Question: Tax Software Assignment - Fall 2023 Ms. Jeanette Letourneau (SIN 123-456-789) was born in Montreal on December 15, 1979. She has spent most of

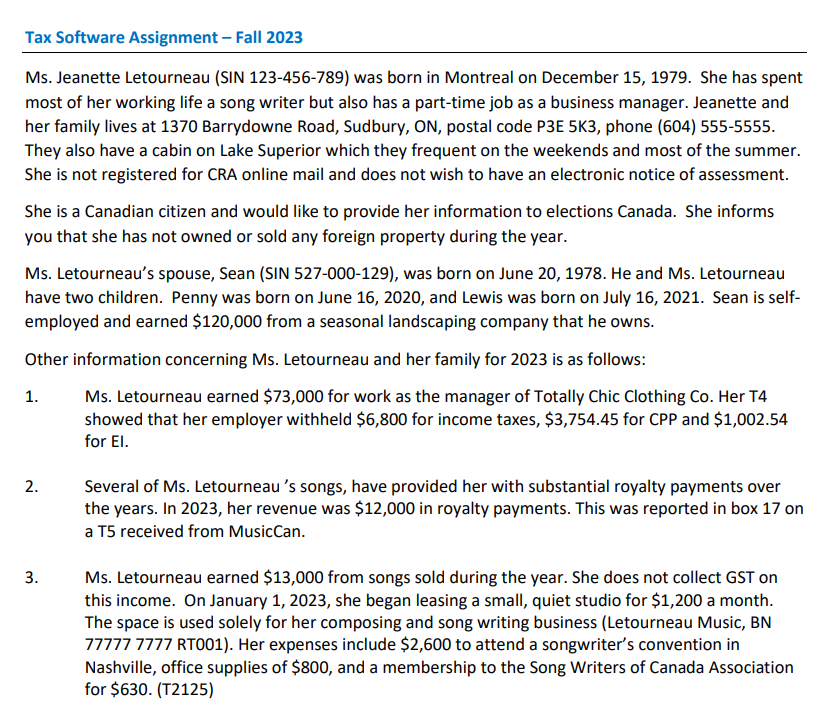

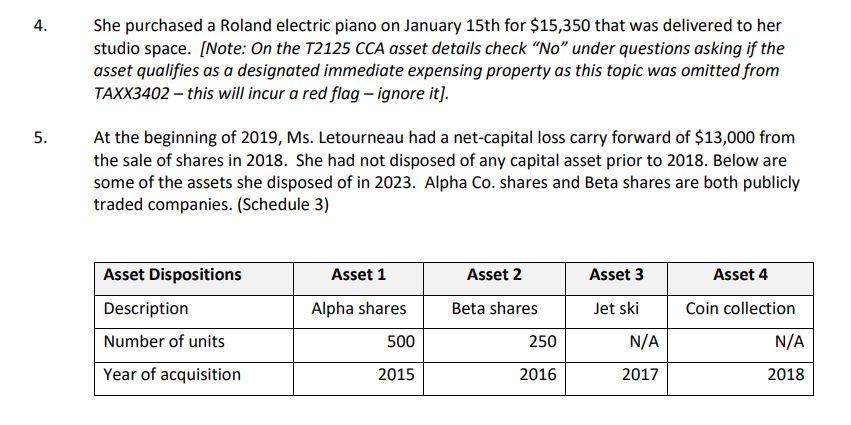

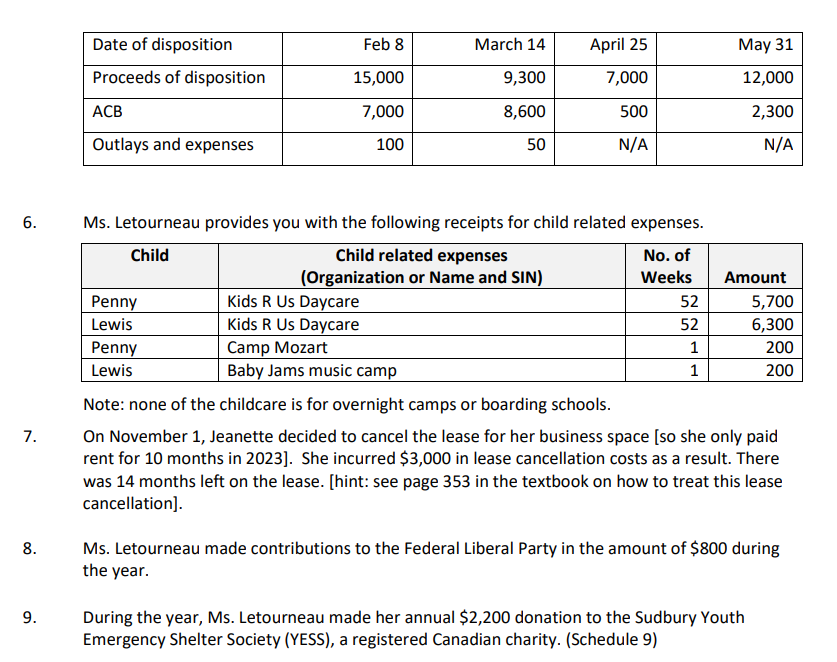

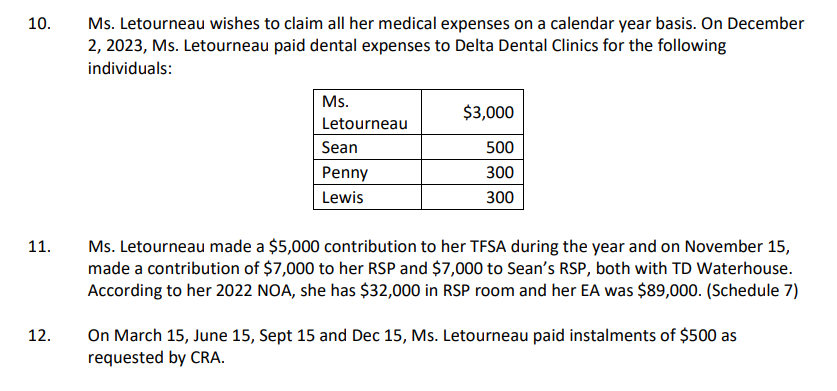

Tax Software Assignment - Fall 2023 Ms. Jeanette Letourneau (SIN 123-456-789) was born in Montreal on December 15, 1979. She has spent most of her working life a song writer but also has a part-time job as a business manager. Jeanette and her family lives at 1370 Barrydowne Road, Sudbury, ON, postal code P3E 5K3, phone (604) 555-5555. They also have a cabin on Lake Superior which they frequent on the weekends and most of the summer. She is not registered for CRA online mail and does not wish to have an electronic notice of assessment. She is a Canadian citizen and would like to provide her information to elections Canada. She informs you that she has not owned or sold any foreign property during the year. Ms. Letourneau's spouse, Sean (SIN 527-000-129), was born on June 20, 1978. He and Ms. Letourneau have two children. Penny was born on June 16, 2020, and Lewis was born on July 16, 2021. Sean is self- employed and earned $120,000 from a seasonal landscaping company that he owns. Other information concerning Ms. Letourneau and her family for 2023 is as follows: 1. 2. 3. Ms. Letourneau earned $73,000 for work as the manager of Totally Chic Clothing Co. Her T4 showed that her employer withheld $6,800 for income taxes, $3,754.45 for CPP and $1,002.54 for El. Several of Ms. Letourneau's songs, have provided her with substantial royalty payments over the years. In 2023, her revenue was $12,000 in royalty payments. This was reported in box 17 on a T5 received from MusicCan. Ms. Letourneau earned $13,000 from songs sold during the