Answered step by step

Verified Expert Solution

Question

1 Approved Answer

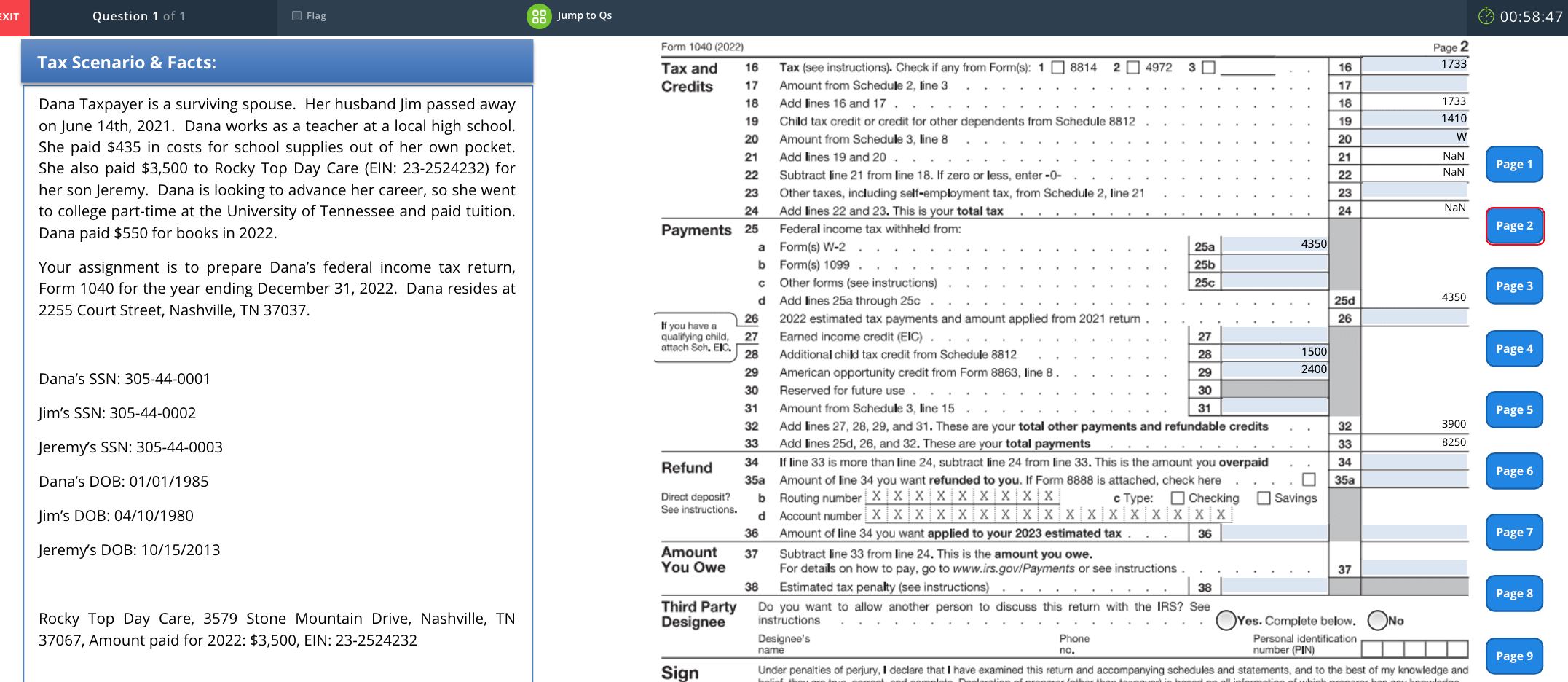

Tax Scenario & Facts: Dana Taxpayer is a surviving spouse. Her husband Jim passed away on June 1 4 th , 2 0 2 1

Tax Scenario & Facts:

Dana Taxpayer is a surviving spouse. Her husband Jim passed away

on June th Dana works as a teacher at a local high school.

She paid $ in costs for school supplies out of her own pocket.

She also paid $ to Rocky Top Day Care EIN: for

her son Jeremy. Dana is looking to advance her career, so she went

to college parttime at the University of Tennessee and paid tuition.

Dana paid $ for books in

Your assignment is to prepare Dana's federal income tax return,

Form for the year ending December Dana resides at

Court Street, Nashville, TN

Dana's SSN:

Jim's SSN:

Jeremy's SSN:

Dana's DOB:

Jim's DOB:

Jeremy's DOB:

Rocky Top Day Care, Stone Mountain Drive, Nashville, TN

Amount paid for : $ EIN:

What is line and line

W is Fed Tax is T is

Please solve for line and line

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started