Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tax Return Project: need a 1040 form filled out with the information below. Thank you! Tom and Thea Bannon (2019 tax year) 1. Tom and

Tax Return Project: need a 1040 form filled out with the information below.

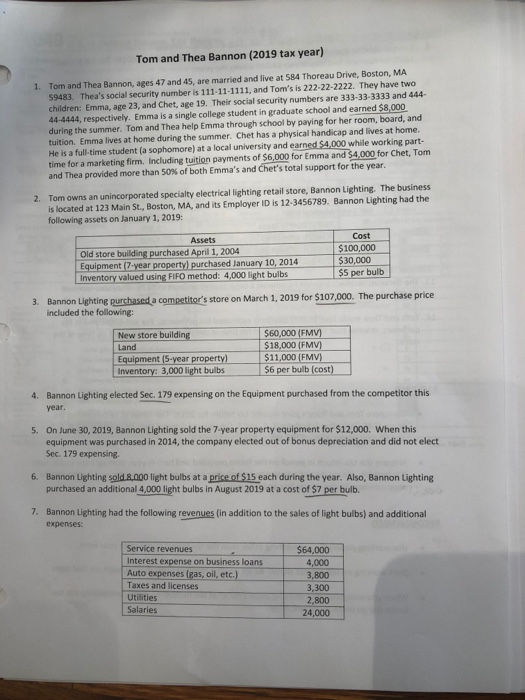

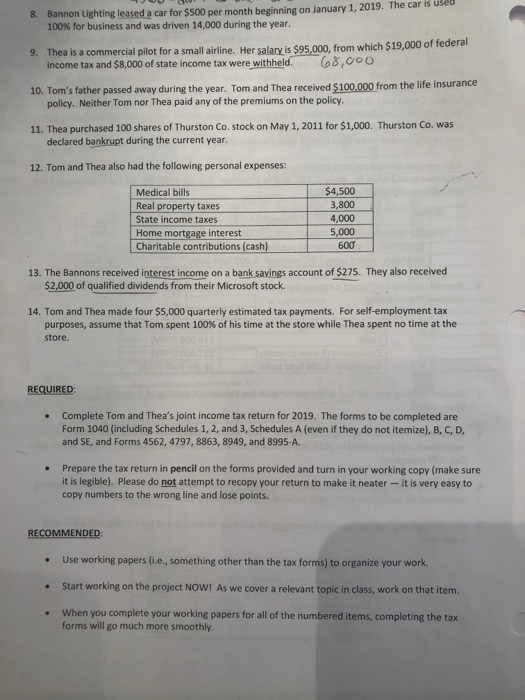

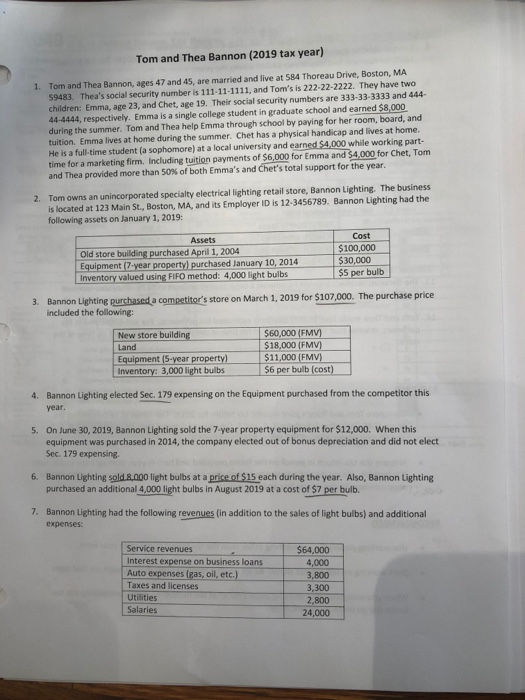

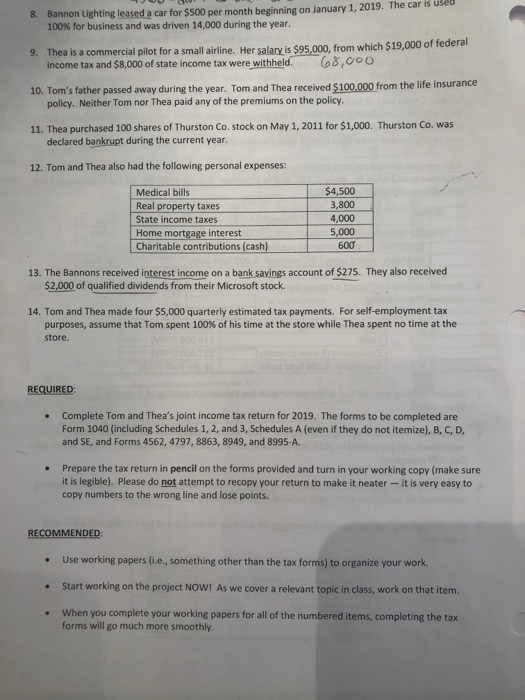

Tom and Thea Bannon (2019 tax year) 1. Tom and Thea Bannon, ages 47 and 45, are married and live at 584 Thoreau Drive, Boston, MA 59483. Thea's social security number is 111-11-1111, and Tom's is 222-22-2222. They have two children: Emma, age 23, and Chet, age 19. Their social security numbers are 333-33-3333 and 444- 44-4444, respectively. Emma is a single college student in graduate school and earned $8,000 during the summer. Tom and Thea help Emma through school by paying for her room, board, and tuition. Emma lives at home during the summer. Chet has a physical handicap and lives at home. He is a full-time student (a sophomore) at a local university and earned $4,000 while working part- time for a marketing firm. Including tuition payments of $6,000 for Emma and $4,000 for Chet, Tom and Thea provided more than 50% of both Emma's and Chet's total support for the year. Tom owns an unincorporated specialty electrical lighting retail store, Bannon Lighting. The business is located at 123 Main St., Boston, MA, and its Employer ID is 12-3456789. Bannon Lighting had the following assets on January 1, 2019: Assets Old store building purchased April 1, 2004 Equipment (7-year property) purchased January 10, 2014 Inventory valued using FIFO method: 4,000 light bulbs Cost $100,000 $30,000 3. Bannon Lighting purchased a competitor's store on March 1, 2019 for $107,000. The purchase price included the following: New store building Land Equipment (5-year property) Inventory: 3,000 light bulbs $60,000 (FMV) $18,000 (FMV) $11,000 (FMV) $6 per bulb (cost) 4. Bannon Lighting elected Sec. 179 expensing on the Equipment purchased from the competitor this year. 5. On June 30, 2019, Bannon Lighting sold the 7-year property equipment for $12,000. When this equipment was purchased in 2014, the company elected out of bonus depreciation and did not elect Sec. 179 expensing 6. Bannon Lighting sold 8.000 light bulbs at a price of $15 each during the year. Also, Bannon Lighting purchased an additional 4,000 light bulbs in August 2019 at a cost of $7 per bulb. 7. Bannon Lighting had the following revenues (in addition to the sales of light bulbs) and additional expenses: Service revenues Interest expense on business loans Auto expenses (gas, oil, etc.) Taxes and licenses Utilities Salaries $64,000 4,000 3,800 3.300 2,800 24,000 8. Bannon Lighting leased a car for $500 per month beginning on January 1, 2019. The car is used 100% for business and was driven 14,000 during the year. 9. Thea is a commercial pilot for a small airline. Her salary is $95,000, from which $19,000 of federal income tax and $8,000 of state income tax were withheld. (8,000 10. Tom's father passed away during the year. Tom and Thea received $100.000 from the life insurance policy. Neither Tom nor Thea paid any of the premiums on the policy. 