year. She does not collect GST on this income. On January 1, 2023, she began leasing a small, quiet studio for $1,200 a month. The space is used solely for her composing and song writing business (Letourneau Music, BN 77777 7777 RT001). Her expenses include $2,600 to attend a songwriter's convention in Nashville, office supplies of $800, and a membership to the Song Writers of Canada Association for $630. (T2125) 4. 5. She purchased a Roland electric piano on January 15th for $15,350 that was delivered to her studio space. [Note: On the T2125 CCA asset details check "No" under questions asking if the asset qualifies as a designated immediate expensing property as this topic was omitted from TAXX3402 - this will incur a red flag - ignore it]. At the beginning of 2019, Ms. Letourneau had a net-capital loss carry forward of $13,000 from the sale of shares in 2018. She had not disposed of any capital asset prior to 2018. Below are some of the assets she disposed of in 2023. Alpha Co. shares and Beta shares are both publicly traded companies. (Schedule 3) Asset Dispositions Asset 1 Asset 2 Asset 3 Asset 4 Description Alpha shares Beta shares Jet ski Coin collection Number of units 500 250 N/A N/A Year of acquisition 2015 2016 2017 2018 Date of disposition Feb 8 March 14 April 25 Proceeds of disposition 15,000 9,300 7,000 May 31 12,000 ACB 7,000 8,600 500 2,300 Outlays and expenses 100 50 N/A N/A 6. Ms. Letourneau provides you with the following receipts for child related expenses. 7. 8. Child Child related expenses (Organization or Name and SIN) Penny Kids R Us Daycare Lewis Kids R Us Daycare Penny Camp Mozart Lewis Baby Jams music camp Note: none of the childcare is for overnight camps or boarding schools. No. of Weeks Amount 52 5,700 52 6,300 1 200 1 200 On November 1, Jeanette decided to cancel the lease for her business space [so she only