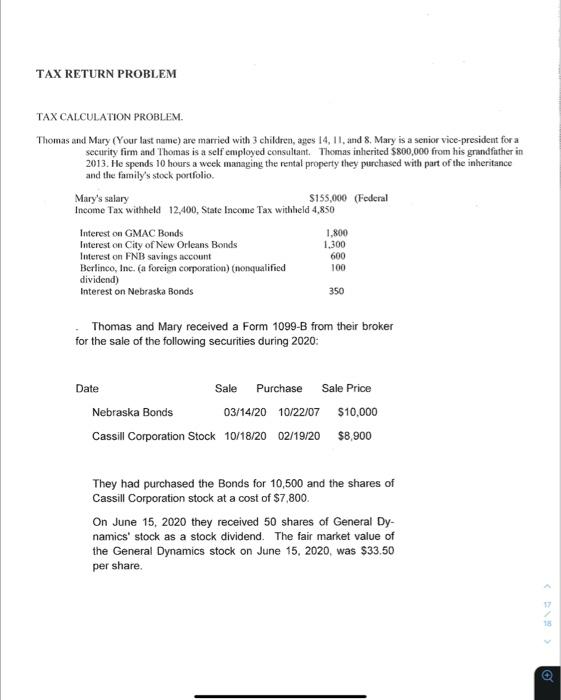

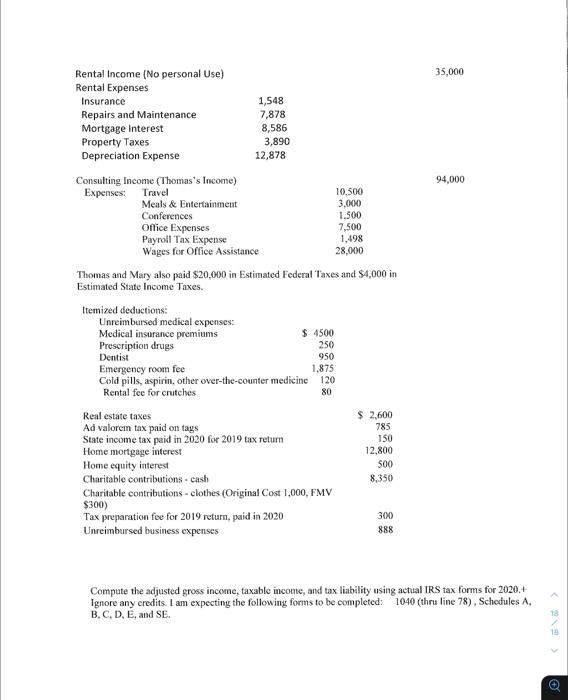

TAX RETURN PROBLEM TAX CALCULATION PROBLEM. Thomas and Mary (Your last name) are married with 3 children, ages 14. 11, and 8. Mary is a senior vice-president for a security firm and Thomas is a self employed consultant. Thomas inherited $800,000 from his grandfather in 2013. He spends 10 hours a week managing the rental property they purchased with part of the inheritance and the family's stock portfolio Mary's salary S155,000 (Federal Income Tax withheld 12,400, State Income Tax withheld 4,850 Interest on GMAC Bonds 1.800 Interest on City of New Orleans Bonds 1,300 Interest on FNB savings account 600 Berlinco, Inc. (a foreign corporation) (nonqualified 100 dividend) Interest on Nebraska Bonds 350 Thomas and Mary received a Form 1099-8 from their broker for the sale of the following securities during 2020: Date Sale Purchase Sale Price Nebraska Bonds 03/14/20 10/22/07 $10,000 Cassill Corporation Stock 10/18/20 02/19/20 $8,900 They had purchased the Bonds for 10,500 and the shares of Cassill Corporation stock at a cost of $7.800. On June 15, 2020 they received 50 shares of General Dy- namics' stock as a stock dividend. The fair market value of the General Dynamics stock on June 15, 2020, was $33.50 per share. 35,000 94,000 Rental Income (No personal use) Rental Expenses Insurance 1,548 Repairs and Maintenance 7,878 Mortgage Interest 8,586 Property Taxes 3,890 Depreciation Expense 12,878 Consulting Income (Thomas's Income) Expenses Travel 10,500 Meals & Entertainment 3,000 Conferences 1.500 Office Expenses 7,500 Payroll Tax Expense 1,498 Wages for Office Assistance 28,000 Thomas and Mary also paid $20,000 in Estimated Federal Taxes and $4,000 in Estimated State Income Taxes. ftemized deductions: Unreimbursed medical expenses: Medical insurance premiums $ 4500 Prescription drugs 250 Dentist Emergency room fee 1.875 Cold pills, aspirin, other over-the-counter medicine 120 Rental fee for crutches 80 950 Real estate taxes Ad valorem tax paid on tags State income tax paid in 2020 for 2019 tax return Home mortgage interest Home equity interest Charitable contributions - cash Charitable contributions - clothes (Original Cost 1,000, FMV $300) Tax preparation fee for 2019 return, paid in 2020 Unreimbursed business expenses $ 2,600 785 150 12,800 500 8,350 300 888 Compute the adjusted gross income taxable income, and tax liability using actual IRS tax forms for 2020.4 Ignore any credits. I am expecting the following forms to be completed: 1040 (thru line 78), Schedules A. B.C, D, E, and SE 18