11. Thea purchased 100 shares of Thurston Co. stock on May 1, 2011 for $1,000. Thurston Co. was declared bankrupt during the current year. 12. Tom and Thea also had the following personal expenses: Medical bills Real property taxes State income taxes Home mortgage interest Charitable contributions (cash) $4,500 3,800 4,000 5,000 600 13. The Bannons received interest income on a bank savings account of $275. They also received $2,000 of qualified dividends from their Microsoft stock. 14. Tom and Thea made four $5,000 quarterly estimated tax payments. For self-employment tax purposes, assume that Tom spent 100% of his time at the store while Thea spent no time at the store. REQUIRED Complete Tom and Thea's joint income tax return for 2019. The forms to be completed are Form 1040 (including Schedules 1, 2, and 3, Schedules A (even if they do not itemize), B, C, D, and SE, and Forms 4562, 4797, 8863, 8949, and 8995-A. Prepare the tax return in pencil on the forms provided and turn in your working copy (make sure it is legible). Please do not attempt to recopy your return to make it neater-it is very easy to copy numbers to the wrong line and lose points. RECOMMENDED Use working papers (i.e., something other than the tax forms) to organize your work. Start working on the project NOW! As we cover a relevant topic in class, work on that item When you complete your working papers for all of the numbered items, completing the tax forms will go much more smoothly. Tom and Thea Bannon (2019 tax year) 1. Tom and Thea Bannon, ages 47 and 45, are married and live at 584 Thoreau Drive, Boston, MA 59483. Thea's social security number is 111-11-1111, and Tom's is 222-22-2222. They have two children: Emma, age 23, and Chet, age 19. Their social security numbers are 333-33-3333 and 444- 44-4444, respectively. Emma is a single college student in graduate school and earned $8,000 during the summer. Tom and Thea help Emma through school by paying for her room, board, and tuition. Emma lives at home during the summer. Chet has a physical handicap and lives at home. He is a full-time student (a sophomore) at a local university and earned $4,000 while working part- time for a marketing firm. Including tuition payments of $6,000 for Emma and $4,000 for Chet, Tom and Thea provided more than 50% of both Emma's and Chet's total support for the year. Tom owns an unincorporated specialty electrical lighting retail store, Bannon Lighting. The business is located at 123 Main St., Boston, MA, and its Employer ID is 12-3456789. Bannon Lighting had the following assets on January 1, 2019: Assets Old store building purchased April 1, 2004 Equipment (7-year property) purchased January 10, 2014 Inventory valued using FIFO method: 4,000 light bulbs Cost $100,000 $30,000 3. Bannon Lighting purchased a