paid rent for 10 months in 2023]. She incurred $3,000 in lease cancellation costs as a result. There was 14 months left on the lease. [hint: see page 353 in the textbook on how to treat this lease cancellation]. Ms. Letourneau made contributions to the Federal Liberal Party in the amount of $800 during the year. 9. During the year, Ms. Letourneau made her annual $2,200 donation to the Sudbury Youth Emergency Shelter Society (YESS), a registered Canadian charity. (Schedule 9) 10. Ms. Letourneau wishes to claim all her medical expenses on a calendar year basis. On December 2, 2023, Ms. Letourneau paid dental expenses to Delta Dental Clinics for the following individuals: Ms. $3,000 Letourneau Sean 500 Penny Lewis 300 300 11. 12. Ms. Letourneau made a $5,000 contribution to her TFSA during the year and on November 15, made a contribution of $7,000 to her RSP and $7,000 to Sean's RSP, both with TD Waterhouse. According to her 2022 NOA, she has $32,000 in RSP room and her EA was $89,000. (Schedule 7) On March 15, June 15, Sept 15 and Dec 15, Ms. Letourneau paid instalments of $500 as requested by CRA. Upon successful completion of this T1 you should have the following schedules: T1 and Schedule 3, 7, 9, T778, T2091, T2125 and Installments (some of these schedules will self- generate from other forms such as the Information and the Dependant information, various T-slips, and receipts you have entered). Your T1 should show the following: Net Income for Tax Purposes $62,030.43 Taxable Income $49,905.43 Final refund $3,831.84

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Here is the completed tax software assignment for Ms Jeanette Let Our Eau for 2023 including all required schedules Personal Information Jeanette Let ... View full answer

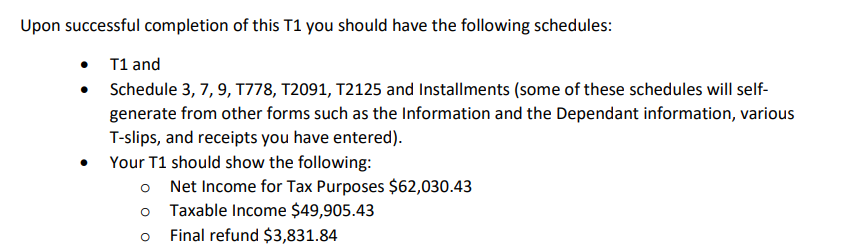

Get step-by-step solutions from verified subject matter experts