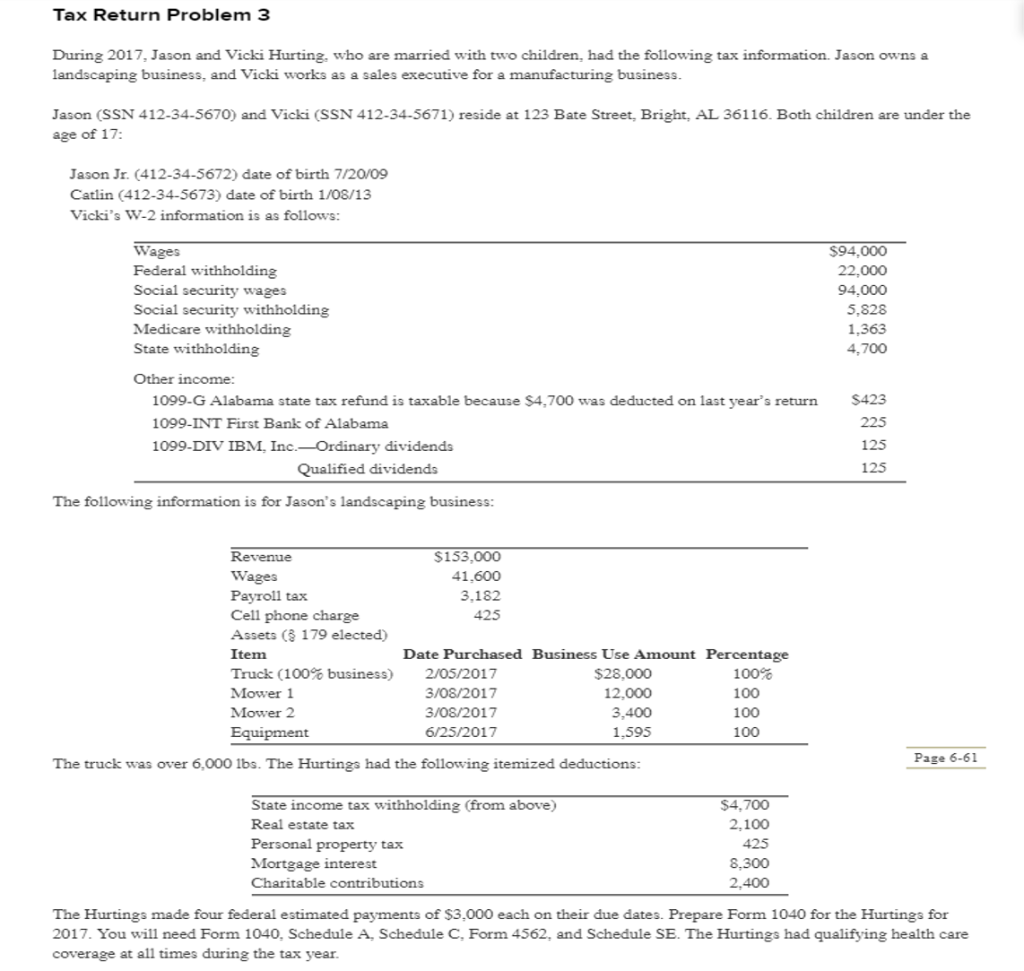

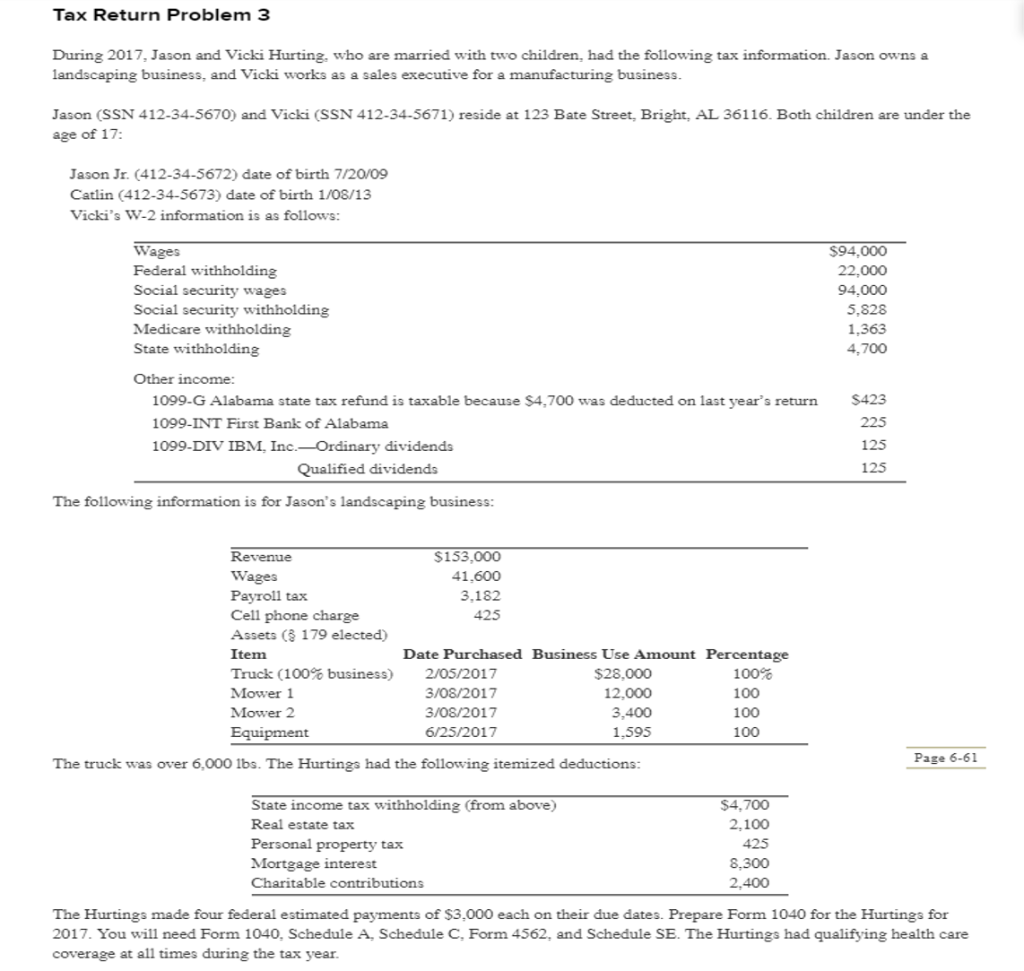

Tax Return Problem 3 During 2017, Jason and Vicki Hurting, who are married with two children, had the following tax information. Jason owns sa landscaping business, and Vicki works as a sales executive for a manufacturing business. Jason (SSN 412-34-5670) and Vicki (SSN 412-34-5671) reside at 123 Bate Street, Bright.361 16. Both children are under the age of 17: Jason Jr. (412-34-5672) date of birth 7/20/09 Catlin (412-34-5673) date of birth 1/08/13 Vicki's W-2 information is as follows: Wages Federal withholding Social security wages Social security withholding Medicare withholding State withholdin $94,000 22,000 94,000 5,828 1,363 4,700 Other income: 1099-G Alabama state tax refund is taxable because $4,700 was deducted on last year's return 1099-INT First Bank of Alabama 1099-DIV IBM. Inc.Ordinary dividends $423 225 125 125 Qualified dividends The following information is for Jason's landsca ping business: $153,000 41.600 3,182 425 Revenue Wages Payroll tax Cell phone charge Assets ( 179 elected) Item Truck (100% business) Mower 1 Mower2 Equipment Date Purchased Business Use Amount Percentase 2/05/2017 3/08/2017 3/08/2017 6/25/2017 $28,000 12,000 3,400 1,595 100% 100 100 100 Page 6-61 The truck was over 6,000 1bs. The Hurtings had the following itemized deductions State income tax withholding (from above) Real estate tax Personal property tax Mortgage interest Charitable contributions $4,700 2,100 425 8,300 2,400 The Hurtings made four federal estimated payments of $3,000 each on their due dates. Prepare Form 1040 for the Hurtings for 2017. You will need Form 1040, Schedule A, Schedule C, Form 4562, and Schedule SE. The Hurtings had qualifying health care