competitor's store on March 1, 2019 for $107,000. The purchase price included the following: New store building Land Equipment (5-year property) Inventory: 3,000 light bulbs $60,000 (FMV) $18,000 (FMV) $11,000 (FMV) $6 per bulb (cost) 4. Bannon Lighting elected Sec. 179 expensing on the Equipment purchased from the competitor this year. 5. On June 30, 2019, Bannon Lighting sold the 7-year property equipment for $12,000. When this equipment was purchased in 2014, the company elected out of bonus depreciation and did not elect Sec. 179 expensing 6. Bannon Lighting sold 8.000 light bulbs at a price of $15 each during the year. Also, Bannon Lighting purchased an additional 4,000 light bulbs in August 2019 at a cost of $7 per bulb. 7. Bannon Lighting had the following revenues (in addition to the sales of light bulbs) and additional expenses: Service revenues Interest expense on business loans Auto expenses (gas, oil, etc.) Taxes and licenses Utilities Salaries $64,000 4,000 3,800 3.300 2,800 24,000 8. Bannon Lighting leased a car for $500 per month beginning on January 1, 2019. The car is used 100% for business and was driven 14,000 during the year. 9. Thea is a commercial pilot for a small airline. Her salary is $95,000, from which $19,000 of federal income tax and $8,000 of state income tax were withheld. (8,000 10. Tom's father passed away during the year. Tom and Thea received $100.000 from the life insurance policy. Neither Tom nor Thea paid any of the premiums on the policy. 11. Thea purchased 100 shares of Thurston Co. stock on May 1, 2011 for $1,000. Thurston Co. was declared bankrupt during the current year. 12. Tom and Thea also had the following personal expenses: Medical bills Real property taxes State income taxes Home mortgage interest Charitable contributions (cash) $4,500 3,800 4,000 5,000 600 13. The Bannons received interest income on a bank savings account of $275. They also received $2,000 of qualified dividends from their Microsoft stock. 14. Tom and Thea made four $5,000 quarterly estimated tax payments. For self-employment tax purposes, assume that Tom spent 100% of his time at the store while Thea spent no time at the store. REQUIRED Complete Tom and Thea's joint income tax return for 2019. The forms to be completed are Form 1040 (including Schedules 1, 2, and 3, Schedules A (even if they do not itemize), B, C, D, and SE, and Forms 4562, 4797, 8863, 8949, and 8995-A. Prepare the tax return in pencil on the forms provided and turn in your working copy (make sure it is legible). Please do not attempt to recopy your return to make it neater-it is very easy to copy numbers to the wrong line and lose points. RECOMMENDED Use working papers (i.e., something other than the tax forms) to organize your work. Start working on the project NOW! As we cover a relevant topic in class, work on that item When you complete your working papers for all of the numbered items, completing the tax forms will go much more smoothly Thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started