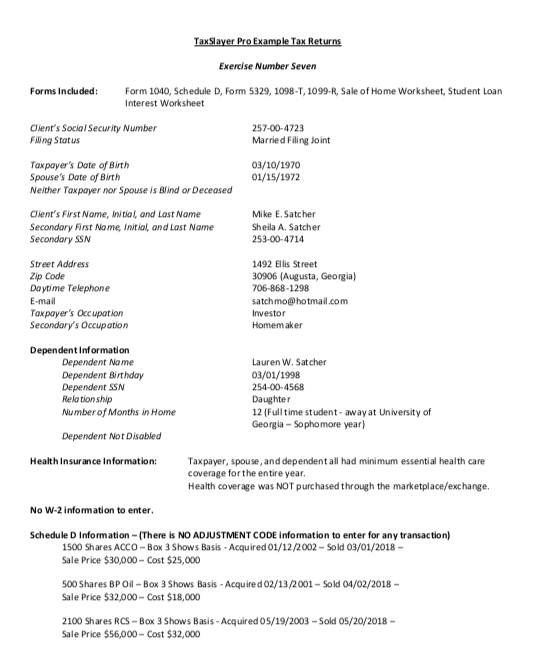

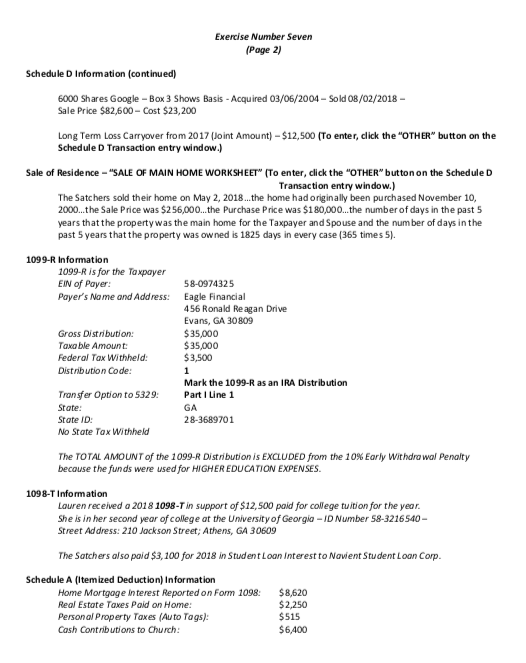

Tax Slayer Pro Example Tax Returns Exercise Number Seven Forms Included: Form 1040, Schedule D, Form 5329, 1098-T, 1099-R, Sale of Home Worksheet, Student Loan Interest Worksheet Client's Social Security Number Fling Status 257-00-4723 Married Filing Joint Taxpayer's Date of Birth Spouse's Date of Birth Neither Taxpayer nor Spouse is Blind or Deceased 03/10/1970 01/15/1972 Client's First Name, Initial, and Last Name Secondary First Name Initial, and Last Name Secondary SSN Mike E. Satcher Sheila A. Satcher 253-00-4714 Street Address Zip Code Daytime Telephone E-mail Taxpayer's Occupation Secondary's Occupation 1492 Ellis Street 30906 (Augusta, Georgia) 706-868-1298 satchmo@hotmail.com Investor Homemaker Dependent Information Dependent Name Dependent Birthday Dependent SSN Relationship Number of Months in Home Lauren W. Satcher 03/01/1998 254-00-4568 Daughter 12 (Fulltime student-away at University of Georgia - Sophomore year) Dependent Not Disabled Health Insurance Information: Taxpayer, spouse, and dependent all had minimum essential health care coverage for the entire year. Health coverage was NOT purchased through the marketplace/exchange. No W-2 information to enter. Schedule D Information - There is NO ADJUSTMENT CODE Information to enter for any transaction) 1500 Shares ACCO-Box 3 Shows Basis - Acquired 01/12/2002 - Sold 03/01/2018 - Sale Price $30,000 - Cost $25,000 500 Shares BP Oil - Box 3 Shows Basis - Acquired 02/13/2001 - Sold 04/02/2018 - Sale Price $32,000 - Cost $18,000 2100 Shares RCS-Box 3 Shows Basis - Acquired 05/19/2003 - Sold 05/20/2018 - Sale Price $56,000 - Cost $32,000 Exercise Number Seven (Page 2) Schedule D Information (continued) 6000 Shares Google -Box 3 Shows Basis - Acquired 03/06/2004 - Sold 08/02/2018 - Sale Price $82,600 - Cost $23,200 Long Term Loss Carryover from 2017 (Joint Amount) - $12,500 (To enter, click the "OTHER" button on the Schedule D Transaction entry window.) Sale of Residence - "SALE OF MAIN HOME WORKSHEET" (To enter, click the "OTHER" button on the Schedule D Transaction entry window.) The Satchers sold their home on May 2, 2018...the home had originally been purchased November 10, 2000..the Sale Price was $256,000...the Purchase Price was $180,000...the number of days in the past 5 years that the property was the main home for the Taxpayer and Spouse and the number of days in the past 5 years that the property was owned is 1825 days in every case (365 times 5). 1099-R Information 1099-R is for the Taxpayer EIN of Payer: Payer's Name and Address: 58-0974325 Eagle Financial 456 Ronald Reagan Drive Evans, GA 30809 $ 35,000 $35,000 $3,500 Gross Distribution: Taxable Amount: Federal Tax Withheld: Distribution Code: Transfer Option to 5329: State: State ID: No State Tax Withheld Mark the 1099-R as an IRA Distribution Part I Line 1 GA 28-3689701 The TOTAL AMOUNT of the 1099-R Distribution is EXCLUDED from the 10% Early Withdrawal Penalty because the funds were used for HIGHER EDUCATION EXPENSES. 