coverage at all times during the tax year Tax Return Problem 3 During 2017, Jason and Vicki Hurting, who are married with two children, had the following tax information. Jason owns sa landscaping business, and Vicki works as a sales executive for a manufacturing business. Jason (SSN 412-34-5670) and Vicki (SSN 412-34-5671) reside at 123 Bate Street, Bright.361 16. Both children are under the age of 17: Jason Jr. (412-34-5672) date of birth 7/20/09 Catlin (412-34-5673) date of birth 1/08/13 Vicki's W-2 information is as follows: Wages Federal withholding Social security wages Social security withholding Medicare withholding State withholdin $94,000 22,000 94,000 5,828 1,363 4,700 Other income: 1099-G Alabama state tax refund is taxable because $4,700 was deducted on last year's return 1099-INT First Bank of Alabama 1099-DIV IBM. Inc.Ordinary dividends $423 225 125 125 Qualified dividends The following information is for Jason's landsca ping business: $153,000 41.600 3,182 425 Revenue Wages Payroll tax Cell phone charge Assets ( 179 elected) Item Truck (100% business) Mower 1 Mower2 Equipment Date Purchased Business Use Amount Percentase 2/05/2017 3/08/2017 3/08/2017 6/25/2017 $28,000 12,000 3,400 1,595 100% 100 100 100 Page 6-61 The truck was over 6,000 1bs. The Hurtings had the following itemized deductions State income tax withholding (from above) Real estate tax Personal property tax Mortgage interest Charitable contributions $4,700 2,100 425 8,300 2,400 The Hurtings made four federal estimated payments of $3,000 each on their due dates. Prepare Form 1040 for the Hurtings for 2017. You will need Form 1040, Schedule A, Schedule C, Form 4562, and Schedule SE. The Hurtings had qualifying health care coverage at all times during the tax year