1098-T Information Louren received a 2018 1098-T in support of $12,500 paid for college tuition for the year. She is in her second year of college at the University of Georgia - ID Number 58-3216540- Street Address: 210 Jackson Street, Athens, GA 30609 The Satchers also paid $3,100 for 2018 in Student Loan Interest to Novient Student Loan Corp. Schedule A (itemized Deduction) Information Home Mortgage Interest Reported on Form 1098 Real Estate Taxes Paid on Home: Personal Property Taxes (Auto Tags): Cash Contributions to Church: $8,620 $2,250 $515 $6,400 Tax Slayer Pro Example Tax Returns Exercise Number Seven Forms Included: Form 1040, Schedule D, Form 5329, 1098-T, 1099-R, Sale of Home Worksheet, Student Loan Interest Worksheet Client's Social Security Number Fling Status 257-00-4723 Married Filing Joint Taxpayer's Date of Birth Spouse's Date of Birth Neither Taxpayer nor Spouse is Blind or Deceased 03/10/1970 01/15/1972 Client's First Name, Initial, and Last Name Secondary First Name Initial, and Last Name Secondary SSN Mike E. Satcher Sheila A. Satcher 253-00-4714 Street Address Zip Code Daytime Telephone E-mail Taxpayer's Occupation Secondary's Occupation 1492 Ellis Street 30906 (Augusta, Georgia) 706-868-1298 satchmo@hotmail.com Investor Homemaker Dependent Information Dependent Name Dependent Birthday Dependent SSN Relationship Number of Months in Home Lauren W. Satcher 03/01/1998 254-00-4568 Daughter 12 (Fulltime student-away at University of Georgia - Sophomore year) Dependent Not Disabled Health Insurance Information: Taxpayer, spouse, and dependent all had minimum essential health care coverage for the entire year. Health coverage was NOT purchased through the marketplace/exchange. No W-2 information to enter. Schedule D Information - There is NO ADJUSTMENT CODE Information to enter for any transaction) 1500 Shares ACCO-Box 3 Shows Basis - Acquired 01/12/2002 - Sold 03/01/2018 - Sale Price $30,000 - Cost $25,000 500 Shares BP Oil - Box 3 Shows Basis - Acquired 02/13/2001 - Sold 04/02/2018 - Sale Price $32,000 - Cost $18,000 2100 Shares RCS-Box 3 Shows Basis - Acquired 05/19/2003 - Sold 05/20/2018 - Sale Price $56,000 - Cost $32,000 Exercise Number Seven (Page 2) Schedule D Information (continued) 6000 Shares Google -Box 3 Shows Basis - Acquired 03/06/2004 - Sold 08/02/2018 - Sale Price $82,600 - Cost $23,200 Long Term Loss Carryover from 2017 (Joint Amount) - $12,500 (To enter, click the "OTHER" button on the Schedule D Transaction entry window.) Sale of Residence - "SALE OF MAIN HOME WORKSHEET" (To enter, click the "OTHER" button on the Schedule D Transaction entry window.) The Satchers sold their home on May 2, 2018...the home had originally been purchased November 10, 2000..the Sale Price was $256,000...the Purchase Price was $180,000...the number of days in the past 5 years that the property was the main home for the Taxpayer and Spouse and the number of days in the past 5 years that the property was owned is 1825 days in every case (365 times 5). 1099-R Information 1099-R is for the Taxpayer EIN of Payer: Payer's Name and Address: 58-0974325 Eagle Financial 456 Ronald Reagan Drive Evans, GA 30809 $ 35,000 $35,000 $3,500 Gross Distribution: Taxable Amount: Federal Tax Withheld: Distribution Code: Transfer Option to 5329: State: State ID: No State Tax Withheld Mark the 1099-R as an IRA Distribution Part I Line 1 GA 28-3689701 The TOTAL AMOUNT of the 1099-R Distribution is EXCLUDED from the 10% Early Withdrawal Penalty because the funds were used for HIGHER EDUCATION EXPENSES. 1098-T Information Louren received a 2018 1098-T in support of $12,500 paid for college tuition for the year. She is in her second year of college at the University of Georgia - ID Number 58-3216540- Street Address: 210 Jackson Street, Athens, GA 30609 The Satchers also paid $3,100 for 2018 in Student Loan Interest to Novient Student Loan Corp. Schedule A (itemized Deduction) Information Home Mortgage Interest Reported on Form 1098 Real Estate Taxes Paid on Home: Personal Property Taxes (Auto Tags): Cash Contributions to Church: $8,620 $2,250 $515 $6,400